Irs 1065 Form

What is the IRS 1065?

The IRS 1065 form is a tax return used by partnerships to report income, deductions, gains, losses, and other information. It is essential for partnerships, which include multi-member LLCs and general partnerships, to file this form annually. Each partner receives a Schedule K-1, detailing their share of the partnership's income, deductions, and credits, which they then report on their personal tax returns. Understanding the IRS 1065 is crucial for compliance with federal tax regulations.

Steps to Complete the IRS 1065

Completing the IRS 1065 involves several key steps:

- Gather Financial Information: Collect all necessary financial documents, including income statements, expense records, and balance sheets.

- Fill Out the Form: Begin with basic information about the partnership, including the name, address, and Employer Identification Number (EIN).

- Report Income and Deductions: Input total income and allowable deductions in the appropriate sections of the form.

- Allocate Income to Partners: Complete Schedule K-1 for each partner, detailing their share of income and deductions.

- Review and Submit: Double-check all entries for accuracy before submitting the form electronically or by mail.

How to Obtain the IRS 1065

The IRS 1065 form can be obtained directly from the IRS website. It is available as a downloadable PDF, which can be filled out electronically or printed for manual completion. Additionally, tax preparation software often includes the IRS 1065 form, making it easier for partnerships to prepare and file their tax returns. Ensure that you are using the most recent version of the form to comply with current tax laws.

Legal Use of the IRS 1065

The IRS 1065 is legally required for partnerships to report their financial activities to the IRS. Filing this form accurately is crucial to avoid penalties. Partnerships must adhere to IRS guidelines regarding the information reported, including income, deductions, and distributions to partners. Non-compliance can lead to audits and potential fines, making it essential to understand the legal implications of this form.

Filing Deadlines / Important Dates

The IRS 1065 must be filed by March 15 for partnerships operating on a calendar year basis. If the deadline falls on a weekend or holiday, it is extended to the next business day. Partnerships can request a six-month extension, allowing them to file by September 15. It is important to keep track of these deadlines to ensure timely submission and avoid penalties.

Required Documents

To complete the IRS 1065 form, partnerships need to gather various documents, including:

- Financial statements, including income and expense reports

- Partnership agreement

- Records of each partner's capital contributions

- Previous year’s tax returns, if applicable

- Any supporting documentation for deductions claimed

Form Submission Methods (Online / Mail / In-Person)

The IRS 1065 can be submitted electronically via e-filing or mailed directly to the IRS. E-filing is often recommended for its speed and efficiency, allowing for quicker processing and confirmation. If choosing to mail the form, ensure it is sent to the correct address based on the partnership's location and include any necessary payment for taxes owed. In-person submissions are not typically available for this form.

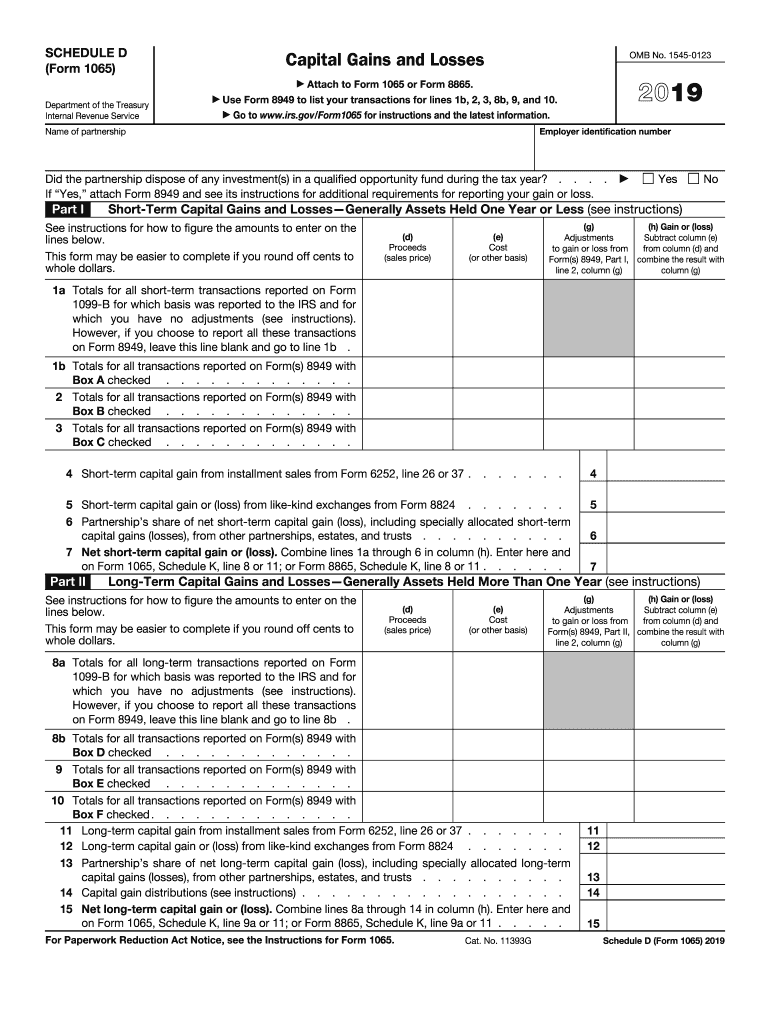

Quick guide on how to complete 2018 schedule d form 1065 internal revenue service

Effortlessly Prepare Irs 1065 on Any Device

Managing documents online has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed paperwork, enabling you to locate the appropriate form and securely store it in the cloud. airSlate SignNow equips you with all the tools necessary to create, edit, and electronically sign your documents swiftly without waiting. Handle Irs 1065 on any device using the airSlate SignNow apps for Android or iOS, and simplify your document-centric tasks today.

