Nyc 5ub Form

What is the NYC 5UB?

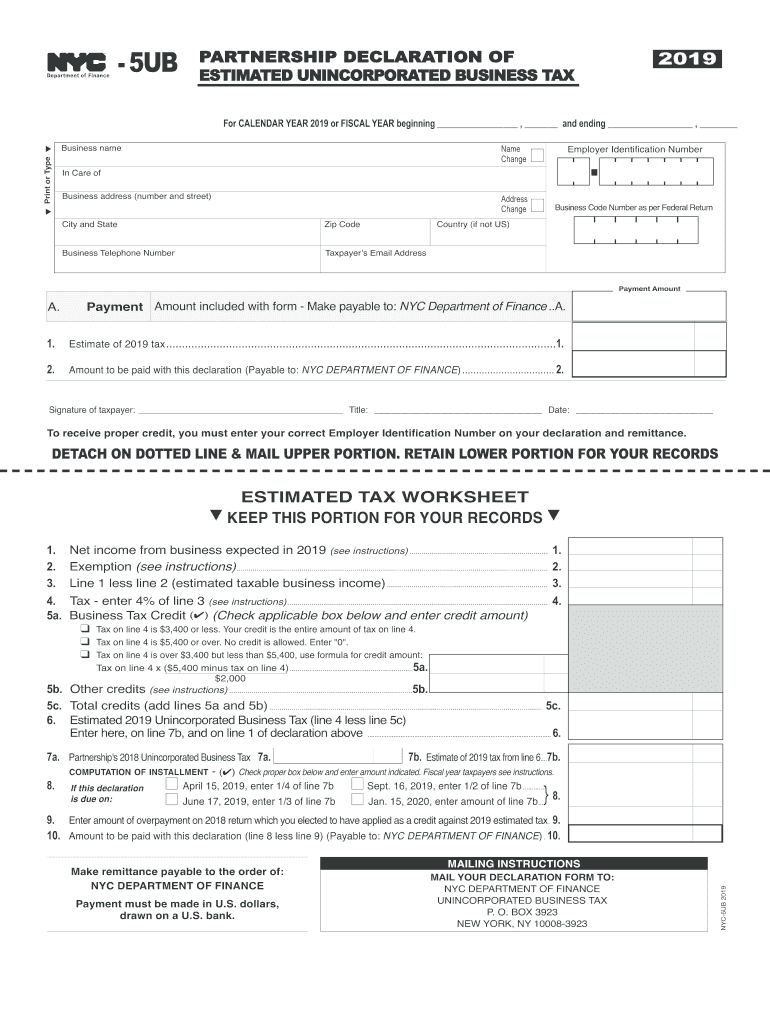

The NYC 5UB is a tax form used by businesses and individuals in New York City to report and pay the Unincorporated Business Tax (UBT). This form is specifically designed for unincorporated entities, including partnerships and sole proprietorships, that conduct business within the city. The NYC 5UB ensures compliance with local tax regulations and helps facilitate the accurate calculation of tax liabilities based on the entity's income.

How to Use the NYC 5UB

Using the NYC 5UB involves several steps to ensure accurate reporting and compliance. First, gather all necessary financial information, including income statements and expense records. Next, complete the form by entering the required details, such as the business name, tax identification number, and income figures. After filling out the form, review it carefully to ensure accuracy before submission. Finally, submit the completed NYC 5UB either online or by mail, following the specific guidelines provided by the New York City Department of Finance.

Steps to Complete the NYC 5UB

Completing the NYC 5UB requires attention to detail and adherence to specific guidelines. Follow these steps:

- Gather financial documents, including profit and loss statements.

- Fill in the business information section, including the name and address.

- Report gross income and allowable deductions accurately.

- Calculate the total tax due based on the applicable rates.

- Review all entries for accuracy and completeness.

- Submit the form by the designated deadline.

Legal Use of the NYC 5UB

The NYC 5UB is legally binding when completed accurately and submitted in compliance with local regulations. It is essential to ensure that all information reported is truthful and reflects the entity's financial situation. Failure to comply with the legal requirements associated with the NYC 5UB may result in penalties or legal repercussions. Utilizing reliable tools for electronic submission can enhance compliance and security.

Filing Deadlines / Important Dates

Filing deadlines for the NYC 5UB are crucial for maintaining compliance. Typically, the form is due on the 15th day of the fourth month following the end of the tax year. For entities operating on a calendar year, this means the deadline is April 15. It is important to stay informed about any changes to deadlines, as these can vary based on specific circumstances or legislative updates.

