Irs Form 56

What is the IRS Form 56?

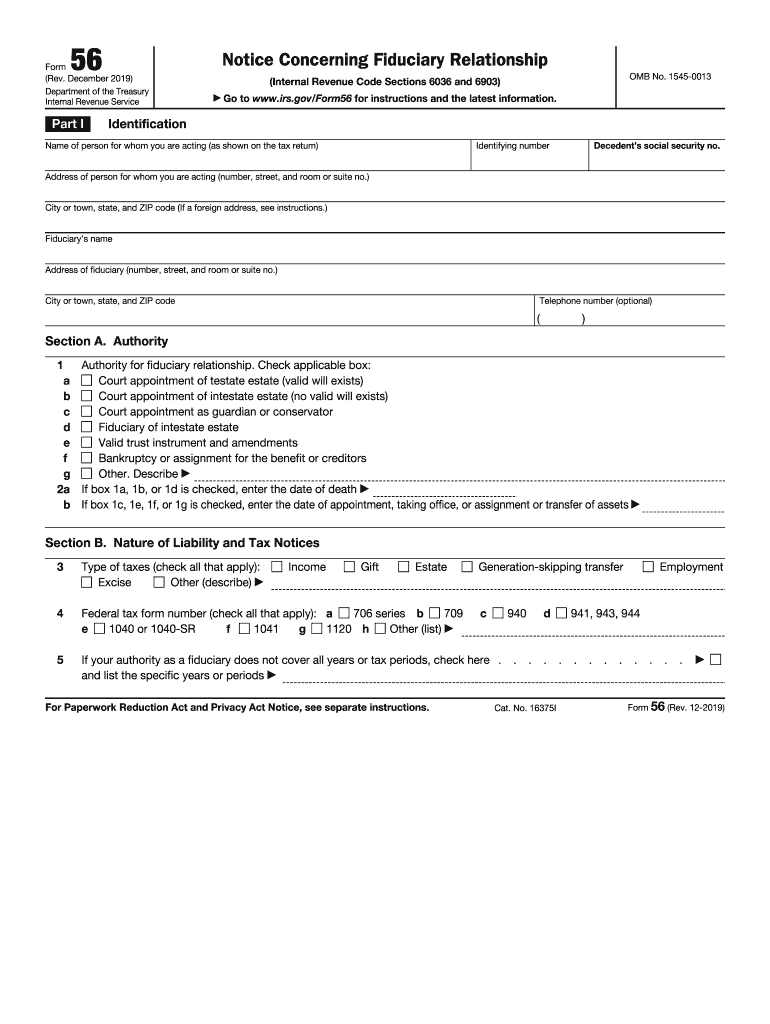

The IRS Form 56 is a document used to notify the Internal Revenue Service of the creation or termination of a fiduciary relationship. This form is essential for individuals acting on behalf of another person or entity, such as executors, administrators, or trustees. By filing Form 56, fiduciaries can ensure that the IRS is aware of their authority to act on behalf of the taxpayer, which is crucial for managing tax obligations and ensuring compliance with federal tax laws.

How to Use the IRS Form 56

Using the IRS Form 56 involves a few straightforward steps. First, you need to gather the necessary information about the taxpayer and the fiduciary relationship. This includes the taxpayer's name, address, and Social Security number, as well as the fiduciary's details. Next, complete the form by accurately filling in all required fields. After completing the form, it should be submitted to the IRS to formally notify them of the fiduciary relationship. It is important to retain a copy for your records.

Steps to Complete the IRS Form 56

Completing the IRS Form 56 requires careful attention to detail. Follow these steps:

- Provide the taxpayer's name, address, and Social Security number.

- Enter the fiduciary's name, address, and title.

- Indicate the type of fiduciary relationship (e.g., executor, trustee).

- Sign and date the form to certify its accuracy.

- Submit the completed form to the IRS.

Ensure that all information is accurate to avoid delays or issues with the IRS.

Legal Use of the IRS Form 56

The IRS Form 56 serves a legal purpose by formally establishing a fiduciary relationship recognized by the IRS. Filing this form is essential for fiduciaries to manage the tax affairs of the taxpayer effectively. It is crucial to understand that without this notification, the IRS may not recognize the fiduciary's authority, which could lead to complications in tax filings and liabilities.

Filing Deadlines / Important Dates

While there is no specific deadline for filing the IRS Form 56, it is recommended to submit it as soon as the fiduciary relationship is established. Timely filing helps ensure that the IRS is informed and can process any tax-related matters efficiently. Additionally, keeping track of any relevant tax deadlines for the taxpayer is essential to avoid penalties.

Required Documents

To complete the IRS Form 56, you will need the following documents:

- The taxpayer's Social Security number or Employer Identification Number.

- Details of the fiduciary relationship, including the fiduciary's name and title.

- Any legal documents that establish the fiduciary relationship, such as a will or trust agreement.

Having these documents ready will streamline the completion process and ensure accuracy.

Quick guide on how to complete form 56 rev june 2019 notice concerning fiduciary relationship

Effortlessly Prepare Irs Form 56 on Any Device

The management of online documents has become increasingly favored by companies and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed papers, allowing you to locate the necessary form and safely save it online. airSlate SignNow provides all the tools required to create, edit, and eSign your documents swiftly without delays. Handle Irs Form 56 across any platform with airSlate SignNow's Android or iOS applications and enhance any document-oriented procedure today.

