Rct 101 Instructions Form

What is the RCT 101 Instructions?

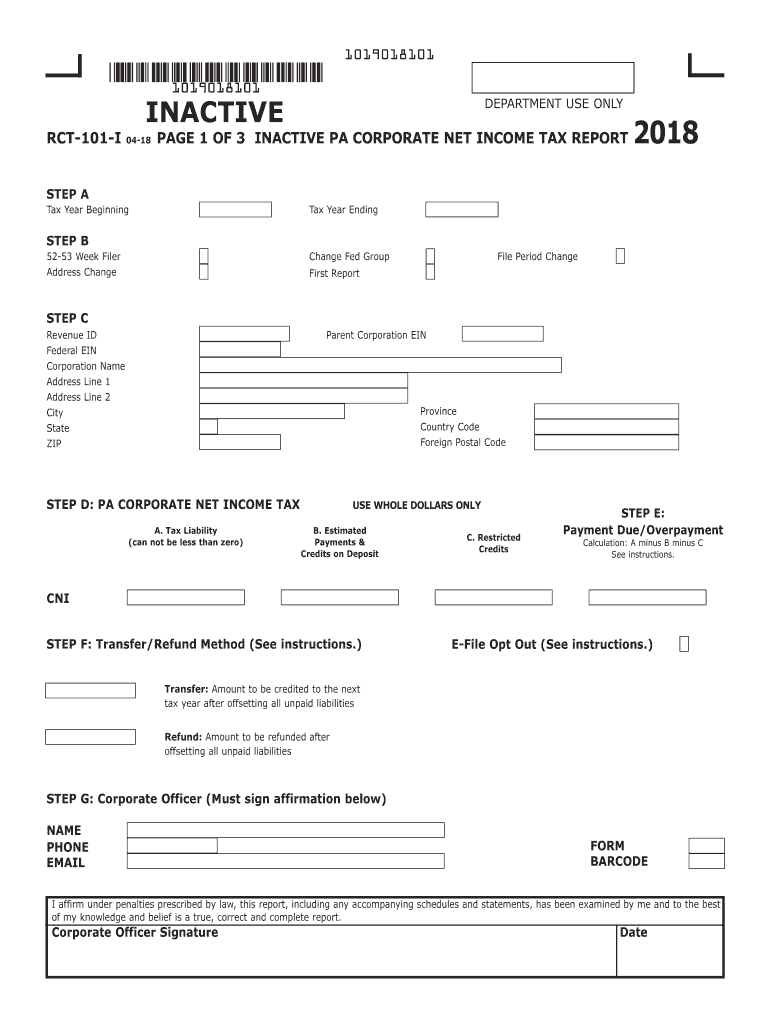

The RCT 101 Instructions are a set of guidelines provided by the Pennsylvania Department of Revenue for the completion of the Pennsylvania Corporate Tax Report. This form is essential for businesses operating in Pennsylvania as it outlines the necessary information required for reporting corporate income and calculating tax liability. The instructions detail the specific sections of the form, including how to report income, deductions, and credits applicable to Pennsylvania corporate taxes.

Steps to Complete the RCT 101 Instructions

Completing the RCT 101 Instructions involves several key steps to ensure accuracy and compliance. Start by gathering all financial documents related to your business operations within Pennsylvania. This includes income statements, expense reports, and any relevant tax documents. Next, follow these steps:

- Review the RCT 101 form and instructions thoroughly.

- Fill out the required sections, including business identification, income, and deductions.

- Double-check all calculations to ensure accuracy.

- Attach any necessary supporting documents as specified in the instructions.

- Sign and date the form before submission.

Legal Use of the RCT 101 Instructions

The RCT 101 Instructions are legally binding and must be completed in accordance with Pennsylvania tax laws. Businesses are required to file this form to report their income and tax obligations accurately. Failure to comply with these instructions can result in penalties, including fines and interest on unpaid taxes. It is crucial to understand the legal implications of the information provided on the form to avoid any potential legal issues.

Filing Deadlines / Important Dates

Timely filing of the RCT 101 is essential to avoid penalties. The typical deadline for submitting the RCT 101 form is the fifteenth day of the fourth month following the close of the corporation's fiscal year. For corporations operating on a calendar year, this means the deadline is April 15. Businesses should also be aware of any extensions that may be available and ensure that they are filed appropriately to maintain compliance with state regulations.

Required Documents

When completing the RCT 101 Instructions, certain documents are required to support the information reported on the form. These include:

- Federal tax return (Form 1120 or 1120-S).

- Financial statements, including balance sheets and income statements.

- Documentation for any claimed deductions or credits.

- Any additional forms or schedules as specified in the RCT 101 instructions.

Examples of Using the RCT 101 Instructions

To illustrate the application of the RCT 101 Instructions, consider a corporation that has generated income from sales in Pennsylvania. This corporation would use the RCT 101 to report its total income, deduct business expenses, and calculate its tax liability based on the net income. Another example could involve a corporation claiming tax credits for job creation, which would also be detailed in the RCT 101 form, demonstrating how these credits reduce overall tax liability.

