Irs Schedule Schedule a Form

Understanding the 2019 Schedule 1

The 2019 Schedule 1 is a crucial tax form used by individuals to report additional income and adjustments to income that are not listed on the main tax return. This form is essential for taxpayers who need to declare specific types of income, such as unemployment compensation, rental income, or business income. Completing this form accurately ensures compliance with IRS regulations and helps in determining the correct tax liability.

Steps to Complete the 2019 Schedule 1

Filling out the 2019 Schedule 1 involves several key steps:

- Begin by gathering all necessary documents, including W-2s, 1099s, and any records of additional income.

- Carefully read the instructions provided with the form to understand the requirements for each section.

- Fill in your personal information, including your name and Social Security number, at the top of the form.

- Report any additional income in Part I, ensuring to include all relevant details.

- Complete Part II to list any adjustments to income, such as educator expenses or health savings account deductions.

- Review the completed form for accuracy before submission.

Legal Use of the 2019 Schedule 1

The 2019 Schedule 1 is legally recognized by the IRS as a valid document for reporting additional income and adjustments. To ensure its legality, it is important to complete the form in accordance with IRS guidelines. This includes providing accurate information and signing the form where required. The use of electronic signatures is permitted, provided that the signer complies with the applicable laws regarding eSignatures.

Filing Deadlines for the 2019 Schedule 1

The filing deadline for the 2019 Schedule 1 coincides with the due date for your federal tax return. Generally, this is April 15 of the following year, unless it falls on a weekend or holiday, in which case the deadline may be extended. It is important to file your Schedule 1 on time to avoid penalties and interest on any taxes owed.

Required Documents for the 2019 Schedule 1

To complete the 2019 Schedule 1 accurately, you will need several key documents:

- W-2 forms from employers for reported wages.

- 1099 forms for any freelance work or interest income.

- Records of any additional income sources, such as rental or investment income.

- Documentation for any adjustments to income, such as receipts for educator expenses.

Examples of Using the 2019 Schedule 1

There are various scenarios where the 2019 Schedule 1 is applicable:

- A self-employed individual reporting business income and expenses.

- A taxpayer who received unemployment benefits during the year.

- Someone claiming deductions for student loan interest or tuition fees.

Digital vs. Paper Version of the 2019 Schedule 1

The 2019 Schedule 1 can be completed either digitally or on paper. Filing electronically is often more efficient, as it allows for faster processing and immediate confirmation of receipt. However, some taxpayers may prefer the traditional paper method. Regardless of the method chosen, it is essential to ensure that the form is filled out correctly and submitted by the deadline.

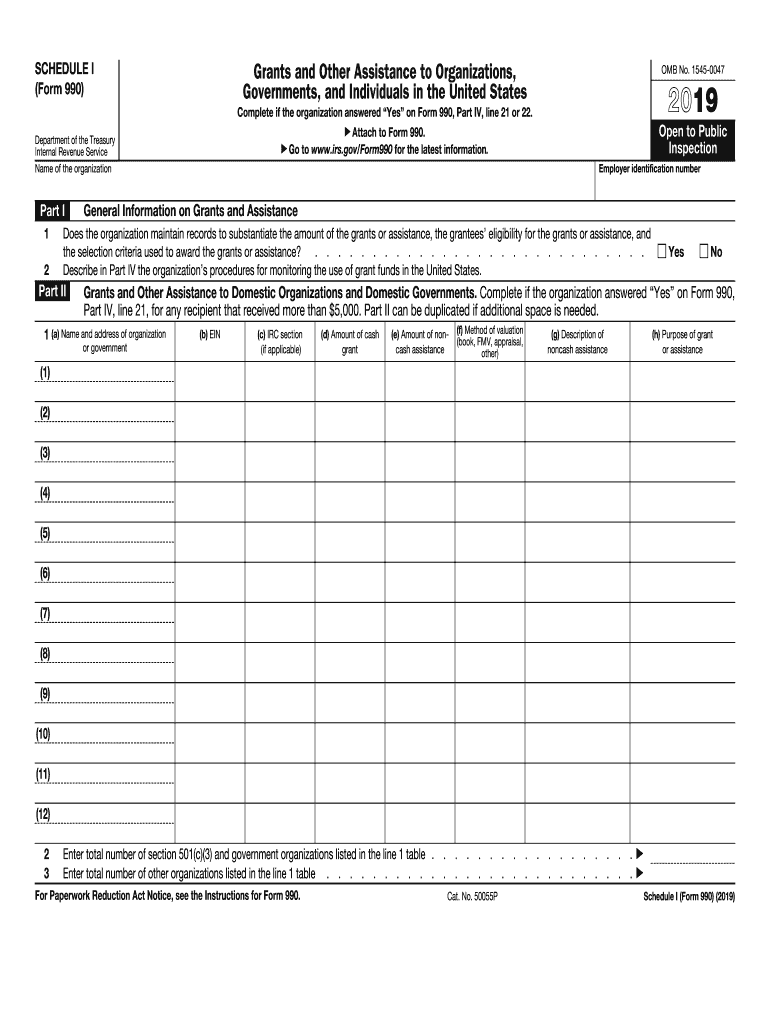

Quick guide on how to complete form 990 schedule i

Complete Irs Schedule Schedule A seamlessly on any device

Digital document management has gained popularity among businesses and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed paperwork, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to create, modify, and eSign your documents quickly without interruptions. Handle Irs Schedule Schedule A on any device with airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The easiest way to modify and eSign Irs Schedule Schedule A effortlessly

- Obtain Irs Schedule Schedule A and then click Get Form to begin.

