Ifta Forms

Understanding IFTA Forms

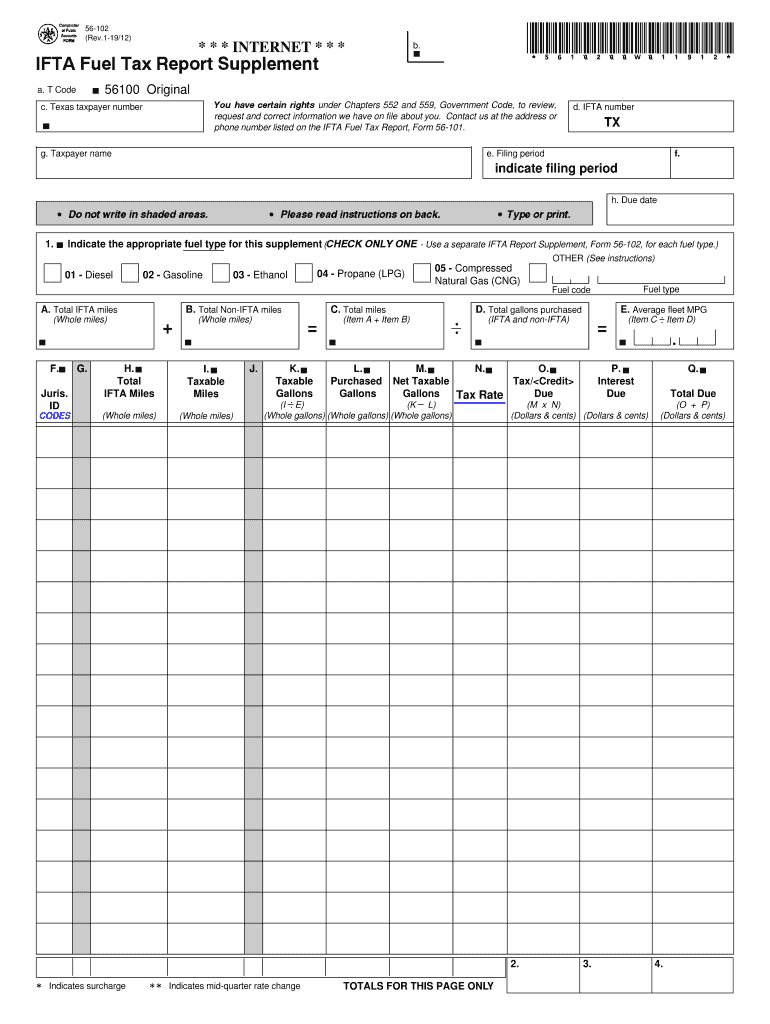

The International Fuel Tax Agreement (IFTA) forms are essential for commercial vehicle operators who travel between states and provinces in the United States and Canada. These forms facilitate the reporting and payment of fuel taxes based on the miles driven in each jurisdiction. The IFTA forms help streamline the tax process, ensuring compliance with state regulations while simplifying the reporting requirements for fleet operators.

Steps to Complete the IFTA Forms

Filling out the IFTA forms requires careful attention to detail. Here are the steps to ensure accurate completion:

- Gather necessary information, including total miles driven and fuel purchased in each state.

- Calculate the total miles traveled and the total gallons of fuel consumed.

- Fill in the IFTA form with the calculated data, ensuring all sections are completed accurately.

- Review the form for any errors or omissions before submission.

- Submit the completed form to the appropriate state agency by the filing deadline.

Legal Use of the IFTA Forms

The legal validity of IFTA forms hinges on compliance with specific regulations. To ensure that the forms are recognized by authorities, it is crucial to adhere to the guidelines set forth by IFTA. This includes accurate reporting of mileage and fuel consumption, as well as maintaining proper records to substantiate the information provided. Using a reliable electronic signature solution can enhance the legitimacy of the submission.

Filing Deadlines and Important Dates

Timely filing of IFTA forms is essential to avoid penalties. Generally, IFTA reports are due quarterly, with specific deadlines for each quarter. For example, the due dates typically fall on the last day of the month following the end of each quarter. It is important to mark these dates on your calendar to ensure compliance and avoid late fees.

Required Documents for IFTA Filing

When preparing to file IFTA forms, certain documents are necessary to support your submission. These may include:

- Fuel purchase receipts for each jurisdiction.

- Mileage records detailing the distance traveled in each state.

- Previous IFTA reports for reference and consistency.

Having these documents organized and readily accessible will streamline the filing process.

Form Submission Methods

IFTA forms can typically be submitted through various methods, including online, by mail, or in person. Many states offer online portals for electronic submission, providing a convenient and efficient way to file. Alternatively, forms can be printed and mailed to the appropriate state agency. In-person submissions may also be accepted at designated locations, depending on state regulations.