Quick guide on how to complete 2018 inactive pa corporate net income tax report rct 101 i print only version formspublications

Complete Rct 101 Instructions effortlessly on any device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal environmentally friendly substitute for traditional printed and signed documents, allowing you to obtain the correct form and safely store it online. airSlate SignNow equips you with all the tools necessary to create, alter, and eSign your documents quickly without unnecessary delays. Handle Rct 101 Instructions on any device with airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to alter and eSign Rct 101 Instructions with ease

- Find Rct 101 Instructions and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of the documents or redact sensitive information using tools that airSlate SignNow specifically provides for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred method for sending your form: via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate worries about lost or missing files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and eSign Rct 101 Instructions and ensure excellent communication at any stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 2018 inactive pa corporate net income tax report rct 101 i print only version formspublications

How to make an electronic signature for the 2018 Inactive Pa Corporate Net Income Tax Report Rct 101 I Print Only Version Formspublications online

How to make an eSignature for your 2018 Inactive Pa Corporate Net Income Tax Report Rct 101 I Print Only Version Formspublications in Google Chrome

How to generate an eSignature for signing the 2018 Inactive Pa Corporate Net Income Tax Report Rct 101 I Print Only Version Formspublications in Gmail

How to create an eSignature for the 2018 Inactive Pa Corporate Net Income Tax Report Rct 101 I Print Only Version Formspublications right from your smart phone

How to generate an electronic signature for the 2018 Inactive Pa Corporate Net Income Tax Report Rct 101 I Print Only Version Formspublications on iOS

How to make an electronic signature for the 2018 Inactive Pa Corporate Net Income Tax Report Rct 101 I Print Only Version Formspublications on Android OS

People also ask

-

What are the PA RCT 101 instructions 2018 and how do they relate to airSlate SignNow?

The PA RCT 101 instructions 2018 are guidelines for completing the Pennsylvania Revenue form for tax exemption. airSlate SignNow simplifies the process by allowing users to eSign and send documents related to these instructions securely and efficiently.

-

Can airSlate SignNow help me understand the PA RCT 101 instructions 2018 better?

Absolutely! airSlate SignNow provides resources and templates to guide users through the PA RCT 101 instructions 2018. Our platform offers features that make it easy to complete and submit necessary documents while ensuring compliance.

-

What features does airSlate SignNow offer for users dealing with PA RCT 101 instructions 2018?

airSlate SignNow offers a multitude of features tailored for users handling PA RCT 101 instructions 2018, including customizable templates, secure eSignature capabilities, and real-time document tracking to streamline the submission process.

-

Is airSlate SignNow a cost-effective solution for managing PA RCT 101 instructions 2018?

Yes, airSlate SignNow is designed to be a cost-effective solution for businesses managing PA RCT 101 instructions 2018. With transparent pricing plans and the ability to save on printing and mailing costs, it provides excellent value.

-

Does airSlate SignNow integrate with other tools to assist with PA RCT 101 instructions 2018?

Yes, airSlate SignNow seamlessly integrates with various business applications, enhancing your ability to manage PA RCT 101 instructions 2018. This integration allows for a smooth workflow and easy access to your documents across platforms.

-

How secure is my information when using airSlate SignNow for PA RCT 101 instructions 2018?

Security is a top priority at airSlate SignNow. When processing PA RCT 101 instructions 2018, all documents are encrypted, and we adhere to industry-leading security standards to ensure your information is protected.

-

How can I get started with airSlate SignNow for PA RCT 101 instructions 2018?

Getting started with airSlate SignNow for PA RCT 101 instructions 2018 is simple. Just sign up for an account, explore our templates, and begin creating your documents with easy electronic signatures to ensure compliance.

Get more for Rct 101 Instructions

- Jumeriah zabeel saray hotel visa application form

- Aaplication for visa to the republic of hungary form

- Thailand visa application form south africa

- Malaysia visa application form

- Filled uk visa application form sample

- Form v39a

- Application for national visa slovak form

- Thailand online visa application form

Find out other Rct 101 Instructions

- How Do I Electronic signature Illinois Courts Document

- How To Electronic signature Missouri Courts Word

- How Can I Electronic signature New Jersey Courts Document

- How Can I Electronic signature New Jersey Courts Document

- Can I Electronic signature Oregon Sports Form

- How To Electronic signature New York Courts Document

- How Can I Electronic signature Oklahoma Courts PDF

- How Do I Electronic signature South Dakota Courts Document

- Can I Electronic signature South Dakota Sports Presentation

- How To Electronic signature Utah Courts Document

- Can I Electronic signature West Virginia Courts PPT

- Send Sign PDF Free

- How To Send Sign PDF

- Send Sign Word Online

- Send Sign Word Now

- Send Sign Word Free

- Send Sign Word Android

- Send Sign Word iOS

- Send Sign Word iPad

- How To Send Sign Word