Required Documents

To complete the NYC 5UB, certain documents are required to substantiate the information provided on the form. These documents may include:

- Financial statements, including profit and loss statements.

- Records of business expenses and deductions.

- Tax identification numbers for the business and any partners.

- Prior year tax returns, if applicable.

Form Submission Methods

The NYC 5UB can be submitted through various methods to accommodate different preferences. These methods include:

- Online submission through the New York City Department of Finance website.

- Mailing the completed form to the appropriate tax office.

- In-person submission at designated tax offices, if necessary.

Quick guide on how to complete nyc taxes nycgov

Effortlessly Prepare Nyc 5ub on Any Device

Digital document management has gained signNow traction among organizations and individuals. It offers an ideal eco-friendly substitute to conventional printed and signed documentation, allowing you to access the necessary forms and securely store them online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents swiftly without delays. Manage Nyc 5ub on any device using the airSlate SignNow applications for Android or iOS, and enhance any document-related procedure today.

The simplest way to modify and electronically sign Nyc 5ub with ease

- Locate Nyc 5ub and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of the documents or obscure sensitive details with tools specifically designed for that purpose by airSlate SignNow.

- Generate your electronic signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet signature.

- Review the details and click the Done button to save your modifications.

- Choose how you wish to share your form, via email, SMS, or an invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form navigation, or mistakes necessitating the printing of new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Nyc 5ub to ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the nyc taxes nycgov

How to make an eSignature for the Nyc Taxes Nycgov online

How to create an eSignature for your Nyc Taxes Nycgov in Google Chrome

How to generate an eSignature for signing the Nyc Taxes Nycgov in Gmail

How to create an eSignature for the Nyc Taxes Nycgov straight from your smart phone

How to generate an electronic signature for the Nyc Taxes Nycgov on iOS

How to make an eSignature for the Nyc Taxes Nycgov on Android

People also ask

-

What is NYC 5UB 5 and how does it relate to airSlate SignNow?

NYC 5UB 5 represents a premium digital signing solution perfect for businesses in New York City. With airSlate SignNow, you can easily send and eSign documents securely, making it an ideal choice for organizations looking for NYC 5UB 5 options.

-

How much does airSlate SignNow cost for NYC 5UB 5 users?

The pricing for airSlate SignNow varies based on the features you choose, but it remains competitive for NYC 5UB 5 users. We offer various subscription tiers to meet the unique needs of businesses, ensuring you only pay for the features you require.

-

What features are included in the NYC 5UB 5 package?

The NYC 5UB 5 package offers robust features such as customizable templates, real-time tracking, and mobile access. These functionalities empower businesses to streamline their document processes efficiently with airSlate SignNow.

-

Can I integrate airSlate SignNow with other tools for NYC 5UB 5?

Yes, airSlate SignNow can easily integrate with a variety of other software tools, making it a great choice for NYC 5UB 5 users. Whether you're using CRM systems or project management tools, integration ensures a seamless workflow.

-

What are the benefits of using airSlate SignNow for NYC 5UB 5?

Using airSlate SignNow for your NYC 5UB 5 needs, you gain the advantage of enhanced security and compliance. Furthermore, the platform signNowly reduces paperwork, allowing for faster transactions and improved efficiency.

-

Is airSlate SignNow user-friendly for first-time NYC 5UB 5 users?

Absolutely! airSlate SignNow is designed with user experience in mind, making it easy for first-time NYC 5UB 5 users to adopt the platform. With its intuitive interface and step-by-step guidance, you'll be eSigning documents in no time.

-

What types of documents can I send with airSlate SignNow for NYC 5UB 5?

With airSlate SignNow, you can send a variety of documents for eSigning, including contracts, agreements, and forms. This versatility makes it an excellent choice for meeting the diverse needs of NYC 5UB 5 users.

Get more for Nyc 5ub

- Form 1041 t allocation of estimated tax payments to beneficiaries under code section 643g

- Form 1116 foreign tax credit individual estate or trust

- Form 8860

- Publication 915 social security and equivalent railroad retirement benefits form

- Publication 3598 rev 11 what you should know about the audit reconsideration process form

- Annual income tax returns form 1120 pol

- Publication 5354 rev 3 criminal tax bulletin form

- Schedule k 1 form 8865 partners share of income iucat

Find out other Nyc 5ub

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors