N 15 10715Notice Regarding Indian Tax Exempt Form

What is the N-15 10715 Notice Regarding Indian Tax Exempt?

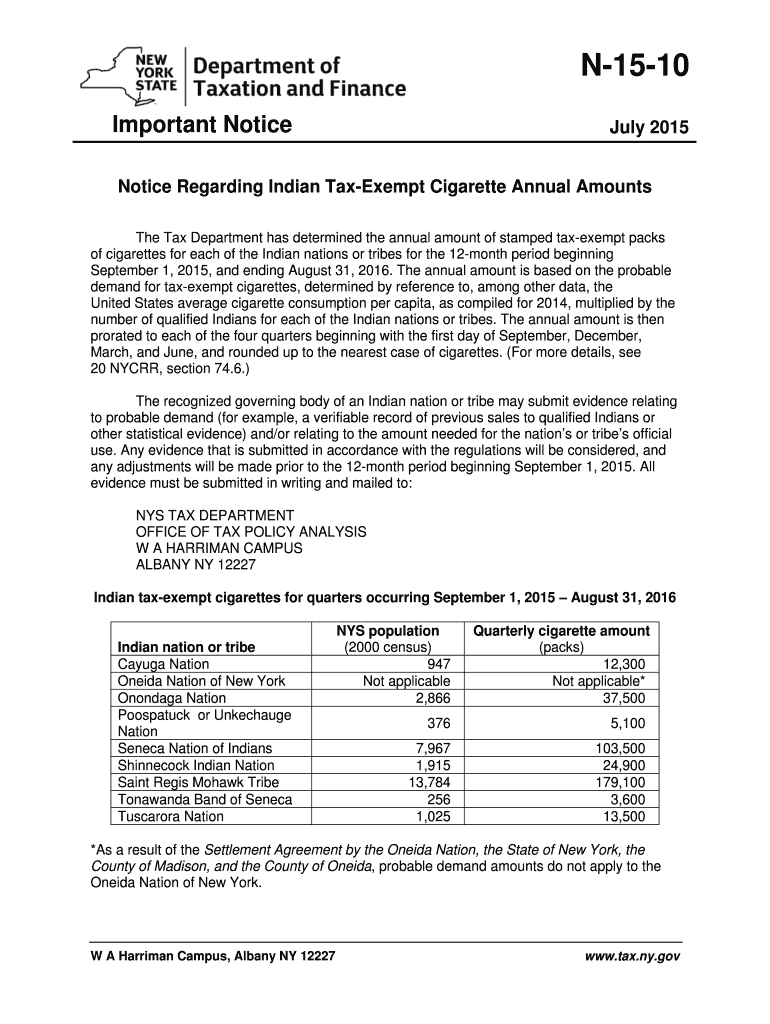

The N-15 10715 Notice is a specific form related to tax exemption for Indian entities operating within the United States. This document serves to clarify the tax-exempt status of certain organizations and individuals, allowing them to operate without incurring specific federal taxes. Understanding this form is crucial for compliance with U.S. tax laws, particularly for those engaged in business activities that may be subject to taxation. The form outlines the eligibility criteria and the necessary documentation required to substantiate the tax-exempt status.

Steps to Complete the N-15 10715 Notice Regarding Indian Tax Exempt

Completing the N-15 10715 Notice involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary documentation that supports your tax-exempt status. This may include proof of your organization’s registration, financial statements, and any previous correspondence with tax authorities. Next, fill out the form accurately, ensuring that all information is current and complete. It is essential to review the form for any errors before submission, as inaccuracies can lead to delays or penalties. Once completed, submit the form according to the specified guidelines, whether electronically or via mail.

Key Elements of the N-15 10715 Notice Regarding Indian Tax Exempt

The N-15 10715 Notice includes several critical elements that must be addressed for the form to be valid. These elements typically encompass the organization’s name, address, and tax identification number. Additionally, the form requires a declaration of the tax-exempt purpose and the specific laws under which the exemption is claimed. Providing accurate and thorough information in these sections is vital for the acceptance of the form by tax authorities.

Legal Use of the N-15 10715 Notice Regarding Indian Tax Exempt

The legal use of the N-15 10715 Notice is governed by U.S. tax laws, which stipulate the requirements for tax exemption. To ensure the form is legally binding, it must be filled out in compliance with the relevant statutes and regulations. This includes adhering to the guidelines set forth by the Internal Revenue Service (IRS) and any applicable state tax authorities. Proper execution of the form not only protects the organization’s tax-exempt status but also mitigates the risk of legal repercussions.

Filing Deadlines / Important Dates

Filing deadlines for the N-15 10715 Notice are crucial for maintaining compliance with tax regulations. Typically, the form must be submitted by specific dates that correspond to the organization’s fiscal year. Missing these deadlines can result in penalties or loss of tax-exempt status. It is advisable to keep track of these important dates and plan submissions accordingly to avoid any complications.

Eligibility Criteria

Eligibility for the N-15 10715 Notice is determined by specific criteria outlined by tax authorities. Generally, organizations must demonstrate that they operate exclusively for charitable, educational, or similar purposes. Additionally, the organization must not engage in activities that would disqualify it from tax-exempt status, such as substantial lobbying or political activities. Understanding these criteria is essential for ensuring that the application process is successful.

