8879 for Form

What is the 8879 For Form

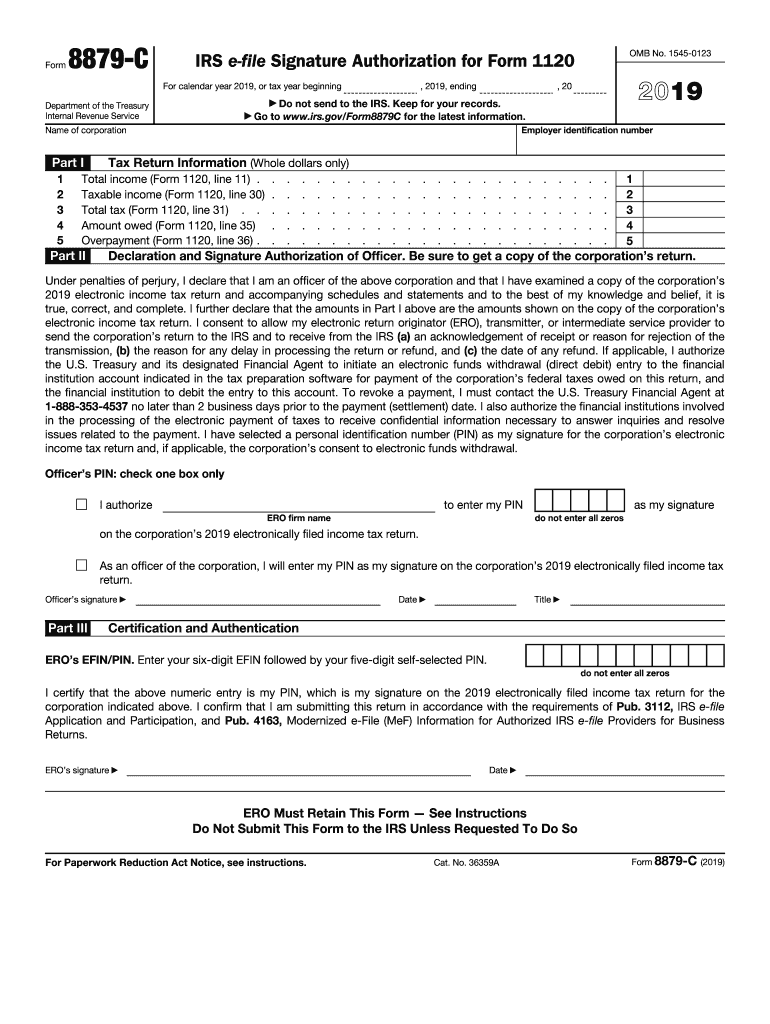

The 8879 form, officially known as the IRS e-file Signature Authorization, is a crucial document used by taxpayers to authorize the electronic filing of their tax returns. This form is particularly important for those who are e-filing their tax returns, as it serves as a signature that verifies the taxpayer's consent for the submission of their return electronically. The 8879 form ensures that the IRS has the necessary authorization to process the return, safeguarding both the taxpayer's information and the integrity of the filing process.

How to use the 8879 For Form

Using the 8879 form involves a straightforward process. Taxpayers typically receive this form from their tax preparer or can generate it through tax software. Once you have the form, you need to review the information carefully to ensure accuracy. After confirming that all details are correct, you will sign the form electronically or physically, depending on the method of filing. This signature indicates your approval for the tax preparer to submit your return electronically to the IRS.

Steps to complete the 8879 For Form

Completing the 8879 form requires a few essential steps:

- Obtain the form from your tax preparer or tax software.

- Review all the pre-filled information for accuracy, including your name, Social Security number, and the details of your tax return.

- Sign the form, either electronically or by hand, as per the instructions provided.

- Return the signed form to your tax preparer or submit it as directed by your tax software.

Following these steps ensures that your e-filing process is authorized and compliant with IRS regulations.

Legal use of the 8879 For Form

The legal use of the 8879 form is governed by IRS guidelines, which stipulate that it must be used to authorize electronic filings. The form must be signed by the taxpayer and retained by the tax preparer for a specified period. This retention is crucial for compliance and audit purposes. By using the 8879 form correctly, taxpayers ensure that their electronic submissions are legally binding and recognized by the IRS, thereby reducing the risk of issues related to unauthorized filings.

IRS Guidelines

The IRS provides specific guidelines for the use of the 8879 form. These guidelines include requirements for the information that must be included on the form, the process for signing it, and the obligations of both the taxpayer and the tax preparer. Taxpayers should familiarize themselves with these guidelines to ensure compliance and to understand their rights and responsibilities regarding electronic filing. Adhering to IRS guidelines helps prevent errors and potential penalties associated with improper filing.

Filing Deadlines / Important Dates

Filing deadlines for the 8879 form align with the overall tax filing deadlines set by the IRS. Typically, individual tax returns are due on April fifteenth each year. If you are filing for an extension, the deadline for submitting the 8879 form may also change. It is essential to keep track of these dates to avoid late penalties and ensure that your electronic filing is submitted on time. Taxpayers should also be aware of any state-specific deadlines that may apply.

