1120s Form

What is the 1120s Form

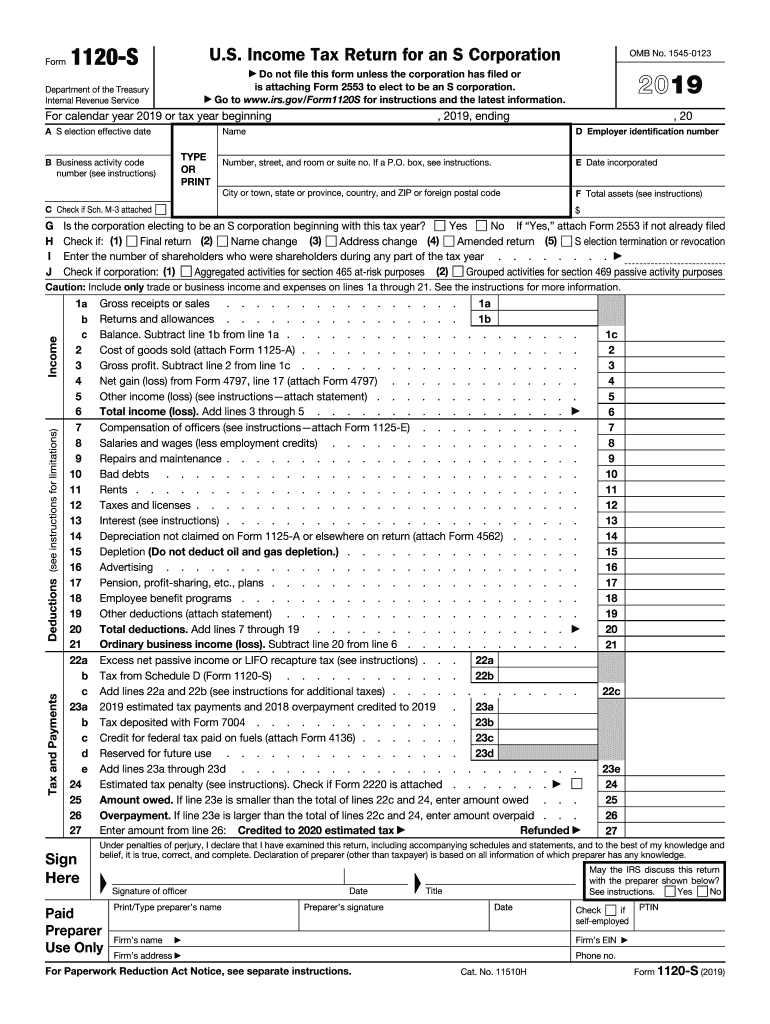

The 1120S form is a tax return specifically designed for S corporations in the United States. This form allows S corporations to report their income, deductions, and credits to the Internal Revenue Service (IRS). Unlike traditional corporations, S corporations pass their income directly to shareholders, who then report it on their personal tax returns. This structure helps avoid double taxation, making the 1120S form essential for S corporations to comply with federal tax regulations.

How to use the 1120s Form

Using the 2019 form 1120S involves several steps to ensure accurate reporting of your S corporation's financial activities. First, gather all necessary financial records, including income statements, balance sheets, and any relevant documentation of deductions. Next, complete the form by entering your corporation's identifying information, such as name, address, and Employer Identification Number (EIN). Follow the instructions for reporting income and expenses, and ensure that all calculations are accurate. Finally, review the form for completeness before submitting it to the IRS.

Steps to complete the 1120s Form

Completing the 2S form requires careful attention to detail. Start by filling out the basic information section, which includes the corporation's name, address, and EIN. Then, report the corporation's income on the first page, including gross receipts and other income sources. Move on to the deductions section, where you can list allowable expenses such as salaries, rent, and utilities. After calculating the total income and deductions, determine the taxable income and any credits that apply. Ensure all sections are filled out correctly before signing and dating the form.

Filing Deadlines / Important Dates

The due date for filing the 2S form is typically March 15, 2020, for calendar year S corporations. If this date falls on a weekend or holiday, the deadline may be extended. It is crucial to file the form on time to avoid penalties and interest charges. If additional time is needed, S corporations can file for an extension, allowing them to submit the form by September 15, 2020. However, an extension to file does not extend the time to pay any taxes owed.

Required Documents

To complete the 2019 form 1120S, several documents are necessary. These include financial statements that detail income and expenses, records of shareholder distributions, and any supporting documentation for deductions claimed. Additionally, corporations should have their previous year's tax return on hand for reference. Gathering these documents in advance can streamline the filing process and help ensure accuracy.

Legal use of the 1120s Form

The 2S form must be completed and filed in accordance with IRS regulations to be considered legally valid. This includes ensuring that all information is accurate and that the form is signed by an authorized officer of the corporation. E-filing is permitted, and using a reliable eSignature solution can enhance the security and legality of the submission. Compliance with the relevant tax laws is essential to avoid penalties and ensure that the S corporation maintains its tax status.

Quick guide on how to complete 2019 form 1120 s us income tax return for an s corporation

Prepare 1120s Form with ease on any device

Digital document management has become increasingly favored by both businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to locate the right form and securely store it online. airSlate SignNow provides you with all the resources necessary to create, edit, and eSign your documents quickly and efficiently. Manage 1120s Form on any device with the airSlate SignNow Android or iOS applications and enhance any document-related process today.

How to modify and eSign 1120s Form effortlessly

- Locate 1120s Form and click Get Form to begin.

- Make use of the tools we offer to complete your document.

- Highlight important sections of the documents or redact sensitive information using the tools that airSlate SignNow specifically provides for that purpose.

- Generate your signature with the Sign tool, which takes only a few seconds and carries the same legal authority as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow takes care of all your document management needs in just a few clicks from any device you prefer. Edit and eSign 1120s Form and ensure exceptional communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 2019 form 1120 s us income tax return for an s corporation

How to generate an eSignature for your 2019 Form 1120 S Us Income Tax Return For An S Corporation in the online mode

How to create an electronic signature for the 2019 Form 1120 S Us Income Tax Return For An S Corporation in Google Chrome

How to generate an electronic signature for signing the 2019 Form 1120 S Us Income Tax Return For An S Corporation in Gmail

How to make an electronic signature for the 2019 Form 1120 S Us Income Tax Return For An S Corporation from your smart phone

How to make an electronic signature for the 2019 Form 1120 S Us Income Tax Return For An S Corporation on iOS

How to generate an electronic signature for the 2019 Form 1120 S Us Income Tax Return For An S Corporation on Android OS

People also ask

-

What is the significance of the 2019 1120S form?

The 2019 1120S form is crucial for S corporations as it reports income, deductions, and credits to the IRS. Understanding the requirements of the 2019 1120S helps businesses ensure compliance and avoid penalties. Accurate completion of this form is essential for maintaining the corporation's status and tax liability.

-

How can airSlate SignNow help with filing the 2019 1120S?

airSlate SignNow offers an efficient way to eSign and send necessary documents for your 2019 1120S filing. With its user-friendly interface, you can quickly get the required signatures and keep records for your tax documents. This simplifies the process of preparing and submitting your 2019 1120S.

-

Is there a cost associated with using airSlate SignNow for the 2019 1120S?

Yes, airSlate SignNow provides various pricing plans that cater to different business needs, including features beneficial for handling the 2019 1120S. The cost-effective solution includes unlimited signing and document storage, which can save time and resources when preparing your tax documentation. Review the pricing options to find the best fit for your business.

-

What features does airSlate SignNow offer that assist with the 2019 1120S?

airSlate SignNow includes features like document templates, automated reminders, and in-app signing, specifically helpful for filing your 2019 1120S. These features streamline the document management process. You can easily customize forms and ensure that all required signatures are collected promptly.

-

Can I integrate airSlate SignNow with accounting software for my 2019 1120S?

Yes, airSlate SignNow integrates seamlessly with various accounting software, which can enhance your workflow for the 2019 1120S. Integration allows for easier document sharing and collaboration with your accounting team. This means you can prepare tax filings more efficiently while ensuring accuracy in your submissions.

-

Are there any benefits of using airSlate SignNow for small businesses filing the 2019 1120S?

Absolutely! airSlate SignNow provides small businesses with a streamlined process for eSigning documents needed for the 2019 1120S. The affordability and convenience signNowly reduce administrative burdens, allowing business owners to focus on other essential tasks while ensuring timely filing of their taxes.

-

How secure is airSlate SignNow for transmitting my 2019 1120S documents?

Security is a top priority for airSlate SignNow. The platform uses bank-level encryption to protect all your documents, including those related to the 2019 1120S. You can confidently transmit sensitive tax information, knowing it is secure and handled with the utmost care.

Get more for 1120s Form

Find out other 1120s Form

- eSignature Nevada Performance Contract Safe

- eSignature California Franchise Contract Secure

- How To eSignature Colorado Sponsorship Proposal Template

- eSignature Alabama Distributor Agreement Template Secure

- eSignature California Distributor Agreement Template Later

- eSignature Vermont General Power of Attorney Template Easy

- eSignature Michigan Startup Cost Estimate Simple

- eSignature New Hampshire Invoice for Services (Standard Format) Computer

- eSignature Arkansas Non-Compete Agreement Later

- Can I eSignature Arizona Non-Compete Agreement

- How Do I eSignature New Jersey Non-Compete Agreement

- eSignature Tennessee Non-Compete Agreement Myself

- How To eSignature Colorado LLC Operating Agreement

- Help Me With eSignature North Carolina LLC Operating Agreement

- eSignature Oregon LLC Operating Agreement Online

- eSignature Wyoming LLC Operating Agreement Online

- eSignature Wyoming LLC Operating Agreement Computer

- eSignature Wyoming LLC Operating Agreement Later

- eSignature Wyoming LLC Operating Agreement Free

- How To eSignature Wyoming LLC Operating Agreement