Form 1120

What is the Form 1120

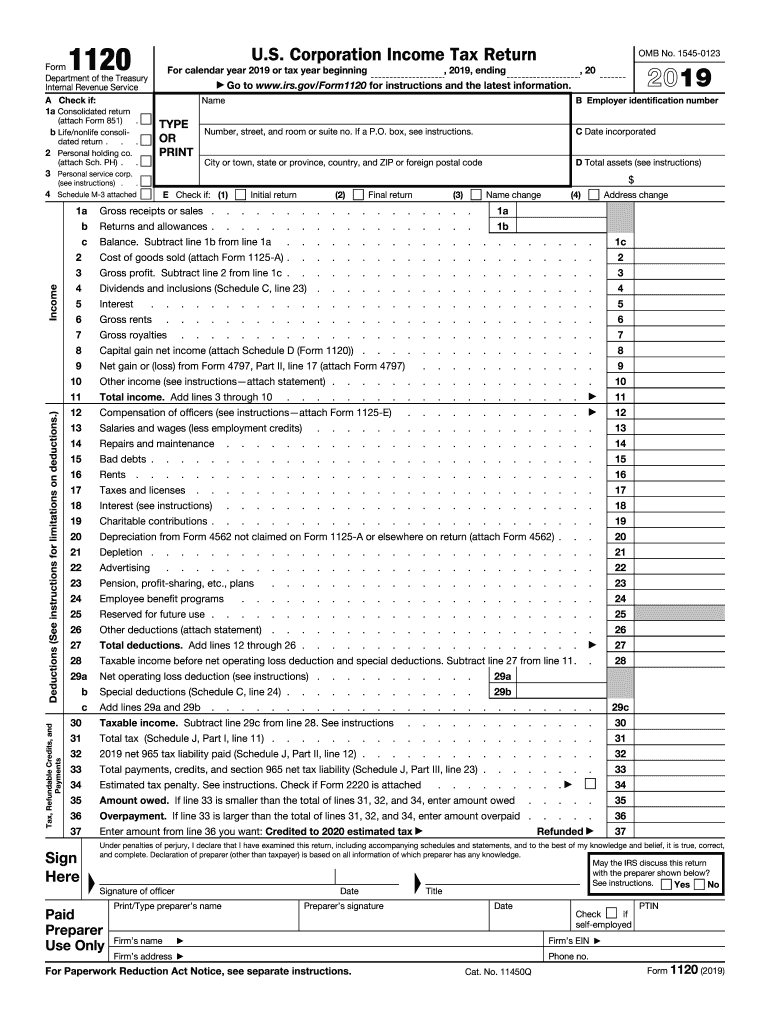

The Form 1120 is the U.S. Corporation Income Tax Return, used by corporations to report their income, gains, losses, deductions, and credits. This form is essential for corporations to calculate their tax liability and is required by the Internal Revenue Service (IRS). The 2019 version of the form includes specific sections that detail income earned, expenses incurred, and any applicable tax credits. Understanding the components of the form is crucial for accurate reporting and compliance with federal tax regulations.

Steps to complete the Form 1120

Completing the Form 1120 involves several key steps to ensure accuracy and compliance. Start by gathering necessary financial documents, including income statements, balance sheets, and any relevant deductions. Follow these steps:

- Fill out the corporation's basic information, including name, address, and Employer Identification Number (EIN).

- Report total income by including all sources of revenue.

- Detail allowable deductions, such as operating expenses, salaries, and cost of goods sold.

- Calculate the taxable income by subtracting total deductions from total income.

- Determine the tax liability based on the applicable corporate tax rate.

- Review the form for accuracy and completeness before submission.

Legal use of the Form 1120

The legal use of the Form 1120 hinges on compliance with IRS regulations. To be considered valid, the form must be filled out accurately and submitted by the designated deadline. Corporations must ensure that all reported information is truthful and supported by appropriate documentation. Any discrepancies or inaccuracies can lead to penalties or audits. Additionally, using a reliable eSignature platform can help ensure that the form is signed and submitted securely, maintaining its legal validity.

Filing Deadlines / Important Dates

Corporations must adhere to specific filing deadlines for the Form 1120. For the tax year 2019, the form is typically due on the fifteenth day of the fourth month following the end of the corporation's tax year. For most corporations operating on a calendar year, this means the deadline is April 15, 2020. It is essential to be aware of these deadlines to avoid late filing penalties and interest charges. Corporations can also request a six-month extension, allowing additional time to prepare the form.

Required Documents

To complete the Form 1120 accurately, several documents are necessary. These include:

- Financial statements, such as profit and loss statements and balance sheets.

- Records of income, including sales receipts and other revenue sources.

- Documentation for deductions, including payroll records and expense receipts.

- Any applicable tax credit forms that may reduce the overall tax liability.

Having these documents organized and readily available will facilitate a smoother filing process.

