Form 8453 for

What is the Form 8453 For

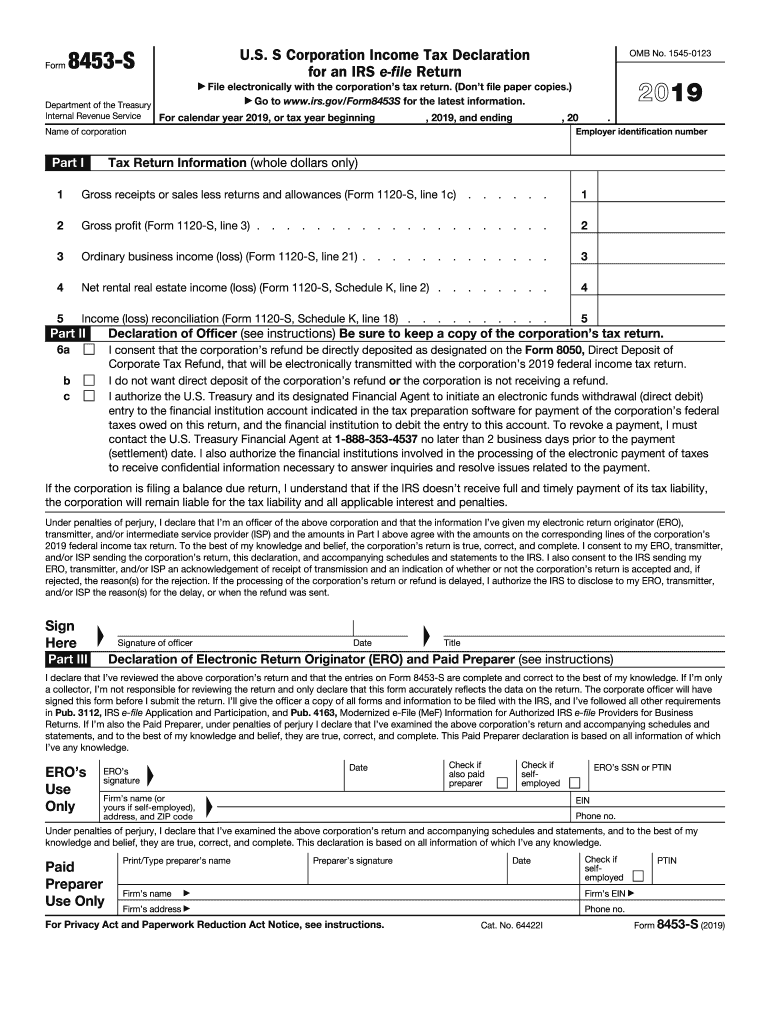

The 2 form, also known as the 2019 IRS signature form, is primarily used for electronically filed tax returns. This form serves as a declaration that the taxpayer has reviewed the return and affirms the accuracy of the information provided. It is essential for individuals and businesses who file their tax returns electronically, as it provides the necessary signature to validate the submission.

How to Obtain the Form 8453

To obtain the 2 form, taxpayers can visit the official IRS website or access it through various tax preparation software platforms. The form is available for download in a printable format, allowing users to fill it out manually if needed. Additionally, tax professionals can provide this form as part of their services, ensuring that clients have the necessary documentation for their electronic filings.

Steps to Complete the Form 8453

Completing the 2 form involves several straightforward steps:

- Begin by entering your personal information, including your name, address, and Social Security number.

- Provide details about your electronic return, including the type of return filed and the total income reported.

- Review the form for accuracy, ensuring all information matches your tax return.

- Sign and date the form to confirm your agreement with the information provided.

Once completed, the form can be submitted electronically alongside your tax return or printed and mailed if required.

Legal Use of the Form 8453

The 2 form holds legal significance as it acts as a signature for electronically filed tax returns. This means that by signing the form, taxpayers are legally affirming that the information provided is true and complete. It is crucial for taxpayers to understand that any inaccuracies or misrepresentations could lead to penalties or legal repercussions. Therefore, using a reliable eSignature solution, like signNow, ensures that the form is executed in compliance with relevant laws.

Filing Deadlines / Important Dates

When filing the 2 form, it is essential to be aware of the relevant deadlines. Generally, the deadline for submitting tax returns falls on April 15 of the following year. If this date falls on a weekend or holiday, the deadline may be extended. Taxpayers should ensure that their 2 form is submitted by this deadline to avoid potential penalties or interest on late filings.

Form Submission Methods

The 2 form can be submitted in various ways. For electronic filings, the form is typically submitted alongside the tax return through approved software. If filing by mail, the completed form should be sent to the appropriate IRS address based on the taxpayer's location and filing status. It is important to follow the specific instructions provided by the IRS to ensure proper submission and processing of the form.

