1040nr Form

What is the 1040nr

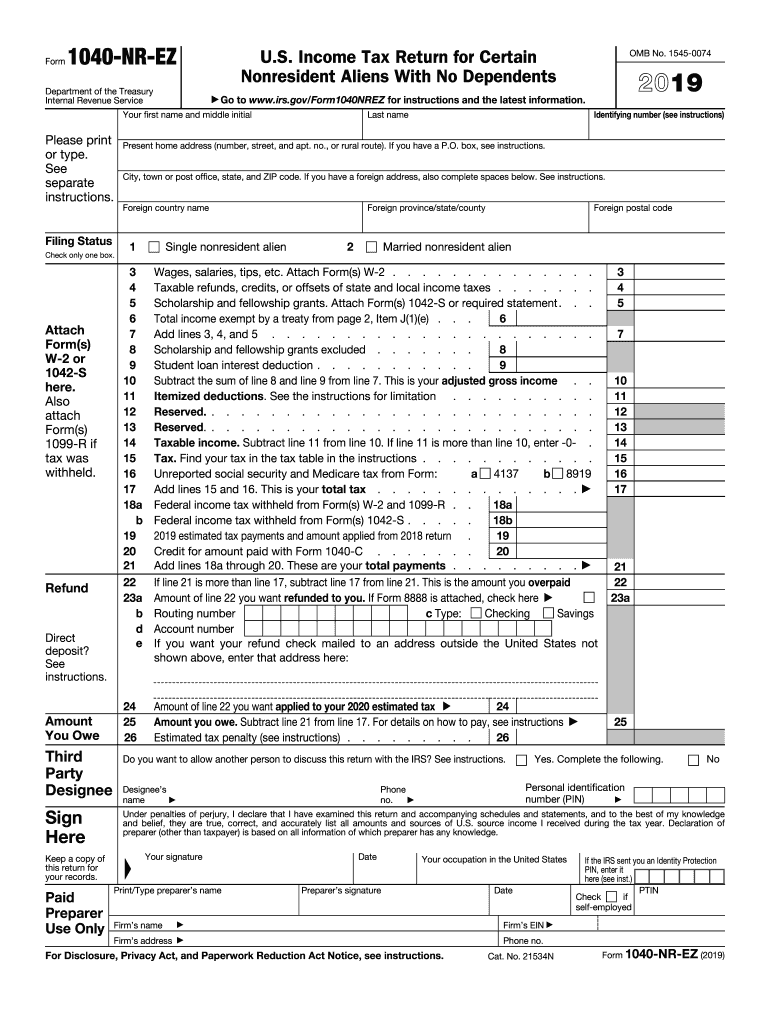

The 1040nr form, officially known as the IRS Form 1040-NR, is a tax return specifically designed for non-resident aliens in the United States. This form is used to report income earned in the U.S. and to calculate the tax owed to the IRS. Non-resident aliens are individuals who do not meet the criteria for being classified as U.S. residents for tax purposes. The form requires detailed information about the taxpayer's income sources, deductions, and any applicable tax treaties that may affect their tax obligations.

Steps to complete the 1040nr

Completing the 1040nr involves several key steps to ensure accuracy and compliance with IRS regulations. First, gather all necessary documents, including income statements, tax identification numbers, and details of any deductions or credits. Next, fill out the form by providing personal information, including your name, address, and filing status. Report your U.S. income, and if applicable, include any tax treaty benefits. After completing the form, review it for accuracy, sign it, and prepare it for submission. Finally, choose your submission method, either electronically or by mail.

How to obtain the 1040nr

The IRS Form 1040nr can be obtained directly from the IRS website, where it is available for download in PDF format. You can also find the form at various tax preparation offices or through tax software that supports non-resident alien filings. Ensure you are using the most current version of the form to comply with the latest tax regulations. If you prefer a physical copy, you can request one to be mailed to you by contacting the IRS directly.

Legal use of the 1040nr

The legal use of the 1040nr is governed by IRS regulations, which stipulate that non-resident aliens must file this form if they have U.S. income that is subject to taxation. To ensure that the form is legally binding, it must be signed appropriately, and all information provided must be accurate and complete. Utilizing a reliable eSignature platform can enhance the legal validity of your submission, ensuring compliance with federal eSignature laws such as ESIGN and UETA. This is particularly important for maintaining the integrity of your tax filings.

Filing Deadlines / Important Dates

Filing deadlines for the 1040nr are crucial for non-resident aliens to avoid penalties. Generally, the deadline for filing is April 15 for income earned in the previous calendar year. However, if you are a non-resident alien who is not a student or scholar, you may have until June 15 to file your return. If you need additional time, you can file for an extension, but it is essential to pay any taxes owed by the original deadline to avoid interest and penalties.

Required Documents

To complete the 1040nr, several documents are typically required. These include:

- Form W-2, if you are employed in the U.S.

- Form 1099, for reporting other types of income.

- Any documentation related to tax treaty benefits.

- Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN).

