Irs Form 656

What is the IRS Form 656?

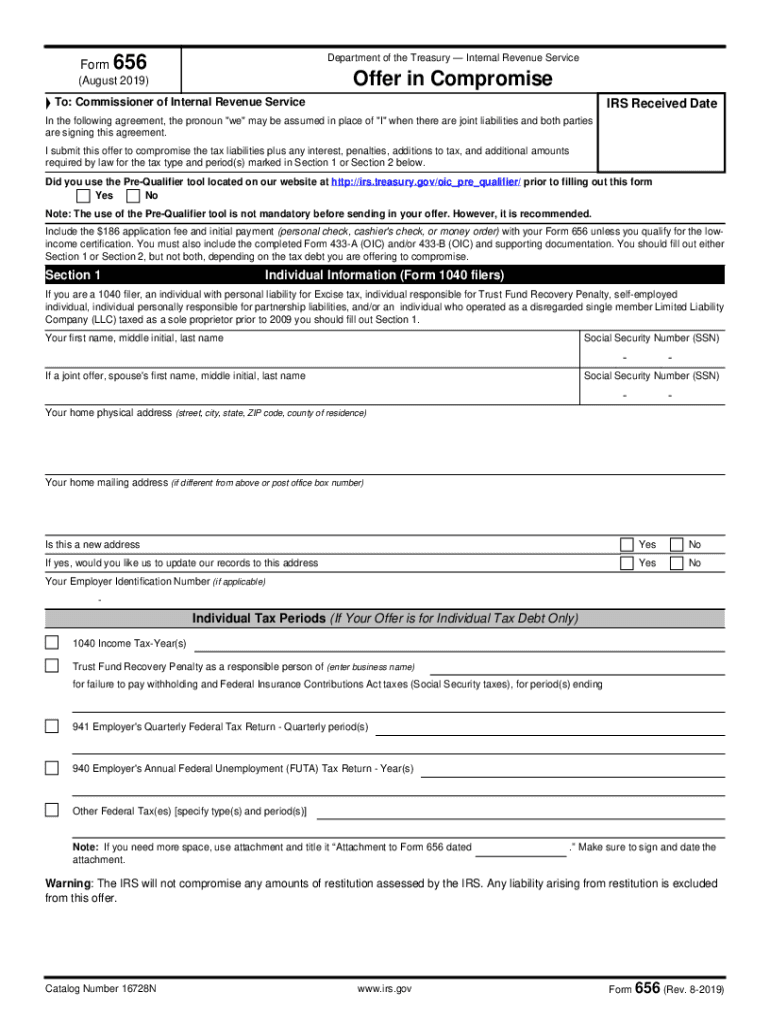

The IRS Form 656 is a crucial document used by taxpayers to propose an Offer in Compromise (OIC) to the Internal Revenue Service. This form allows individuals and businesses to settle their tax debts for less than the full amount owed. The purpose of the form is to provide a structured way for taxpayers to request a reduction in their tax liabilities based on their financial situation. The IRS evaluates these requests based on several factors, including the taxpayer's ability to pay, income, expenses, and asset equity.

How to Use the IRS Form 656

Using the IRS Form 656 involves several steps. First, taxpayers must assess their eligibility to submit an OIC. This includes determining if their tax debt qualifies and if they meet the IRS's criteria. Once eligibility is confirmed, the taxpayer fills out the form, providing detailed financial information, including income, expenses, and assets. After completing the form, it must be submitted to the IRS, along with the required application fee and any supporting documentation that demonstrates financial hardship.

Steps to Complete the IRS Form 656

Completing the IRS Form 656 requires careful attention to detail. Here are the steps to follow:

- Gather Financial Information: Collect all necessary documents that reflect your financial situation, including income statements, bank statements, and expense records.

- Fill Out the Form: Complete each section of the form accurately. Include your personal information, tax details, and financial disclosures.

- Calculate Offer Amount: Use the IRS guidelines to determine a reasonable offer amount based on your ability to pay.

- Attach Required Documents: Include any supporting documents that validate your financial claims and the proposed offer.

- Submit the Form: Send the completed form and payment to the appropriate IRS address, ensuring it is sent via a traceable method.

Legal Use of the IRS Form 656

The IRS Form 656 is legally binding once submitted and accepted by the IRS. It is essential that all information provided is truthful and accurate, as false statements can lead to penalties or rejection of the offer. The form must be completed in compliance with IRS regulations, ensuring that all required documentation is included to support the claim. Legal use also involves adhering to deadlines and responding to any IRS inquiries promptly.

Eligibility Criteria for the IRS Form 656

To qualify for submitting the IRS Form 656, taxpayers must meet specific eligibility criteria. These include:

- Having an outstanding tax liability that is eligible for an OIC.

- Demonstrating an inability to pay the full amount due based on financial hardship.

- Filing all required tax returns before submitting the form.

- Making any required estimated tax payments for the current year.

Required Documents for the IRS Form 656

When submitting the IRS Form 656, certain documents are necessary to support the application. These may include:

- Proof of income, such as pay stubs or tax returns.

- Documentation of monthly expenses, including bills and receipts.

- Bank statements showing current account balances.

