Mn Department of Revenue Form M99

What is the Mn Department Of Revenue Form M99

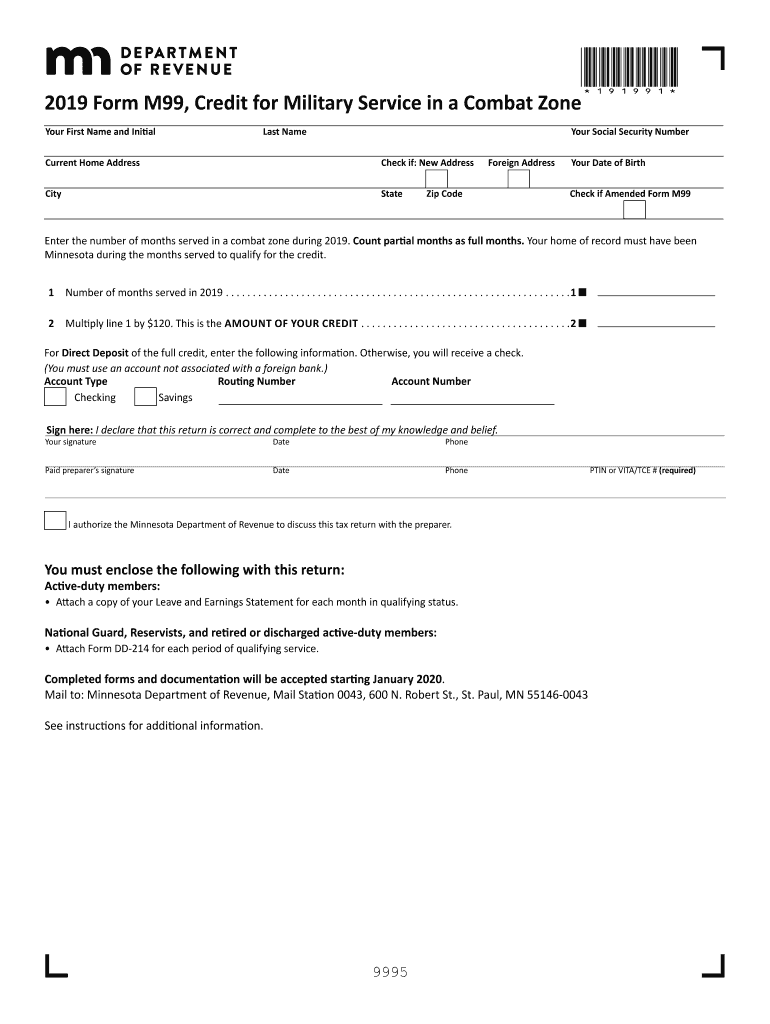

The Mn Department Of Revenue Form M99 is a specific tax form used by residents of Minnesota to report certain tax-related information. This form is essential for individuals or entities that need to disclose specific financial details to the state for tax assessment purposes. Understanding the purpose of the M99 is crucial for ensuring compliance with state tax laws.

How to use the Mn Department Of Revenue Form M99

Using the Mn Department Of Revenue Form M99 involves several steps to ensure accurate completion. First, gather all necessary financial documents and information required for the form. Next, fill out the form carefully, ensuring that all sections are completed accurately. After completing the form, review it for any errors before submission. This process helps in avoiding delays or issues with the Minnesota Department of Revenue.

Steps to complete the Mn Department Of Revenue Form M99

Completing the Mn Department Of Revenue Form M99 requires careful attention to detail. Follow these steps:

- Gather required documents, including previous tax returns and financial statements.

- Download the form from the Minnesota Department of Revenue website or access it through the m99 online login app.

- Fill out the form, ensuring all information is accurate and complete.

- Review the completed form for any mistakes or missing information.

- Submit the form electronically or by mail, following the submission guidelines provided.

Legal use of the Mn Department Of Revenue Form M99

The legal use of the Mn Department Of Revenue Form M99 is governed by Minnesota tax laws. To be considered valid, the form must be completed accurately and submitted within the designated deadlines. Failure to comply with these regulations can result in penalties or legal repercussions. It is important to understand the legal implications of submitting this form to ensure compliance with state regulations.

Key elements of the Mn Department Of Revenue Form M99

The Mn Department Of Revenue Form M99 includes several key elements that must be addressed for proper submission. These elements typically include:

- Taxpayer identification information

- Details of income and deductions

- Signature and date fields

- Instructions for submission

Each of these components plays a vital role in the overall accuracy and legality of the form.

Required Documents

When completing the Mn Department Of Revenue Form M99, certain documents are required to support the information provided. These documents may include:

- Previous tax returns

- W-2 forms and 1099 statements

- Receipts for deductions

- Any other relevant financial documentation

Having these documents ready will streamline the completion process and help ensure accuracy.

