LEASE INVOICE Total Leasing Commission Fees Due Berkshire Form

What is the LEASE INVOICE Total Leasing Commission Fees Due Berkshire

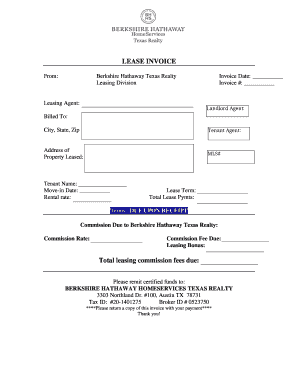

The LEASE INVOICE Total Leasing Commission Fees Due Berkshire is a financial document that outlines the total leasing commission fees owed for a specific lease agreement in Berkshire. This invoice serves as a formal request for payment from the lessee to the lessor, detailing the amounts due for services rendered in the context of leasing property. It typically includes information such as the lease term, property details, and any applicable taxes or fees associated with the leasing commission.

Key Elements of the LEASE INVOICE Total Leasing Commission Fees Due Berkshire

Several key elements are essential for the LEASE INVOICE Total Leasing Commission Fees Due Berkshire to be effective and compliant. These include:

- Property Information: Details about the leased property, including the address and type of property.

- Lease Terms: The duration of the lease and any relevant dates.

- Commission Fees: A breakdown of the total leasing commission fees, including percentages and calculations.

- Payment Instructions: Clear guidance on how and when to make the payment.

- Contact Information: Details for reaching out to the lessor for any inquiries or clarifications.

Steps to Complete the LEASE INVOICE Total Leasing Commission Fees Due Berkshire

Completing the LEASE INVOICE Total Leasing Commission Fees Due Berkshire involves several straightforward steps:

- Gather all necessary information regarding the lease agreement and property details.

- Calculate the total leasing commission fees based on the agreed-upon percentage.

- Fill out the invoice template, ensuring all key elements are included.

- Review the invoice for accuracy, checking for any errors in calculations or information.

- Send the completed invoice to the lessee through the preferred method of communication, whether digitally or via mail.

Legal Use of the LEASE INVOICE Total Leasing Commission Fees Due Berkshire

The LEASE INVOICE Total Leasing Commission Fees Due Berkshire must comply with local and state regulations governing leasing agreements and invoicing practices. It serves as a legally binding document that can be used in disputes regarding payment. Ensuring that the invoice is clear, accurate, and properly formatted is crucial for its legal validity. It is advisable to consult with legal professionals to ensure compliance with all applicable laws and regulations.

Examples of Using the LEASE INVOICE Total Leasing Commission Fees Due Berkshire

Examples of the LEASE INVOICE Total Leasing Commission Fees Due Berkshire can vary based on the type of property and the specific terms of the lease. For instance:

- A commercial property lease may include additional fees for maintenance or utilities.

- A residential lease might feature a standard commission percentage based on the rental price.

- Different lease agreements may have unique payment terms that should be clearly stated in the invoice.

Required Documents for the LEASE INVOICE Total Leasing Commission Fees Due Berkshire

To complete the LEASE INVOICE Total Leasing Commission Fees Due Berkshire, certain documents may be required:

- The original lease agreement outlining the terms and conditions.

- Any amendments or addendums to the lease that affect commission fees.

- Proof of services rendered, if applicable, such as documentation of property showings or marketing efforts.

Quick guide on how to complete lease invoice total leasing commission fees due berkshire

Easily Prepare LEASE INVOICE Total Leasing Commission Fees Due Berkshire on Any Device

Managing documents online has gained popularity among businesses and individuals. It offers a fantastic eco-friendly solution to traditional printed and signed documents, as you can access the necessary form and securely save it online. airSlate SignNow provides all the tools required to create, modify, and eSign your documents swiftly without delays. Handle LEASE INVOICE Total Leasing Commission Fees Due Berkshire on any device with airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

The easiest way to alter and eSign LEASE INVOICE Total Leasing Commission Fees Due Berkshire effortlessly

- Obtain LEASE INVOICE Total Leasing Commission Fees Due Berkshire and then click Get Form to begin.

- Employ the tools we offer to complete your form.

- Emphasize important sections of your documents or obscure sensitive information with features that airSlate SignNow specifically provides for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and has the same legal validity as a conventional wet ink signature.

- Review the details and then click on the Done button to save your changes.

- Choose how you would like to send your form, via email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that require printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from your preferred device. Modify and eSign LEASE INVOICE Total Leasing Commission Fees Due Berkshire and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the lease invoice total leasing commission fees due berkshire

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a LEASE INVOICE Total Leasing Commission Fees Due Berkshire?

A LEASE INVOICE Total Leasing Commission Fees Due Berkshire is a detailed document that outlines the total leasing commission fees owed for a property in Berkshire. This invoice helps landlords and property managers keep track of their financial obligations and ensures transparency in leasing transactions.

-

How can airSlate SignNow help with LEASE INVOICE Total Leasing Commission Fees Due Berkshire?

airSlate SignNow provides an efficient platform for creating, sending, and eSigning LEASE INVOICE Total Leasing Commission Fees Due Berkshire. With its user-friendly interface, you can streamline the invoicing process, ensuring that all parties involved can easily access and sign the necessary documents.

-

What features does airSlate SignNow offer for managing LEASE INVOICE Total Leasing Commission Fees Due Berkshire?

airSlate SignNow offers features such as customizable templates, automated reminders, and real-time tracking for LEASE INVOICE Total Leasing Commission Fees Due Berkshire. These tools help you manage your leasing documents effectively, reducing the time spent on administrative tasks.

-

Is airSlate SignNow cost-effective for handling LEASE INVOICE Total Leasing Commission Fees Due Berkshire?

Yes, airSlate SignNow is a cost-effective solution for managing LEASE INVOICE Total Leasing Commission Fees Due Berkshire. By reducing paper usage and streamlining the signing process, businesses can save both time and money while ensuring compliance with leasing regulations.

-

Can I integrate airSlate SignNow with other software for LEASE INVOICE Total Leasing Commission Fees Due Berkshire?

Absolutely! airSlate SignNow offers integrations with various software solutions, allowing you to manage LEASE INVOICE Total Leasing Commission Fees Due Berkshire seamlessly. This ensures that your invoicing process is connected with your existing systems, enhancing overall efficiency.

-

What are the benefits of using airSlate SignNow for LEASE INVOICE Total Leasing Commission Fees Due Berkshire?

Using airSlate SignNow for LEASE INVOICE Total Leasing Commission Fees Due Berkshire provides numerous benefits, including faster processing times, improved accuracy, and enhanced security. These advantages help businesses maintain professionalism and build trust with clients.

-

How secure is airSlate SignNow for handling LEASE INVOICE Total Leasing Commission Fees Due Berkshire?

airSlate SignNow prioritizes security, employing advanced encryption and authentication measures to protect your LEASE INVOICE Total Leasing Commission Fees Due Berkshire. This ensures that sensitive information remains confidential and secure throughout the signing process.

Get more for LEASE INVOICE Total Leasing Commission Fees Due Berkshire

- Meet our facultytiffin university form

- Transplant education book texas childrens hospital form

- Fillable online welcome to pediatrics plus therapy services fax form

- Wwwtexasmedcliniccom form

- Request for proposals rfp 20192020 005 form

- Notice of address change texas board of veterinary form

- Blue graduated from wake forest university school of medicine form

- Family diagnostic clinic in tomball tx with reviews ypcom form

Find out other LEASE INVOICE Total Leasing Commission Fees Due Berkshire

- eSignature Delaware Software Development Proposal Template Now

- eSignature Kentucky Product Development Agreement Simple

- eSignature Georgia Mobile App Design Proposal Template Myself

- eSignature Indiana Mobile App Design Proposal Template Now

- eSignature Utah Mobile App Design Proposal Template Now

- eSignature Kentucky Intellectual Property Sale Agreement Online

- How Do I eSignature Arkansas IT Consulting Agreement

- eSignature Arkansas IT Consulting Agreement Safe

- eSignature Delaware IT Consulting Agreement Online

- eSignature New Jersey IT Consulting Agreement Online

- How Can I eSignature Nevada Software Distribution Agreement

- eSignature Hawaii Web Hosting Agreement Online

- How Do I eSignature Hawaii Web Hosting Agreement

- eSignature Massachusetts Web Hosting Agreement Secure

- eSignature Montana Web Hosting Agreement Myself

- eSignature New Jersey Web Hosting Agreement Online

- eSignature New York Web Hosting Agreement Mobile

- eSignature North Carolina Web Hosting Agreement Secure

- How Do I eSignature Utah Web Hosting Agreement

- eSignature Connecticut Joint Venture Agreement Template Myself