Schedule J Form

What is the Schedule J

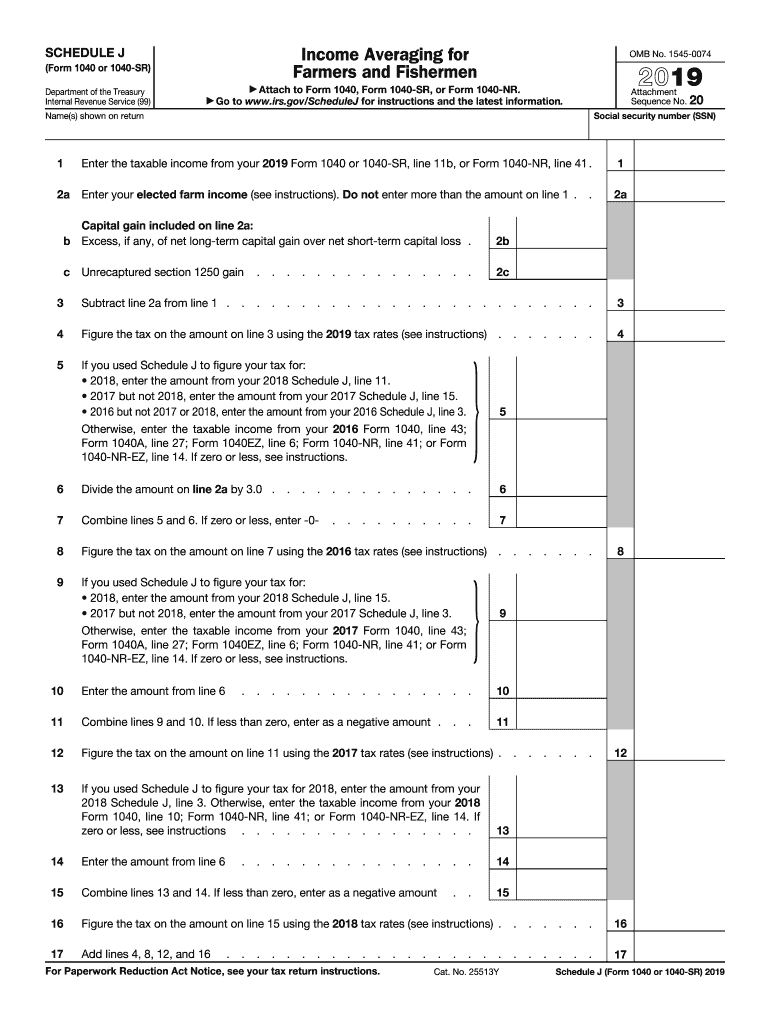

The Schedule J is a form used by taxpayers to report income averaging for the 2019 tax year. This form allows individuals to spread their income over several years, which can be beneficial for those experiencing fluctuating income levels. By utilizing the Schedule J, taxpayers can potentially lower their overall tax liability by taking advantage of lower tax rates in previous years. This form is particularly relevant for farmers and fishermen who often have variable income patterns.

How to use the Schedule J

Using the Schedule J involves several steps to ensure accurate reporting of income. Taxpayers must first gather their income records for the current and prior years. Next, they will calculate their average income over the specified years and fill out the form accordingly. It is essential to follow the IRS instructions closely, as errors can lead to delays in processing or issues with tax compliance. The completed Schedule J should be attached to the main tax return form, such as the 1040 or 1120.

Steps to complete the Schedule J

Completing the Schedule J requires careful attention to detail. Here are the steps to follow:

- Gather all relevant income documents for the current year and the previous three years.

- Determine the total income for each year and calculate the average income.

- Fill out the Schedule J form, entering the calculated average income and any necessary adjustments.

- Review the form for accuracy, ensuring all calculations are correct.

- Attach the completed Schedule J to your tax return before submission.

Legal use of the Schedule J

The Schedule J is legally recognized by the IRS as a valid method for reporting income averaging. To ensure compliance, taxpayers must adhere to the guidelines set forth by the IRS regarding eligibility and proper use of the form. It is crucial to maintain accurate records and documentation to support the income reported on the Schedule J, as this may be required in the event of an audit.

Filing Deadlines / Important Dates

For the 2019 tax year, the filing deadline for submitting the Schedule J is typically the same as the deadline for the main tax return. Taxpayers should be aware of these dates to avoid penalties. Extensions may be available, but it is essential to file the Schedule J along with the main tax return by the due date to ensure compliance with IRS regulations.