Quick guide on how to complete fillable online comune spilamberto mo fax prenotazione ist

Complete Ifta Forms effortlessly on any device

Digital document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, as you can easily locate the correct form and store it securely online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents swiftly without any obstacles. Manage Ifta Forms on any device using airSlate SignNow's Android or iOS applications and enhance any document-centered task today.

How to modify and eSign Ifta Forms with ease

- Locate Ifta Forms and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize relevant sections of the documents or black out sensitive information with the tools that airSlate SignNow specifically offers for this purpose.

- Create your eSignature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose your preferred method to send your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from your preferred device. Alter and eSign Ifta Forms while ensuring excellent communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the fillable online comune spilamberto mo fax prenotazione ist

How to create an electronic signature for the Fillable Online Comune Spilamberto Mo Fax Prenotazione Ist online

How to generate an eSignature for your Fillable Online Comune Spilamberto Mo Fax Prenotazione Ist in Google Chrome

How to generate an electronic signature for putting it on the Fillable Online Comune Spilamberto Mo Fax Prenotazione Ist in Gmail

How to create an electronic signature for the Fillable Online Comune Spilamberto Mo Fax Prenotazione Ist right from your mobile device

How to make an eSignature for the Fillable Online Comune Spilamberto Mo Fax Prenotazione Ist on iOS devices

How to make an electronic signature for the Fillable Online Comune Spilamberto Mo Fax Prenotazione Ist on Android OS

People also ask

-

What is an IFTA report?

An IFTA report is a document that stands for the International Fuel Tax Agreement report. It is used by companies operating commercial vehicles to calculate fuel taxes based on the miles driven in each jurisdiction. By using airSlate SignNow, you can efficiently prepare and submit your IFTA report, ensuring compliance and accuracy.

-

How can airSlate SignNow help me with my IFTA report?

airSlate SignNow provides an easy-to-use platform that simplifies the process of creating and managing your IFTA report. With its powerful e-signature capabilities, you can securely sign and send your documents, reducing the time spent on paperwork and allowing you to focus on your business.

-

Is there a cost associated with using airSlate SignNow for IFTA reports?

Yes, airSlate SignNow offers competitive pricing plans that cater to businesses of all sizes. By investing in our service, you can streamline your IFTA report management while reducing overall operational costs associated with document handling and compliance.

-

Can I integrate airSlate SignNow with other software for my IFTA report?

Absolutely! airSlate SignNow integrates seamlessly with various accounting and logistics software, making it easier to gather and manage the data necessary for your IFTA report. This integration ensures a smooth workflow and enhances your ability to generate accurate reports swiftly.

-

What benefits does using airSlate SignNow provide for my IFTA report process?

Using airSlate SignNow for your IFTA report process provides numerous benefits, including faster document processing times, improved accuracy, and enhanced security. Additionally, the platform's user-friendly interface and robust features help eliminate common errors that can occur during manual reporting.

-

Do I need technical skills to use airSlate SignNow for my IFTA report?

No, you don’t need any technical skills to use airSlate SignNow for your IFTA report. Our platform is designed for users of all experience levels, with intuitive navigation and comprehensive support resources to help you throughout the process.

-

How can I ensure my IFTA report is compliant with state regulations?

airSlate SignNow helps you ensure your IFTA report is compliant by providing templates and guidelines that align with state regulations. Our platform also allows for easy updates and modifications to keep your reporting compliant with any changes in the law.

Get more for Ifta Forms

- P h y 5 i cornellent form

- Application for health insurance 3939 39 39 coverageforall form

- Colorado multi member llc operating agreement template form

- Dance contract template 787751166 form

- Podcast guest contract template form

- Podcast sponsorship contract template form

- Political consult contract template form

- Political campaign manager contract template form

Find out other Ifta Forms

- How Do I Sign Rhode Island Real Estate Form

- Can I Sign Vermont Real Estate Document

- How To Sign Wyoming Orthodontists Document

- Help Me With Sign Alabama Courts Form

- Help Me With Sign Virginia Police PPT

- How To Sign Colorado Courts Document

- Can I eSign Alabama Banking PPT

- How Can I eSign California Banking PDF

- How To eSign Hawaii Banking PDF

- How Can I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- Help Me With eSign Hawaii Banking Document

- How To eSign Hawaii Banking Document

- Can I eSign Hawaii Banking Presentation

- Can I Sign Iowa Courts Form

- Help Me With eSign Montana Banking Form

- Can I Sign Kentucky Courts Document

- How To eSign New York Banking Word

- Can I eSign South Dakota Banking PPT