Federal Tax Form 8880

What is the Federal Tax Form 8880

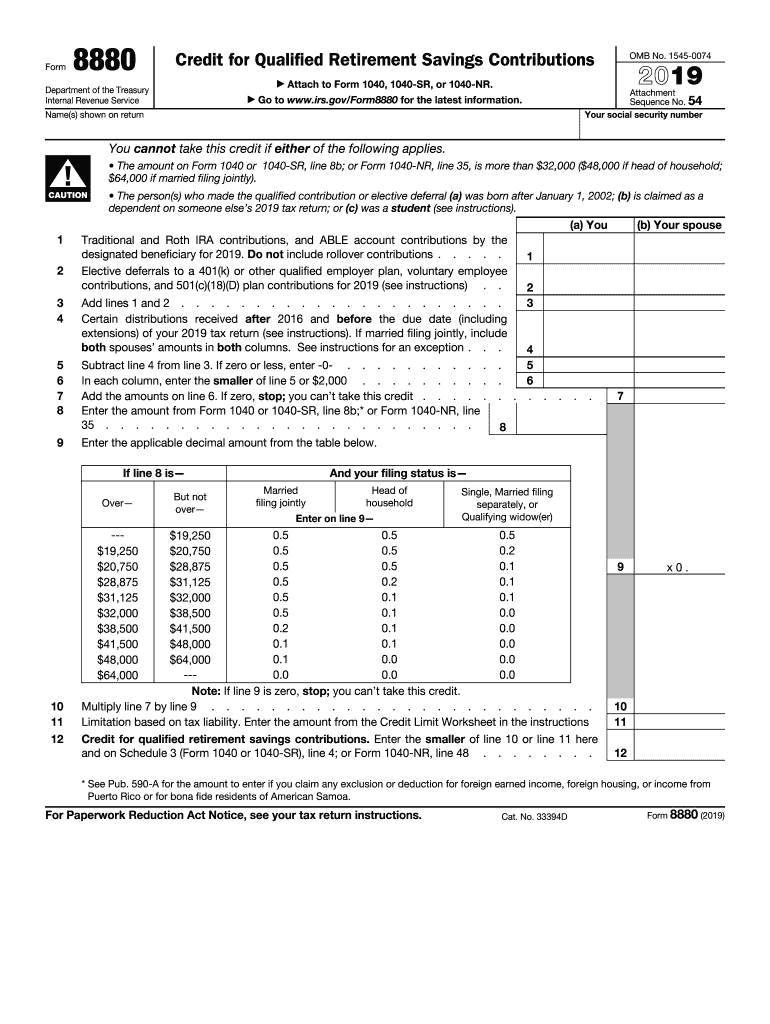

The Federal Tax Form 8880, officially known as the Credit for Qualified Retirement Savings Contributions, is a tax form used by eligible taxpayers to claim a credit for contributions made to qualified retirement savings accounts. This form is particularly relevant for individuals who make contributions to IRAs, 401(k)s, or other retirement plans. By filing this form, taxpayers can reduce their overall tax liability, making it a valuable tool for encouraging retirement savings.

How to use the Federal Tax Form 8880

To use the Federal Tax Form 8880, taxpayers need to determine their eligibility based on income and filing status. The form requires information about the contributions made to retirement accounts during the tax year. Taxpayers must complete the form by providing their adjusted gross income (AGI) and the amount contributed to retirement accounts. Once completed, the form should be attached to the taxpayer's annual income tax return.

Steps to complete the Federal Tax Form 8880

Completing the Federal Tax Form 8880 involves several key steps:

- Gather necessary documents, including records of retirement contributions and income statements.

- Determine eligibility by checking the income limits based on filing status.

- Fill out the form by entering personal information, including AGI and contribution amounts.

- Calculate the credit amount based on the contributions made and the applicable percentage.

- Attach the completed form to your tax return before submission.

Eligibility Criteria

To qualify for the credit on the Federal Tax Form 8880, taxpayers must meet specific eligibility criteria. These include:

- Filing status: Must be single, married filing jointly, head of household, or married filing separately.

- Income limits: The taxpayer's AGI must fall below certain thresholds, which vary based on filing status.

- Age: Taxpayers must be at least eighteen years old and not a full-time student.

- Retirement contributions: Contributions must be made to qualified retirement accounts during the tax year.

Required Documents

When preparing to file the Federal Tax Form 8880, taxpayers should gather the following documents:

- Form W-2 or 1099, which provides information on income.

- Records of contributions made to retirement accounts, such as bank statements or account summaries.

- Previous year’s tax return, which can help in calculating adjusted gross income.

Filing Deadlines / Important Dates

The Federal Tax Form 8880 must be filed along with the annual income tax return, typically due on April fifteenth of the following year. For taxpayers who file for an extension, the deadline may be extended to October fifteenth. It is essential to adhere to these deadlines to ensure eligibility for the retirement savings credit.

