T1213OASRequest to Reduce Old Age Security Recovery Form

Understanding the T1213OAS Request to Reduce Old Age Security Recovery

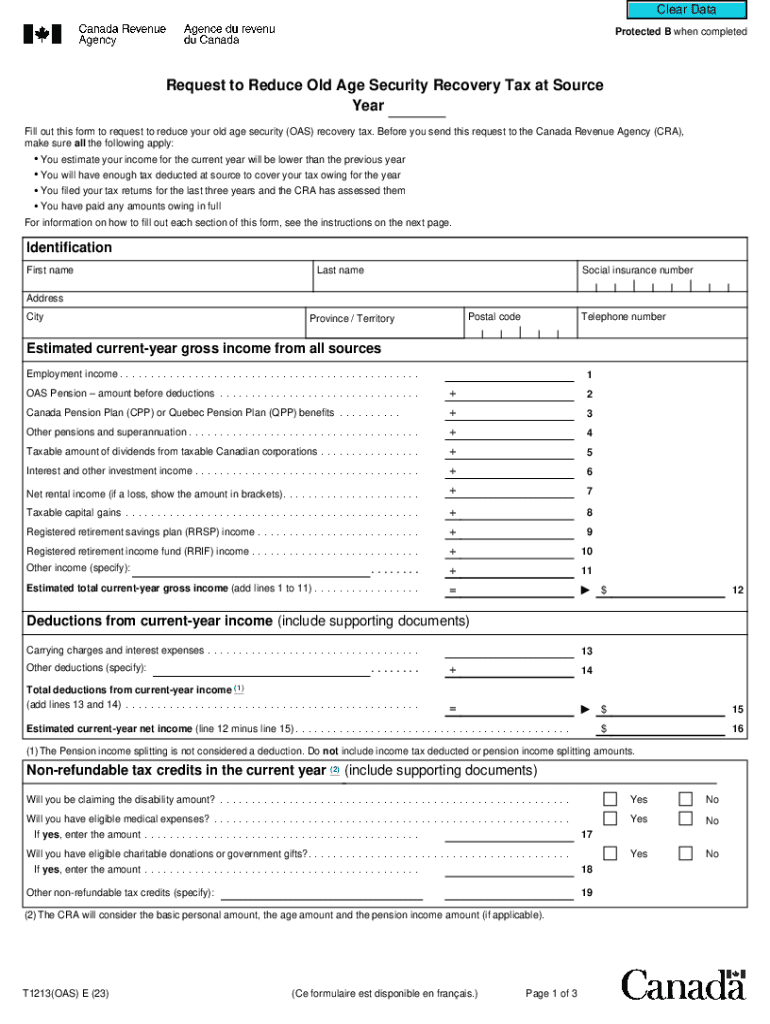

The T1213OAS is a form used by individuals in Canada to request a reduction in the recovery amount of Old Age Security (OAS) benefits. This recovery tax applies to those whose income exceeds a certain threshold, resulting in a reduction of their OAS benefits. The form allows taxpayers to provide the Canada Revenue Agency (CRA) with information about their expected income, which can help in adjusting the recovery tax amount. Understanding the purpose and implications of this form is crucial for those affected by the OAS recovery tax.

Steps to Complete the T1213OAS Form

Completing the T1213OAS fillable form involves several key steps to ensure accuracy and compliance. First, gather all necessary financial documents, including income statements and any relevant tax information. Next, accurately fill out the form, providing details about your income and any deductions you expect to claim. It is essential to double-check all entries for accuracy. Once completed, the form can be submitted to the CRA either online or by mail, depending on your preference. Following these steps carefully can help facilitate a smoother process in reducing your OAS recovery tax.

Eligibility Criteria for the T1213OAS Form

To be eligible for the T1213OAS, individuals must meet specific criteria set by the CRA. Primarily, applicants should have an income that exceeds the threshold for OAS recovery but expect their income to decrease in the upcoming year. This form is particularly relevant for retirees or individuals whose financial situations may have changed. Understanding these eligibility requirements is vital for those looking to reduce their OAS recovery tax burden.