Quick guide on how to complete 2019 m99 credit for military service in a combat zone

Effortlessly Prepare Mn Department Of Revenue Form M99 on Any Device

Managing documents online has become increasingly favored by both companies and individuals. It serves as an excellent eco-friendly alternative to conventional printed and signed documentation, allowing you to find the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly and without delays. Handle Mn Department Of Revenue Form M99 on any platform with airSlate SignNow's Android or iOS applications and streamline any document-related task today.

How to Modify and eSign Mn Department Of Revenue Form M99 with Ease

- Find Mn Department Of Revenue Form M99 and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Select pertinent sections of the documents or redact sensitive information using tools specifically provided by airSlate SignNow for that purpose.

- Generate your eSignature with the Sign tool, which takes seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the details and click on the Done button to finalize your changes.

- Choose your preferred method to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced files, cumbersome form searching, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choice. Modify and eSign Mn Department Of Revenue Form M99 to ensure outstanding communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 2019 m99 credit for military service in a combat zone

How to create an eSignature for the 2019 M99 Credit For Military Service In A Combat Zone online

How to generate an electronic signature for the 2019 M99 Credit For Military Service In A Combat Zone in Google Chrome

How to generate an electronic signature for signing the 2019 M99 Credit For Military Service In A Combat Zone in Gmail

How to create an electronic signature for the 2019 M99 Credit For Military Service In A Combat Zone right from your mobile device

How to generate an eSignature for the 2019 M99 Credit For Military Service In A Combat Zone on iOS devices

How to create an eSignature for the 2019 M99 Credit For Military Service In A Combat Zone on Android devices

People also ask

-

What is the m99 online login password process for airSlate SignNow?

To access your airSlate SignNow account, you'll need the m99 online login password, which you create during account setup. If you forget your password, you can easily recover it by clicking the 'Forgot Password?' link on the login page and following the prompted steps to reset it.

-

How do I change my m99 online login password?

Changing your m99 online login password is straightforward. Simply log in to your airSlate SignNow account, navigate to the 'Settings' menu, and select 'Change Password' where you can enter your current password and then your new password.

-

Is it secure to use the m99 online login password for my documents?

Yes, airSlate SignNow employs state-of-the-art encryption protocols to safeguard your m99 online login password and all your documents. Your data is protected both in transit and at rest, ensuring that only you have access to your sensitive information.

-

Can I integrate airSlate SignNow with other tools using the m99 online login password?

Absolutely! Once you've logged into your airSlate SignNow account with your m99 online login password, you can integrate with a variety of applications, such as CRM systems and cloud storage services, enhancing your workflow and productivity.

-

What features are included when I log in with my m99 online login password?

By logging in with your m99 online login password, you gain access to a suite of features including eSignature capabilities, document tracking, and customizable templates. This ensures that your document signing process is both efficient and effective.

-

What happens if I fail to log in with the correct m99 online login password multiple times?

If you attempt to log in with an incorrect m99 online login password too many times, your account may be temporarily locked for security reasons. You will then need to wait a specified time or follow the recovery process to regain access.

-

Are there any costs associated with resetting my m99 online login password?

No, resetting your m99 online login password on airSlate SignNow is completely free. Simply follow the prompts on the login page and you'll be able to create a new password without any associated fees.

Get more for Mn Department Of Revenue Form M99

- The business case for fuel cells energizing americas top companies this report profiles a select group of nationally form

- Dental contract template form

- Dental practice manager contract template form

- Event for photographers contract template form

- Pandemic pod contract template form

- Paralegal service contract template form

- Parent child behavior contract template form

- Parent child contract template form

Find out other Mn Department Of Revenue Form M99

- Can I eSign Colorado Startup Business Plan Template

- eSign Massachusetts Startup Business Plan Template Online

- eSign New Hampshire Startup Business Plan Template Online

- How To eSign New Jersey Startup Business Plan Template

- eSign New York Startup Business Plan Template Online

- eSign Colorado Income Statement Quarterly Mobile

- eSignature Nebraska Photo Licensing Agreement Online

- How To eSign Arizona Profit and Loss Statement

- How To eSign Hawaii Profit and Loss Statement

- How To eSign Illinois Profit and Loss Statement

- How To eSign New York Profit and Loss Statement

- How To eSign Ohio Profit and Loss Statement

- How Do I eSign Ohio Non-Compete Agreement

- eSign Utah Non-Compete Agreement Online

- eSign Tennessee General Partnership Agreement Mobile

- eSign Alaska LLC Operating Agreement Fast

- How Can I eSign Hawaii LLC Operating Agreement

- eSign Indiana LLC Operating Agreement Fast

- eSign Michigan LLC Operating Agreement Fast

- eSign North Dakota LLC Operating Agreement Computer