M 8379 Nondebtor Spouse Claim Rmassachusetts Form

What is the MA 8379 Nondebtor Spouse Claim?

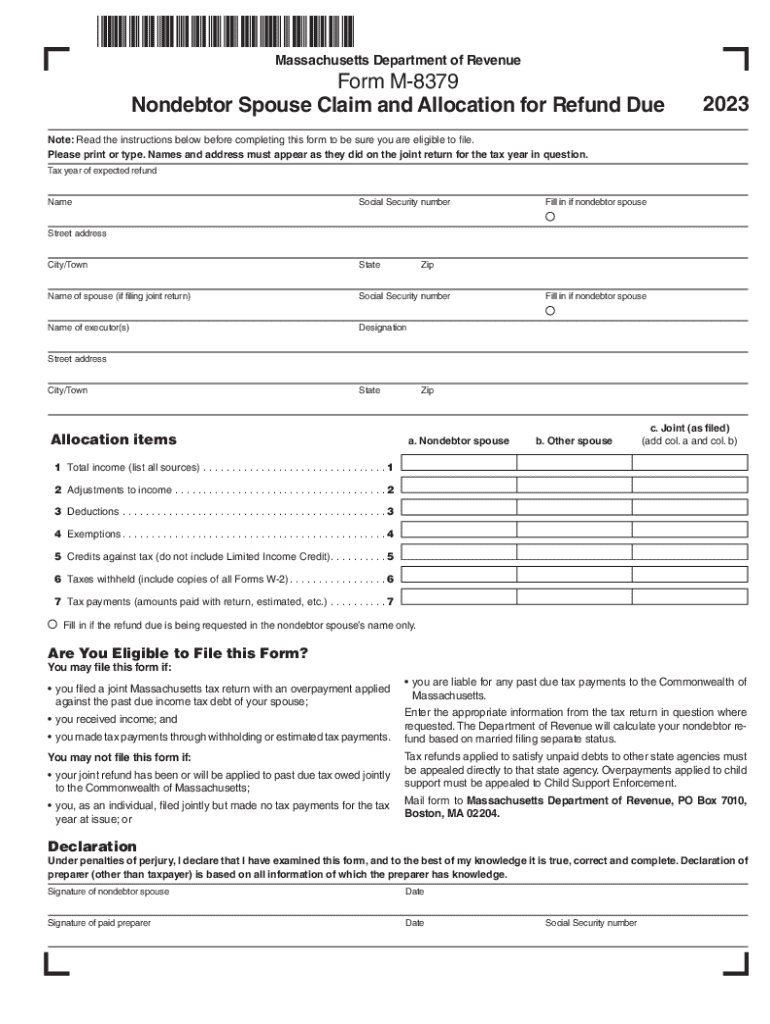

The MA 8379 form, also known as the Nondebtor Spouse Claim, is a document used in Massachusetts for individuals who are married but filing taxes separately. This form allows a nondebtor spouse to claim their share of a tax refund that may be withheld due to the debts of their spouse. It is specifically designed to protect the nondebtor spouse from having their portion of the refund applied to the debts of the other spouse, ensuring that they receive the funds they are entitled to.

Steps to Complete the MA 8379 Nondebtor Spouse Claim

Completing the MA 8379 form involves several important steps:

- Gather necessary information, including both spouses' names, Social Security numbers, and tax filing status.

- Determine the amount of the refund that is attributable to the nondebtor spouse.

- Fill out the form accurately, ensuring all sections are complete and correct.

- Attach any required documentation that supports the claim, such as tax returns or proof of income.

- Review the form for accuracy before submission.

Required Documents for the MA 8379 Nondebtor Spouse Claim

When filing the MA 8379 form, certain documents are necessary to support the claim. These may include:

- Copies of both spouses' tax returns for the relevant year.

- Proof of income for both spouses, such as W-2 forms or 1099 statements.

- Any documentation that demonstrates the debts of the debtor spouse, if applicable.

Filing Deadlines for the MA 8379 Nondebtor Spouse Claim

It is crucial to be aware of filing deadlines when submitting the MA 8379 form. Generally, the form must be filed within three years from the original due date of the tax return to which it relates. This ensures that the nondebtor spouse can claim their rightful share of the refund in a timely manner.

Eligibility Criteria for the MA 8379 Nondebtor Spouse Claim

To qualify for filing the MA 8379 form, the nondebtor spouse must meet specific eligibility criteria:

- The individual must be legally married to the debtor spouse.

- The couple must have filed taxes jointly or separately, with the nondebtor spouse seeking a claim on a refund.

- The claim must pertain to a tax refund that is being withheld due to the debts of the other spouse.

How to Obtain the MA 8379 Nondebtor Spouse Claim

The MA 8379 form can be obtained through the Massachusetts Department of Revenue's website or by contacting their office directly. It is available in a downloadable format, allowing individuals to print and complete the form at their convenience. Ensuring that the latest version of the form is used is essential for compliance with current regulations.