How to Edit and eSign Irs Form 56 with Ease

- Locate Irs Form 56 and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize pertinent sections of your documents or redact sensitive information using tools provided by airSlate SignNow specifically for that purpose.

- Create your signature with the Sign feature, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review all details and click on the Done button to save your modifications.

- Select your preferred method for sending your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you choose. Alter and eSign Irs Form 56 to ensure seamless communication at every step of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 56 rev june 2019 notice concerning fiduciary relationship

How to generate an electronic signature for your Form 56 Rev June 2019 Notice Concerning Fiduciary Relationship in the online mode

How to create an electronic signature for the Form 56 Rev June 2019 Notice Concerning Fiduciary Relationship in Google Chrome

How to generate an electronic signature for putting it on the Form 56 Rev June 2019 Notice Concerning Fiduciary Relationship in Gmail

How to make an electronic signature for the Form 56 Rev June 2019 Notice Concerning Fiduciary Relationship from your smartphone

How to make an electronic signature for the Form 56 Rev June 2019 Notice Concerning Fiduciary Relationship on iOS

How to generate an electronic signature for the Form 56 Rev June 2019 Notice Concerning Fiduciary Relationship on Android OS

People also ask

-

What is the 2019 56 gov and how does it relate to airSlate SignNow?

The 2019 56 gov refers to specific regulatory guidelines that impact eSignature solutions. AirSlate SignNow complies with these regulations, ensuring your documents are signed securely and legally. This alignment with the 2019 56 gov standards reassures users of the platform's reliability and legal compliance.

-

What features does airSlate SignNow offer in relation to the 2019 56 gov?

AirSlate SignNow includes various features that align with the 2019 56 gov, such as legally binding eSignatures, customizable workflows, and secure document storage. These features empower businesses to streamline their signing processes while adhering to compliant frameworks laid out by 2019 56 gov. This ensures that users can manage their documentation efficiently and securely.

-

How does airSlate SignNow's pricing structure support compliance with 2019 56 gov?

AirSlate SignNow offers a transparent pricing model that supports compliance with the 2019 56 gov. With multiple plans available, businesses can choose a solution that meets their budget while ensuring they remain compliant with eSignature regulations. This affordability allows organizations of all sizes to access advanced signing solutions without compromising on security.

-

What benefits can businesses expect from using airSlate SignNow regarding 2019 56 gov compliance?

By using airSlate SignNow, businesses can expect enhanced workflow efficiency, better document tracking, and a reduction in turnaround times—all while staying compliant with the 2019 56 gov. Additionally, users enjoy the peace of mind that comes from knowing their documents meet required legal standards. These benefits contribute to improved operational productivity.

-

Can airSlate SignNow integrate with other software to enhance compliance with 2019 56 gov?

Yes, airSlate SignNow can integrate with various business applications to enhance compliance with 2019 56 gov. This seamless integration allows users to connect their document workflows with CRM systems, project management tools, and more. By doing so, businesses can ensure that all aspects of their operations are aligned with the necessary compliance requirements.

-

Is training available for businesses to effectively use airSlate SignNow in line with 2019 56 gov?

AirSlate SignNow offers comprehensive training resources and customer support to help businesses use the platform in adherence to 2019 56 gov standards. These resources ensure that users understand how to utilize every feature effectively, promoting compliance and best practices. This training contributes to a smoother onboarding experience and increased user confidence.

-

What industries can benefit from using airSlate SignNow with respect to 2019 56 gov?

Various industries, including finance, healthcare, and legal, can greatly benefit from using airSlate SignNow with respect to 2019 56 gov. These sectors require stringent compliance measures, making airSlate SignNow's features particularly valuable. By utilizing the platform, organizations can ensure they meet regulatory demands while increasing productivity.

Get more for Irs Form 56

Find out other Irs Form 56

- Can I eSign North Carolina Courts Limited Power Of Attorney

- eSign North Dakota Courts Quitclaim Deed Safe

- How To eSign Rhode Island Sports Quitclaim Deed

- Help Me With eSign Oregon Courts LLC Operating Agreement

- eSign North Dakota Police Rental Lease Agreement Now

- eSign Tennessee Courts Living Will Simple

- eSign Utah Courts Last Will And Testament Free

- eSign Ohio Police LLC Operating Agreement Mobile

- eSign Virginia Courts Business Plan Template Secure

- How To eSign West Virginia Courts Confidentiality Agreement

- eSign Wyoming Courts Quitclaim Deed Simple

- eSign Vermont Sports Stock Certificate Secure

- eSign Tennessee Police Cease And Desist Letter Now

- Help Me With eSign Texas Police Promissory Note Template

- eSign Utah Police LLC Operating Agreement Online

- eSign West Virginia Police Lease Agreement Online

- eSign Wyoming Sports Residential Lease Agreement Online

- How Do I eSign West Virginia Police Quitclaim Deed

- eSignature Arizona Banking Moving Checklist Secure

- eSignature California Banking Warranty Deed Later