Instructions 1098 T Form

What is the Instructions 1098 T

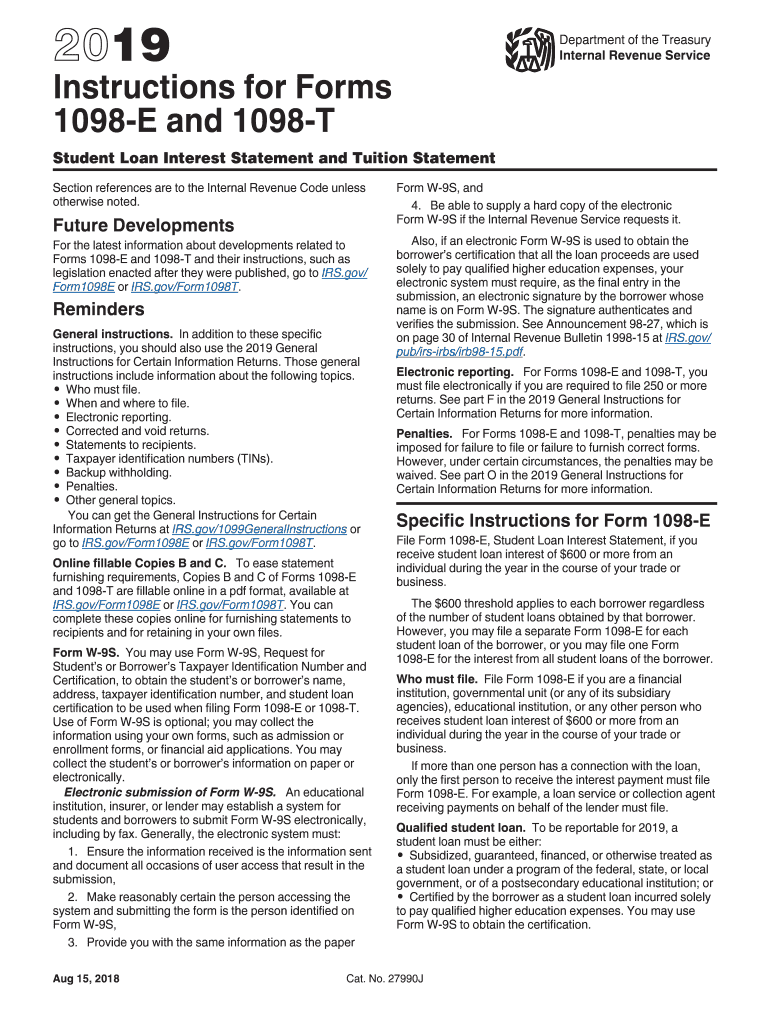

The Instructions 1098 T provide essential guidance for educational institutions and students regarding the reporting of tuition payments and related expenses. This form is primarily used to report qualified tuition and related expenses to the Internal Revenue Service (IRS) and to students. It helps students claim education credits or deductions on their tax returns, such as the American Opportunity Credit or the Lifetime Learning Credit. Understanding the details outlined in the Instructions 1098 T is crucial for ensuring compliance and maximizing potential tax benefits.

Steps to complete the Instructions 1098 T

Completing the Instructions 1098 T involves several key steps to ensure accurate reporting. First, educational institutions must gather necessary information, including the student’s name, Social Security number, and the amounts paid for qualified tuition and related expenses. Next, institutions should accurately fill out the form, ensuring that all required fields are completed. It is important to verify that the amounts reported match the institution's records. Finally, the completed form must be submitted to the IRS and provided to the student by the specified deadline, typically by January 31 of the following year.

Legal use of the Instructions 1098 T

The legal use of the Instructions 1098 T is governed by IRS regulations, which require educational institutions to report specific financial information accurately. This form must be used in compliance with the Internal Revenue Code, ensuring that all data reported is truthful and complete. Failure to comply with these regulations can lead to penalties for the institution. It is essential for both institutions and students to understand the legal implications of the information provided on the form, as it directly affects tax filings and potential refunds.

Required Documents

To accurately complete the Instructions 1098 T, several documents are necessary. Educational institutions should maintain records of tuition payments, financial aid received, and any scholarships awarded to students. Students may also need to provide documentation such as their Social Security number, tax identification number, and any relevant financial statements. These documents ensure that the information reported on the form is accurate and supports claims for education-related tax credits.

Filing Deadlines / Important Dates

Filing deadlines for the Instructions 1098 T are critical for compliance. Educational institutions must provide the completed forms to students by January 31 of the year following the tax year being reported. Additionally, institutions must file the forms with the IRS by the end of February if filing by paper or by the end of March if filing electronically. Adhering to these deadlines helps avoid penalties and ensures that students can claim their eligible tax credits in a timely manner.

IRS Guidelines

The IRS provides specific guidelines for completing and filing the Instructions 1098 T. These guidelines outline the requirements for reporting qualified tuition and related expenses, including what constitutes qualified expenses. Institutions must also be aware of the IRS rules regarding the issuance of the form, including who qualifies as a student and what information must be included. Following these guidelines is essential for ensuring proper compliance and minimizing the risk of audits or penalties.

Quick guide on how to complete 2019 instructions for forms 1098 e and 1098 t instructions for forms 1098 e and 1098 t student loan interest statement and

Complete Instructions 1098 T effortlessly on any gadget

Digital document management has become increasingly popular among businesses and individuals. It offers an excellent sustainable alternative to traditional printed and signed documents, as you can locate the correct template and securely save it online. airSlate SignNow equips you with all the tools you need to create, modify, and electronically sign your documents swiftly and without delays. Manage Instructions 1098 T on any gadget with airSlate SignNow Android or iOS apps and simplify any document-related process today.

