Minnesota Form M1w

What is the Minnesota Form M1W

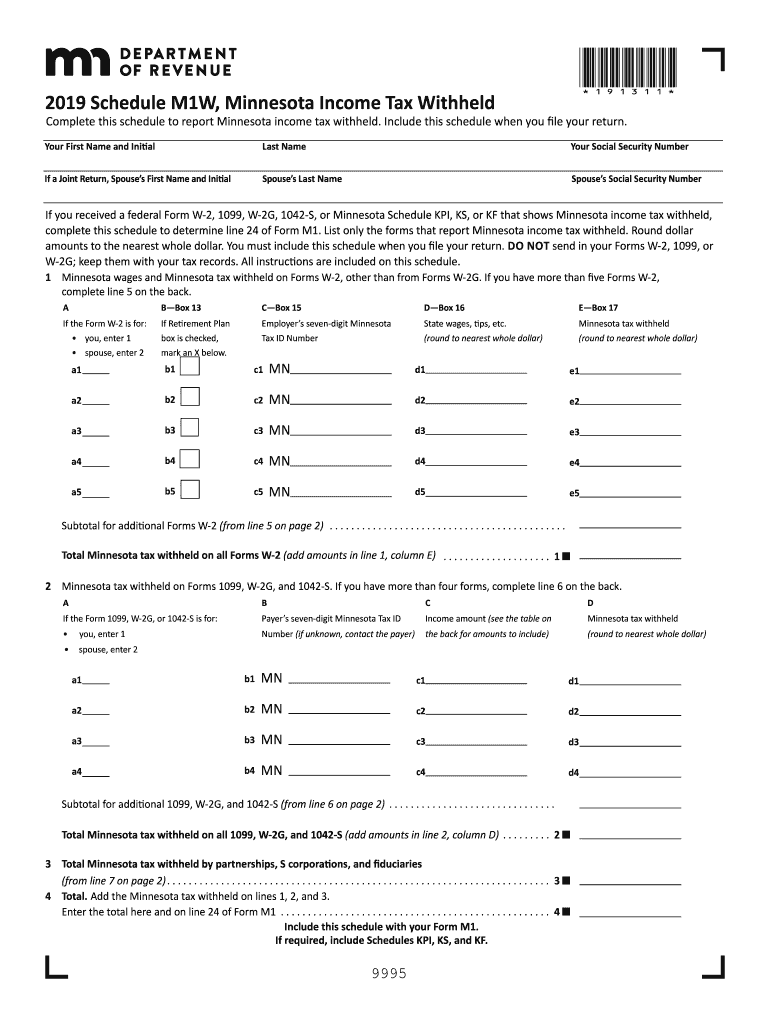

The Minnesota Form M1W is a tax form used by residents of Minnesota to report income tax withheld from their earnings. This form is essential for individuals who have had state income tax withheld from their paychecks throughout the year. It serves as a summary of the total amount withheld and is typically required when filing state income tax returns. The M1W form helps ensure that taxpayers receive proper credit for the taxes already paid, which can affect their overall tax liability.

How to use the Minnesota Form M1W

Using the Minnesota Form M1W involves several straightforward steps. First, gather all necessary documents, including W-2 forms and any other income statements that indicate state tax withholding. Next, complete the M1W form by entering your personal information, including your name, address, and Social Security number. Then, accurately report the total amount of Minnesota income tax withheld as shown on your W-2 forms. Finally, submit the completed form along with your state tax return to ensure that your withholding is properly accounted for.

Steps to complete the Minnesota Form M1W

Completing the Minnesota Form M1W requires careful attention to detail. Follow these steps:

- Gather all relevant documents, including W-2 forms and any other income statements.

- Enter your personal information, such as your name, address, and Social Security number, at the top of the form.

- Report the total amount of Minnesota income tax withheld from your earnings as indicated on your W-2 forms.

- Review the form for accuracy and completeness.

- Submit the form along with your Minnesota state tax return by the designated deadline.

Legal use of the Minnesota Form M1W

The Minnesota Form M1W is legally binding when completed and submitted according to state regulations. It is crucial for taxpayers to ensure that the information provided is accurate and truthful, as discrepancies can lead to penalties or audits. The form must be filed with the Minnesota Department of Revenue and is subject to the same legal requirements as other tax documents. Utilizing a reliable electronic signature solution can enhance the security and legitimacy of your submission.

Filing Deadlines / Important Dates

Filing deadlines for the Minnesota Form M1W typically align with the state income tax return deadlines. For most taxpayers, the deadline to file is April 15 of the following year. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. It is essential to stay informed about any changes to these dates, as they can vary from year to year. Late submissions may result in penalties, so timely filing is crucial.

Form Submission Methods (Online / Mail / In-Person)

The Minnesota Form M1W can be submitted through various methods to accommodate different preferences. Taxpayers may choose to file online through the Minnesota Department of Revenue's e-file system, which offers a convenient and efficient way to submit forms. Alternatively, the form can be mailed directly to the appropriate address specified by the Department of Revenue. For those who prefer in-person submissions, visiting a local revenue office is also an option, although this may require an appointment.

