Nyc Commercial Rent Tax Instructions Form

Understanding the NYC Commercial Rent Tax Instructions

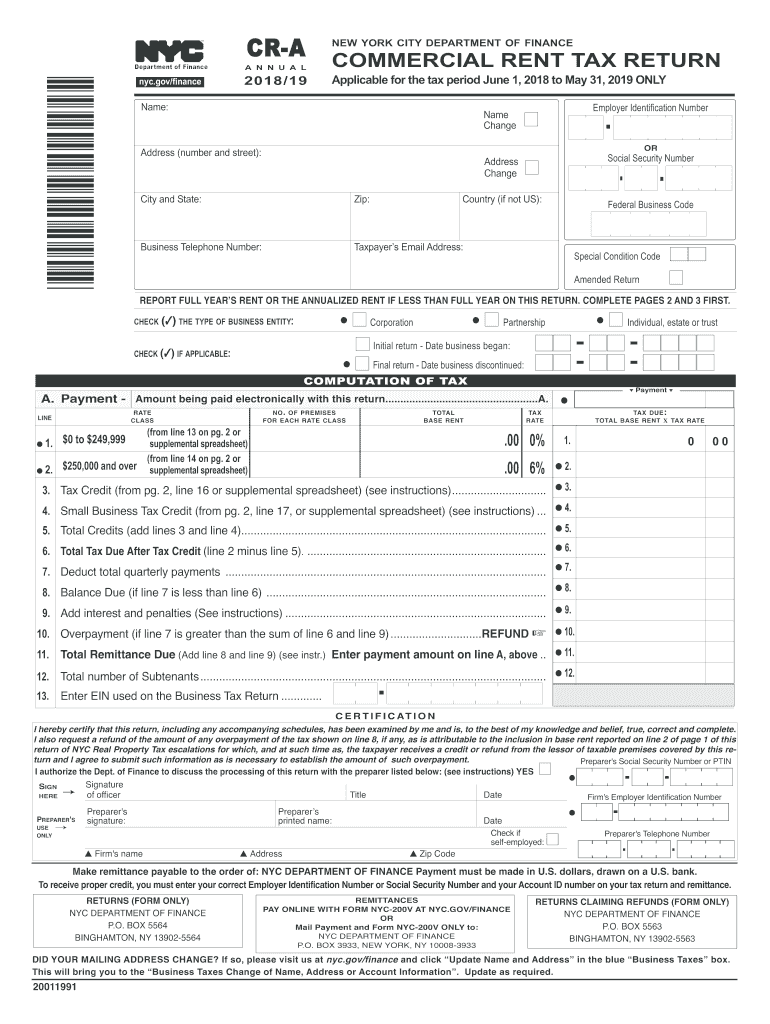

The NYC Commercial Rent Tax Instructions provide essential guidelines for businesses operating in New York City that are subject to the commercial rent tax. This tax applies to businesses renting commercial space in Manhattan below 96th Street, where the annual rent exceeds a specified threshold. The instructions outline the necessary steps for compliance, including how to calculate the tax owed based on rental payments and applicable deductions. Understanding these instructions is crucial for businesses to ensure they meet their tax obligations and avoid potential penalties.

Steps to Complete the NYC Commercial Rent Tax Instructions

Completing the NYC Commercial Rent Tax Instructions involves several key steps:

- Gather necessary documents, including your lease agreement and financial records.

- Determine your total annual rent and any applicable deductions.

- Calculate the commercial rent tax based on the provided rates in the instructions.

- Fill out the NYC Commercial Rent Tax return form accurately, ensuring all information is complete.

- Submit the completed form by the specified deadline, either online or via mail.

Following these steps carefully will help ensure compliance with the tax requirements.

Required Documents for Filing

To file the NYC Commercial Rent Tax return, you will need several key documents:

- Your current lease agreement, which outlines the rental terms.

- Records of all rent payments made during the tax year.

- Any documentation supporting deductions claimed, such as sublease agreements.

- Previous years' tax returns, if applicable, for reference.

Having these documents ready will streamline the filing process and ensure accuracy.

Filing Deadlines and Important Dates

It is essential to be aware of the filing deadlines for the NYC Commercial Rent Tax to avoid late fees and penalties. Typically, the tax return is due on the last day of the month following the end of the tax year. For most businesses, this means the return must be filed by March 31 for the previous calendar year. Additionally, estimated payments may be required throughout the year, with specific due dates outlined in the instructions.

Legal Use of the NYC Commercial Rent Tax Instructions

The NYC Commercial Rent Tax Instructions are legally binding and must be adhered to by all businesses subject to this tax. Compliance with these instructions ensures that businesses fulfill their tax obligations under New York City law. Failure to follow the instructions can result in penalties, including fines and interest on unpaid taxes. It is important for businesses to stay informed about any changes in tax law or filing requirements to maintain compliance.

Examples of Using the NYC Commercial Rent Tax Instructions

Understanding practical applications of the NYC Commercial Rent Tax Instructions can help businesses navigate their tax responsibilities more effectively. For example, a retail store renting a space for $200,000 annually would refer to the instructions to determine the applicable tax rate and calculate their tax owed. Similarly, a restaurant that subleases part of its space may need to adjust its calculations based on the rental agreements in place. These examples illustrate the importance of accurately applying the instructions to specific business scenarios.

Quick guide on how to complete applicable for the tax period june 1 2018 to may 31 2019 only

Prepare Nyc Commercial Rent Tax Instructions effortlessly on any device

Digital document management has gained traction among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed paperwork, allowing you to access the requisite form and securely keep it online. airSlate SignNow equips you with all the resources necessary to create, modify, and eSign your documents rapidly without any hold-ups. Manage Nyc Commercial Rent Tax Instructions on any device using airSlate SignNow's Android or iOS applications and streamline any document-related task today.

