File & Pay Business SC Department of Revenue SC GOV Form

Understanding the SC Estimated Tax Payment Process

The South Carolina estimated tax payment process allows individuals and businesses to pay their estimated taxes online efficiently. This system is designed for taxpayers who expect to owe tax of $100 or more when filing their annual return. By making these payments, taxpayers can avoid penalties and interest associated with underpayment. The process is straightforward and can be completed through the South Carolina Department of Revenue's online portal.

Steps to Pay SC Estimated Taxes Online

To pay South Carolina estimated taxes online, follow these steps:

- Visit the South Carolina Department of Revenue website.

- Navigate to the File & Pay section.

- Select the option for estimated tax payments.

- Provide the necessary information, including your Social Security number or business tax ID, and the amount you wish to pay.

- Choose your payment method, such as bank transfer or credit card.

- Review your payment details and submit your payment.

Once completed, you will receive a confirmation of your payment, which is essential for your records.

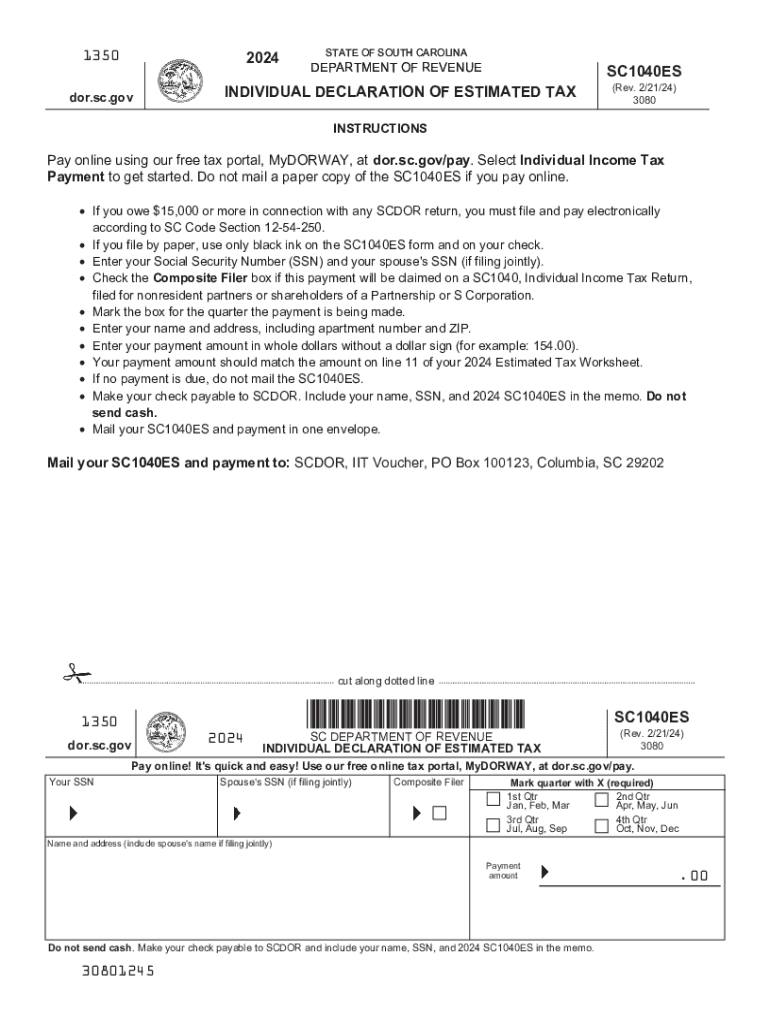

Required Documents for SC Estimated Tax Payments

When preparing to pay SC estimated taxes online, ensure you have the following documents ready:

- Your Social Security number or Employer Identification Number (EIN).

- The SC1040ES form, which outlines your estimated tax payment details.

- Income documentation to accurately estimate your tax liability.

Having these documents on hand will streamline the payment process and help ensure accuracy.

Filing Deadlines for Estimated Taxes

Understanding the filing deadlines for estimated taxes is crucial to avoid penalties. In South Carolina, estimated tax payments are typically due on the following dates:

- April 15 for the first payment.

- June 15 for the second payment.

- September 15 for the third payment.

- January 15 of the following year for the fourth payment.

It is important to mark these dates on your calendar to ensure timely payments.

Penalties for Non-Compliance

Failing to pay estimated taxes on time can result in significant penalties. South Carolina imposes a penalty of up to 5 percent of the unpaid tax amount for each month that the payment is late, up to a maximum of 25 percent. Additionally, interest may accrue on the unpaid balance. To avoid these penalties, it is advisable to make timely payments and keep accurate records of your tax obligations.

Eligibility Criteria for Making Estimated Tax Payments

Not all taxpayers are required to make estimated tax payments. Generally, you must pay estimated taxes if you expect to owe $100 or more in tax when you file your return. Additionally, your withholding and refundable credits must be less than the smaller of:

- 90 percent of the tax for the current year, or

- 100 percent of the tax for the previous year.

Reviewing these criteria can help determine if you need to make estimated payments.