IRS Guidelines

The IRS provides specific guidelines for the completion and submission of the Schedule J. Taxpayers should refer to the official IRS instructions for detailed information on eligibility, calculation methods, and documentation requirements. Following these guidelines is crucial for ensuring that the form is filled out correctly and submitted on time.

Quick guide on how to complete 2016 schedule j form 1040 internal revenue service

Effortlessly prepare Schedule J on any device

Digital document management has gained traction among businesses and individuals alike. It serves as an ideal environmentally friendly substitute for typical printed and signed documents, as you can easily locate the right form and securely save it online. airSlate SignNow equips you with all the necessary tools to swiftly create, edit, and eSign your documents without any delays. Handle Schedule J on any device using the airSlate SignNow Android or iOS applications and enhance any document-related procedure today.

The easiest method to modify and eSign Schedule J effortlessly

- Obtain Schedule J and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a traditional ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you wish to share your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or mislaid files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you choose. Edit and eSign Schedule J and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 2016 schedule j form 1040 internal revenue service

How to create an electronic signature for your 2016 Schedule J Form 1040 Internal Revenue Service online

How to create an eSignature for the 2016 Schedule J Form 1040 Internal Revenue Service in Chrome

How to make an eSignature for putting it on the 2016 Schedule J Form 1040 Internal Revenue Service in Gmail

How to generate an eSignature for the 2016 Schedule J Form 1040 Internal Revenue Service from your smartphone

How to generate an electronic signature for the 2016 Schedule J Form 1040 Internal Revenue Service on iOS devices

How to generate an electronic signature for the 2016 Schedule J Form 1040 Internal Revenue Service on Android devices

People also ask

-

What is airSlate SignNow and how does it relate to 2019 j?

airSlate SignNow is a powerful eSignature solution designed to simplify document management. In 2019 j, the platform gained signNow traction with its user-friendly interface and robust features, allowing businesses to streamline their signing processes effectively.

-

How much does airSlate SignNow cost for users interested in 2019 j?

Pricing for airSlate SignNow varies based on the plan you choose, making it a cost-effective solution for businesses focused on 2019 j. Users can select from multiple tiers to find the best fit for their budget and required features.

-

What features does airSlate SignNow offer for 2019 j users?

airSlate SignNow includes a variety of features tailored for 2019 j, such as real-time document tracking, templates, and mobile access. This makes it easier for users to manage and sign documents efficiently, regardless of where they are.

-

Can airSlate SignNow integrate with other tools beneficial for 2019 j?

Yes, airSlate SignNow can seamlessly integrate with various applications such as Google Drive, Salesforce, and more. These integrations enhance the efficiency of workflows established in 2019 j, making document management more streamlined.

-

What are the benefits of using airSlate SignNow in 2019 j?

Utilizing airSlate SignNow in 2019 j provides businesses with improved efficiency, reduced paperwork, and faster document turnaround times. The platform's simplicity also empowers teams to focus on core tasks rather than being bogged down by manual processes.

-

Is airSlate SignNow secure for document signing relevant to 2019 j?

Absolutely, airSlate SignNow prioritizes security by implementing advanced encryption and compliance protocols, ensuring documents signed in 2019 j are protected. This commitment to security helps users trust the platform with sensitive information.

-

How can businesses leverage airSlate SignNow to improve their 2019 j strategies?

Businesses can leverage airSlate SignNow to enhance their 2019 j strategies by automating signature requests and improving collaboration. This allows for quicker decision-making and a more efficient workflow, ultimately leading to better business outcomes.

Get more for Schedule J

Find out other Schedule J

- How To Sign Arizona Business Operations PDF

- Help Me With Sign Nebraska Business Operations Presentation

- How To Sign Arizona Car Dealer Form

- How To Sign Arkansas Car Dealer Document

- How Do I Sign Colorado Car Dealer PPT

- Can I Sign Florida Car Dealer PPT

- Help Me With Sign Illinois Car Dealer Presentation

- How Can I Sign Alabama Charity Form

- How Can I Sign Idaho Charity Presentation

- How Do I Sign Nebraska Charity Form

- Help Me With Sign Nevada Charity PDF

- How To Sign North Carolina Charity PPT

- Help Me With Sign Ohio Charity Document

- How To Sign Alabama Construction PDF

- How To Sign Connecticut Construction Document

- How To Sign Iowa Construction Presentation

- How To Sign Arkansas Doctors Document

- How Do I Sign Florida Doctors Word

- Can I Sign Florida Doctors Word

- How Can I Sign Illinois Doctors PPT