Itemized Deduction Worksheet & Small Business Itemized Form

What is the Itemized deduction worksheet & Small Business Itemized

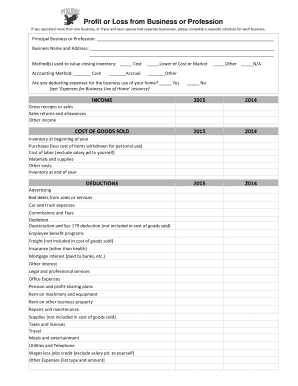

The Itemized deduction worksheet is a crucial tax document used by individuals and small business owners in the United States to detail specific expenses that can be deducted from their taxable income. This worksheet allows taxpayers to list various deductible expenses, such as medical costs, mortgage interest, and charitable contributions, thereby potentially lowering their overall tax liability. Small business owners can also utilize this worksheet to itemize business-related expenses, ensuring they maximize their deductions and comply with IRS regulations.

How to use the Itemized deduction worksheet & Small Business Itemized

Using the Itemized deduction worksheet involves several straightforward steps. First, gather all relevant financial documents, including receipts and statements for deductible expenses. Next, fill out the worksheet by categorizing expenses into appropriate sections, such as medical expenses, taxes paid, and business expenses. It is essential to accurately record each expense and ensure that it qualifies under IRS guidelines. After completing the worksheet, review it for accuracy before including it with your tax return.

Steps to complete the Itemized deduction worksheet & Small Business Itemized

Completing the Itemized deduction worksheet requires careful attention to detail. Begin by entering your personal information at the top of the form. Then, systematically list your deductible expenses in their respective categories. For each expense, provide the amount and any necessary documentation to support your claim. Once all sections are filled out, total your deductions and ensure they align with your financial records. Finally, keep a copy of the completed worksheet for your records and submit it with your tax return.

IRS Guidelines

The IRS provides specific guidelines regarding the use of the Itemized deduction worksheet. Taxpayers must understand which expenses are eligible for deduction and the limits that apply. For instance, certain medical expenses must exceed a specific percentage of adjusted gross income to qualify. Additionally, the IRS requires that all deductions be substantiated with proper documentation. Familiarizing yourself with these guidelines is essential for ensuring compliance and maximizing your deductions.

Required Documents

When preparing to fill out the Itemized deduction worksheet, it is important to gather all necessary documents. This includes receipts for medical expenses, mortgage interest statements, property tax bills, and records of charitable contributions. For small business owners, documentation of business expenses such as invoices, receipts, and bank statements is also required. Having these documents organized will streamline the process and help ensure accuracy in reporting deductions.

Eligibility Criteria

Eligibility for using the Itemized deduction worksheet is generally based on the taxpayer's filing status and the types of expenses incurred. Taxpayers must choose between taking the standard deduction or itemizing their deductions, depending on which option provides a greater tax benefit. Additionally, certain expenses may only be deductible if they exceed a specific threshold of income. Understanding these criteria is crucial for making informed decisions about tax filing.

Examples of using the Itemized deduction worksheet & Small Business Itemized

Examples of using the Itemized deduction worksheet include scenarios where individuals or small business owners can deduct specific expenses. For instance, a self-employed individual may deduct home office expenses, business travel costs, and equipment purchases. Similarly, a homeowner can itemize deductions for mortgage interest and property taxes. These examples illustrate how effectively utilizing the worksheet can lead to significant tax savings.

Quick guide on how to complete itemized deduction worksheet amp small business itemized

Effortlessly prepare Itemized deduction worksheet & Small Business Itemized on any device

Managing documents online has gained popularity among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed paperwork, allowing you to access the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents quickly and without delays. Handle Itemized deduction worksheet & Small Business Itemized on any platform using the airSlate SignNow Android or iOS applications and enhance any document-driven process today.

The easiest way to modify and eSign Itemized deduction worksheet & Small Business Itemized with ease

- Find Itemized deduction worksheet & Small Business Itemized and click on Get Form to begin.

- Utilize the tools available to fill out your document.

- Select important sections of the document or redact sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your eSignature with the Sign tool, which takes mere seconds and holds the same legal significance as a conventional wet ink signature.

- Review all the information and click on the Done button to save your modifications.

- Decide how you wish to send your form—by email, text message (SMS), invitation link, or download it to your computer.