Form Submission Methods (Online / Mail / In-Person)

The Form 1120 can be submitted through various methods, providing flexibility for corporations. Options include:

- Online submission through the IRS e-file system, which is efficient and allows for quicker processing.

- Mailing the completed form to the appropriate IRS address, based on the corporation's location and tax status.

- In-person submission at designated IRS offices, although this option may be less common.

Choosing the right submission method can impact the processing time and confirmation of receipt by the IRS.

Quick guide on how to complete where to file your taxes for forms 1120internal

Easily Prepare Form 1120 on Any Device

Digital document management has gained traction among businesses and individuals alike. It serves as an excellent environmentally friendly alternative to traditional printed and signed papers, allowing you to find the right template and store it securely online. airSlate SignNow equips you with all the necessary tools to create, alter, and eSign your documents swiftly and without complications. Manage Form 1120 on any platform using the airSlate SignNow apps for Android or iOS and enhance your document-driven processes today.

Easily Modify and eSign Form 1120

- Find Form 1120 and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize relevant sections of your files or obscure sensitive details using tools that airSlate SignNow specifically offers for this task.

- Create your signature using the Sign feature, which takes just a few seconds and holds the same legal validity as a conventional handwritten signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred method to submit your document, whether by email, text message (SMS), invitation link, or download it to your PC.

Say goodbye to lost or misplaced documents, frustrating form navigation, or errors necessitating the printing of new copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device of your choice. Modify and eSign Form 1120 while ensuring effective communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the where to file your taxes for forms 1120internal

How to make an electronic signature for the Where To File Your Taxes For Forms 1120internal in the online mode

How to generate an eSignature for the Where To File Your Taxes For Forms 1120internal in Google Chrome

How to create an eSignature for signing the Where To File Your Taxes For Forms 1120internal in Gmail

How to create an eSignature for the Where To File Your Taxes For Forms 1120internal straight from your smartphone

How to make an electronic signature for the Where To File Your Taxes For Forms 1120internal on iOS

How to create an electronic signature for the Where To File Your Taxes For Forms 1120internal on Android OS

People also ask

-

What is the 1120 2019 field and why is it important?

The 1120 2019 field refers to the specific entries in the IRS Form 1120 for the tax year 2019. Understanding this field is vital for businesses to accurately report their income and deductions, ensuring compliance with tax regulations.

-

How does airSlate SignNow simplify the completion of the 1120 2019 field?

airSlate SignNow streamlines the process of filling out the 1120 2019 field by allowing users to electronically sign and send documents securely. This saves time and reduces errors, making tax preparation more efficient and straightforward.

-

Can I integrate airSlate SignNow with other accounting software to manage the 1120 2019 field?

Yes, airSlate SignNow integrates seamlessly with various accounting software, enabling users to manage the 1120 2019 field directly within their existing workflows. This integration enhances productivity and ensures that all documentation is easily accessible.

-

What pricing plans are available for using airSlate SignNow for the 1120 2019 field?

airSlate SignNow offers flexible pricing plans to cater to different business needs. Each plan provides access to essential features that can assist users in managing the 1120 2019 field efficiently without breaking the bank.

-

What are the key benefits of using airSlate SignNow for the 1120 2019 field?

Using airSlate SignNow for the 1120 2019 field provides key benefits such as enhanced security, ease of use, and rapid document processing. These features help businesses meet tax filing deadlines with confidence.

-

Is airSlate SignNow secure for handling sensitive information in the 1120 2019 field?

Absolutely. airSlate SignNow employs robust security protocols to protect sensitive information in the 1120 2019 field. This ensures that your documents and signatures are secure from unauthorized access.

-

How can I obtain support for issues related to the 1120 2019 field while using airSlate SignNow?

airSlate SignNow offers comprehensive customer support to assist with any issues related to the 1120 2019 field. Users can access resources such as FAQs, live chat, or direct support to ensure a smooth experience.

Get more for Form 1120

Find out other Form 1120

- How To eSignature Massachusetts Government Form

- How Can I eSignature Oregon Government PDF

- How Can I eSignature Oklahoma Government Document

- How To eSignature Texas Government Document

- Can I eSignature Vermont Government Form

- How Do I eSignature West Virginia Government PPT

- How Do I eSignature Maryland Healthcare / Medical PDF

- Help Me With eSignature New Mexico Healthcare / Medical Form

- How Do I eSignature New York Healthcare / Medical Presentation

- How To eSignature Oklahoma Finance & Tax Accounting PPT

- Help Me With eSignature Connecticut High Tech Presentation

- How To eSignature Georgia High Tech Document

- How Can I eSignature Rhode Island Finance & Tax Accounting Word

- How Can I eSignature Colorado Insurance Presentation

- Help Me With eSignature Georgia Insurance Form

- How Do I eSignature Kansas Insurance Word

- How Do I eSignature Washington Insurance Form

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word