What is Form 50 283 Used for

What is the 283 property affidavit used for?

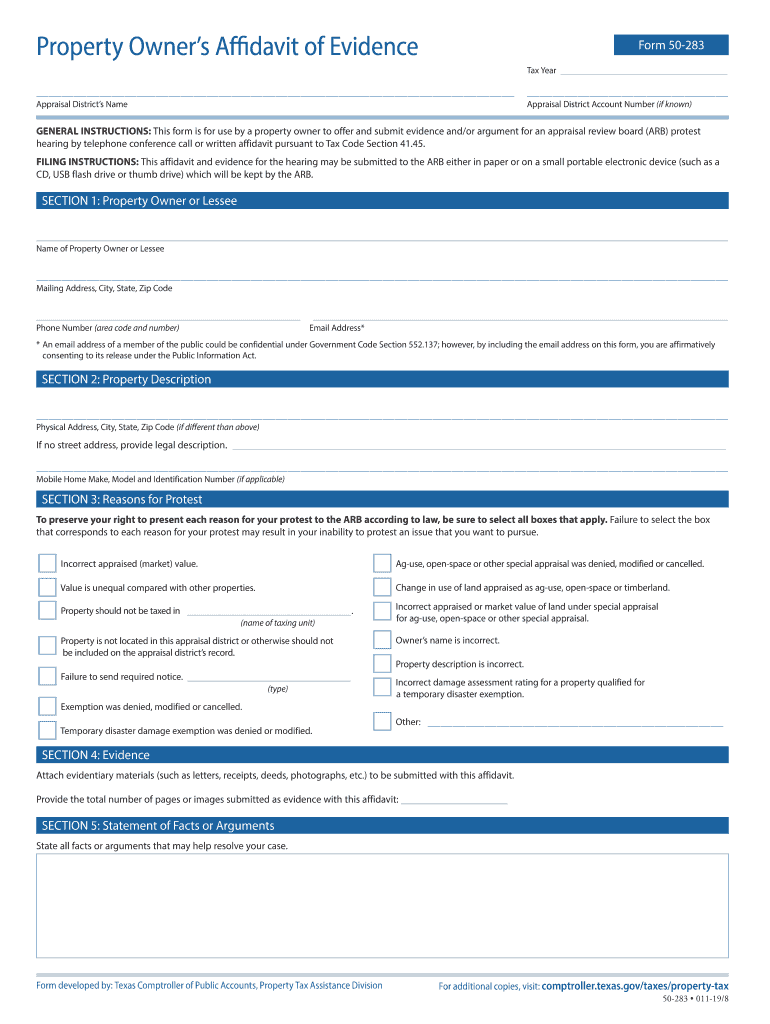

The 283 property affidavit is a legal document primarily used in the state of Texas to provide evidence of property ownership and valuation. This form is essential for property owners who wish to claim exemptions or provide proof of ownership for taxation purposes. By submitting this affidavit, property owners can assert their rights and responsibilities related to their property, ensuring compliance with local tax regulations.

Key elements of the 283 property affidavit

Several critical components make up the 283 property affidavit. These include:

- Property Description: A detailed description of the property, including its location and boundaries.

- Owner Information: The name and contact details of the property owner, ensuring that the affidavit is linked to the correct individual.

- Affidavit Statement: A declaration affirming the truthfulness of the information provided, typically requiring the owner's signature.

- Notary Public Signature: A notarized signature to validate the document and confirm the identity of the signer.

Steps to complete the 283 property affidavit

Completing the 283 property affidavit involves a series of straightforward steps:

- Gather Necessary Information: Collect all relevant details about the property and owner.

- Fill Out the Form: Accurately complete the affidavit, ensuring all sections are filled in correctly.

- Review for Accuracy: Double-check all information to avoid errors that could delay processing.

- Sign the Affidavit: Sign the document in the presence of a notary public to ensure legal validity.

- Submit the Affidavit: File the completed affidavit with the appropriate local tax authority.

Legal use of the 283 property affidavit

The legal use of the 283 property affidavit is crucial for property owners in Texas. This affidavit serves as a formal declaration of ownership and is often required when applying for property tax exemptions or appealing property valuations. The affidavit must comply with state laws to be considered valid, ensuring that it meets all necessary legal requirements.

Form submission methods for the 283 property affidavit

Property owners can submit the 283 property affidavit through various methods, including:

- Online Submission: Many counties in Texas allow for electronic filing of the affidavit through their official websites.

- Mail: The affidavit can be printed and mailed to the local tax office.

- In-Person: Property owners may also choose to deliver the affidavit directly to the local tax authority.

Examples of using the 283 property affidavit

Common scenarios for utilizing the 283 property affidavit include:

- Claiming a homestead exemption for primary residences.

- Providing documentation for property tax appeals.

- Establishing proof of ownership for estate planning or legal disputes.