Eliminate the worry of lost or misfiled documents, tedious form searching, or errors that require new document copies. airSlate SignNow meets all your document management requirements with just a few clicks from any device you choose. Adjust and eSign Itemized deduction worksheet & Small Business Itemized to ensure outstanding communication at every step of the form preparation process using airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the itemized deduction worksheet amp small business itemized

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an Itemized deduction worksheet & Small Business Itemized?

An Itemized deduction worksheet & Small Business Itemized is a tool that helps small business owners track and calculate their deductible expenses. This worksheet simplifies the process of itemizing deductions, ensuring that you maximize your tax benefits. By using this worksheet, you can easily identify which expenses qualify for deductions, ultimately saving you money.

-

How can airSlate SignNow help with my Itemized deduction worksheet & Small Business Itemized?

airSlate SignNow provides a user-friendly platform to create, send, and eSign your Itemized deduction worksheet & Small Business Itemized documents. With our solution, you can streamline the documentation process, ensuring that all necessary forms are completed accurately and efficiently. This not only saves time but also reduces the risk of errors in your tax filings.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers flexible pricing plans tailored to meet the needs of small businesses. Our plans include various features that support the creation and management of your Itemized deduction worksheet & Small Business Itemized. You can choose a plan that fits your budget while still gaining access to essential tools for document management.

-

Are there any integrations available for airSlate SignNow?

Yes, airSlate SignNow integrates seamlessly with various applications to enhance your workflow. You can connect your accounting software or other business tools to easily manage your Itemized deduction worksheet & Small Business Itemized. This integration allows for a more streamlined process, ensuring that all your financial documents are in one place.

-

What are the benefits of using airSlate SignNow for my Itemized deduction worksheet & Small Business Itemized?

Using airSlate SignNow for your Itemized deduction worksheet & Small Business Itemized offers numerous benefits, including increased efficiency and reduced paperwork. Our platform allows for quick eSigning and document sharing, which can expedite your tax preparation process. Additionally, our secure storage ensures that your sensitive information is protected.

-

Is airSlate SignNow suitable for all types of small businesses?

Absolutely! airSlate SignNow is designed to cater to a wide range of small businesses, regardless of industry. Whether you are a freelancer or a small business owner, our tools for managing your Itemized deduction worksheet & Small Business Itemized can be customized to fit your specific needs, making it a versatile solution.

-

How does airSlate SignNow ensure the security of my Itemized deduction worksheet & Small Business Itemized?

Security is a top priority at airSlate SignNow. We utilize advanced encryption and secure cloud storage to protect your Itemized deduction worksheet & Small Business Itemized documents. This ensures that your sensitive financial information remains confidential and secure from unauthorized access.

Get more for Itemized deduction worksheet & Small Business Itemized

- Apartment rules and regulations florida form

- Agreed cancellation of lease florida form

- Amendment of residential lease florida form

- Florida payment rent form

- Commercial lease assignment from tenant to new tenant florida form

- Tenant consent to background and reference check florida form

- Florida lease form

- Residential rental lease agreement florida 497303225 form

Find out other Itemized deduction worksheet & Small Business Itemized

- Electronic signature Michigan Email Cover Letter Template Free

- Electronic signature Delaware Termination Letter Template Now

- How Can I Electronic signature Washington Employee Performance Review Template

- Electronic signature Florida Independent Contractor Agreement Template Now

- Electronic signature Michigan Independent Contractor Agreement Template Now

- Electronic signature Oregon Independent Contractor Agreement Template Computer

- Electronic signature Texas Independent Contractor Agreement Template Later

- Electronic signature Florida Employee Referral Form Secure

- How To Electronic signature Florida CV Form Template

- Electronic signature Mississippi CV Form Template Easy

- Electronic signature Ohio CV Form Template Safe

- Electronic signature Nevada Employee Reference Request Mobile

- How To Electronic signature Washington Employee Reference Request

- Electronic signature New York Working Time Control Form Easy

- How To Electronic signature Kansas Software Development Proposal Template

- Electronic signature Utah Mobile App Design Proposal Template Fast

- Electronic signature Nevada Software Development Agreement Template Free

- Electronic signature New York Operating Agreement Safe

- How To eSignature Indiana Reseller Agreement

- Electronic signature Delaware Joint Venture Agreement Template Free