TEB Surrender 073014 Form

What is the TEB Surrender 073014

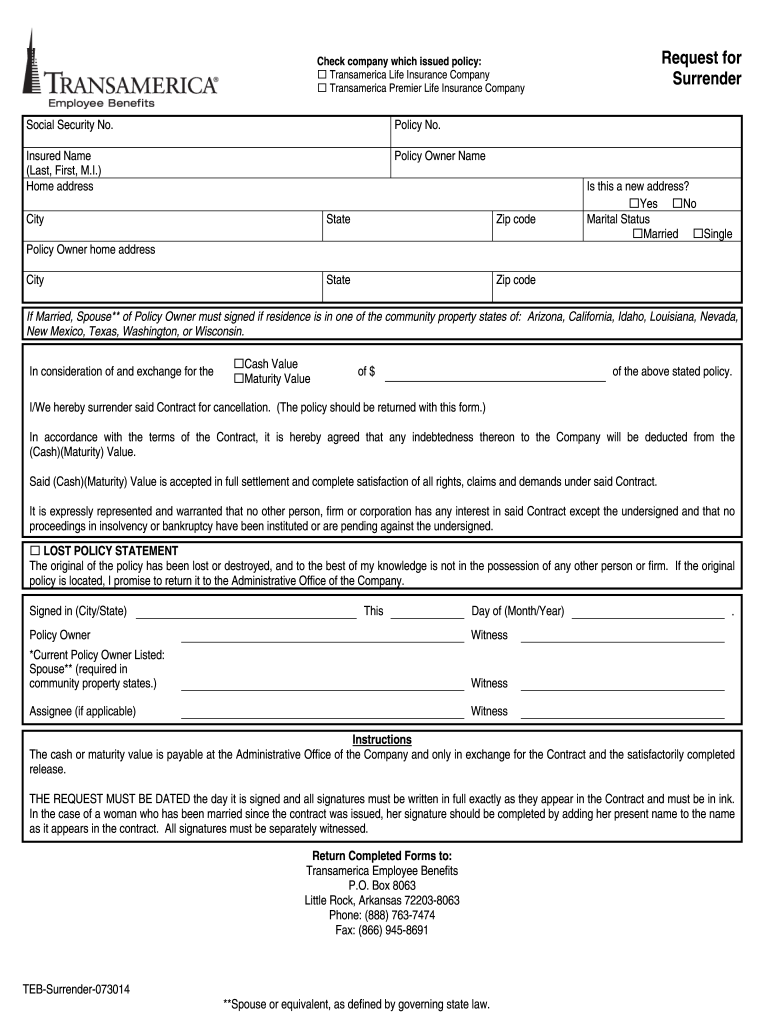

The TEB Surrender 073014 is a specific form utilized in the context of tax compliance and reporting. This form is primarily designed for taxpayers who wish to surrender their tax-exempt bonds. It serves as a formal declaration to the Internal Revenue Service (IRS) regarding the status of these financial instruments. Understanding the purpose of this form is essential for ensuring accurate tax reporting and compliance with federal regulations.

Steps to complete the TEB Surrender 073014

Completing the TEB Surrender 073014 involves several important steps to ensure accuracy and compliance. First, gather all necessary information related to the tax-exempt bonds you are surrendering. This includes details such as bond identification numbers, dates of issuance, and any relevant financial data. Next, fill out the form carefully, ensuring that all sections are completed accurately. After filling out the form, review it for any errors or omissions. Finally, submit the completed form to the IRS, either electronically or via mail, based on your preference and compliance requirements.

Required Documents

When preparing to submit the TEB Surrender 073014, several documents are typically required. These may include:

- Copies of the tax-exempt bonds being surrendered.

- Financial statements related to the bonds.

- Any prior correspondence with the IRS regarding the bonds.

- Identification information for the taxpayer or entity submitting the form.

Having these documents ready will facilitate a smoother submission process and help ensure compliance with IRS regulations.

Legal use of the TEB Surrender 073014

The legal use of the TEB Surrender 073014 is crucial for maintaining compliance with federal tax laws. This form must be used in accordance with IRS guidelines to ensure that the surrender of tax-exempt bonds is properly documented. Failure to use the form correctly can result in penalties or legal issues. It is important for taxpayers to understand the legal implications of submitting this form and to ensure that all information provided is truthful and accurate.

