Berkheimer Tax Forms Pa

What is the Berkheimer Tax Forms Pa

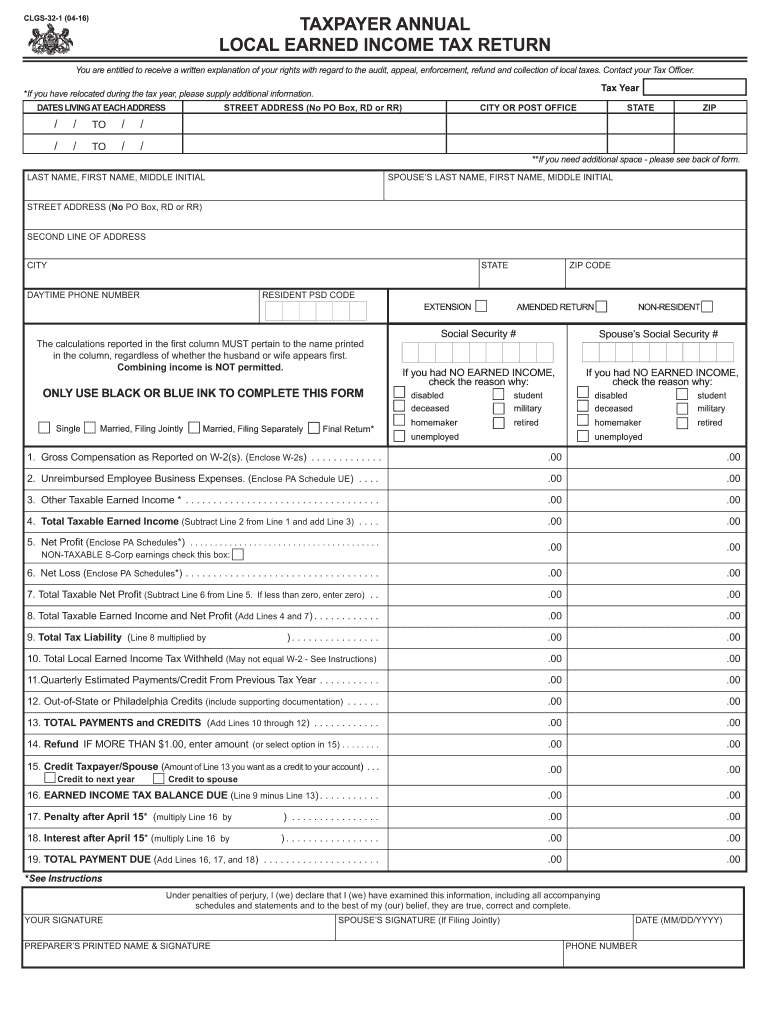

The Berkheimer Tax Forms are essential documents used for local tax filings in Pennsylvania, particularly for earned income tax. These forms are primarily associated with the Berkheimer Business Tax Center, which manages local tax collections for various municipalities. The forms help residents report their income and calculate the taxes owed to local authorities. Understanding the purpose and requirements of these forms is crucial for compliance with local tax laws.

How to use the Berkheimer Tax Forms Pa

Using the Berkheimer Tax Forms involves several steps to ensure accurate completion and submission. First, gather all necessary financial documents, such as W-2s and 1099s, to provide the required income information. Next, download the appropriate form, such as the Berkheimer local tax form for the specific tax year. Fill out the form carefully, ensuring all information is accurate and complete. After completing the form, review it for any errors before submitting it to the Berkheimer Business Tax Center via the preferred submission method.

Steps to complete the Berkheimer Tax Forms Pa

Completing the Berkheimer Tax Forms requires careful attention to detail. Follow these steps for successful completion:

- Collect your income documentation, including W-2s and other relevant tax documents.

- Select the correct Berkheimer tax form based on your residency and income type.

- Fill in your personal information, including name, address, and Social Security number.

- Report your total income accurately, ensuring that all sources of income are included.

- Calculate the local taxes owed based on the provided tax rates.

- Review the entire form for accuracy and completeness.

- Submit the completed form to the Berkheimer Business Tax Center through your chosen method.

Legal use of the Berkheimer Tax Forms Pa

The Berkheimer Tax Forms are legally binding documents that must be completed and submitted in accordance with Pennsylvania tax laws. Proper use of these forms ensures compliance with local tax regulations and helps avoid penalties. It is essential to provide accurate information and maintain copies of submitted forms for personal records. The legal framework surrounding these forms is supported by various state and federal tax regulations, emphasizing the importance of accurate reporting.

Filing Deadlines / Important Dates

Staying informed about filing deadlines is critical for timely submission of the Berkheimer Tax Forms. Typically, the deadline for filing local earned income tax returns is April 15 of the following year. However, extensions may be available under certain circumstances. It is advisable to check with the Berkheimer Business Tax Center for any specific deadlines or changes that may apply to your situation, as local jurisdictions may have different requirements.

