Schedule Se Form

What is the Schedule SE?

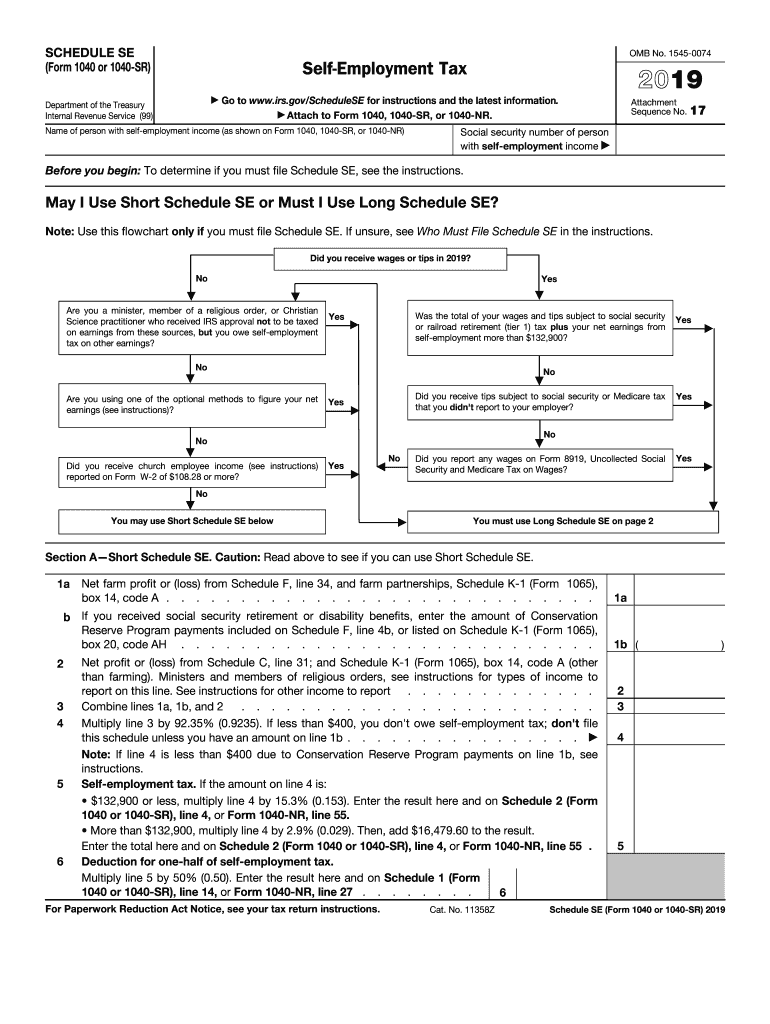

The Schedule SE is a tax form used by self-employed individuals to calculate their self-employment tax. This tax is essential for those who earn income through self-employment, including freelancers, independent contractors, and business owners. The form helps determine how much self-employment tax is owed, which contributes to Social Security and Medicare. Understanding the Schedule SE is crucial for accurate tax reporting and compliance with IRS regulations.

How to Use the Schedule SE

To use the Schedule SE effectively, begin by gathering all relevant income information from your self-employment activities. This includes income from freelance work, business earnings, and any other self-employed income sources. Next, complete the form by following the instructions carefully. You will need to report your net earnings, which is your total income minus any allowable business deductions. The form also requires calculations to determine the self-employment tax based on your net earnings.

Steps to Complete the Schedule SE

Completing the Schedule SE involves several key steps:

- Gather your income information from all self-employment sources.

- Calculate your net earnings by subtracting business expenses from gross income.

- Fill out the form, starting with your net earnings figure.

- Calculate the self-employment tax using the provided rates on the form.

- Transfer the calculated tax amount to your Form 1040.

Make sure to review the completed form for accuracy before submission.

Legal Use of the Schedule SE

The Schedule SE is legally recognized by the IRS for calculating self-employment tax obligations. To ensure compliance, it is essential to fill out the form accurately and submit it along with your annual tax return. Electronic filing through a trusted platform can enhance the security and validity of your submission. Adhering to IRS guidelines and maintaining proper documentation will help avoid potential legal issues related to tax compliance.

IRS Guidelines

The IRS provides specific guidelines for using the Schedule SE. It is important to refer to the latest IRS publications and instructions related to the form. These guidelines include eligibility criteria for self-employment, the calculation of net earnings, and instructions for filing. Staying updated with IRS changes ensures that you are using the most current information and complying with tax laws effectively.

Filing Deadlines / Important Dates

Filing deadlines for the Schedule SE align with the annual tax return deadlines. Typically, self-employed individuals must file their taxes by April 15 of the following year. If you need additional time, you can file for an extension, but it's important to pay any estimated taxes owed by the original deadline to avoid penalties. Keeping track of these dates is essential for timely and compliant tax filing.

Quick guide on how to complete form 1040 schedule se internal revenue service

Effortlessly Prepare Schedule Se on Any Device

Online document management has become increasingly favored by businesses and individuals alike. It offers an ideal environmentally friendly substitute for traditional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the features required to create, modify, and eSign your documents quickly and without interruptions. Manage Schedule Se on any platform with airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to Alter and eSign Schedule Se with Ease

- Locate Schedule Se and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize necessary sections of your documents or redact sensitive information using the tools that airSlate SignNow specifically offers for this purpose.

- Create your eSignature using the Sign tool, which only takes a few seconds and holds the same legal validity as a traditional ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select how you want to share your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns over lost or misplaced files, tedious form exploration, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs with just a few clicks from any device of your choice. Modify and eSign Schedule Se while ensuring exceptional communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 1040 schedule se internal revenue service

How to make an electronic signature for your Form 1040 Schedule Se Internal Revenue Service in the online mode

How to create an eSignature for your Form 1040 Schedule Se Internal Revenue Service in Chrome

How to create an eSignature for signing the Form 1040 Schedule Se Internal Revenue Service in Gmail

How to make an eSignature for the Form 1040 Schedule Se Internal Revenue Service from your smart phone

How to generate an electronic signature for the Form 1040 Schedule Se Internal Revenue Service on iOS

How to create an eSignature for the Form 1040 Schedule Se Internal Revenue Service on Android devices

People also ask

-

What is the best way to schedule SE 2019 with airSlate SignNow?

To effectively schedule SE 2019 using airSlate SignNow, simply create an account and navigate to the scheduling feature. The platform allows you to set up automated reminders and track document statuses, ensuring your scheduling process is streamlined and efficient.

-

How does airSlate SignNow facilitate document management for schedule SE 2019?

airSlate SignNow offers robust document management features that allow users to easily store, organize, and retrieve important files related to schedule SE 2019. With customizable folders and search functionality, finding the right documents is quick and hassle-free.

-

What pricing plans are available for airSlate SignNow for schedule SE 2019?

airSlate SignNow offers various pricing plans tailored to different business needs, including options specifically designed to support scheduling tasks like schedule SE 2019. Each plan provides access to essential features, ensuring that you can choose the right one for your organization’s requirements.

-

Can I integrate airSlate SignNow with other tools while managing schedule SE 2019?

Yes, airSlate SignNow supports numerous integrations with popular tools such as Google Drive, Dropbox, and Salesforce. These integrations enhance your ability to manage schedule SE 2019 efficiently by connecting your existing workflows and applications.

-

What features does airSlate SignNow offer for enhancing schedule SE 2019 processes?

airSlate SignNow includes features like customizable templates, bulk sending, and advanced reporting that can signNowly enhance your schedule SE 2019 processes. These tools help automate workflows, saving you time and increasing productivity.

-

Is airSlate SignNow secure for handling documents related to schedule SE 2019?

Absolutely! airSlate SignNow is designed with security in mind, employing encryption and authentication measures to safeguard your documents, including those related to schedule SE 2019. Your sensitive information is always protected while you manage your eSigning tasks.

-

How can airSlate SignNow improve collaboration for schedule SE 2019?

With airSlate SignNow, collaboration for schedule SE 2019 is enhanced through shared document access, real-time notifications, and in-app commenting. This ensures that all stakeholders are kept in the loop and can work together seamlessly on important schedules and documents.

Get more for Schedule Se

Find out other Schedule Se

- How Do I Sign Massachusetts Car Dealer Warranty Deed

- How To Sign Nebraska Car Dealer Resignation Letter

- How Can I Sign New Jersey Car Dealer Arbitration Agreement

- How Can I Sign Ohio Car Dealer Cease And Desist Letter

- How To Sign Ohio Car Dealer Arbitration Agreement

- How To Sign Oregon Car Dealer Limited Power Of Attorney

- How To Sign Pennsylvania Car Dealer Quitclaim Deed

- How Can I Sign Pennsylvania Car Dealer Quitclaim Deed

- Sign Rhode Island Car Dealer Agreement Safe

- Sign South Dakota Car Dealer Limited Power Of Attorney Now

- Sign Wisconsin Car Dealer Quitclaim Deed Myself

- Sign Wisconsin Car Dealer Quitclaim Deed Free

- Sign Virginia Car Dealer POA Safe

- Sign Wisconsin Car Dealer Quitclaim Deed Fast

- How To Sign Wisconsin Car Dealer Rental Lease Agreement

- How To Sign Wisconsin Car Dealer Quitclaim Deed

- How Do I Sign Wisconsin Car Dealer Quitclaim Deed

- Sign Wyoming Car Dealer Purchase Order Template Mobile

- Sign Arizona Charity Business Plan Template Easy

- Can I Sign Georgia Charity Warranty Deed