Required Documents for the T1213OAS Submission

When submitting the T1213OAS form, certain documents are required to support your request. These typically include proof of income, such as recent pay stubs or tax returns, and any documentation that verifies deductions or credits you plan to claim. Having these documents ready can streamline the submission process and enhance the likelihood of a favorable outcome. It is advisable to keep copies of all submitted documents for your records.

How to Obtain the T1213OAS Form

The T1213OAS form can be easily obtained from the Canada Revenue Agency's website. It is available as a fillable PDF, allowing users to complete the form digitally. Additionally, individuals can request a paper version of the form through the CRA's contact channels. Ensuring you have the correct version of the form is important for compliance and to avoid any delays in processing your request.

Form Submission Methods for the T1213OAS

There are multiple methods available for submitting the T1213OAS form. Individuals can choose to submit the form online through the CRA's secure portal, which is often the fastest method. Alternatively, the form can be mailed to the appropriate CRA office or submitted in person, depending on individual preferences and circumstances. Each method has its own processing times, so it is beneficial to choose one that aligns with your needs.

Quick guide on how to complete t1213oasrequest to reduce old age security recovery

Complete T1213OASRequest To Reduce Old Age Security Recovery effortlessly on any device

Digital document management has gained traction among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents quickly and efficiently. Manage T1213OASRequest To Reduce Old Age Security Recovery on any device with airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

How to modify and eSign T1213OASRequest To Reduce Old Age Security Recovery seamlessly

- Locate T1213OASRequest To Reduce Old Age Security Recovery and then click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize signNow sections of your documents or obscure sensitive information with tools that airSlate SignNow supplies specifically for that purpose.

- Generate your eSignature using the Sign tool, which only takes seconds and carries the same legal significance as a conventional wet ink signature.

- Review all the details and then click on the Done button to finalize your adjustments.

- Choose how you prefer to share your form, whether by email, SMS, invitation link, or downloading it to your computer.

Say goodbye to lost or disorganized documents, cumbersome form navigation, or mistakes that require printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from your preferred device. Alter and eSign T1213OASRequest To Reduce Old Age Security Recovery and ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the t1213oasrequest to reduce old age security recovery

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the t1213oas fillable form?

The t1213oas fillable form is a document that allows users to provide their tax information to the Canada Revenue Agency (CRA). This form can be easily filled out online, ensuring accuracy and efficiency. Using airSlate SignNow, you can create and manage this form seamlessly.

-

How can I access the t1213oas fillable form?

You can access the t1213oas fillable form directly through the airSlate SignNow platform. Simply log in to your account, navigate to the forms section, and select the t1213oas fillable form to begin. Our user-friendly interface makes it easy to find and fill out the necessary documents.

-

Is there a cost associated with using the t1213oas fillable form?

Using the t1213oas fillable form on airSlate SignNow is part of our subscription plans, which are designed to be cost-effective for businesses of all sizes. We offer various pricing tiers to suit different needs, ensuring you get the best value for your document management. Check our pricing page for more details.

-

What features does the t1213oas fillable form offer?

The t1213oas fillable form on airSlate SignNow includes features such as electronic signatures, customizable fields, and secure storage. These features enhance the user experience by making it easier to complete and manage your forms. Additionally, you can track the status of your submissions in real-time.

-

Can I integrate the t1213oas fillable form with other applications?

Yes, the t1213oas fillable form can be integrated with various applications through airSlate SignNow's API. This allows you to streamline your workflow by connecting with tools you already use, such as CRM systems and project management software. Integration enhances productivity and ensures a seamless experience.

-

What are the benefits of using the t1213oas fillable form?

Using the t1213oas fillable form provides numerous benefits, including time savings, reduced paperwork, and improved accuracy. With airSlate SignNow, you can fill out and sign documents electronically, eliminating the need for physical copies. This not only speeds up the process but also contributes to a more environmentally friendly approach.

-

Is the t1213oas fillable form secure?

Absolutely! The t1213oas fillable form on airSlate SignNow is designed with security in mind. We utilize advanced encryption and secure cloud storage to protect your sensitive information, ensuring that your data remains confidential and safe from unauthorized access.

Get more for T1213OASRequest To Reduce Old Age Security Recovery

Find out other T1213OASRequest To Reduce Old Age Security Recovery

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors