8801 Form

What is the 8801

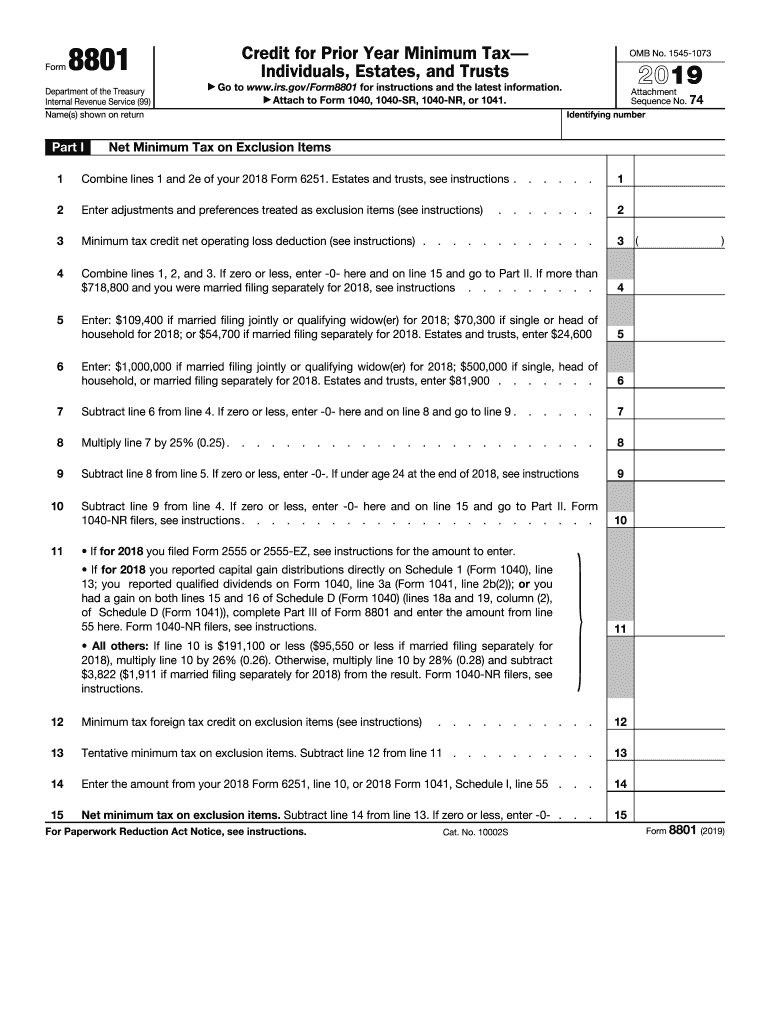

The 8801 form, officially known as the IRS Form 8801, is used to calculate and claim the credit for prior year minimum tax. This form is essential for taxpayers who have paid alternative minimum tax (AMT) in previous years and are eligible to recover some of that amount in the current tax year. The 8801 credit serves as a means to alleviate the tax burden for those who may have faced higher taxes due to AMT regulations in the past.

How to use the 8801

To effectively use the 8801 form, taxpayers must first determine their eligibility for the credit. This involves reviewing prior tax returns to confirm that AMT was paid in previous years. Once eligibility is established, the taxpayer can proceed to fill out the form, ensuring that all required information is accurately entered. The completed form is then submitted with the taxpayer's current year tax return, allowing for the credit to be applied against any taxes owed.

Steps to complete the 8801

Completing the IRS Form 8801 involves several key steps:

- Gather necessary documents, including prior year tax returns and any relevant financial statements.

- Review the instructions provided with the form to understand the specific requirements and calculations needed.

- Fill out the form carefully, ensuring that all sections are completed accurately, particularly those that pertain to prior year minimum tax amounts.

- Double-check the calculations to confirm the credit amount being claimed.

- Submit the completed form along with your current year tax return by the designated filing deadline.

IRS Guidelines

The IRS provides specific guidelines regarding the use of Form 8801. Taxpayers must adhere to these guidelines to ensure compliance and avoid penalties. Key points include the requirement to file the form with the appropriate tax return, the necessity of accurate reporting of prior year AMT, and adherence to the deadlines established by the IRS. It is crucial to consult the latest IRS publications or the official IRS website for updates on any changes to the guidelines.

