Form 5227

What is the Form 5227

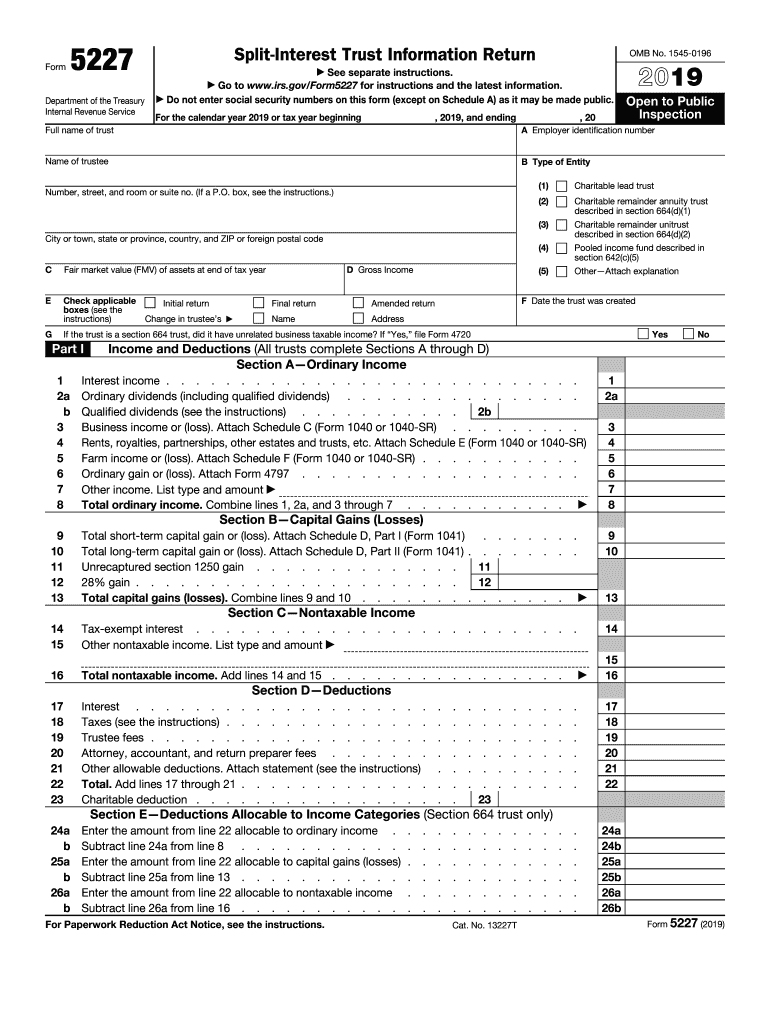

The Form 5227, officially known as the 5227 IRS form, is a tax document used to report the activities of split-interest trusts. These trusts typically include charitable remainder trusts and charitable lead trusts. The form provides the IRS with essential information regarding the trust's income, deductions, and distributions. Understanding the purpose of the Form 5227 is crucial for trustees and beneficiaries to ensure compliance with federal tax regulations.

How to use the Form 5227

Using the Form 5227 involves several steps to ensure accurate reporting. First, gather all necessary financial information related to the trust, including income generated, deductions claimed, and distributions made to beneficiaries. Next, fill out the form by providing detailed information in the designated sections, which may include the trust's name, taxpayer identification number, and specific financial data. Once completed, the form must be submitted to the IRS by the designated deadline to avoid penalties.

Steps to complete the Form 5227

Completing the Form 5227 requires careful attention to detail. Follow these steps:

- Obtain the latest version of the Form 5227 from the IRS website.

- Fill in the trust's identifying information at the top of the form.

- Report all sources of income generated by the trust, including dividends, interest, and capital gains.

- Document any deductions, such as administrative expenses or distributions to beneficiaries.

- Ensure all calculations are accurate and double-check for any errors.

- Sign and date the form before submission.

Legal use of the Form 5227

The legal use of the Form 5227 is governed by IRS regulations. It is essential for trustees to understand that submitting this form is a legal requirement for split-interest trusts. Failure to comply can result in penalties, including fines or additional scrutiny from the IRS. By accurately completing and submitting the Form 5227, trustees fulfill their legal obligations and maintain transparency with tax authorities.

Filing Deadlines / Important Dates

Filing deadlines for the Form 5227 are crucial for compliance. The form is typically due on the fifteenth day of the fourth month following the end of the trust's tax year. For trusts operating on a calendar year basis, this means the form is due on April 15. It is important to mark this date on your calendar to avoid late filing penalties. If additional time is needed, trustees may file for an extension, but this must be done before the original deadline.

Form Submission Methods (Online / Mail / In-Person)

The Form 5227 can be submitted to the IRS through various methods. Trustees have the option to file the form electronically or via traditional mail. Electronic filing is often preferred for its speed and efficiency, while mailing a paper form requires ensuring it is sent to the correct IRS address based on the trust's location. In-person submission is generally not an option for this form, as the IRS does not accept forms at local offices. Always verify the submission method and ensure that the form is sent well before the deadline to avoid complications.

Quick guide on how to complete about form 5227 split interest trust information return

Effortlessly Prepare Form 5227 on Any Device

Managing documents online has gained traction among businesses and individuals. It offers a perfect environmentally friendly substitute for traditional printed and signed paperwork, allowing you to locate the correct template and securely save it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents quickly and without delay. Handle Form 5227 on any platform with the airSlate SignNow applications for Android or iOS and streamline any document-related process today.

How to Edit and Electronically Sign Form 5227 with Ease

- Locate Form 5227 and click Get Form to begin.

- Utilize the resources we offer to complete your document.

- Emphasize relevant sections of your documents or conceal sensitive details with tools specifically provided by airSlate SignNow.

- Create your signature using the Sign feature, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click the Done button to save your changes.

- Select your preferred delivery method for your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, time-consuming form searches, or errors requiring new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Modify and electronically sign Form 5227 to ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the about form 5227 split interest trust information return

How to make an electronic signature for the About Form 5227 Split Interest Trust Information Return in the online mode

How to create an electronic signature for your About Form 5227 Split Interest Trust Information Return in Chrome

How to create an electronic signature for putting it on the About Form 5227 Split Interest Trust Information Return in Gmail

How to generate an eSignature for the About Form 5227 Split Interest Trust Information Return from your mobile device

How to create an electronic signature for the About Form 5227 Split Interest Trust Information Return on iOS devices

How to create an eSignature for the About Form 5227 Split Interest Trust Information Return on Android OS

People also ask

-

What is Form 5227 and how does it relate to airSlate SignNow?

Form 5227 is a tax form used for reporting information related to certain tax-exempt organizations. With airSlate SignNow, businesses can easily create, send, and eSign Form 5227 securely online, streamlining the process and ensuring compliance with IRS regulations.

-

How can I use airSlate SignNow to eSign Form 5227?

To eSign Form 5227 using airSlate SignNow, simply upload the form to your account, add the necessary signers, and customize the signing fields. The platform provides a user-friendly interface that makes it easy to manage signatures, ensuring your Form 5227 is completed quickly and accurately.

-

What are the pricing options for airSlate SignNow when working with forms like Form 5227?

airSlate SignNow offers various pricing plans to accommodate different business needs. Each plan includes features that support document management and eSigning, making it a cost-effective solution for handling forms like Form 5227 efficiently.

-

Can I integrate airSlate SignNow with other software for managing Form 5227?

Yes, airSlate SignNow provides integration capabilities with various third-party applications, allowing you to manage Form 5227 seamlessly alongside your existing workflows. This enhances productivity by enabling you to automate processes and keep all your documents organized.

-

What are the benefits of using airSlate SignNow for Form 5227?

Using airSlate SignNow for Form 5227 offers numerous benefits, including enhanced security, reduced turnaround time for signatures, and easy access to completed forms. Its intuitive platform ensures that businesses can focus on what matters most without the hassle of paper forms.

-

Is airSlate SignNow compliant with regulations for submitting Form 5227?

Absolutely. airSlate SignNow is designed to comply with various legal standards, ensuring that your eSigned Form 5227 meets all regulatory requirements. This means your documents are not only valid but also secure throughout the signing process.

-

How do I ensure my Form 5227 is securely signed using airSlate SignNow?

airSlate SignNow employs advanced encryption and security protocols to protect your Form 5227 from unauthorized access. You can also track the status of your document and receive notifications, ensuring that your signed forms are always secure and easily accessible.

Get more for Form 5227

Find out other Form 5227

- How To Sign Arkansas Doctors Document

- How Do I Sign Florida Doctors Word

- Can I Sign Florida Doctors Word

- How Can I Sign Illinois Doctors PPT

- How To Sign Texas Doctors PDF

- Help Me With Sign Arizona Education PDF

- How To Sign Georgia Education Form

- How To Sign Iowa Education PDF

- Help Me With Sign Michigan Education Document

- How Can I Sign Michigan Education Document

- How Do I Sign South Carolina Education Form

- Can I Sign South Carolina Education Presentation

- How Do I Sign Texas Education Form

- How Do I Sign Utah Education Presentation

- How Can I Sign New York Finance & Tax Accounting Document

- How Can I Sign Ohio Finance & Tax Accounting Word

- Can I Sign Oklahoma Finance & Tax Accounting PPT

- How To Sign Ohio Government Form

- Help Me With Sign Washington Government Presentation

- How To Sign Maine Healthcare / Medical PPT