Quick guide on how to complete file amp pay business sc department of revenue sc gov

Complete File & Pay Business SC Department Of Revenue SC GOV effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed paperwork, as you can access the necessary form and securely keep it online. airSlate SignNow equips you with all the resources you require to create, modify, and eSign your documents swiftly and without interruptions. Handle File & Pay Business SC Department Of Revenue SC GOV on any platform with airSlate SignNow's Android or iOS applications and enhance any document-based process today.

The simplest way to modify and eSign File & Pay Business SC Department Of Revenue SC GOV without hassle

- Locate File & Pay Business SC Department Of Revenue SC GOV and click on Get Form to begin.

- Utilize the tools available to fill out your form.

- Emphasize important sections of the documents or redact confidential information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign feature, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your modifications.

- Select how you want to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that require printing new copies. airSlate SignNow fulfills your needs in document management with just a few clicks from any device you choose. Modify and eSign File & Pay Business SC Department Of Revenue SC GOV and ensure excellent communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the file amp pay business sc department of revenue sc gov

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the process to pay SC estimated taxes online using airSlate SignNow?

To pay SC estimated taxes online with airSlate SignNow, simply log into your account, navigate to the tax payment section, and follow the prompts to complete your payment. Our platform ensures a seamless experience, allowing you to eSign necessary documents quickly. You can also save your payment details for future transactions, making it easier to manage your tax obligations.

-

Are there any fees associated with paying SC estimated taxes online through airSlate SignNow?

While airSlate SignNow offers a cost-effective solution for eSigning and document management, there may be transaction fees imposed by the state for processing your SC estimated taxes online. It's advisable to check the specific fee structure on the South Carolina Department of Revenue's website. Our platform aims to minimize costs while providing a reliable service.

-

Can I integrate airSlate SignNow with other accounting software for paying SC estimated taxes online?

Yes, airSlate SignNow can be integrated with various accounting software solutions, allowing you to streamline your tax payment process. This integration helps you manage your financial documents and payments efficiently. By connecting your accounting tools, you can easily pay SC estimated taxes online without switching between platforms.

-

What are the benefits of using airSlate SignNow to pay SC estimated taxes online?

Using airSlate SignNow to pay SC estimated taxes online offers numerous benefits, including enhanced security, ease of use, and quick processing times. Our platform allows you to eSign documents securely, ensuring that your sensitive information is protected. Additionally, you can access your tax documents anytime, making it easier to stay organized.

-

Is it safe to pay SC estimated taxes online through airSlate SignNow?

Absolutely! airSlate SignNow employs advanced encryption and security protocols to ensure that your information is safe when you pay SC estimated taxes online. We prioritize the security of our users' data, providing a reliable platform for all your eSigning and payment needs. You can trust us to handle your sensitive tax information with care.

-

What types of documents can I eSign when paying SC estimated taxes online?

When you pay SC estimated taxes online with airSlate SignNow, you can eSign a variety of documents, including tax forms, payment confirmations, and other related paperwork. Our platform supports multiple document formats, making it easy to manage all your tax-related documents in one place. This feature simplifies the process and keeps everything organized.

-

Can I track my payment status after I pay SC estimated taxes online?

Yes, airSlate SignNow provides tracking features that allow you to monitor the status of your payment after you pay SC estimated taxes online. You will receive notifications and updates regarding your payment, ensuring you stay informed throughout the process. This transparency helps you manage your tax obligations effectively.

Get more for File & Pay Business SC Department Of Revenue SC GOV

- Residential rental lease agreement pennsylvania form

- Tenant welcome letter pennsylvania form

- Warning of default on commercial lease pennsylvania form

- Warning of default on residential lease pennsylvania form

- Pa security deposit 497324651 form

- Pennsylvania name change 497324652 form

- Name change notification form pennsylvania

- Commercial building or space lease pennsylvania form

Find out other File & Pay Business SC Department Of Revenue SC GOV

- eSignature Kansas Plumbing Lease Agreement Template Myself

- eSignature Louisiana Plumbing Rental Application Secure

- eSignature Maine Plumbing Business Plan Template Simple

- Can I eSignature Massachusetts Plumbing Business Plan Template

- eSignature Mississippi Plumbing Emergency Contact Form Later

- eSignature Plumbing Form Nebraska Free

- How Do I eSignature Alaska Real Estate Last Will And Testament

- Can I eSignature Alaska Real Estate Rental Lease Agreement

- eSignature New Jersey Plumbing Business Plan Template Fast

- Can I eSignature California Real Estate Contract

- eSignature Oklahoma Plumbing Rental Application Secure

- How Can I eSignature Connecticut Real Estate Quitclaim Deed

- eSignature Pennsylvania Plumbing Business Plan Template Safe

- eSignature Florida Real Estate Quitclaim Deed Online

- eSignature Arizona Sports Moving Checklist Now

- eSignature South Dakota Plumbing Emergency Contact Form Mobile

- eSignature South Dakota Plumbing Emergency Contact Form Safe

- Can I eSignature South Dakota Plumbing Emergency Contact Form

- eSignature Georgia Real Estate Affidavit Of Heirship Later

- eSignature Hawaii Real Estate Operating Agreement Online