Bt Summary NH Department of Revenue Administration Form

What is the BT Summary?

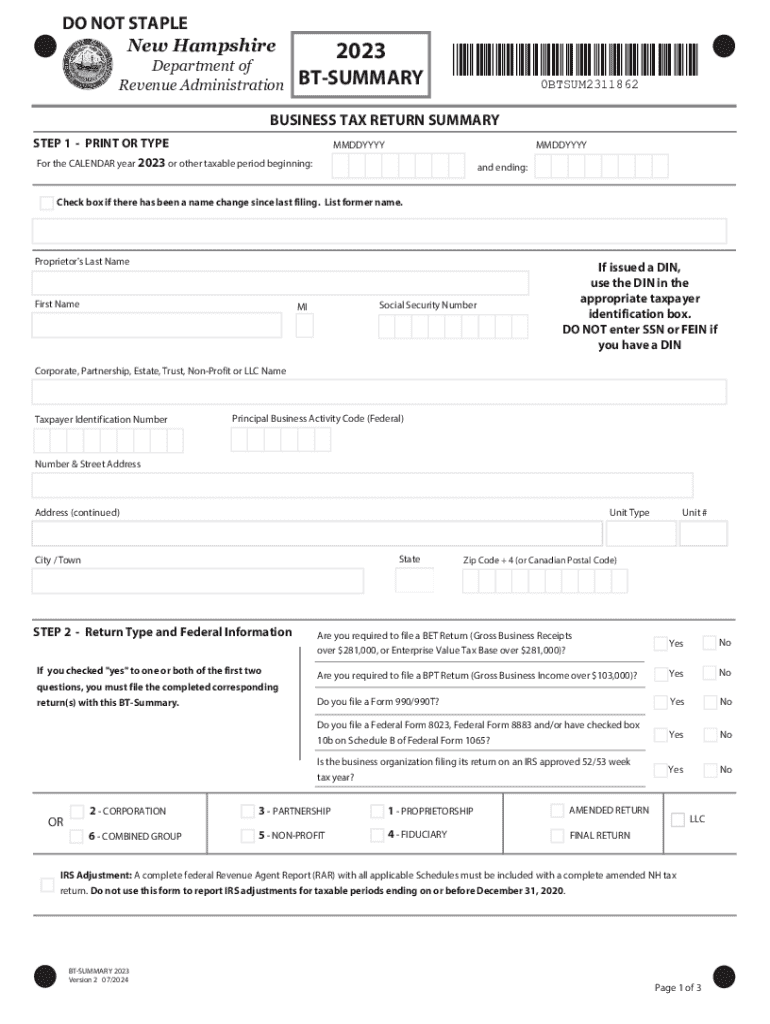

The BT Summary is a form provided by the New Hampshire Department of Revenue Administration. It serves as a summary of business taxes owed by businesses operating within the state. This form is essential for businesses to report their tax liabilities accurately and ensure compliance with state tax laws. The BT Summary consolidates information regarding business profits, losses, and tax calculations, making it a crucial document for both business owners and tax authorities.

Key Elements of the BT Summary

Understanding the key elements of the BT Summary is vital for accurate completion. The form typically includes:

- Business Identification: Name, address, and tax identification number of the business.

- Tax Calculation: Detailed sections for reporting gross receipts, deductions, and taxable income.

- Tax Due: The total amount of tax owed based on the calculations provided.

- Signature Section: A space for the authorized person to sign and date the form, affirming its accuracy.

Steps to Complete the BT Summary

Completing the BT Summary involves several important steps:

- Gather all relevant financial documents, including income statements and expense reports.

- Fill in the business identification section with accurate details.

- Report gross receipts and any applicable deductions in the designated areas.

- Calculate the taxable income and the corresponding tax due based on the current rates.

- Review the completed form for accuracy and ensure all sections are filled out.

- Sign and date the form before submission.

How to Obtain the BT Summary

Businesses can obtain the BT Summary from the New Hampshire Department of Revenue Administration's official website. The form is available for download in a printable format, allowing business owners to fill it out manually. Additionally, some businesses may choose to complete the form electronically, depending on their filing preferences. It is important to ensure that the most current version of the form is used to avoid any compliance issues.

Legal Use of the BT Summary

The BT Summary is legally required for businesses operating in New Hampshire to report their business taxes. Failing to submit this form can result in penalties and interest on unpaid taxes. It is important for businesses to understand their obligations under state law and ensure timely and accurate filing to maintain compliance. Consulting with a tax professional can also provide guidance on the legal implications of the BT Summary.

Form Submission Methods

Businesses have several options for submitting the BT Summary:

- Online Submission: Many businesses prefer to file electronically through the New Hampshire Department of Revenue Administration's online portal.

- Mail: Completed forms can be printed and mailed to the appropriate address provided by the Department of Revenue Administration.

- In-Person: Businesses may also choose to submit the form in person at designated state offices.

Quick guide on how to complete bt summary nh department of revenue administration

Effortlessly Prepare Bt summary NH Department Of Revenue Administration on Any Device

Online document management has gained traction among businesses and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to locate the right form and securely save it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents swiftly without delays. Manage Bt summary NH Department Of Revenue Administration on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The Easiest Way to Edit and eSign Bt summary NH Department Of Revenue Administration with Ease

- Locate Bt summary NH Department Of Revenue Administration and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight signNow sections of the documents or redact sensitive information using tools that airSlate SignNow specifically provides for that purpose.

- Create your signature with the Sign tool, which only takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Choose your preferred method to send your form—via email, SMS, invite link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious searches for forms, or errors that necessitate printing new copies. airSlate SignNow covers all your document management requirements with just a few clicks from any device you prefer. Edit and eSign Bt summary NH Department Of Revenue Administration to ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the bt summary nh department of revenue administration

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a revenue btsummary summary printable?

A revenue btsummary summary printable is a document that provides a concise overview of revenue-related data, making it easy for businesses to analyze their financial performance. This printable format allows for quick reference and sharing among team members, enhancing collaboration and decision-making.

-

How can I create a revenue btsummary summary printable using airSlate SignNow?

Creating a revenue btsummary summary printable with airSlate SignNow is straightforward. Simply upload your data, customize the summary layout, and generate the printable document. Our platform ensures that the process is user-friendly and efficient, allowing you to focus on your business.

-

Is there a cost associated with generating a revenue btsummary summary printable?

Yes, airSlate SignNow offers various pricing plans that include the ability to generate revenue btsummary summary printables. Our plans are designed to be cost-effective, providing excellent value for businesses of all sizes while ensuring access to essential features.

-

What features does airSlate SignNow offer for revenue btsummary summary printables?

airSlate SignNow provides a range of features for creating revenue btsummary summary printables, including customizable templates, eSignature capabilities, and secure document storage. These features streamline the process of managing and sharing financial summaries, making it easier for teams to collaborate.

-

Can I integrate airSlate SignNow with other tools for revenue btsummary summary printables?

Absolutely! airSlate SignNow offers integrations with various tools and platforms, allowing you to seamlessly incorporate your revenue btsummary summary printables into your existing workflows. This enhances productivity and ensures that your financial data is always accessible.

-

What are the benefits of using airSlate SignNow for revenue btsummary summary printables?

Using airSlate SignNow for your revenue btsummary summary printables provides numerous benefits, including improved accuracy, faster turnaround times, and enhanced collaboration. Our platform simplifies the document management process, allowing you to focus on growing your business.

-

Is it easy to share a revenue btsummary summary printable with my team?

Yes, sharing a revenue btsummary summary printable with your team is easy using airSlate SignNow. You can send documents directly via email or generate shareable links, ensuring that everyone has access to the information they need for informed decision-making.

Get more for Bt summary NH Department Of Revenue Administration

- Bill of sale in connection with sale of business by individual or corporate seller south dakota form

- Office lease agreement south dakota form

- South dakota service form

- Notice of entry of judgment and decree of divorce south dakota form

- Commercial sublease south dakota form

- Residential lease renewal agreement south dakota form

- Notice to lessor exercising option to purchase south dakota form

- Assignment of lease and rent from borrower to lender south dakota form

Find out other Bt summary NH Department Of Revenue Administration

- How Can I Electronic signature Oklahoma Doctors Document

- How Can I Electronic signature Alabama Finance & Tax Accounting Document

- How To Electronic signature Delaware Government Document

- Help Me With Electronic signature Indiana Education PDF

- How To Electronic signature Connecticut Government Document

- How To Electronic signature Georgia Government PDF

- Can I Electronic signature Iowa Education Form

- How To Electronic signature Idaho Government Presentation

- Help Me With Electronic signature Hawaii Finance & Tax Accounting Document

- How Can I Electronic signature Indiana Government PDF

- How Can I Electronic signature Illinois Finance & Tax Accounting PPT

- How To Electronic signature Maine Government Document

- How To Electronic signature Louisiana Education Presentation

- How Can I Electronic signature Massachusetts Government PDF

- How Do I Electronic signature Montana Government Document

- Help Me With Electronic signature Louisiana Finance & Tax Accounting Word

- How To Electronic signature Pennsylvania Government Document

- Can I Electronic signature Texas Government PPT

- How To Electronic signature Utah Government Document

- How To Electronic signature Washington Government PDF