How to modify and eSign Instructions 1098 T with ease

- Obtain Instructions 1098 T and click Get Form to commence.

- Utilize the tools we provide to complete your document.

- Highlight relevant sections of your documents or conceal sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which takes moments and carries the same legal standing as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, text message (SMS), or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or errors that require reprinting new document copies. airSlate SignNow fulfills all your requirements in document management in just a few clicks from any device of your preference. Modify and eSign Instructions 1098 T and ensure excellent communication at any stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 2019 instructions for forms 1098 e and 1098 t instructions for forms 1098 e and 1098 t student loan interest statement and

How to create an electronic signature for the 2019 Instructions For Forms 1098 E And 1098 T Instructions For Forms 1098 E And 1098 T Student Loan Interest Statement And online

How to create an electronic signature for the 2019 Instructions For Forms 1098 E And 1098 T Instructions For Forms 1098 E And 1098 T Student Loan Interest Statement And in Google Chrome

How to make an eSignature for putting it on the 2019 Instructions For Forms 1098 E And 1098 T Instructions For Forms 1098 E And 1098 T Student Loan Interest Statement And in Gmail

How to make an electronic signature for the 2019 Instructions For Forms 1098 E And 1098 T Instructions For Forms 1098 E And 1098 T Student Loan Interest Statement And right from your smart phone

How to generate an electronic signature for the 2019 Instructions For Forms 1098 E And 1098 T Instructions For Forms 1098 E And 1098 T Student Loan Interest Statement And on iOS

How to generate an eSignature for the 2019 Instructions For Forms 1098 E And 1098 T Instructions For Forms 1098 E And 1098 T Student Loan Interest Statement And on Android OS

People also ask

-

What is e institution identification in airSlate SignNow?

E institution identification in airSlate SignNow refers to the unique identifiers assigned to businesses to authenticate their identity during electronic signing. This feature ensures that all parties involved in the document signing process are verified and secure, enhancing the overall trust in the transaction.

-

How does e institution identification enhance security in document signing?

E institution identification enhances security by verifying the identities of signers through established protocols. This minimizes the risk of fraud and ensures that only authorized individuals can access and sign documents, making airSlate SignNow a trusted solution for sensitive transactions.

-

Is there a cost associated with e institution identification for airSlate SignNow users?

Using e institution identification is included in the standard pricing plans of airSlate SignNow, providing users with a secure environment at no additional cost. Our cost-effective solutions allow businesses to authenticate documents without worrying about hidden fees or charges.

-

Can I integrate e institution identification with other applications?

Yes, airSlate SignNow allows for seamless integration of e institution identification with various applications and platforms. This feature enhances workflow automation and ensures that all systems are synchronized for a smoother document signing experience.

-

What are the benefits of using airSlate SignNow's e institution identification?

AirSlate SignNow's e institution identification provides numerous benefits, including enhanced security, compliance with legal standards, and improved user trust. By ensuring that signers are properly authenticated, your business can avoid potential legal issues associated with document signing.

-

How can e institution identification improve my business operations?

Implementing e institution identification in airSlate SignNow can streamline your business operations by reducing the time needed for document verification. This feature allows for faster processing of signed documents, facilitating smoother workflows and increasing overall productivity.

-

What types of businesses benefit from e institution identification?

Various types of businesses, including legal firms, financial institutions, and healthcare providers, can benefit from e institution identification in airSlate SignNow. Any organization requiring verified electronic signatures for important documents can enhance security and compliance with this feature.

Get more for Instructions 1098 T

- Pennsylvania gaming control board institutional investor notice of ownership form

- Pa certified gaming service provider form

- Renewal instructions for alarm business license dlt ri form

- Ri dem water resources freshwater wetlands application and dem ri form

- New boat blank title form

- 18 usc 1033 texas form

- Net operating loss addition modification sheet form

- Fuel refund claim form 4923

Find out other Instructions 1098 T

- eSignature Louisiana Car Dealer Profit And Loss Statement Easy

- How To eSignature Maryland Business Operations Business Letter Template

- How Do I eSignature Arizona Charity Rental Application

- How To eSignature Minnesota Car Dealer Bill Of Lading

- eSignature Delaware Charity Quitclaim Deed Computer

- eSignature Colorado Charity LLC Operating Agreement Now

- eSignature Missouri Car Dealer Purchase Order Template Easy

- eSignature Indiana Charity Residential Lease Agreement Simple

- How Can I eSignature Maine Charity Quitclaim Deed

- How Do I eSignature Michigan Charity LLC Operating Agreement

- eSignature North Carolina Car Dealer NDA Now

- eSignature Missouri Charity Living Will Mobile

- eSignature New Jersey Business Operations Memorandum Of Understanding Computer

- eSignature North Dakota Car Dealer Lease Agreement Safe

- eSignature Oklahoma Car Dealer Warranty Deed Easy

- eSignature Oregon Car Dealer Rental Lease Agreement Safe

- eSignature South Carolina Charity Confidentiality Agreement Easy

- Can I eSignature Tennessee Car Dealer Limited Power Of Attorney

- eSignature Utah Car Dealer Cease And Desist Letter Secure

- eSignature Virginia Car Dealer Cease And Desist Letter Online