Irs Form 4419

What is the IRS Form 4419?

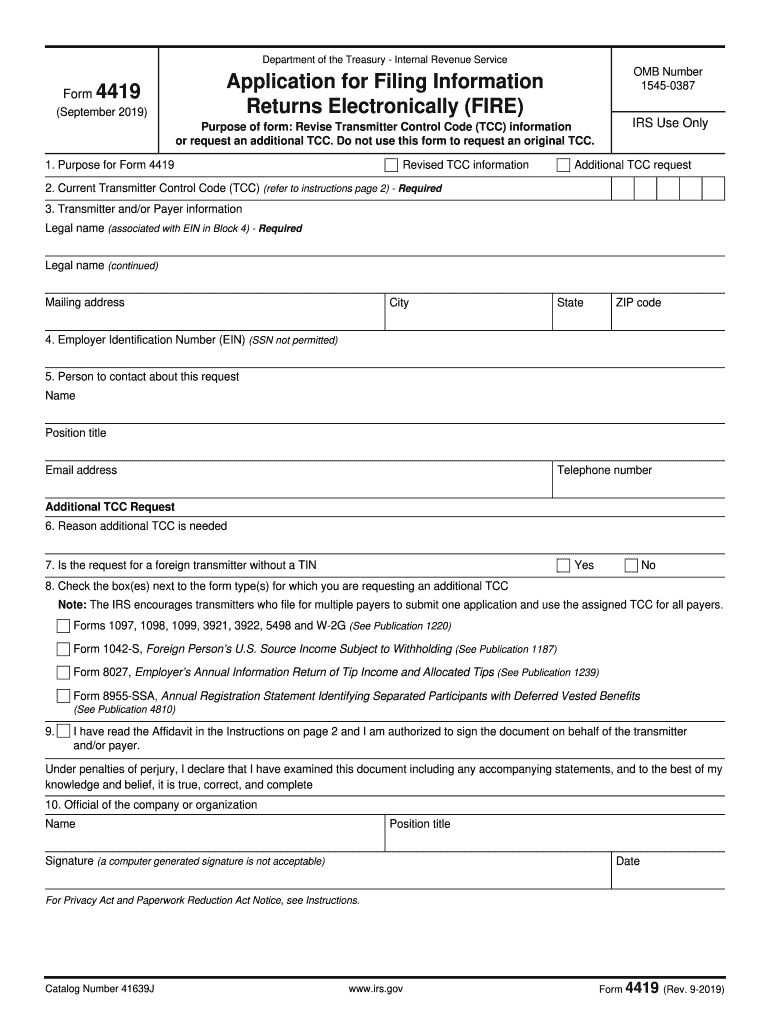

The IRS Form 4419 is a crucial document for businesses that wish to electronically file information returns with the Internal Revenue Service. This form is specifically used to request authorization to file forms electronically, ensuring that businesses can submit their data securely and efficiently. By completing the 4419, businesses can facilitate the electronic transmission of various tax documents, such as Forms 1099 and W-2, streamlining the reporting process while maintaining compliance with IRS regulations.

How to Use the IRS Form 4419

Using the IRS Form 4419 involves a straightforward process. First, businesses must complete the form with accurate information, including the name of the business, Employer Identification Number (EIN), and contact details. Once filled out, the form can be submitted to the IRS, either electronically or by mail. Upon approval, businesses will receive a confirmation that allows them to file their information returns electronically. This process not only enhances efficiency but also reduces the risk of errors associated with paper filing.

Steps to Complete the IRS Form 4419

Completing the IRS Form 4419 requires careful attention to detail. Here are the essential steps:

- Gather necessary information, including your business name, EIN, and contact information.

- Fill out the form accurately, ensuring all details are correct to avoid processing delays.

- Review the completed form for any errors or omissions.

- Submit the form to the IRS via the preferred method, either electronically or by mail.

- Wait for confirmation from the IRS regarding your authorization to file electronically.

Legal Use of the IRS Form 4419

The IRS Form 4419 is legally binding, provided it is completed and submitted in accordance with IRS regulations. By using this form, businesses ensure they are compliant with federal laws regarding electronic filing. The form serves as a formal request for authorization, which is necessary for the electronic submission of tax documents. This compliance helps avoid potential penalties associated with incorrect or late filings.

Filing Deadlines / Important Dates

Understanding the filing deadlines associated with the IRS Form 4419 is vital for businesses. The form must be submitted in advance of the electronic filing of information returns. Typically, businesses should allow sufficient time for processing and approval from the IRS. It is advisable to check the IRS website for specific deadlines related to the current tax year, as they may vary annually.

Form Submission Methods

The IRS Form 4419 can be submitted through various methods, providing flexibility for businesses. The preferred method is electronic submission, which allows for quicker processing and confirmation. Alternatively, businesses can mail the completed form to the IRS. It is essential to choose a method that aligns with your business's operational capabilities and timelines to ensure timely approval.