Penalties for Non-Compliance

Failure to comply with the Berkheimer Tax filing requirements can result in significant penalties. These may include late fees, interest on unpaid taxes, and potential legal action for continued non-compliance. It is crucial to file your forms accurately and on time to avoid these consequences. Understanding the implications of non-compliance can help motivate timely and accurate tax filing.

Quick guide on how to complete contact your tax officer

Effortlessly Prepare Berkheimer Tax Forms Pa on Any Device

Managing documents online has become increasingly favored by both businesses and individuals. It offers a superb eco-friendly alternative to traditional printed and signed paperwork, allowing you to access the proper form and securely keep it online. airSlate SignNow provides you with all the necessary tools to create, modify, and eSign your documents promptly without any hold-ups. Manage Berkheimer Tax Forms Pa on any device with the airSlate SignNow applications for Android or iOS and enhance any document-focused procedure today.

How to Alter and eSign Berkheimer Tax Forms Pa with Ease

- Obtain Berkheimer Tax Forms Pa and click on Get Form to initiate.

- Utilize the tools we offer to fill out your document.

- Emphasize important sections of the documents or redact sensitive information with tools that airSlate SignNow specifically provides for this purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

No more worrying about lost or misplaced documents, exhausting form searches, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign Berkheimer Tax Forms Pa to ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the contact your tax officer

How to make an eSignature for the Contact Your Tax Officer online

How to create an electronic signature for the Contact Your Tax Officer in Chrome

How to create an eSignature for putting it on the Contact Your Tax Officer in Gmail

How to make an eSignature for the Contact Your Tax Officer from your smart phone

How to make an eSignature for the Contact Your Tax Officer on iOS

How to generate an eSignature for the Contact Your Tax Officer on Android devices

People also ask

-

What is a PA local tax form and why is it important?

A PA local tax form is a document required by municipalities in Pennsylvania for the collection of local taxes. It's essential for both individuals and businesses to ensure compliance with local tax regulations. Failing to submit the correct PA local tax form can result in penalties and additional fees.

-

How can airSlate SignNow help me with PA local tax forms?

airSlate SignNow simplifies the process of completing and submitting PA local tax forms by providing a user-friendly eSignature platform. You can easily fill out, sign, and send your forms securely online. This not only saves time but also reduces the chances of errors in your documentation.

-

Is there a cost associated with using airSlate SignNow for PA local tax forms?

Yes, airSlate SignNow offers various pricing plans that fit different business needs. The cost is competitive, especially considering the efficiency and ease of use it provides for managing PA local tax forms. Check our pricing page for specific details on subscriptions.

-

Can I integrate airSlate SignNow with my existing accounting software for PA local tax forms?

Absolutely! airSlate SignNow integrates smoothly with various accounting and payroll software. This means you can streamline the process of filling out PA local tax forms directly from your preferred accounting tools, enhancing productivity and accuracy.

-

What features does airSlate SignNow offer for managing PA local tax forms?

airSlate SignNow offers features such as customizable templates, document tracking, and real-time collaboration. These tools make managing PA local tax forms much easier, ensuring that you can complete and submit necessary documents accurately and promptly.

-

Are there any benefits to using eSignatures for PA local tax forms?

Yes, using eSignatures for PA local tax forms enhances security and ensures the integrity of your documents. It also enables faster processing times, allowing you to meet deadlines with ease. Additionally, you can store your signed forms securely in the cloud for easy access anytime.

-

How secure is airSlate SignNow when handling sensitive PA local tax forms?

Security is a top priority for airSlate SignNow. We employ advanced encryption protocols and comply with industry standards to safeguard your PA local tax forms and personal information. Rest assured that your documents are kept confidential and secure throughout the signing process.

Get more for Berkheimer Tax Forms Pa

- 5e inventory sheet pdf form

- A guide to completing the mini nutritional assessment form

- Dealership contract template form

- Personal goal contract template form

- Personal investment contract template form

- Personal lend contract template form

- Personal loan between family contract template form

- Personal loan between friends contract template form

Find out other Berkheimer Tax Forms Pa

- eSignature Tennessee Business Operations Moving Checklist Easy

- eSignature Georgia Construction Residential Lease Agreement Easy

- eSignature Kentucky Construction Letter Of Intent Free

- eSignature Kentucky Construction Cease And Desist Letter Easy

- eSignature Business Operations Document Washington Now

- How To eSignature Maine Construction Confidentiality Agreement

- eSignature Maine Construction Quitclaim Deed Secure

- eSignature Louisiana Construction Affidavit Of Heirship Simple

- eSignature Minnesota Construction Last Will And Testament Online

- eSignature Minnesota Construction Last Will And Testament Easy

- How Do I eSignature Montana Construction Claim

- eSignature Construction PPT New Jersey Later

- How Do I eSignature North Carolina Construction LLC Operating Agreement

- eSignature Arkansas Doctors LLC Operating Agreement Later

- eSignature Tennessee Construction Contract Safe

- eSignature West Virginia Construction Lease Agreement Myself

- How To eSignature Alabama Education POA

- How To eSignature California Education Separation Agreement

- eSignature Arizona Education POA Simple

- eSignature Idaho Education Lease Termination Letter Secure