Quick guide on how to complete form 8453 attachments file taxes online w free tax

Complete Form 8453 For effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed paperwork, as you can obtain the appropriate form and safely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and eSign your documents quickly without delays. Handle Form 8453 For on any platform using airSlate SignNow’s Android or iOS applications and enhance any document-centric process today.

The simplest way to modify and eSign Form 8453 For without stress

- Locate Form 8453 For and click on Get Form to begin.

- Use the tools we provide to complete your document.

- Mark important sections of your documents or redact sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Generate your eSignature with the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Verify the information and click on the Done button to save your changes.

- Select how you wish to submit your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate issues with missing or lost documents, tedious form navigation, or mistakes that require printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choice. Modify and eSign Form 8453 For and ensure effective communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 8453 attachments file taxes online w free tax

How to generate an eSignature for the Form 8453 Attachments File Taxes Online W Free Tax in the online mode

How to make an electronic signature for the Form 8453 Attachments File Taxes Online W Free Tax in Chrome

How to generate an eSignature for signing the Form 8453 Attachments File Taxes Online W Free Tax in Gmail

How to create an electronic signature for the Form 8453 Attachments File Taxes Online W Free Tax from your smart phone

How to generate an electronic signature for the Form 8453 Attachments File Taxes Online W Free Tax on iOS

How to create an electronic signature for the Form 8453 Attachments File Taxes Online W Free Tax on Android devices

People also ask

-

What is the importance of a 2019 IRS signature for tax documents?

A 2019 IRS signature is crucial for validating your tax documents and ensuring their acceptance by the IRS. Without a proper signature, your forms may be rejected or delayed, which can affect your tax refunds. Using airSlate SignNow streamlines this process by providing a secure and user-friendly platform for obtaining necessary signatures on your IRS submissions.

-

How does airSlate SignNow facilitate obtaining a 2019 IRS signature?

AirSlate SignNow allows users to electronically sign and send documents, including forms requiring a 2019 IRS signature, quickly and efficiently. Our intuitive interface guides you through the signing process, ensuring compliance and security. Additionally, our platform stores all signed documents, making it easy to retrieve and manage your tax-related paperwork.

-

Is there a cost associated with using airSlate SignNow for a 2019 IRS signature?

Yes, airSlate SignNow offers various pricing plans tailored to different business needs. Each plan includes access to features that facilitate obtaining a 2019 IRS signature with ease and efficiency. Competitive pricing ensures that you receive a cost-effective solution without sacrificing quality or security.

-

Can airSlate SignNow integrate with my existing tax software to handle 2019 IRS signatures?

Absolutely! AirSlate SignNow seamlessly integrates with many popular tax software platforms, simplifying the process for obtaining 2019 IRS signatures. This integration saves you time and effort, allowing for a more streamlined workflow in preparing and signing your tax documents. You can manage everything from one central platform.

-

What features does airSlate SignNow offer to improve the eSigning experience for 2019 IRS signatures?

AirSlate SignNow provides features like template creation, bulk sending, and real-time tracking which enhance the eSigning experience. For 2019 IRS signatures, these features ensure the signing process is quick, efficient, and compliant. You can also set reminders and receive notifications to keep track of outstanding signatures.

-

How secure is the airSlate SignNow platform for handling 2019 IRS signatures?

Security is a top priority at airSlate SignNow. Our platform utilizes SSL encryption and complies with eSignature regulations to ensure that all documents, including those requiring a 2019 IRS signature, are handled safely. You can sign with confidence, knowing that your sensitive information is well protected.

-

What are the benefits of using airSlate SignNow for my 2019 IRS signature needs?

Using airSlate SignNow for your 2019 IRS signature needs streamlines the signing process and reduces paperwork. It enhances productivity and ensures that you meet deadlines efficiently. Furthermore, the cost-effective nature of our solution allows businesses of all sizes to manage their tax documentation effortlessly.

Get more for Form 8453 For

Find out other Form 8453 For

- How To eSign Rhode Island Residential lease agreement form

- Can I eSign Pennsylvania Residential lease agreement form

- eSign Texas Residential lease agreement form Easy

- eSign Florida Residential lease agreement Easy

- eSign Hawaii Residential lease agreement Online

- Can I eSign Hawaii Residential lease agreement

- eSign Minnesota Residential lease agreement Simple

- How To eSign Pennsylvania Residential lease agreement

- eSign Maine Simple confidentiality agreement Easy

- eSign Iowa Standard rental agreement Free

- eSignature Florida Profit Sharing Agreement Template Online

- eSignature Florida Profit Sharing Agreement Template Myself

- eSign Massachusetts Simple rental agreement form Free

- eSign Nebraska Standard residential lease agreement Now

- eSign West Virginia Standard residential lease agreement Mobile

- Can I eSign New Hampshire Tenant lease agreement

- eSign Arkansas Commercial real estate contract Online

- eSign Hawaii Contract Easy

- How Do I eSign Texas Contract

- How To eSign Vermont Digital contracts