Quick guide on how to complete n 15 10715notice regarding indian tax exempt

Prepare N 15 10715Notice Regarding Indian Tax Exempt effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides all the tools you require to create, modify, and electronically sign your documents swiftly without delays. Manage N 15 10715Notice Regarding Indian Tax Exempt on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to modify and electronically sign N 15 10715Notice Regarding Indian Tax Exempt with ease

- Find N 15 10715Notice Regarding Indian Tax Exempt and then click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your documents or obscure sensitive information using tools specifically designed by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional ink signature.

- Review all information and then click the Done button to save your changes.

- Choose how you would like to send your form—via email, SMS, invite link, or download it to your computer.

eliminate concerns about lost or misplaced files, tedious form searches, or errors that require printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you select. Modify and electronically sign N 15 10715Notice Regarding Indian Tax Exempt to ensure effective communication at any stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the n 15 10715notice regarding indian tax exempt

How to make an eSignature for the N 15 10715notice Regarding Indian Tax Exempt online

How to generate an eSignature for the N 15 10715notice Regarding Indian Tax Exempt in Chrome

How to make an eSignature for putting it on the N 15 10715notice Regarding Indian Tax Exempt in Gmail

How to create an electronic signature for the N 15 10715notice Regarding Indian Tax Exempt right from your smartphone

How to create an electronic signature for the N 15 10715notice Regarding Indian Tax Exempt on iOS

How to make an eSignature for the N 15 10715notice Regarding Indian Tax Exempt on Android

People also ask

-

What is an Indian tax exempt form template and why do I need it?

An Indian tax exempt form template is a standardized document designed for individuals or businesses to claim tax exemptions in India. Using this template simplifies the process of filling out and submitting the required information, ensuring compliance with tax regulations. It's essential for avoiding tax-related issues and optimizing financial management.

-

How can airSlate SignNow help me with the Indian tax exempt form template?

airSlate SignNow provides an easy-to-use platform for creating and managing your Indian tax exempt form template. You can quickly customize the template to meet your specific needs, enabling efficient document preparation and timely submissions. With our solution, you can streamline workflows and enhance team collaboration.

-

Is there a cost associated with using the Indian tax exempt form template on airSlate SignNow?

Yes, airSlate SignNow offers various pricing plans tailored to your needs, including access to the Indian tax exempt form template. Our cost-effective solutions allow businesses of all sizes to benefit from eSigning and document management. Pricing details can be found on our website.

-

Can I integrate the Indian tax exempt form template with other software?

Absolutely! airSlate SignNow supports integrations with multiple software applications, allowing you to seamlessly connect your Indian tax exempt form template with your existing tools. This enhances productivity and ensures a smoother workflow, making it easy to manage your documents across platforms.

-

What are the key features of the Indian tax exempt form template in airSlate SignNow?

The Indian tax exempt form template includes features such as customizable fields, easy eSignatures, and secure storage options. These features streamline the documentation process while ensuring compliance and easy tracking. SignNow greatly enhances the efficiency of handling tax exemptions.

-

How secure is my information when using the Indian tax exempt form template?

When using the Indian tax exempt form template on airSlate SignNow, your data is protected with top-tier encryption and security protocols. We prioritize the confidentiality and integrity of your documents, ensuring that your sensitive tax information remains safe. Trust in our platform for secure document management.

-

Can I access the Indian tax exempt form template on mobile devices?

Yes, airSlate SignNow is mobile-friendly, allowing you to access the Indian tax exempt form template from your smartphone or tablet. This flexibility ensures you can manage important documents on-the-go, providing convenience and efficiency in your document workflows. Stay productive no matter where you are.

Get more for N 15 10715Notice Regarding Indian Tax Exempt

- Fidelity simple ira account application form

- Blank ira statement form

- Inherited ira for spouses application fidelity form

- Use this form to pledge fidelity mutual fund shares only

- Bank of america application pdf form

- Payroll direct deposit new account application form

- Fidelity re registration form for nonretirement inherited assets

- For the year january 1 december 31 or fiscal tax year beginning form

Find out other N 15 10715Notice Regarding Indian Tax Exempt

- Can I Electronic signature Illinois Government Rental Lease Agreement

- Electronic signature Kentucky Government Promissory Note Template Fast

- Electronic signature Kansas Government Last Will And Testament Computer

- Help Me With Electronic signature Maine Government Limited Power Of Attorney

- How To Electronic signature Massachusetts Government Job Offer

- Electronic signature Michigan Government LLC Operating Agreement Online

- How To Electronic signature Minnesota Government Lease Agreement

- Can I Electronic signature Minnesota Government Quitclaim Deed

- Help Me With Electronic signature Mississippi Government Confidentiality Agreement

- Electronic signature Kentucky Finance & Tax Accounting LLC Operating Agreement Myself

- Help Me With Electronic signature Missouri Government Rental Application

- Can I Electronic signature Nevada Government Stock Certificate

- Can I Electronic signature Massachusetts Education Quitclaim Deed

- Can I Electronic signature New Jersey Government LLC Operating Agreement

- Electronic signature New Jersey Government Promissory Note Template Online

- Electronic signature Michigan Education LLC Operating Agreement Myself

- How To Electronic signature Massachusetts Finance & Tax Accounting Quitclaim Deed

- Electronic signature Michigan Finance & Tax Accounting RFP Now

- Electronic signature Oklahoma Government RFP Later

- Electronic signature Nebraska Finance & Tax Accounting Business Plan Template Online