Quick guide on how to complete property tax form 50 283ampquot keyword found websites listing

Effortlessly Prepare What Is Form 50 283 Used For on Any Device

Online document management has gained traction among businesses and individuals alike. It offers an ideal environmentally friendly substitute for traditional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents promptly without delays. Manage What Is Form 50 283 Used For across any platform using airSlate SignNow's Android or iOS applications and streamline any document-related task today.

How to Edit and eSign What Is Form 50 283 Used For with Ease

- Find What Is Form 50 283 Used For and select Get Form to begin.

- Utilize the available tools to complete your form.

- Highlight important sections of the documents or obscure sensitive information with tools specifically provided by airSlate SignNow.

- Generate your eSignature using the Sign tool, which takes seconds and carries the same legal validity as a conventional ink signature.

- Review the information and click the Done button to save your edits.

- Choose how you want to share your form, via email, SMS, or link invitation, or download it to your computer.

Eliminate concerns about lost or mislaid documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Modify and eSign What Is Form 50 283 Used For, ensuring effective communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the property tax form 50 283ampquot keyword found websites listing

How to create an electronic signature for the Property Tax Form 50 283' Keyword Found Websites Listing in the online mode

How to generate an eSignature for your Property Tax Form 50 283' Keyword Found Websites Listing in Chrome

How to generate an electronic signature for putting it on the Property Tax Form 50 283' Keyword Found Websites Listing in Gmail

How to generate an electronic signature for the Property Tax Form 50 283' Keyword Found Websites Listing from your mobile device

How to create an eSignature for the Property Tax Form 50 283' Keyword Found Websites Listing on iOS devices

How to generate an eSignature for the Property Tax Form 50 283' Keyword Found Websites Listing on Android OS

People also ask

-

What is a 283 property affidavit?

A 283 property affidavit is a legal document used to affirm the ownership and details of a property. It is often required for property transactions and legal proceedings, providing a verified statement that can support claims regarding property rights.

-

How can airSlate SignNow help with my 283 property affidavit?

airSlate SignNow streamlines the process of creating, signing, and sending your 283 property affidavit. With its user-friendly interface, you can easily prepare the document, collect signatures, and ensure compliance with legal standards in a timely manner.

-

Is there a cost associated with using airSlate SignNow for my 283 property affidavit?

Yes, airSlate SignNow offers various pricing plans to suit different business needs. The pricing is competitive and ensures that you have access to all the features necessary for executing your 283 property affidavit efficiently without breaking the bank.

-

What features does airSlate SignNow offer for managing a 283 property affidavit?

airSlate SignNow provides features like document templates, electronic signatures, and customizable workflows, specifically for managing 283 property affidavits. These tools help simplify the document management process while enhancing collaboration between parties.

-

Can I integrate airSlate SignNow with other tools for my 283 property affidavit?

Yes, airSlate SignNow offers seamless integrations with various applications, including CRM and document management systems. This allows you to manage your 283 property affidavit alongside your existing tools, enhancing productivity and efficiency.

-

What are the benefits of using airSlate SignNow for my 283 property affidavit?

Using airSlate SignNow for your 283 property affidavit provides advantages such as time savings, improved accuracy, and enhanced security. The platform ensures that your document is securely stored, signed, and shared, giving you peace of mind throughout the process.

-

Is airSlate SignNow compliant with legal requirements for a 283 property affidavit?

Yes, airSlate SignNow adheres to legal standards for eSignatures and document handling, making it compliant for use with a 283 property affidavit. This compliance ensures that your signed documents are legally binding and recognized by authorities.

Get more for What Is Form 50 283 Used For

- Workers comp return to work form omes

- Dj wedding contract template form

- Damage contract template form

- Dance choreography contract template form

- Pool construction contract template form

- Pool installation contract template form

- Pool contract template 787753843 form

- Pool maintenance contract template form

Find out other What Is Form 50 283 Used For

- eSign Wisconsin Codicil to Will Online

- eSign Hawaii Guaranty Agreement Mobile

- eSign Hawaii Guaranty Agreement Now

- How Can I eSign Kentucky Collateral Agreement

- eSign Louisiana Demand for Payment Letter Simple

- eSign Missouri Gift Affidavit Myself

- eSign Missouri Gift Affidavit Safe

- eSign Nevada Gift Affidavit Easy

- eSign Arizona Mechanic's Lien Online

- eSign Connecticut IOU Online

- How To eSign Florida Mechanic's Lien

- eSign Hawaii Mechanic's Lien Online

- How To eSign Hawaii Mechanic's Lien

- eSign Hawaii IOU Simple

- eSign Maine Mechanic's Lien Computer

- eSign Maryland Mechanic's Lien Free

- How To eSign Illinois IOU

- Help Me With eSign Oregon Mechanic's Lien

- eSign South Carolina Mechanic's Lien Secure

- eSign Tennessee Mechanic's Lien Later