Quick guide on how to complete form 4419 rev 9 2019 application for filing information returns electronically fire

Effortlessly Prepare Irs Form 4419 on Any Device

The management of online documents has become increasingly favored by businesses and individuals alike. It offers an excellent environmentally friendly substitute for conventional printed and signed documents, allowing you to access the appropriate form and securely keep it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents quickly without delays. Handle Irs Form 4419 on any device using airSlate SignNow's Android or iOS applications and simplify any document-related procedure today.

The Easiest Way to Alter and eSign Irs Form 4419 with Ease

- Locate Irs Form 4419 and click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize important sections of your documents or obscure sensitive details using tools specifically provided by airSlate SignNow for that purpose.

- Create your eSignature with the Sign tool, which takes mere seconds and holds the same legal authority as a traditional handwritten signature.

- Review the details and click the Done button to save your changes.

- Select your preferred method to send your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Modify and eSign Irs Form 4419 to ensure outstanding communication at any point in your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 4419 rev 9 2019 application for filing information returns electronically fire

How to generate an electronic signature for the Form 4419 Rev 9 2019 Application For Filing Information Returns Electronically Fire in the online mode

How to create an eSignature for the Form 4419 Rev 9 2019 Application For Filing Information Returns Electronically Fire in Google Chrome

How to make an eSignature for signing the Form 4419 Rev 9 2019 Application For Filing Information Returns Electronically Fire in Gmail

How to generate an electronic signature for the Form 4419 Rev 9 2019 Application For Filing Information Returns Electronically Fire from your mobile device

How to create an eSignature for the Form 4419 Rev 9 2019 Application For Filing Information Returns Electronically Fire on iOS

How to generate an eSignature for the Form 4419 Rev 9 2019 Application For Filing Information Returns Electronically Fire on Android devices

People also ask

-

What is IRS Form 4419 and why do I need it?

IRS Form 4419 is a crucial document for businesses that need to file electronic tax returns. This form allows you to request permission to submit forms electronically, streamlining the filing process. By ensuring you have the correct IRS Form 4419, you can avoid delays and penalties associated with tax submissions.

-

How can airSlate SignNow help me with IRS Form 4419?

airSlate SignNow simplifies the process of preparing and submitting IRS Form 4419. With our user-friendly platform, you can easily eSign and send documents, ensuring compliance with IRS requirements. Plus, our integration capabilities make it easy to manage your tax documents alongside other important paperwork.

-

Is there a cost associated with using airSlate SignNow for IRS Form 4419?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs, including features for managing IRS Form 4419 submissions. Our plans are designed to be cost-effective, ensuring you get the best value for your eSigning and document management needs. Check our pricing page for more details on the options available.

-

What features does airSlate SignNow offer for managing IRS Form 4419?

airSlate SignNow provides features such as document templates, secure eSigning, and automated workflows to help manage IRS Form 4419 effectively. These tools streamline the process, making it easier for you to complete and submit your forms on time. Additionally, our platform ensures that your documents remain secure throughout the process.

-

Can I integrate airSlate SignNow with other software for IRS Form 4419?

Absolutely! airSlate SignNow offers seamless integrations with various software platforms, which can enhance your workflow for managing IRS Form 4419. Whether you use accounting software or document management systems, our integrations ensure that your eSigning process is efficient and hassle-free.

-

What are the benefits of using airSlate SignNow for IRS Form 4419 submissions?

Using airSlate SignNow for IRS Form 4419 submissions offers numerous benefits, including time savings, increased accuracy, and enhanced security. Our platform enables you to eSign documents quickly and securely, reducing the risk of errors during the filing process. This efficiency helps you focus on other important aspects of your business.

-

How do I get started with airSlate SignNow for IRS Form 4419?

Getting started with airSlate SignNow for IRS Form 4419 is easy. Simply sign up for an account on our website, choose a pricing plan that suits your needs, and start uploading your documents. Our intuitive interface will guide you through the process of eSigning and submitting your IRS Form 4419 efficiently.

Get more for Irs Form 4419

Find out other Irs Form 4419

- How Do I eSignature Texas Real Estate Document

- How Can I eSignature Colorado Courts PDF

- Can I eSignature Louisiana Courts Document

- How To Electronic signature Arkansas Banking Document

- How Do I Electronic signature California Banking Form

- How Do I eSignature Michigan Courts Document

- Can I eSignature Missouri Courts Document

- How Can I Electronic signature Delaware Banking PDF

- Can I Electronic signature Hawaii Banking Document

- Can I eSignature North Carolina Courts Presentation

- Can I eSignature Oklahoma Courts Word

- How To Electronic signature Alabama Business Operations Form

- Help Me With Electronic signature Alabama Car Dealer Presentation

- How Can I Electronic signature California Car Dealer PDF

- How Can I Electronic signature California Car Dealer Document

- How Can I Electronic signature Colorado Car Dealer Form

- How To Electronic signature Florida Car Dealer Word

- How Do I Electronic signature Florida Car Dealer Document

- Help Me With Electronic signature Florida Car Dealer Presentation

- Can I Electronic signature Georgia Car Dealer PDF