502x Form

What is the 502x Form

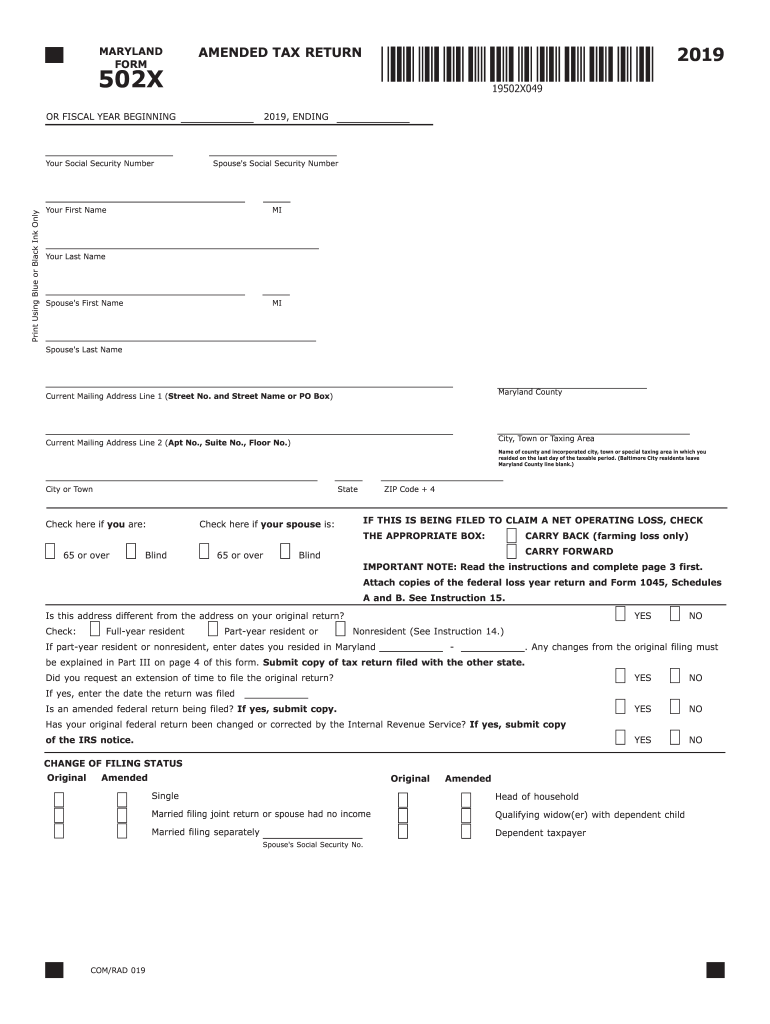

The 2019 Maryland 502x is an amended tax return form used by Maryland residents to correct errors on their original Maryland tax return. This form allows taxpayers to make necessary adjustments to their income, deductions, and credits reported in the initial filing. It is essential for ensuring that the tax records reflect accurate information, which can impact tax liabilities and potential refunds.

How to use the 502x Form

To effectively use the 2019 Maryland 502x, begin by gathering all relevant documents related to your original tax return, including W-2s, 1099s, and any other supporting information. Carefully follow the instructions provided on the form to report the changes you are making. It is crucial to clearly indicate the original amounts and the corrected figures to avoid confusion. If you are claiming additional refunds or making changes that affect your tax liability, ensure that you provide all necessary documentation to support your amendments.

Steps to complete the 502x Form

Completing the 2019 Maryland 502x involves several key steps:

- Obtain the 502x form from the Maryland Comptroller's website or other official sources.

- Fill in your personal information, including your name, address, and Social Security number.

- Indicate the tax year you are amending, which in this case is 2019.

- Report the original amounts from your initial tax return and the corrected amounts in the designated sections.

- Provide explanations for each change made, if applicable, to clarify the reasons for the amendments.

- Sign and date the form to certify that the information is accurate to the best of your knowledge.

Legal use of the 502x Form

The 2019 Maryland 502x is legally recognized for making amendments to previously filed tax returns. To ensure its legal validity, it must be completed accurately and submitted within the designated time frames set by the Maryland Comptroller. Compliance with state tax laws is essential, as failure to properly amend your tax return can lead to penalties or issues with the state tax authority. Additionally, using a reliable electronic signature tool can enhance the legal standing of your submission.

Filing Deadlines / Important Dates

When filing the 2019 Maryland 502x, it is important to be aware of the deadlines. Generally, amended returns must be filed within three years from the original due date of the return or within two years from the date the tax was paid, whichever is later. For the 2019 tax year, this means that the deadline to submit your amended return would typically fall in 2022. Keeping track of these dates helps ensure compliance and avoids unnecessary penalties.

