Wt4 Form

What is the W-4 Form?

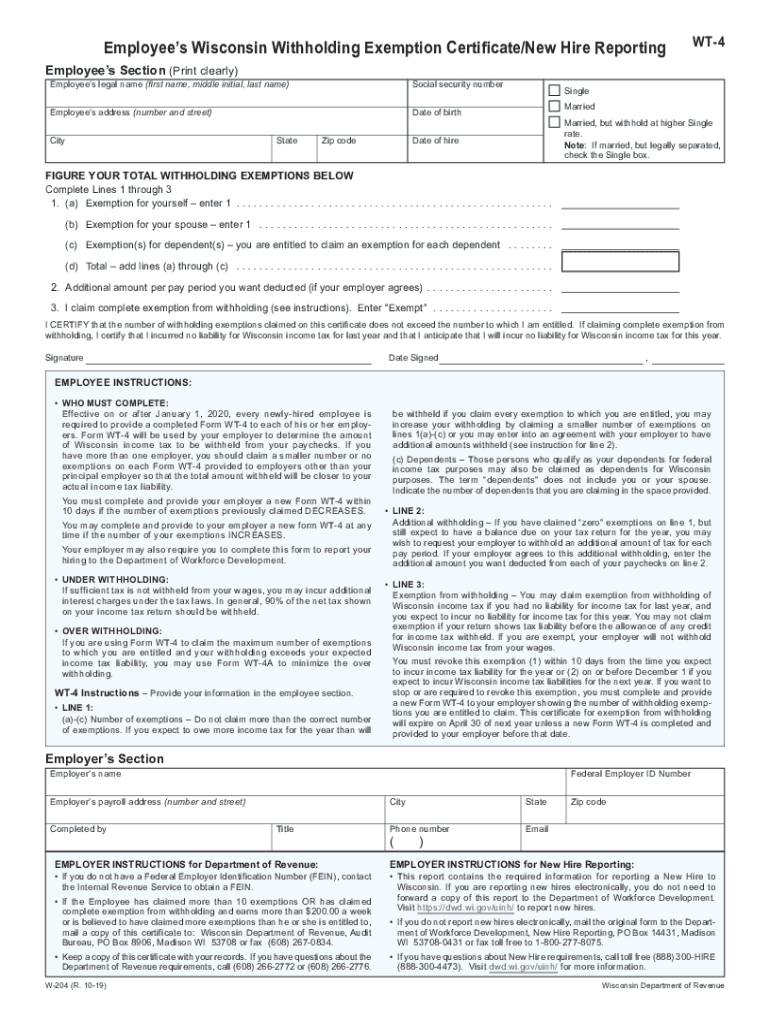

The W-4 form, officially known as the Employee's Withholding Certificate, is a crucial document used by employers in the United States to determine the amount of federal income tax to withhold from an employee's paycheck. In Wisconsin, the W-4 form is often used in conjunction with the state-specific withholding form, the WT-4. This form ensures that the correct amount of tax is deducted, helping employees avoid underpayment or overpayment of taxes throughout the year.

Steps to Complete the WT-4

Completing the WT-4 form involves several straightforward steps:

- Obtain the WT-4 Form: You can download the WT-4 from the Wisconsin Department of Revenue website or request a paper copy from your employer.

- Fill Out Personal Information: Enter your name, address, Social Security number, and filing status. This information is essential for accurate tax withholding.

- Claim Exemptions: If you qualify for exemptions, indicate them on the form. This may reduce the amount of tax withheld from your paycheck.

- Sign and Date: Ensure you sign and date the form to validate it. An unsigned form is not considered valid.

Legal Use of the WT-4

The WT-4 form is legally binding and must be filled out accurately to comply with tax regulations in Wisconsin. Employers are required to keep the completed forms on file for their records. The information provided on the WT-4 helps ensure that both the employee and employer meet their tax obligations. It is essential to review and update the form whenever there are significant changes in your financial situation, such as a change in marital status or the birth of a child.

Key Elements of the WT-4

When filling out the WT-4, several key elements must be considered:

- Personal Information: Accurate personal details are necessary for correct tax withholding.

- Filing Status: Your filing status (single, married, etc.) affects the withholding calculations.

- Exemptions: Claiming exemptions can lower your tax withholding, but it is crucial to ensure eligibility.

- Signature: A valid signature confirms the accuracy of the information provided.

How to Obtain the WT-4

The WT-4 form can be obtained through various channels:

- Online: Visit the Wisconsin Department of Revenue website to download the form.

- Employer: Request a copy from your employer, who may have printed forms available.

- Tax Professionals: Consult with a tax advisor or accountant who can provide the form and assist with completion.

Examples of Using the WT-4

Understanding how to use the WT-4 can help clarify its importance:

- New Employees: A new hire should complete the WT-4 to ensure proper tax withholding from their first paycheck.

- Life Changes: An employee who gets married may need to update their WT-4 to reflect a change in filing status.

- Exemptions: If an employee qualifies for exemptions due to low income, they should indicate this on the WT-4 to reduce withholding.

Quick guide on how to complete september 2019 w 204 wt 4 employees wisconsin withholding exemption certificatenew hire reporting

Complete Wt4 effortlessly on any device

Digital document management has become widely embraced by companies and individuals alike. It offers an ideal sustainable substitute for conventional printed and signed materials, as you can access the necessary form and safely store it online. airSlate SignNow equips you with all the resources needed to create, modify, and electronically sign your documents swiftly without any holdups. Manage Wt4 on any device with the airSlate SignNow Android or iOS applications and enhance any document-focused operation today.

The simplest way to modify and electronically sign Wt4 without hassle

- Find Wt4 and click Get Form to commence.

- Utilize the tools at your disposal to complete your form.

- Emphasize important sections of the documents or obscure sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Generate your eSignature using the Sign tool, which takes merely seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the details and click on the Done button to confirm your changes.

- Select your preferred method of sharing your form, via email, text message (SMS), invitation link, or download it to your computer.

Forget about lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any chosen device. Modify and electronically sign Wt4 and guarantee excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the september 2019 w 204 wt 4 employees wisconsin withholding exemption certificatenew hire reporting

How to make an eSignature for the September 2019 W 204 Wt 4 Employees Wisconsin Withholding Exemption Certificatenew Hire Reporting in the online mode

How to create an eSignature for your September 2019 W 204 Wt 4 Employees Wisconsin Withholding Exemption Certificatenew Hire Reporting in Chrome

How to create an electronic signature for signing the September 2019 W 204 Wt 4 Employees Wisconsin Withholding Exemption Certificatenew Hire Reporting in Gmail

How to make an eSignature for the September 2019 W 204 Wt 4 Employees Wisconsin Withholding Exemption Certificatenew Hire Reporting straight from your smart phone

How to generate an electronic signature for the September 2019 W 204 Wt 4 Employees Wisconsin Withholding Exemption Certificatenew Hire Reporting on iOS devices

How to create an eSignature for the September 2019 W 204 Wt 4 Employees Wisconsin Withholding Exemption Certificatenew Hire Reporting on Android

People also ask

-

What is the 2020 Wisconsin hire process?

The 2020 Wisconsin hire process involves specific steps for onboarding new employees in compliance with state regulations. Businesses should ensure they are familiar with local hiring laws and best practices, which can be simplified through the use of digital tools like airSlate SignNow. Utilizing our platform can help streamline document signing and management for new hires.

-

How does airSlate SignNow simplify the 2020 Wisconsin hire documentation?

airSlate SignNow simplifies the 2020 Wisconsin hire documentation by providing a user-friendly platform for eSigning and managing employment documents. Our solution enables businesses to create, send, and securely sign documents in real-time, reducing paperwork and improving efficiency in the hiring process. This allows employers to focus more on their new hires rather than on administrative tasks.

-

What are the pricing options for airSlate SignNow for businesses hiring in 2020 Wisconsin?

AirSlate SignNow offers several pricing tiers designed to meet different business needs, including those for 2020 Wisconsin hire processes. Each plan is tailored for scalability, allowing businesses of all sizes to choose a workshop that fits their budget while gaining access to essential features for document management and eSigning. Detailed pricing can be found on our website.

-

What features does airSlate SignNow offer that benefit the 2020 Wisconsin hire process?

AirSlate SignNow provides features like customizable templates, automated workflows, and mobile capabilities that specifically benefit the 2020 Wisconsin hire process. These tools help ensure that employers can create compliant documents quickly and efficiently. Our platform also ensures secure storage and easy retrieval of signed documents.

-

Can airSlate SignNow integrate with other HR software for the 2020 Wisconsin hire?

Yes, airSlate SignNow integrates seamlessly with various HR software solutions, enhancing the 2020 Wisconsin hire process. This integration allows for automatic data transfer and document generation, minimizing manual entry errors. By connecting with existing systems, businesses can create a cohesive onboarding experience for new hires.

-

What benefits does airSlate SignNow provide for small businesses in Wisconsin hiring in 2020?

For small businesses in Wisconsin, airSlate SignNow offers a cost-effective solution for the 2020 Wisconsin hire process. By reducing the need for physical paperwork and enabling quick eSigning, small businesses can save time and resources. Additionally, our platform helps maintain compliance with state hiring regulations, ensuring peace of mind.

-

Is airSlate SignNow secure for managing sensitive information during the 2020 Wisconsin hire?

Absolutely, airSlate SignNow prioritizes security to protect sensitive information during the 2020 Wisconsin hire process. We utilize advanced encryption and compliance standards, ensuring that all documents and personal data remain confidential. Clients can trust that their hiring processes are safeguarded while using our platform.

Get more for Wt4

Find out other Wt4

- How To Electronic signature Colorado Courts PDF

- How To Electronic signature Nebraska Sports Form

- How To Electronic signature Colorado Courts Word

- How To Electronic signature Colorado Courts Form

- How To Electronic signature Colorado Courts Presentation

- Can I Electronic signature Connecticut Courts PPT

- Can I Electronic signature Delaware Courts Document

- How Do I Electronic signature Illinois Courts Document

- How To Electronic signature Missouri Courts Word

- How Can I Electronic signature New Jersey Courts Document

- How Can I Electronic signature New Jersey Courts Document

- Can I Electronic signature Oregon Sports Form

- How To Electronic signature New York Courts Document

- How Can I Electronic signature Oklahoma Courts PDF

- How Do I Electronic signature South Dakota Courts Document

- Can I Electronic signature South Dakota Sports Presentation

- How To Electronic signature Utah Courts Document

- Can I Electronic signature West Virginia Courts PPT

- Send Sign PDF Free

- How To Send Sign PDF