Quick guide on how to complete 2019 form 8880 credit for qualified retirement savings contributions

Prepare Federal Tax Form 8880 effortlessly on any device

Web-based document management has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed paperwork, as you can easily find the correct form and securely archive it online. airSlate SignNow provides you with all the resources necessary to create, modify, and eSign your documents swiftly without any delays. Manage Federal Tax Form 8880 on any device using the airSlate SignNow Android or iOS applications and streamline any document-related task today.

The easiest way to modify and eSign Federal Tax Form 8880 without hassle

- Find Federal Tax Form 8880 and then click Get Form to begin.

- Use the tools available to complete your document.

- Mark important sections of the documents or black out sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your eSignature with the Sign feature, which takes mere seconds and has the same legal validity as a traditional handwritten signature.

- Review the details and then click on the Done button to save your modifications.

- Select how you wish to send your form, via email, text message (SMS), or invite link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form hunting, or mistakes that require printing new copies. airSlate SignNow addresses all your document management requirements with just a few clicks from any device you prefer. Modify and eSign Federal Tax Form 8880 and ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 2019 form 8880 credit for qualified retirement savings contributions

How to generate an electronic signature for the 2019 Form 8880 Credit For Qualified Retirement Savings Contributions online

How to generate an eSignature for your 2019 Form 8880 Credit For Qualified Retirement Savings Contributions in Google Chrome

How to create an eSignature for putting it on the 2019 Form 8880 Credit For Qualified Retirement Savings Contributions in Gmail

How to create an eSignature for the 2019 Form 8880 Credit For Qualified Retirement Savings Contributions right from your mobile device

How to generate an electronic signature for the 2019 Form 8880 Credit For Qualified Retirement Savings Contributions on iOS devices

How to make an eSignature for the 2019 Form 8880 Credit For Qualified Retirement Savings Contributions on Android

People also ask

-

What is Form 8880 and how can airSlate SignNow help with it?

Form 8880, also known as the Credit for Qualified Retirement Savings Contributions, can be easily managed with airSlate SignNow. Our platform allows you to fill out, sign, and save your Form 8880 securely and efficiently. With intuitive tools, you can ensure all details are correctly filled, minimizing mistakes.

-

How does airSlate SignNow protect personal information on Form 8880?

At airSlate SignNow, we prioritize your security. When filling out Form 8880, our platform uses advanced encryption protocols to keep your personal and financial information safe. You can confidently sign your documents knowing that your data is securely protected.

-

Are there any costs associated with using airSlate SignNow for Form 8880?

Yes, airSlate SignNow offers a range of pricing plans to cater to different business needs. For managing Form 8880 and other documents, our plans are cost-effective. You can choose a plan that fits your budget while still getting powerful features for document management.

-

Can I integrate airSlate SignNow with other software for handling Form 8880?

Absolutely! airSlate SignNow offers integrations with various third-party applications that enhance your productivity. You can seamlessly integrate your workflow with tools like CRM software to efficiently manage your Form 8880 and other important documents.

-

What features does airSlate SignNow offer to streamline Form 8880 processing?

airSlate SignNow includes features like templates, automated workflows, and mobile access to facilitate the processing of Form 8880. These tools help you create, customize, and send your form quickly, ensuring a hassle-free experience.

-

Is it easy to make changes to Form 8880 in airSlate SignNow?

Yes, making changes to Form 8880 is straightforward with airSlate SignNow. Our user-friendly interface allows you to edit any part of the document, ensuring you can update information as needed without any hassle.

-

How do I share my completed Form 8880 with others using airSlate SignNow?

Sharing your completed Form 8880 is simple with airSlate SignNow. You can send your signed document directly through email or share a secure link with stakeholders to ensure they have access to the document right away.

Get more for Federal Tax Form 8880

Find out other Federal Tax Form 8880

- How Do I Sign Tennessee Real Estate Warranty Deed

- Sign Tennessee Real Estate Last Will And Testament Free

- Sign Colorado Police Memorandum Of Understanding Online

- How To Sign Connecticut Police Arbitration Agreement

- Sign Utah Real Estate Quitclaim Deed Safe

- Sign Utah Real Estate Notice To Quit Now

- Sign Hawaii Police LLC Operating Agreement Online

- How Do I Sign Hawaii Police LLC Operating Agreement

- Sign Hawaii Police Purchase Order Template Computer

- Sign West Virginia Real Estate Living Will Online

- How Can I Sign West Virginia Real Estate Confidentiality Agreement

- Sign West Virginia Real Estate Quitclaim Deed Computer

- Can I Sign West Virginia Real Estate Affidavit Of Heirship

- Sign West Virginia Real Estate Lease Agreement Template Online

- How To Sign Louisiana Police Lease Agreement

- Sign West Virginia Orthodontists Business Associate Agreement Simple

- How To Sign Wyoming Real Estate Operating Agreement

- Sign Massachusetts Police Quitclaim Deed Online

- Sign Police Word Missouri Computer

- Sign Missouri Police Resignation Letter Fast