- Asset documentation, such as property deeds or vehicle titles.

Quick guide on how to complete about form 656internal revenue service

Prepare Irs Form 656 effortlessly on any device

Web-based document management has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage Irs Form 656 on any platform with the airSlate SignNow Android or iOS applications and enhance any document-oriented process today.

How to alter and eSign Irs Form 656 with ease

- Locate Irs Form 656 and click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize relevant sections of your documents or redact sensitive information using the tools that airSlate SignNow specifically offers for that purpose.

- Create your eSignature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you want to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you prefer. Edit and eSign Irs Form 656 and ensure exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the about form 656internal revenue service

How to generate an eSignature for the About Form 656internal Revenue Service in the online mode

How to create an electronic signature for your About Form 656internal Revenue Service in Google Chrome

How to create an electronic signature for signing the About Form 656internal Revenue Service in Gmail

How to generate an eSignature for the About Form 656internal Revenue Service from your mobile device

How to create an electronic signature for the About Form 656internal Revenue Service on iOS devices

How to create an electronic signature for the About Form 656internal Revenue Service on Android

People also ask

-

What is the 656 OIC 2019 form and how can airSlate SignNow help?

The 656 OIC 2019 form is used for submitting an Offer in Compromise to settle tax debts with the IRS. airSlate SignNow empowers you to easily complete and eSign this document, ensuring a smooth submission process. Our platform simplifies gathering the required signatures and documents, making compliance easier for businesses.

-

How much does airSlate SignNow cost for processing the 656 OIC 2019 form?

The pricing for airSlate SignNow is competitive and cost-effective, designed to meet the needs of small and medium-sized businesses handling forms like the 656 OIC 2019. With various subscription plans, you can choose the best fit based on your document volume and essential features without breaking the bank.

-

What features does airSlate SignNow offer for the 656 OIC 2019 form?

airSlate SignNow offers several powerful features for managing the 656 OIC 2019 form, including customizable templates, real-time tracking, and automated reminders. These features streamline the signing process, ensuring that all parties are informed and documents are managed efficiently. This saves time and helps avoid delays in submissions.

-

Is airSlate SignNow compliant with IRS standards for the 656 OIC 2019?

Yes, airSlate SignNow is fully compliant with IRS e-signature standards for submitting forms like the 656 OIC 2019. Our security measures and legal compliance provide confidence that your documents are handled securely and meet official requirements for acceptance by the IRS.

-

Can I integrate airSlate SignNow with my existing software for the 656 OIC 2019 form?

Absolutely! airSlate SignNow offers seamless integrations with a variety of software applications, making it easy to incorporate your workflow for the 656 OIC 2019 form. Whether you're using CRM systems, project management tools, or document storage services, we ensure a smooth user experience.

-

What are the benefits of using airSlate SignNow for the 656 OIC 2019 form?

Using airSlate SignNow to handle the 656 OIC 2019 form offers several benefits, including increased efficiency, reduced turnaround time, and improved accuracy. eSigning documents allows for quicker approvals and minimizes the risk of errors that could delay your application with the IRS.

-

How can airSlate SignNow enhance my business efficiency while filing the 656 OIC 2019?

airSlate SignNow enhances business efficiency by automating the signing process for the 656 OIC 2019 form, allowing you to focus on your core activities. The platform's user-friendly interface simplifies document management, and its tracking features ensure you are updated on the document's status at all times. This boosts overall productivity and saves precious time.

Get more for Irs Form 656

- Application ocwfcd form

- City of gulfport florida gateway to the gulf pinellas form

- Answers microsoft comen uswindowswhat do you do to fill out a form that has been sent to you

- Hardees application pdf form

- Employee warning form consultstu llc

- Job description job offer letter 69 25 48 form

- Www chaffeecounty orgemergency medical servicesemergency medical services chaffee county colorado form

- Job application form elizabethfpd colorado gov

Find out other Irs Form 656

- Can I eSignature Oregon Orthodontists LLC Operating Agreement

- How To eSignature Rhode Island Orthodontists LLC Operating Agreement

- Can I eSignature West Virginia Lawers Cease And Desist Letter

- eSignature Alabama Plumbing Confidentiality Agreement Later

- How Can I eSignature Wyoming Lawers Quitclaim Deed

- eSignature California Plumbing Profit And Loss Statement Easy

- How To eSignature California Plumbing Business Letter Template

- eSignature Kansas Plumbing Lease Agreement Template Myself

- eSignature Louisiana Plumbing Rental Application Secure

- eSignature Maine Plumbing Business Plan Template Simple

- Can I eSignature Massachusetts Plumbing Business Plan Template

- eSignature Mississippi Plumbing Emergency Contact Form Later

- eSignature Plumbing Form Nebraska Free

- How Do I eSignature Alaska Real Estate Last Will And Testament

- Can I eSignature Alaska Real Estate Rental Lease Agreement

- eSignature New Jersey Plumbing Business Plan Template Fast

- Can I eSignature California Real Estate Contract

- eSignature Oklahoma Plumbing Rental Application Secure

- How Can I eSignature Connecticut Real Estate Quitclaim Deed

- eSignature Pennsylvania Plumbing Business Plan Template Safe