Who Issues the Form

The TEB Surrender 073014 is issued by the Internal Revenue Service (IRS), the federal agency responsible for tax administration in the United States. The IRS provides guidelines and instructions for the proper completion and submission of this form. Taxpayers should refer to the IRS website or official publications for the most current information regarding the form and its requirements.

Filing Deadlines / Important Dates

Filing deadlines for the TEB Surrender 073014 can vary based on individual circumstances and IRS regulations. It is essential for taxpayers to be aware of any specific deadlines that may apply to their situation. Generally, forms should be submitted as soon as the decision to surrender the bonds is made, but taxpayers should consult the IRS guidelines for any specific dates or timeframes that need to be adhered to.

Quick guide on how to complete teb surrender 073014

Complete TEB Surrender 073014 seamlessly on any device

Digital document management has become favored by organizations and individuals alike. It offers an ideal environmentally friendly alternative to conventional printed and signed forms, as you can easily locate the necessary document and securely store it online. airSlate SignNow equips you with all the resources required to create, alter, and eSign your documents promptly without any hold-ups. Manage TEB Surrender 073014 on any device using airSlate SignNow's Android or iOS applications and enhance any document-based workflow today.

The simplest method to modify and eSign TEB Surrender 073014 effortlessly

- Obtain TEB Surrender 073014 and then click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of the documents or redact sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Create your signature with the Sign tool, which takes seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the details and then click the Done button to save your changes.

- Choose how you would like to share your form, via email, text message (SMS), or invitation link, or download it to your computer.

Forget about missing or misfiled documents, tedious form searching, or errors that require you to print new copies. airSlate SignNow meets your document management needs in just a few clicks from the device of your choice. Modify and eSign TEB Surrender 073014 and ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the teb surrender 073014

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is TEB Surrender 073014?

TEB Surrender 073014 refers to a specific document or process related to the surrender of TEB (Tax Exempt Bonds). Understanding this process is crucial for businesses looking to manage their financial obligations effectively.

-

How can airSlate SignNow assist with TEB Surrender 073014?

airSlate SignNow provides a streamlined platform for sending and eSigning documents related to TEB Surrender 073014. Our solution simplifies the process, ensuring that all necessary documents are completed accurately and efficiently.

-

What are the pricing options for using airSlate SignNow for TEB Surrender 073014?

airSlate SignNow offers competitive pricing plans tailored to meet the needs of businesses handling TEB Surrender 073014. We provide flexible subscription options that ensure you only pay for what you need, making it a cost-effective solution.

-

What features does airSlate SignNow offer for TEB Surrender 073014?

Our platform includes features such as customizable templates, secure eSigning, and real-time tracking for TEB Surrender 073014 documents. These features enhance efficiency and ensure compliance with legal standards.

-

What are the benefits of using airSlate SignNow for TEB Surrender 073014?

Using airSlate SignNow for TEB Surrender 073014 offers numerous benefits, including reduced turnaround times, improved document security, and enhanced collaboration among stakeholders. This leads to a more efficient workflow and better management of your documents.

-

Can airSlate SignNow integrate with other tools for TEB Surrender 073014?

Yes, airSlate SignNow seamlessly integrates with various business tools and applications, making it easier to manage TEB Surrender 073014 alongside your existing workflows. This integration capability enhances productivity and streamlines processes.

-

Is airSlate SignNow secure for handling TEB Surrender 073014 documents?

Absolutely! airSlate SignNow employs advanced security measures to protect your TEB Surrender 073014 documents. Our platform is compliant with industry standards, ensuring that your sensitive information remains safe and confidential.

Get more for TEB Surrender 073014

Find out other TEB Surrender 073014

- How Do I eSign Hawaii Charity Document

- Can I eSign Hawaii Charity Document

- How Can I eSign Hawaii Charity Document

- Can I eSign Hawaii Charity Document

- Help Me With eSign Hawaii Charity Document

- How Can I eSign Hawaii Charity Presentation

- Help Me With eSign Hawaii Charity Presentation

- How Can I eSign Hawaii Charity Presentation

- How Do I eSign Hawaii Charity Presentation

- How Can I eSign Illinois Charity Word

- How To eSign Virginia Business Operations Presentation

- How To eSign Hawaii Construction Word

- How Can I eSign Hawaii Construction Word

- How Can I eSign Hawaii Construction Word

- How Do I eSign Hawaii Construction Form

- How Can I eSign Hawaii Construction Form

- How To eSign Hawaii Construction Document

- Can I eSign Hawaii Construction Document

- How Do I eSign Hawaii Construction Form

- How To eSign Hawaii Construction Form