- Make use of the tools we offer to complete your form.

- Highlight pertinent sections of the documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and then click on the Done button to save your changes.

- Select your preferred method to share your form: via email, text message (SMS), an invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Modify and eSign Irs Schedule Schedule A and ensure effective communication at any stage of your form preparation workflow with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 990 schedule i

How to create an eSignature for the Form 990 Schedule I online

How to generate an eSignature for your Form 990 Schedule I in Chrome

How to generate an eSignature for putting it on the Form 990 Schedule I in Gmail

How to make an electronic signature for the Form 990 Schedule I right from your mobile device

How to create an electronic signature for the Form 990 Schedule I on iOS

How to make an eSignature for the Form 990 Schedule I on Android

People also ask

-

What is the Irs Schedule Schedule A, and why is it important?

The Irs Schedule Schedule A is a tax form used to itemize deductions for individual taxpayers. It allows taxpayers to deduct certain expenses, such as medical expenses, mortgage interest, and charitable contributions, potentially reducing their taxable income. Understanding how to effectively use the Irs Schedule Schedule A can help maximize your tax savings.

-

How can airSlate SignNow assist with Irs Schedule Schedule A submissions?

airSlate SignNow provides a seamless solution for eSigning and sending documents, including the Irs Schedule Schedule A. With our user-friendly platform, you can easily prepare, sign, and send your tax documents securely, ensuring compliance and accuracy. Our service streamlines the process, making it simple to manage and submit your Irs Schedule Schedule A electronically.

-

What features does airSlate SignNow offer for managing the Irs Schedule Schedule A?

With airSlate SignNow, you can access features such as customizable templates, bulk sending, and real-time tracking for your Irs Schedule Schedule A submissions. Our platform ensures that all your documents are securely stored and easily retrievable. Additionally, you can set reminders for deadlines, so you never miss an important filing date.

-

Is airSlate SignNow cost-effective for handling the Irs Schedule Schedule A?

Yes, airSlate SignNow is a cost-effective solution for individuals and businesses needing to manage documents like the Irs Schedule Schedule A. Our pricing plans are designed to fit various budgets, offering flexibility and value. You can save time and resources while ensuring that your eSigning and document management needs are met efficiently.

-

Can airSlate SignNow integrate with other software used for tax preparation related to Irs Schedule Schedule A?

Absolutely! airSlate SignNow integrates seamlessly with various tax preparation software and tools that can handle the Irs Schedule Schedule A. This integration allows for a smooth workflow, enabling you to import and export your tax documents effortlessly. By connecting your tools, you can enhance your efficiency and accuracy when preparing your tax returns.

-

What are the benefits of using airSlate SignNow for Irs Schedule Schedule A forms?

Using airSlate SignNow for your Irs Schedule Schedule A forms offers numerous benefits, including improved efficiency, enhanced security, and easy document management. Our platform ensures that your sensitive tax information is protected while allowing for quick eSigning and sharing of your forms. Additionally, the user-friendly interface simplifies the process, making it accessible for everyone.

-

How does airSlate SignNow ensure the security of my Irs Schedule Schedule A documents?

airSlate SignNow takes security seriously, employing advanced encryption and secure storage solutions to protect your Irs Schedule Schedule A documents. We comply with industry standards to ensure that your sensitive information remains confidential throughout the signing process. You can trust that your documents are safe with us, providing peace of mind during tax season.

Get more for Irs Schedule Schedule A

Find out other Irs Schedule Schedule A

- Can I eSign Hawaii Reference Checking Form

- Help Me With eSign Hawaii Acknowledgement Letter

- eSign Rhode Island Deed of Indemnity Template Secure

- eSign Illinois Car Lease Agreement Template Fast

- eSign Delaware Retainer Agreement Template Later

- eSign Arkansas Attorney Approval Simple

- eSign Maine Car Lease Agreement Template Later

- eSign Oregon Limited Power of Attorney Secure

- How Can I eSign Arizona Assignment of Shares

- How To eSign Hawaii Unlimited Power of Attorney

- How To eSign Louisiana Unlimited Power of Attorney

- eSign Oklahoma Unlimited Power of Attorney Now

- How To eSign Oregon Unlimited Power of Attorney

- eSign Hawaii Retainer for Attorney Easy

- How To eSign Texas Retainer for Attorney

- eSign Hawaii Standstill Agreement Computer

- How Can I eSign Texas Standstill Agreement

- How To eSign Hawaii Lease Renewal

- How Can I eSign Florida Lease Amendment

- eSign Georgia Lease Amendment Free