Quick guide on how to complete m 8379 nondebtor spouse claim rmassachusetts

Effortlessly Prepare M 8379 Nondebtor Spouse Claim Rmassachusetts on Any Device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to access the required form and store it safely online. airSlate SignNow equips you with all the resources necessary to create, edit, and eSign your documents quickly and without interruptions. Handle M 8379 Nondebtor Spouse Claim Rmassachusetts on any device through the airSlate SignNow applications for Android or iOS and streamline any document-related task today.

The Easiest Way to Edit and eSign M 8379 Nondebtor Spouse Claim Rmassachusetts Seamlessly

- Locate M 8379 Nondebtor Spouse Claim Rmassachusetts and click Get Form to commence.

- Utilize the tools we offer to fill out your document.

- Highlight important sections of the documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes only a few seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Choose your preferred method for delivering your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Edit and eSign M 8379 Nondebtor Spouse Claim Rmassachusetts and ensure exceptional communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the m 8379 nondebtor spouse claim rmassachusetts

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the MA 8379 form?

The MA 8379 form is a tax form used in Massachusetts for requesting a refund of state income tax. It allows taxpayers to claim their share of a joint refund when filing separately. Understanding the MA 8379 form is essential for ensuring accurate tax filings and maximizing potential refunds.

-

How can airSlate SignNow help with the MA 8379 form?

airSlate SignNow simplifies the process of completing and eSigning the MA 8379 form. Our platform allows users to fill out the form electronically, ensuring accuracy and efficiency. With airSlate SignNow, you can easily send the completed MA 8379 form to the appropriate tax authorities.

-

Is there a cost associated with using airSlate SignNow for the MA 8379 form?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. Our cost-effective solution provides access to features that streamline the completion and signing of documents, including the MA 8379 form. You can choose a plan that best fits your budget and requirements.

-

What features does airSlate SignNow offer for the MA 8379 form?

airSlate SignNow provides features such as customizable templates, secure eSigning, and document tracking for the MA 8379 form. These tools enhance the user experience by making it easier to manage and submit tax documents. Additionally, our platform ensures compliance with legal standards for electronic signatures.

-

Can I integrate airSlate SignNow with other applications for the MA 8379 form?

Yes, airSlate SignNow offers integrations with various applications to streamline your workflow when handling the MA 8379 form. You can connect with popular tools like Google Drive, Dropbox, and CRM systems. This integration capability enhances productivity and ensures seamless document management.

-

What are the benefits of using airSlate SignNow for the MA 8379 form?

Using airSlate SignNow for the MA 8379 form provides numerous benefits, including time savings and improved accuracy. Our platform reduces the risk of errors associated with manual entry and speeds up the submission process. Additionally, you can access your documents anytime, anywhere, enhancing convenience.

-

Is airSlate SignNow secure for handling the MA 8379 form?

Absolutely! airSlate SignNow prioritizes security and compliance, ensuring that your MA 8379 form and other documents are protected. We use advanced encryption and secure storage solutions to safeguard your sensitive information. You can trust airSlate SignNow for secure document management.

Get more for M 8379 Nondebtor Spouse Claim Rmassachusetts

- Notices resolutions simple stock ledger and certificate oregon form

- Minutes for organizational meeting oregon oregon form

- Oregon incorporation form

- Js 44 civil cover sheet federal district court oregon form

- Lead based paint form 497324095

- Lead disclosure form 497324096

- Notice of lease for recording oregon form

- Sample cover letter for filing of llc articles or certificate with secretary of state oregon form

Find out other M 8379 Nondebtor Spouse Claim Rmassachusetts

- eSign Minnesota Share Donation Agreement Simple

- Can I eSign Hawaii Collateral Debenture

- eSign Hawaii Business Credit Application Mobile

- Help Me With eSign California Credit Memo

- eSign Hawaii Credit Memo Online

- Help Me With eSign Hawaii Credit Memo

- How Can I eSign Hawaii Credit Memo

- eSign Utah Outsourcing Services Contract Computer

- How Do I eSign Maryland Interview Non-Disclosure (NDA)

- Help Me With eSign North Dakota Leave of Absence Agreement

- How To eSign Hawaii Acknowledgement of Resignation

- How Can I eSign New Jersey Resignation Letter

- How Do I eSign Ohio Resignation Letter

- eSign Arkansas Military Leave Policy Myself

- How To eSign Hawaii Time Off Policy

- How Do I eSign Hawaii Time Off Policy

- Help Me With eSign Hawaii Time Off Policy

- How To eSign Hawaii Addressing Harassement

- How To eSign Arkansas Company Bonus Letter

- eSign Hawaii Promotion Announcement Secure