Form Submission Methods (Online / Mail / In-Person)

The 2019 Maryland 502x can be submitted through various methods. Taxpayers have the option to file the form electronically using approved software that supports Maryland tax filings. Alternatively, the completed form can be mailed to the appropriate address provided by the Maryland Comptroller's office. For those who prefer in-person submissions, visiting a local tax office may also be an option, although it is advisable to check for any specific requirements or appointments needed.

Quick guide on how to complete dependents information attach to form 502 505 or 515

Effortlessly Prepare 502x Form on Any Device

Managing documents online has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow provides all the tools required to swiftly create, modify, and eSign your documents without any delays. Handle 502x Form on any device using the airSlate SignNow Android or iOS applications and enhance any document-focused process today.

The Simplest Way to Edit and eSign 502x Form with Ease

- Find 502x Form and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize important sections of the documents or conceal sensitive information with the tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes only seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you want to send your form, whether by email, text message (SMS), an invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that require reprinting new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign 502x Form while ensuring excellent communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the dependents information attach to form 502 505 or 515

How to create an electronic signature for the Dependents Information Attach To Form 502 505 Or 515 in the online mode

How to generate an electronic signature for the Dependents Information Attach To Form 502 505 Or 515 in Chrome

How to create an eSignature for signing the Dependents Information Attach To Form 502 505 Or 515 in Gmail

How to generate an electronic signature for the Dependents Information Attach To Form 502 505 Or 515 from your smart phone

How to create an eSignature for the Dependents Information Attach To Form 502 505 Or 515 on iOS

How to make an eSignature for the Dependents Information Attach To Form 502 505 Or 515 on Android

People also ask

-

What is the 2019 Maryland 502x form?

The 2019 Maryland 502x form is a tax return correction document that allows taxpayers to amend their Maryland state tax returns. It provides individuals with an efficient way to rectify any mistakes made on their original filings, ensuring compliance with state tax regulations.

-

How can airSlate SignNow help with the 2019 Maryland 502x form?

airSlate SignNow simplifies the process of completing and submitting the 2019 Maryland 502x form by providing an easy-to-use platform for eSigning. You can securely send the form to recipients for online signature, streamlining the amendment process and reducing paperwork.

-

What features does airSlate SignNow offer for the 2019 Maryland 502x?

airSlate SignNow offers features that cater to the needs of users completing the 2019 Maryland 502x form, such as template creation, real-time document tracking, and customizable workflows. These features enhance productivity and ensure timely submission of your amended tax return.

-

Is airSlate SignNow cost-effective for handling the 2019 Maryland 502x?

Yes, airSlate SignNow is a cost-effective solution for managing the 2019 Maryland 502x form. With various pricing plans available, users can choose an option that fits their budget while still benefiting from an efficient eSignature process.

-

Can I integrate airSlate SignNow with other tools for the 2019 Maryland 502x?

Absolutely! airSlate SignNow offers integrations with various business applications that can help facilitate the completion of the 2019 Maryland 502x form. This includes tools for document storage, customer relationship management, and more, making your workflow seamless.

-

What are the benefits of using airSlate SignNow for the 2019 Maryland 502x?

Using airSlate SignNow for the 2019 Maryland 502x form signNowly reduces the time and effort involved in document management. eSigning eliminates the need for printing, scanning, and mailing, thus making the amendment process faster and more efficient.

-

Can multiple users collaborate on the 2019 Maryland 502x using airSlate SignNow?

Yes, airSlate SignNow allows multiple users to collaborate on the 2019 Maryland 502x form through its user-friendly platform. This feature is especially beneficial for teams working together to ensure all necessary corrections are made accurately.

Get more for 502x Form

- Oregon petition for review administrative child support order form

- Pennsylvania gaming control board institutional investor notice of ownership form

- Pa certified gaming service provider form

- Renewal instructions for alarm business license dlt ri form

- Ri dem water resources freshwater wetlands application and dem ri form

- New boat blank title form

- Fuel refund claim form 4923

- Collectoramp039s annual settlement missouri department of revenue form

Find out other 502x Form

- Help Me With Sign Nebraska Business Operations Presentation

- How To Sign Arizona Car Dealer Form

- How To Sign Arkansas Car Dealer Document

- How Do I Sign Colorado Car Dealer PPT

- Can I Sign Florida Car Dealer PPT

- Help Me With Sign Illinois Car Dealer Presentation

- How Can I Sign Alabama Charity Form

- How Can I Sign Idaho Charity Presentation

- How Do I Sign Nebraska Charity Form

- Help Me With Sign Nevada Charity PDF

- How To Sign North Carolina Charity PPT

- Help Me With Sign Ohio Charity Document

- How To Sign Alabama Construction PDF

- How To Sign Connecticut Construction Document

- How To Sign Iowa Construction Presentation

- How To Sign Arkansas Doctors Document

- How Do I Sign Florida Doctors Word

- Can I Sign Florida Doctors Word

- How Can I Sign Illinois Doctors PPT

- How To Sign Texas Doctors PDF