How to modify and eSign Nyc Commercial Rent Tax Instructions with ease

- Find Nyc Commercial Rent Tax Instructions and then click Get Form to begin.

- Make use of the tools we provide to complete your form.

- Highlight pertinent sections of the documents or conceal sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature with the Sign tool, which takes moments and holds the same legal validity as a conventional wet ink signature.

- Verify the details and click on the Done button to save your modifications.

- Choose your preferred method for delivering your form, whether by email, SMS, invite link, or download to your PC.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Edit and eSign Nyc Commercial Rent Tax Instructions to ensure excellent communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the applicable for the tax period june 1 2018 to may 31 2019 only

How to generate an eSignature for the Applicable For The Tax Period June 1 2018 To May 31 2019 Only online

How to make an electronic signature for the Applicable For The Tax Period June 1 2018 To May 31 2019 Only in Chrome

How to create an eSignature for putting it on the Applicable For The Tax Period June 1 2018 To May 31 2019 Only in Gmail

How to create an eSignature for the Applicable For The Tax Period June 1 2018 To May 31 2019 Only right from your mobile device

How to make an electronic signature for the Applicable For The Tax Period June 1 2018 To May 31 2019 Only on iOS

How to create an eSignature for the Applicable For The Tax Period June 1 2018 To May 31 2019 Only on Android

People also ask

-

What is the naeyc 72 hour reporting form and why is it important?

The naeyc 72 hour reporting form is a critical document for early childhood education centers that must report specific situations within a 72-hour timeframe. This form ensures compliance with the standards set by the National Association for the Education of Young Children (NAEYC), helping to maintain the quality and safety of educational environments. Proper use of this form can reflect positively on your institution's credibility.

-

How does airSlate SignNow facilitate the completion of the naeyc 72 hour reporting form?

airSlate SignNow streamlines the process of completing the naeyc 72 hour reporting form by providing an easy-to-use electronic signature platform. Users can fill out, sign, and send the form digitally, enhancing efficiency and reducing paperwork. This ensures timely submission to meet compliance requirements swiftly.

-

Is there a cost associated with using the naeyc 72 hour reporting form through airSlate SignNow?

Yes, airSlate SignNow offers various pricing plans that include the capability to utilize the naeyc 72 hour reporting form. Each plan is designed to be cost-effective, allowing businesses of all sizes to benefit from electronic document management. You can choose a plan that best fits your needs and budget while ensuring compliance with NAEYC standards.

-

Can the naeyc 72 hour reporting form be customized within airSlate SignNow?

Absolutely! airSlate SignNow allows you to customize the naeyc 72 hour reporting form to suit your institution's specific needs. You can add branding, modify fields, and choose pre-filled options, enabling a tailored approach for your compliance documentation. This flexibility helps you maintain your identity while ensuring adherence to regulations.

-

What are the security features of airSlate SignNow when using the naeyc 72 hour reporting form?

airSlate SignNow prioritizes security for all documents, including the naeyc 72 hour reporting form. The platform employs advanced encryption standards, secure storage, and authentication measures to protect sensitive information. This ensures that your compliance documents remain confidential and secure throughout the signing process.

-

Are there integrations available for the naeyc 72 hour reporting form with other software?

Yes, airSlate SignNow offers seamless integrations with various software solutions, enhancing the usability of the naeyc 72 hour reporting form. You can connect with popular platforms like Google Drive, Dropbox, and CRM systems to easily manage your documents and workflows. This integration capability streamlines your processes and enhances productivity.

-

How can airSlate SignNow improve the efficiency of handling the naeyc 72 hour reporting form?

By utilizing airSlate SignNow for the naeyc 72 hour reporting form, you can signNowly improve efficiency with features like bulk sending, automated reminders, and instant notifications. This eliminates delays in document handling, ensuring that you meet compliance deadlines effortlessly. Additionally, the user-friendly interface makes it quick for users to navigate through the process.

Get more for Nyc Commercial Rent Tax Instructions

- Online certificate fillable llc wv form

- Wv abca form

- Cosmetic total loss form

- Wv public accountant renewal form 2013

- Cdcsp form

- Fax application for wisconsin birth certificate form

- I 0101 schedule sb form 1 subtractions from income 794892427

- I 030 wisconsin schedule cc request for a closing certificate for fiduciaries 794892428 form

Find out other Nyc Commercial Rent Tax Instructions

- How To Electronic signature West Virginia Sports Arbitration Agreement

- Electronic signature Wisconsin Sports Residential Lease Agreement Myself

- Help Me With Sign Arizona Banking Document

- How Do I Sign Arizona Banking Form

- How Can I Sign Arizona Banking Form

- How Can I Sign Arizona Banking Form

- Can I Sign Colorado Banking PPT

- How Do I Sign Idaho Banking Presentation

- Can I Sign Indiana Banking Document

- How Can I Sign Indiana Banking PPT

- How To Sign Maine Banking PPT

- Help Me With Sign Massachusetts Banking Presentation

- Can I Sign Michigan Banking PDF

- Can I Sign Michigan Banking PDF

- Help Me With Sign Minnesota Banking Word

- How To Sign Missouri Banking Form

- Help Me With Sign New Jersey Banking PDF

- How Can I Sign New Jersey Banking Document

- Help Me With Sign New Mexico Banking Word

- Help Me With Sign New Mexico Banking Document