Form 8962 Instructions

What is the Form 8962 Instructions

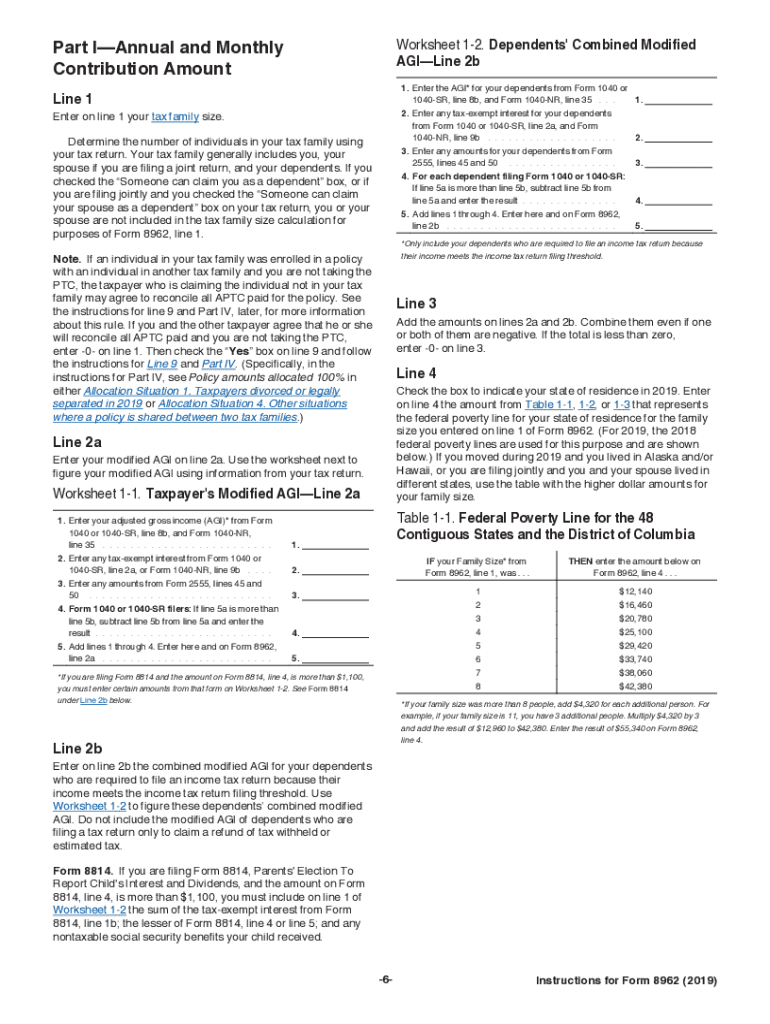

The Form 8962 instructions provide guidance on how to complete the 2019 Form 8962, which is used to calculate the Premium Tax Credit (PTC) for individuals and families who purchased health insurance through the Health Insurance Marketplace. This form is essential for taxpayers who wish to reconcile the amount of PTC they received with their actual income and family size for the tax year.

Steps to complete the Form 8962 Instructions

Completing the Form 8962 requires several steps to ensure accuracy and compliance with IRS regulations. Begin by gathering necessary documents, including your Form 1095-A, which details your health coverage. Follow these steps:

- Enter your personal information, including your name and Social Security number.

- Input the information from your Form 1095-A regarding the coverage you received.

- Calculate your annual premium tax credit based on your household income and family size.

- Reconcile any advance payments of the premium tax credit with the calculated amount.

- Sign and date the form before submission.

How to obtain the Form 8962 Instructions

The Form 8962 instructions can be obtained directly from the IRS website or through tax preparation software that includes the form. It is important to ensure that you are using the correct version for the tax year you are filing. You can also request a paper copy from the IRS if needed.

Legal use of the Form 8962 Instructions

Using the Form 8962 instructions legally requires adherence to IRS guidelines. The form must be filed accurately to avoid penalties and ensure compliance with tax laws. Electronic submission is acceptable, and using a reliable eSignature platform can enhance the security and validity of your submission.

Filing Deadlines / Important Dates

For the 2019 tax year, the deadline to file your tax return, including the Form 8962, was typically April 15 of the following year. If you filed for an extension, you had until October 15 to submit your return. It is crucial to be aware of these dates to avoid late filing penalties.

Required Documents

To complete the Form 8962, you will need several documents, including:

- Your Form 1095-A, which provides information about your health insurance coverage.

- Your tax return from the previous year for reference on income and family size.

- Any additional documentation that supports your income claims, such as W-2 forms or 1099s.

IRS Guidelines

The IRS provides specific guidelines for completing the Form 8962. These guidelines include instructions on calculating your premium tax credit, reconciling any advance payments, and ensuring that all information is accurate and complete. Following these guidelines is essential for a successful filing.

Quick guide on how to complete 04 department of the treasury internal revenue service

Complete Form 8962 Instructions effortlessly on any gadget

Digital document administration has become increasingly favored among companies and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can easily find the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents promptly without delay. Manage Form 8962 Instructions on any gadget using airSlate SignNow Android or iOS applications and enhance any document-based process today.

The easiest way to revise and eSign Form 8962 Instructions with minimal effort

- Find Form 8962 Instructions and click on Get Form to begin.

- Utilize the provided tools to finish your document.

- Emphasize signNow sections of the documents or redact sensitive information using tools that airSlate SignNow specifically provides for that purpose.

- Create your signature with the Sign tool, which takes moments and holds the same legal validity as a conventional wet ink signature.

- Verify the information and click on the Done button to save your changes.

- Choose how you wish to distribute your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow fulfills your document management requirements in just a few clicks from your preferred device. Revise and eSign Form 8962 Instructions and ensure superior communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 04 department of the treasury internal revenue service

How to generate an eSignature for your 04 Department Of The Treasury Internal Revenue Service in the online mode

How to make an electronic signature for the 04 Department Of The Treasury Internal Revenue Service in Google Chrome

How to create an electronic signature for signing the 04 Department Of The Treasury Internal Revenue Service in Gmail

How to make an eSignature for the 04 Department Of The Treasury Internal Revenue Service from your smart phone

How to create an electronic signature for the 04 Department Of The Treasury Internal Revenue Service on iOS devices

How to make an electronic signature for the 04 Department Of The Treasury Internal Revenue Service on Android devices

People also ask

-

What is TurboTax 2019 8962, and why is it important?

TurboTax 2019 8962 is a critical form for taxpayers who received premium tax credits to help pay for health insurance. Understanding this form is vital for accurately calculating your tax refund or liability. This ensures compliance with IRS requirements while maximizing your potential benefits.

-

How can I integrate airSlate SignNow with TurboTax 2019 8962?

Integrating airSlate SignNow with TurboTax 2019 8962 simplifies the eSigning process for your tax forms. You can easily send your 8962 forms for electronic signatures directly from the airSlate platform. This reduces paperwork and streamlines the submission of your tax documents.

-

What features does airSlate SignNow offer for managing TurboTax 2019 8962?

airSlate SignNow offers robust features for managing TurboTax 2019 8962, including customizable templates, secure eSigning, and automated reminders. These tools help you organize your tax documentation efficiently, making it easier to file your taxes on time. With airSlate, you can focus more on your finances and less on paperwork.

-

Is airSlate SignNow cost-effective for eSigning TurboTax 2019 8962?

Yes, airSlate SignNow is designed to be a cost-effective solution for eSigning and managing your TurboTax 2019 8962 forms. It offers various pricing plans that cater to different needs, ensuring that individual users and businesses alike can afford to streamline their document processes. This cost-effectiveness can lead to signNow savings through time and resource management.

-

Can I track the status of my TurboTax 2019 8962 eSignatures with airSlate SignNow?

Absolutely! airSlate SignNow provides real-time tracking for the status of your TurboTax 2019 8962 eSignatures. This feature keeps you updated on who has signed your document and who still needs to review it. It enhances the accountability and speed of your tax filing process.

-

What benefits does airSlate SignNow bring to my TurboTax 2019 8962 workflow?

Using airSlate SignNow enhances your TurboTax 2019 8962 workflow by providing a seamless and secure eSigning experience. You save time by eliminating paper processes and ensuring that your forms are signed and submitted promptly. Additionally, the platform enhances data security, giving users peace of mind when handling sensitive tax information.

-

How does airSlate SignNow compare to other solutions for TurboTax 2019 8962?

airSlate SignNow stands out from other solutions for TurboTax 2019 8962 by offering an intuitive interface and affordable pricing plans. It is tailored for both individual users and businesses, providing a range of features that simplify the eSigning process. This ensures user satisfaction while meeting all compliance needs.

Get more for Form 8962 Instructions

Find out other Form 8962 Instructions

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation

- How Can I eSignature Louisiana Non-Profit PDF

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document