- Records of any deductions or credits you plan to claim.

Having these documents ready will streamline the process of filling out the form and ensure that all income is accurately reported.

Quick guide on how to complete f1040c form 1040 c department of the treasury internal

Complete 1040nr effortlessly on any device

Managing documents online has gained popularity among businesses and individuals. It offers a perfect eco-friendly substitute for conventional printed and signed papers, allowing you to obtain the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, edit, and eSign your documents quickly without any delays. Handle 1040nr on any device using airSlate SignNow’s Android or iOS applications and simplify any document-related procedure today.

The easiest way to modify and eSign 1040nr with ease

- Obtain 1040nr and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight important sections of the documents or obscure sensitive information using tools that airSlate SignNow provides specifically for that purpose.

- Create your signature with the Sign feature, which takes seconds and holds the same legal validity as a traditional wet-ink signature.

- Review the information and click on the Done button to save your changes.

- Select how you wish to share your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, lengthy form navigation, or mistakes that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Modify and eSign 1040nr and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the f1040c form 1040 c department of the treasury internal

How to generate an eSignature for your F1040c Form 1040 C Department Of The Treasury Internal in the online mode

How to create an electronic signature for the F1040c Form 1040 C Department Of The Treasury Internal in Google Chrome

How to create an eSignature for putting it on the F1040c Form 1040 C Department Of The Treasury Internal in Gmail

How to create an electronic signature for the F1040c Form 1040 C Department Of The Treasury Internal straight from your smartphone

How to make an electronic signature for the F1040c Form 1040 C Department Of The Treasury Internal on iOS

How to create an electronic signature for the F1040c Form 1040 C Department Of The Treasury Internal on Android

People also ask

-

What is form 1040nr and who needs to file it?

Form 1040nr is the U.S. Nonresident Alien Income Tax Return used by nonresident aliens to report their income. Individuals who earned income in the U.S. and do not meet the criteria for residency must file this form. It ensures that nonresidents comply with U.S. tax laws.

-

How can airSlate SignNow help me with form 1040nr?

airSlate SignNow allows you to securely send and eSign your form 1040nr documents, ensuring a smooth filing process. Our platform streamlines document management, making it easier to prepare and submit your tax forms. With SignNow, you'll save time and enhance your compliance.

-

What are the pricing options for using airSlate SignNow?

airSlate SignNow offers various pricing plans to cater to different needs, starting with a free trial. This flexibility allows you to choose the best option for managing your form 1040nr and other documents. Our cost-effective solutions ensure that you only pay for what you need.

-

Is airSlate SignNow safe for filing sensitive tax forms like form 1040nr?

Yes, airSlate SignNow prioritizes security and compliance, making it safe for filing sensitive documents like form 1040nr. Our platform is equipped with advanced encryption and authentication features. You can trust that your information is protected throughout the signing process.

-

Can I integrate airSlate SignNow with other accounting software for form 1040nr?

Absolutely! airSlate SignNow integrates seamlessly with various accounting and tax software, allowing you to manage your form 1040nr alongside your financial records. This integration simplifies the workflow and enhances data accuracy while preparing your tax documents.

-

What features does airSlate SignNow offer for managing form 1040nr?

airSlate SignNow provides features such as customizable templates, real-time tracking, and audit trails specifically designed for managing form 1040nr and other documents. These tools enhance collaboration and efficiency, helping you stay organized during tax season. Easy-to-use functionalities make it accessible for all users.

-

How long does it take to complete and eSign form 1040nr using airSlate SignNow?

Using airSlate SignNow, completing and eSigning form 1040nr can be done in just minutes. The user-friendly interface and template features expedite the process, so you can focus on ensuring your tax information is accurate. Quick turnaround times make handling tax documents much easier.

Get more for 1040nr

Find out other 1040nr

- eSign Oregon Government Business Plan Template Easy

- How Do I eSign Oklahoma Government Separation Agreement

- How Do I eSign Tennessee Healthcare / Medical Living Will

- eSign West Virginia Healthcare / Medical Forbearance Agreement Online

- eSign Alabama Insurance LLC Operating Agreement Easy

- How Can I eSign Alabama Insurance LLC Operating Agreement

- eSign Virginia Government POA Simple

- eSign Hawaii Lawers Rental Application Fast

- eSign Hawaii Lawers Cease And Desist Letter Later

- How To eSign Hawaii Lawers Cease And Desist Letter

- How Can I eSign Hawaii Lawers Cease And Desist Letter

- eSign Hawaii Lawers Cease And Desist Letter Free

- eSign Maine Lawers Resignation Letter Easy

- eSign Louisiana Lawers Last Will And Testament Mobile

- eSign Louisiana Lawers Limited Power Of Attorney Online

- eSign Delaware Insurance Work Order Later

- eSign Delaware Insurance Credit Memo Mobile

- eSign Insurance PPT Georgia Computer

- How Do I eSign Hawaii Insurance Operating Agreement

- eSign Hawaii Insurance Stock Certificate Free