3 Form

What is the 2019 Form SS?

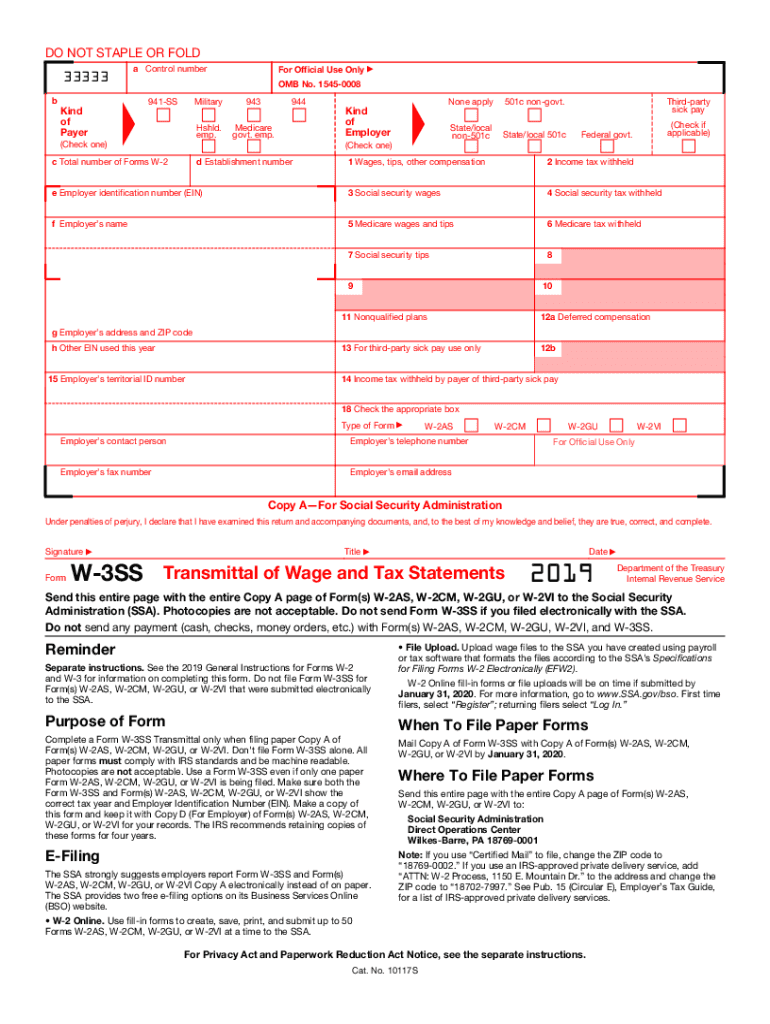

The 2019 Form SS, also known as the 2019 Form W-3SS, is a crucial document used in the United States for reporting income and tax information to the Internal Revenue Service (IRS). This form is specifically designed for employers who are required to submit wage and tax information for their employees. It serves as a summary of all W-2 forms issued by an employer, consolidating the total wages paid and taxes withheld for the year. Understanding the purpose and requirements of the 2019 Form SS is essential for compliance with federal tax regulations.

Steps to Complete the 2019 Form SS

Completing the 2019 Form SS involves several key steps to ensure accuracy and compliance. Follow these guidelines:

- Gather all necessary employee information, including names, Social Security numbers, and total wages paid.

- Ensure that all W-2 forms are accurately filled out and match the information for each employee.

- Fill out the 2019 Form SS by entering the total amounts from all W-2 forms in the appropriate fields.

- Review the completed form for any errors or omissions before submission.

- Sign and date the form to certify that the information provided is correct.

Legal Use of the 2019 Form SS

The 2019 Form SS is legally binding and must be filed with the IRS to fulfill employer reporting obligations. To ensure legal compliance, it is important to adhere to IRS guidelines regarding the accuracy and timeliness of submissions. Failure to file the form or inaccuracies can lead to penalties, including fines and interest on unpaid taxes. Employers should keep copies of all submitted forms for their records, as they may be required for future audits or inquiries.

Filing Deadlines for the 2019 Form SS

Filing deadlines for the 2019 Form SS are critical for compliance. Employers must submit the form to the IRS by January 31 of the year following the tax year being reported. If filing electronically, the deadline remains the same. It is advisable to check for any updates or changes to deadlines on the IRS website to avoid penalties. Additionally, employers should ensure that all W-2 forms are distributed to employees by the same deadline, allowing them to prepare their personal tax returns accurately.

Required Documents for the 2019 Form SS

To complete the 2019 Form SS, employers need several documents to ensure all information is accurate and complete. These include:

- All W-2 forms issued to employees during the tax year.

- Employer identification number (EIN) for accurate reporting.

- Records of total wages paid and taxes withheld for each employee.

- Any additional documentation related to employee benefits or deductions that may affect tax calculations.

Examples of Using the 2019 Form SS

Employers in various industries utilize the 2019 Form SS to report employee wages and taxes. For instance:

- A small business owner must report wages for their employees to the IRS using the form.

- A corporation consolidates multiple W-2 forms for its employees into a single 2019 Form SS for submission.

- A non-profit organization must accurately report wages to comply with federal tax regulations.

Quick guide on how to complete form w 3ss

Effortlessly Prepare 3 Form on Any Device

Digital document management has become increasingly favored by businesses and individuals alike. It serves as an ideal environmentally friendly substitute for traditional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools needed to create, edit, and electronically sign your documents quickly and without interruptions. Manage 3 Form on any device with the airSlate SignNow applications for Android or iOS, simplifying any document-related workflow today.

Effortlessly Edit and Electronically Sign 3 Form

- Find 3 Form and click Get Form to begin.

- Use the tools we provide to fill out your form.

- Emphasize important sections of the documents or obscure sensitive information with the tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which only takes moments and carries the same legal validity as a conventional wet ink signature.

- Review all details and then click the Done button to save your modifications.

- Select your preferred method to send your form, whether by email, SMS, invite link, or downloading it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, and errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from your chosen device. Edit and electronically sign 3 Form to ensure excellent communication throughout your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form w 3ss

How to create an eSignature for the Form W 3ss online

How to create an electronic signature for your Form W 3ss in Google Chrome

How to generate an electronic signature for signing the Form W 3ss in Gmail

How to generate an eSignature for the Form W 3ss from your smart phone

How to make an eSignature for the Form W 3ss on iOS

How to create an eSignature for the Form W 3ss on Android devices

People also ask

-

What is the ss 2019 form?

The ss 2019 form is a specific document required for certain business-related procedures. Understanding its importance can help streamline your processes. With airSlate SignNow, you can easily manage and eSign the ss 2019 form digitally, saving time and reducing paperwork.

-

How can airSlate SignNow help with the ss 2019 form?

airSlate SignNow simplifies the process of filling out and sending the ss 2019 form. Our platform allows for easy eSigning and tracking, making it easier for businesses to stay organized. You can complete and send the form quickly from anywhere, ensuring efficient document management.

-

Is there a cost associated with using airSlate SignNow for the ss 2019 form?

Yes, there is a subscription fee for using airSlate SignNow, but we offer a cost-effective solution compared to traditional methods. The pricing plans are flexible and designed to accommodate businesses of all sizes. Investing in our platform will save you money on printing and mailing costs associated with the ss 2019 form.

-

What features does airSlate SignNow offer for the ss 2019 form?

airSlate SignNow includes features like eSigning, document templates, and real-time tracking specifically tailored to forms such as the ss 2019 form. These tools enhance efficiency and accuracy in document management. Our user-friendly interface ensures that even those unfamiliar with digital forms can easily navigate the process.

-

Can I integrate airSlate SignNow with other software when handling the ss 2019 form?

Absolutely! airSlate SignNow offers seamless integrations with various software tools that can enhance your workflow when dealing with the ss 2019 form. From CRM systems to cloud storage, our integrations ensure that you can manage all aspects of your business efficiently.

-

How secure is my data when using airSlate SignNow for the ss 2019 form?

Security is a top priority for airSlate SignNow. We employ advanced encryption and compliance protocols to protect your data while you manage the ss 2019 form. You can trust that your sensitive information remains secure throughout the signing process.

-

Can I track the status of the ss 2019 form after sending it through airSlate SignNow?

Yes, airSlate SignNow provides real-time tracking for your documents, including the ss 2019 form. You will receive notifications when the form is viewed, signed, or completed. This feature ensures you stay informed throughout the entire process.

Get more for 3 Form

Find out other 3 Form

- eSign Insurance PPT Georgia Computer

- How Do I eSign Hawaii Insurance Operating Agreement

- eSign Hawaii Insurance Stock Certificate Free

- eSign New Hampshire Lawers Promissory Note Template Computer

- Help Me With eSign Iowa Insurance Living Will

- eSign North Dakota Lawers Quitclaim Deed Easy

- eSign Ohio Lawers Agreement Computer

- eSign North Dakota Lawers Separation Agreement Online

- How To eSign North Dakota Lawers Separation Agreement

- eSign Kansas Insurance Moving Checklist Free

- eSign Louisiana Insurance Promissory Note Template Simple

- eSign Texas Lawers Contract Fast

- eSign Texas Lawers Lease Agreement Free

- eSign Maine Insurance Rental Application Free

- How Can I eSign Maryland Insurance IOU

- eSign Washington Lawers Limited Power Of Attorney Computer

- eSign Wisconsin Lawers LLC Operating Agreement Free

- eSign Alabama Legal Quitclaim Deed Online

- eSign Alaska Legal Contract Safe

- How To eSign Alaska Legal Warranty Deed