Quick guide on how to complete 2019 m1w minnesota income tax withheld

Effortlessly Prepare Minnesota Form M1w on Any Device

Managing documents online has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documentation, allowing you to find the necessary form and securely store it online. airSlate SignNow equips you with all the tools needed to create, modify, and electronically sign your documents swiftly and without delays. Handle Minnesota Form M1w on any device using the airSlate SignNow Android or iOS applications and enhance any document-related process today.

The Easiest Way to Modify and eSign Minnesota Form M1w Seamlessly

- Obtain Minnesota Form M1w and click Get Form to begin.

- Utilize the resources we provide to complete your form.

- Mark important sections of your documents or redact sensitive information with tools that airSlate SignNow offers for this purpose.

- Create your signature using the Sign feature, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Verify the details and click on the Done button to secure your changes.

- Choose how you want to send your form, whether by email, SMS, invitation link, or download it to your computer.

Forget about lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign Minnesota Form M1w and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 2019 m1w minnesota income tax withheld

How to generate an eSignature for the 2019 M1w Minnesota Income Tax Withheld online

How to make an eSignature for your 2019 M1w Minnesota Income Tax Withheld in Chrome

How to create an electronic signature for putting it on the 2019 M1w Minnesota Income Tax Withheld in Gmail

How to generate an eSignature for the 2019 M1w Minnesota Income Tax Withheld right from your smartphone

How to make an eSignature for the 2019 M1w Minnesota Income Tax Withheld on iOS

How to generate an electronic signature for the 2019 M1w Minnesota Income Tax Withheld on Android devices

People also ask

-

What is the 2019 Minnesota form and how can I use it with airSlate SignNow?

The 2019 Minnesota form is a specific document used for various official purposes. With airSlate SignNow, you can easily upload, edit, and eSign your 2019 Minnesota form online, making it a hassle-free process to gain necessary approvals.

-

Is airSlate SignNow compatible with the 2019 Minnesota form?

Yes, airSlate SignNow is fully compatible with the 2019 Minnesota form. Our platform supports various document types, allowing you to send and sign your 2019 Minnesota form securely and efficiently.

-

What are the pricing options for using airSlate SignNow for my 2019 Minnesota form?

airSlate SignNow offers flexible pricing plans that suit businesses of all sizes. Whether you need to manage a single 2019 Minnesota form or multiple documents, you can choose a plan that fits your budget and requirements.

-

What features does airSlate SignNow provide for managing the 2019 Minnesota form?

airSlate SignNow provides features such as eSigning, document tracking, and templates specifically designed for forms like the 2019 Minnesota form. These tools streamline the signing process and enhance document management.

-

How can I integrate airSlate SignNow with other applications for the 2019 Minnesota form?

airSlate SignNow integrates seamlessly with various applications like Google Drive, Dropbox, and more. This allows you to upload and manage your 2019 Minnesota form alongside your other essential business tools.

-

What are the security features offered by airSlate SignNow when dealing with the 2019 Minnesota form?

Security is a top priority at airSlate SignNow. When handling the 2019 Minnesota form, all documents are encrypted and access-controlled, ensuring your sensitive information remains protected during the signing process.

-

Can I access my 2019 Minnesota form from anywhere using airSlate SignNow?

Absolutely! With airSlate SignNow, you can access your 2019 Minnesota form from any device with an internet connection. This flexibility allows you to manage your documents on the go, ensuring timely completion.

Get more for Minnesota Form M1w

- Application letter the long term care application stella maris form

- Event manager contract template form

- Partner contract template form

- Party bus contract template form

- Party contract template form

- Party decor contract template form

- Party decorator contract template form

- Party event contract template form

Find out other Minnesota Form M1w

- eSign Louisiana Notice of Rent Increase Mobile

- eSign Washington Notice of Rent Increase Computer

- How To eSign Florida Notice to Quit

- How To eSign Hawaii Notice to Quit

- eSign Montana Pet Addendum to Lease Agreement Online

- How To eSign Florida Tenant Removal

- How To eSign Hawaii Tenant Removal

- eSign Hawaii Tenant Removal Simple

- eSign Arkansas Vacation Rental Short Term Lease Agreement Easy

- Can I eSign North Carolina Vacation Rental Short Term Lease Agreement

- eSign Michigan Escrow Agreement Now

- eSign Hawaii Sales Receipt Template Online

- eSign Utah Sales Receipt Template Free

- eSign Alabama Sales Invoice Template Online

- eSign Vermont Escrow Agreement Easy

- How Can I eSign Wisconsin Escrow Agreement

- How To eSign Nebraska Sales Invoice Template

- eSign Nebraska Sales Invoice Template Simple

- eSign New York Sales Invoice Template Now

- eSign Pennsylvania Sales Invoice Template Computer