Quick guide on how to complete form 8453 i internal revenue service

Effortlessly Prepare 8879 For Form on Any Device

Managing documents online has gained popularity among businesses and individuals. It offers an excellent environmentally friendly substitute to conventional printed and signed documents, as you can obtain the required form and safely store it online. airSlate SignNow equips you with all the necessary resources to create, modify, and electronically sign your documents quickly without any hold-ups. Handle 8879 For Form on any device using airSlate SignNow Android or iOS applications and simplify any document-related tasks today.

The easiest way to modify and eSign 8879 For Form with ease

- Find 8879 For Form and then click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize important sections of the documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Generate your electronic signature using the Sign tool, which takes moments and carries the same legal validity as a traditional wet ink signature.

- Review all the details and then click on the Done button to save your changes.

- Select your preferred delivery method for the form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow caters to all your document management requirements in just a few clicks from any device you choose. Modify and electronically sign 8879 For Form and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 8453 i internal revenue service

How to generate an electronic signature for your Form 8453 I Internal Revenue Service online

How to make an electronic signature for your Form 8453 I Internal Revenue Service in Chrome

How to generate an electronic signature for signing the Form 8453 I Internal Revenue Service in Gmail

How to make an eSignature for the Form 8453 I Internal Revenue Service right from your smartphone

How to create an electronic signature for the Form 8453 I Internal Revenue Service on iOS

How to make an electronic signature for the Form 8453 I Internal Revenue Service on Android

People also ask

-

What is the 8879 For Form and how does it work with airSlate SignNow?

The 8879 For Form is an IRS eSignature form that allows taxpayers to electronically sign and transmit their tax return authorization. With airSlate SignNow, you can easily fill out, sign, and send the 8879 For Form securely, ensuring compliance and efficiency in your tax filing process.

-

How much does it cost to use airSlate SignNow for the 8879 For Form?

airSlate SignNow offers a variety of pricing plans to suit different business needs, including a free trial option. Pricing for using the 8879 For Form starts at competitive rates, making it a cost-effective solution for electronic signatures and document management.

-

What features does airSlate SignNow provide for the 8879 For Form?

airSlate SignNow provides essential features for the 8879 For Form, including customizable templates, secure cloud storage, and real-time tracking of document status. These features streamline the signing process and enhance collaboration, making it easier for users to manage their tax documents.

-

Can I integrate airSlate SignNow with other software for processing the 8879 For Form?

Yes, airSlate SignNow offers seamless integrations with various software applications such as CRM systems, accounting software, and cloud storage platforms. This allows you to efficiently manage the 8879 For Form alongside your existing workflow, increasing productivity and reducing errors.

-

Is airSlate SignNow secure for signing the 8879 For Form?

Absolutely! airSlate SignNow employs industry-leading security measures, including encryption and secure access controls, to protect your sensitive information. When signing the 8879 For Form, you can trust that your data is safeguarded against unauthorized access.

-

How can airSlate SignNow benefit my business when using the 8879 For Form?

Using airSlate SignNow for the 8879 For Form can signNowly streamline your tax filing process. It reduces paperwork, accelerates the signing process, and enhances compliance, allowing your business to focus on its core activities while ensuring timely submission of tax documents.

-

What support options are available for airSlate SignNow users dealing with the 8879 For Form?

airSlate SignNow provides comprehensive support for users, including a detailed knowledge base, tutorials, and customer service options. Whether you have questions about the 8879 For Form or need assistance with the platform, our support team is here to help you succeed.

Get more for 8879 For Form

Find out other 8879 For Form

- eSignature Texas Legal Affidavit Of Heirship Easy

- eSignature Utah Legal Promissory Note Template Free

- eSignature Louisiana Lawers Living Will Free

- eSignature Louisiana Lawers Last Will And Testament Now

- How To eSignature West Virginia Legal Quitclaim Deed

- eSignature West Virginia Legal Lease Agreement Template Online

- eSignature West Virginia Legal Medical History Online

- eSignature Maine Lawers Last Will And Testament Free

- eSignature Alabama Non-Profit Living Will Free

- eSignature Wyoming Legal Executive Summary Template Myself

- eSignature Alabama Non-Profit Lease Agreement Template Computer

- eSignature Arkansas Life Sciences LLC Operating Agreement Mobile

- eSignature California Life Sciences Contract Safe

- eSignature California Non-Profit LLC Operating Agreement Fast

- eSignature Delaware Life Sciences Quitclaim Deed Online

- eSignature Non-Profit Form Colorado Free

- eSignature Mississippi Lawers Residential Lease Agreement Later

- How To eSignature Mississippi Lawers Residential Lease Agreement

- Can I eSignature Indiana Life Sciences Rental Application

- eSignature Indiana Life Sciences LLC Operating Agreement Fast