The Easiest Way to Modify and Electronically Sign Irs 1065 Effortlessly

- Locate Irs 1065 and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Shade important sections of your documents or obscure sensitive information with the tools specifically provided by airSlate SignNow for this purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to save your modifications.

- Choose your preferred method to deliver your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misfiled documents, frustrating form hunting, or errors that require reprinting new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Irs 1065 while ensuring excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 2018 schedule d form 1065 internal revenue service

How to make an eSignature for the 2018 Schedule D Form 1065 Internal Revenue Service online

How to generate an eSignature for your 2018 Schedule D Form 1065 Internal Revenue Service in Chrome

How to generate an electronic signature for putting it on the 2018 Schedule D Form 1065 Internal Revenue Service in Gmail

How to make an electronic signature for the 2018 Schedule D Form 1065 Internal Revenue Service right from your smart phone

How to generate an eSignature for the 2018 Schedule D Form 1065 Internal Revenue Service on iOS devices

How to make an eSignature for the 2018 Schedule D Form 1065 Internal Revenue Service on Android OS

People also ask

-

What is the IRS Schedule D and how does it relate to eSigning documents?

The IRS Schedule D is a form used for reporting capital gains and losses on your tax return. When using airSlate SignNow, you can easily eSign documents related to your IRS Schedule D, ensuring a quick and legally binding way to manage your tax filings.

-

How can airSlate SignNow help streamline the IRS Schedule D preparation process?

With airSlate SignNow, you can prepare your IRS Schedule D more efficiently by digitizing your document workflows. Our platform enables you to collect signatures seamlessly, reducing the time spent on paperwork and allowing you to focus on your financial planning.

-

What features does airSlate SignNow offer for managing IRS Schedule D documents?

airSlate SignNow provides features such as customizable templates, automated workflows, and secure storage for IRS Schedule D documents. These tools help ensure compliance and simplify the process of collecting necessary signatures and documentation.

-

Is there a cost associated with using airSlate SignNow for IRS Schedule D eSigning?

Yes, airSlate SignNow offers various pricing plans tailored to fit different budgets. Whether you are a small business or a large enterprise, our solutions are competitively priced, helping you manage your IRS Schedule D and other documents affordably.

-

Can I integrate airSlate SignNow with other applications for IRS Schedule D management?

Absolutely! airSlate SignNow offers integrations with popular business applications, such as accounting software and document management systems. This allows you to seamlessly incorporate IRS Schedule D management into your existing workflows and improve overall efficiency.

-

What are the benefits of using airSlate SignNow for my IRS Schedule D eSigning needs?

The main benefits of using airSlate SignNow for your IRS Schedule D include reduced turnaround time for signatures, enhanced security for your documents, and accessibility from any device. This ensures you can manage your tax-related paperwork conveniently and effectively.

-

Is airSlate SignNow compliant with IRS regulations for document signing?

Yes, airSlate SignNow complies with all relevant IRS regulations for electronic signatures, ensuring that your eSigned IRS Schedule D documents are legally binding. We prioritize security and compliance, so you can feel confident in using our services for your tax documents.

Get more for Irs 1065

- Apprentice form for barber 390782259

- Admissions and continued occupancy policy form

- Bop guidelines for forensic evaluations fd org form

- Mom fdw contract template form

- Monetary contract template form

- Money borrow contract template form

- Money between friends contract template form

- Money back guarantee contract template form

Find out other Irs 1065

- How Can I eSign Maine Construction Quitclaim Deed

- eSign Colorado Education Promissory Note Template Easy

- eSign North Dakota Doctors Affidavit Of Heirship Now

- eSign Oklahoma Doctors Arbitration Agreement Online

- eSign Oklahoma Doctors Forbearance Agreement Online

- eSign Oregon Doctors LLC Operating Agreement Mobile

- eSign Hawaii Education Claim Myself

- eSign Hawaii Education Claim Simple

- eSign Hawaii Education Contract Simple

- eSign Hawaii Education NDA Later

- How To eSign Hawaii Education NDA

- How Do I eSign Hawaii Education NDA

- eSign Hawaii Education Arbitration Agreement Fast

- eSign Minnesota Construction Purchase Order Template Safe

- Can I eSign South Dakota Doctors Contract

- eSign Mississippi Construction Rental Application Mobile

- How To eSign Missouri Construction Contract

- eSign Missouri Construction Rental Lease Agreement Easy

- How To eSign Washington Doctors Confidentiality Agreement

- Help Me With eSign Kansas Education LLC Operating Agreement