Form 8889

What is the Form 8889

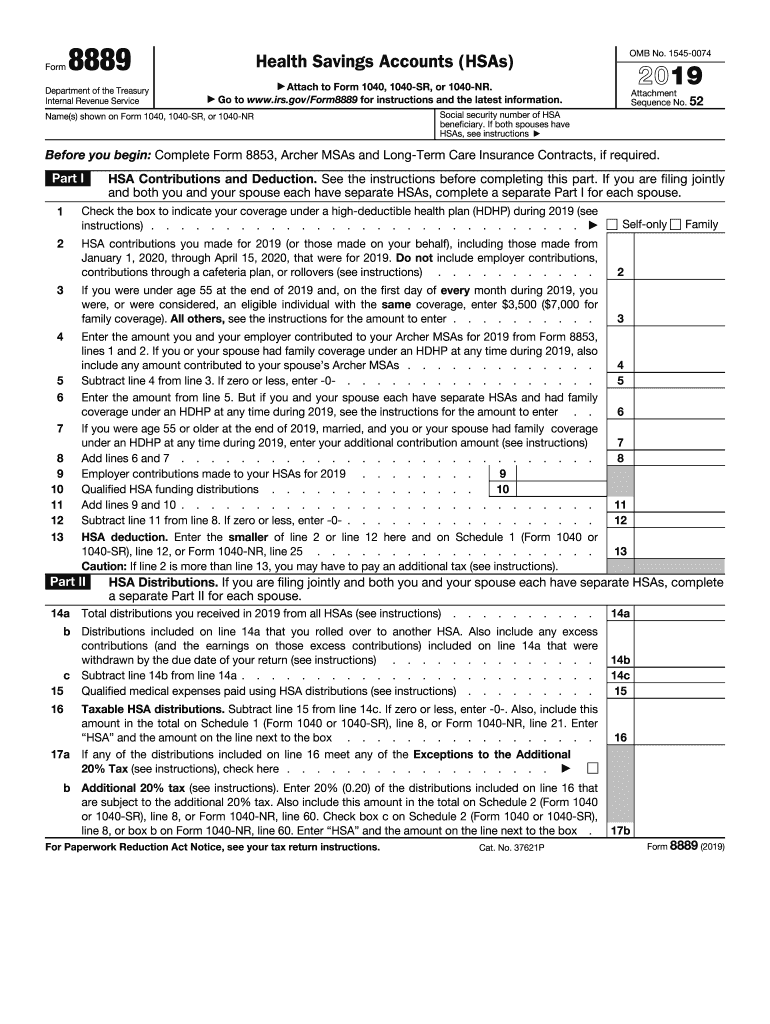

The Form 8889 is a tax document used by individuals to report Health Savings Account (HSA) contributions and distributions. This form is essential for taxpayers who have established HSAs, as it provides a detailed account of how funds are contributed and withdrawn throughout the tax year. The IRS requires this form to ensure compliance with tax regulations regarding HSAs, which are designed to help individuals save for medical expenses while enjoying tax benefits.

How to use the Form 8889

Using the Form 8889 involves several key steps. First, gather all relevant information regarding your HSA contributions and distributions for the tax year. This includes any contributions made by you or your employer, as well as any withdrawals for qualified medical expenses. Next, complete the form by accurately filling in the required fields, ensuring that all figures are correct. Finally, attach the completed Form 8889 to your federal tax return when filing. This process ensures that you take full advantage of the tax benefits associated with your HSA.

Steps to complete the Form 8889

Completing the Form 8889 requires careful attention to detail. Follow these steps:

- Begin by entering your personal information, including your name and Social Security number.

- Report your HSA contributions on Part I of the form. Include contributions made by you and your employer.

- In Part II, detail any distributions taken from your HSA. Specify whether these distributions were used for qualified medical expenses.

- Calculate the total amounts in each section and ensure that all entries are accurate.

- Finally, sign and date the form before submitting it with your tax return.

Legal use of the Form 8889

The legal use of the Form 8889 is governed by IRS regulations. To be considered valid, the form must be completed accurately and submitted on time. It is essential to maintain records of all contributions and distributions related to your HSA, as these may be required for verification purposes. Additionally, understanding the tax implications of your HSA transactions can help ensure compliance and avoid potential penalties.

Filing Deadlines / Important Dates

Filing deadlines for the Form 8889 align with the general tax return deadlines set by the IRS. Typically, individual tax returns must be filed by April 15 of the following year. If this date falls on a weekend or holiday, the deadline may be extended. It is crucial to be aware of these dates to avoid late filing penalties and ensure that your HSA contributions and distributions are reported accurately within the required timeframe.

Required Documents

To complete the Form 8889, you will need several key documents:

- Your W-2 forms showing HSA contributions made by your employer.

- Records of any personal contributions made to your HSA.

- Documentation of HSA distributions, including receipts for qualified medical expenses.

- Any other relevant tax documents that may impact your HSA reporting.

Quick guide on how to complete 2019 instructions for form 8889 internal revenue service

Effortlessly Prepare Form 8889 on Any Device

The use of online document management has surged in popularity among businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to easily locate the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, edit, and electronically sign your documents swiftly without any delays. Manage Form 8889 on any device using the airSlate SignNow apps for Android or iOS and enhance your document-driven processes today.

How to Edit and Electronically Sign Form 8889 with Ease

- Find Form 8889 and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize important sections of your documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your electronic signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Verify the details and click on the Done button to save your changes.

- Choose your preferred method to send your form, whether by email, SMS, invite link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searching, and errors that require printing new copies of documents. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Form 8889 and ensure outstanding communication at every step of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 2019 instructions for form 8889 internal revenue service

How to create an electronic signature for your 2019 Instructions For Form 8889 Internal Revenue Service online

How to create an eSignature for your 2019 Instructions For Form 8889 Internal Revenue Service in Chrome

How to create an eSignature for putting it on the 2019 Instructions For Form 8889 Internal Revenue Service in Gmail

How to generate an eSignature for the 2019 Instructions For Form 8889 Internal Revenue Service right from your smart phone

How to create an eSignature for the 2019 Instructions For Form 8889 Internal Revenue Service on iOS devices

How to make an electronic signature for the 2019 Instructions For Form 8889 Internal Revenue Service on Android devices

People also ask

-

What is the 2019 IRS Form 8889 used for?

The 2019 IRS Form 8889 is used by individuals to report Health Savings Account (HSA) contributions and distributions. This form helps ensure that you are in compliance with IRS regulations regarding HSAs, allowing you to report amounts accurately and claim tax benefits.

-

How do I fill out the 2019 IRS Form 8889?

To fill out the 2019 IRS Form 8889, you need to provide information about your HSA contributions and distributions. Make sure to gather your HSA records and properly document contributions for the tax year, ensuring correct completion to maximize your tax benefits.

-

Can I eSign the 2019 IRS Form 8889 using airSlate SignNow?

Yes, you can easily eSign the 2019 IRS Form 8889 using airSlate SignNow. Our platform provides a secure, user-friendly solution for you to electronically sign, send, and manage your tax documents seamlessly.

-

Is there a cost associated with using airSlate SignNow to manage the 2019 IRS Form 8889?

airSlate SignNow offers cost-effective solutions for document management, including the eSigning of the 2019 IRS Form 8889. Our various subscription plans cater to different business needs, ensuring you find a price point that fits your budget.

-

What features does airSlate SignNow offer for managing the 2019 IRS Form 8889?

AirSlate SignNow provides numerous features for managing the 2019 IRS Form 8889, including customizable templates, automatic reminders, and secure cloud storage. These tools streamline your document workflows, making it easier to complete your forms accurately and on time.

-

How can I ensure compliance when using the 2019 IRS Form 8889?

Using airSlate SignNow to complete the 2019 IRS Form 8889 helps ensure compliance with IRS requirements. By utilizing our platform's secure and documented processes, you can maintain comprehensive records of your HSA transactions that can be easily referenced if needed.

-

Does airSlate SignNow integrate with accounting software for the 2019 IRS Form 8889?

Yes, airSlate SignNow seamlessly integrates with popular accounting software, allowing for efficient management of the 2019 IRS Form 8889. This integration helps streamline your financial processes, ensuring that your HSA contributions and distributions are accurately reflected in your accounting records.

Get more for Form 8889

Find out other Form 8889

- How Do I eSignature Arizona Charity Rental Application

- How To eSignature Minnesota Car Dealer Bill Of Lading

- eSignature Delaware Charity Quitclaim Deed Computer

- eSignature Colorado Charity LLC Operating Agreement Now

- eSignature Missouri Car Dealer Purchase Order Template Easy

- eSignature Indiana Charity Residential Lease Agreement Simple

- How Can I eSignature Maine Charity Quitclaim Deed

- How Do I eSignature Michigan Charity LLC Operating Agreement

- eSignature North Carolina Car Dealer NDA Now

- eSignature Missouri Charity Living Will Mobile

- eSignature New Jersey Business Operations Memorandum Of Understanding Computer

- eSignature North Dakota Car Dealer Lease Agreement Safe

- eSignature Oklahoma Car Dealer Warranty Deed Easy

- eSignature Oregon Car Dealer Rental Lease Agreement Safe

- eSignature South Carolina Charity Confidentiality Agreement Easy

- Can I eSignature Tennessee Car Dealer Limited Power Of Attorney

- eSignature Utah Car Dealer Cease And Desist Letter Secure

- eSignature Virginia Car Dealer Cease And Desist Letter Online

- eSignature Virginia Car Dealer Lease Termination Letter Easy

- eSignature Alabama Construction NDA Easy