Legal use of the 8801

The legal use of Form 8801 is grounded in its compliance with IRS regulations. To be considered valid, the form must be filled out accurately and submitted within the designated time frame. Additionally, the taxpayer must ensure that they meet all eligibility criteria for claiming the credit. Using a reliable eSignature platform, such as signNow, can facilitate the signing and submission process, ensuring that the form is executed legally and securely.

Filing Deadlines / Important Dates

Filing deadlines for the IRS Form 8801 coincide with the overall tax return deadlines. Typically, individual taxpayers must submit their tax returns by April 15 of the following year. If additional time is needed, taxpayers can file for an extension, but it is important to note that any taxes owed should still be paid by the original deadline to avoid penalties. Keeping track of these dates is essential for successful filing and credit recovery.

Quick guide on how to complete about form 8801 credit for prior year minimum tax

Prepare 8801 effortlessly on any device

Digital document management has gained traction among organizations and individuals alike. It serves as an excellent environmentally friendly alternative to conventional printed and signed paperwork, as you can obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents quickly and without delays. Manage 8801 on any device using the airSlate SignNow Android or iOS applications and enhance your document-related tasks today.

How to modify and eSign 8801 with ease

- Locate 8801 and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Select important sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature using the Sign tool, which takes only seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the details and click on the Done button to save your updates.

- Choose your preferred method for sending your form, be it email, SMS, or an invite link, or download it directly to your computer.

Eliminate the hassle of lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Modify and eSign 8801 and ensure outstanding communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the about form 8801 credit for prior year minimum tax

How to make an eSignature for your About Form 8801 Credit For Prior Year Minimum Tax online

How to make an electronic signature for your About Form 8801 Credit For Prior Year Minimum Tax in Chrome

How to generate an electronic signature for putting it on the About Form 8801 Credit For Prior Year Minimum Tax in Gmail

How to create an eSignature for the About Form 8801 Credit For Prior Year Minimum Tax straight from your smart phone

How to make an electronic signature for the About Form 8801 Credit For Prior Year Minimum Tax on iOS

How to generate an electronic signature for the About Form 8801 Credit For Prior Year Minimum Tax on Android OS

People also ask

-

What is Form 8801 and why do I need it?

Form 8801 is used to calculate and claim your investment credit. It's essential for businesses that want to take advantage of tax benefits related to investments. Ensuring accurate completion of Form 8801 can save you money on taxes, making it crucial for any business owner.

-

How can airSlate SignNow help me with Form 8801?

airSlate SignNow streamlines the process of filling out and signing Form 8801. With its user-friendly interface, you can easily prepare and send this form for eSignature. This efficient solution saves you time and ensures that your form is processed quickly and accurately.

-

Is airSlate SignNow a cost-effective solution for managing Form 8801?

Yes, airSlate SignNow offers competitive pricing plans that cater to businesses of all sizes. By utilizing this tool for Form 8801, you save on traditional paperwork costs and enhance productivity. The cost-effectiveness of airSlate SignNow allows you to focus on your business rather than paperwork.

-

Are there any features specifically designed for handling Form 8801?

airSlate SignNow provides features such as templates and predefined fields, which can simplify the completion of Form 8801. You can customize your documents based on your needs and reduce the likelihood of errors. These features ensure that your tax forms are filled out correctly and efficiently.

-

Can I integrate airSlate SignNow with other applications when working on Form 8801?

Absolutely! airSlate SignNow integrates seamlessly with various applications such as CRM systems and cloud storage. This allows you to access and manage Form 8801 efficiently within your existing workflows, creating a more streamlined experience.

-

What are the benefits of eSigning Form 8801 with airSlate SignNow?

eSigning Form 8801 with airSlate SignNow enhances security and speeds up the approval process. You receive instant notifications when the form is signed, allowing for real-time tracking. This reduces the time spent managing signatures and helps ensure timely filing.

-

Is training or support available for using airSlate SignNow with Form 8801?

Yes, airSlate SignNow offers comprehensive support and training resources to help you navigate the eSigning process for Form 8801. You can access tutorials, FAQs, and customer support to address any questions you might have. This ensures you make the most of the platform's capabilities.

Get more for 8801

Find out other 8801

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors