1350 Dor Sc Gov2024STATE of SOUTH CAROLINADEPARTME Form

Understanding the SC1041ES Tax Form

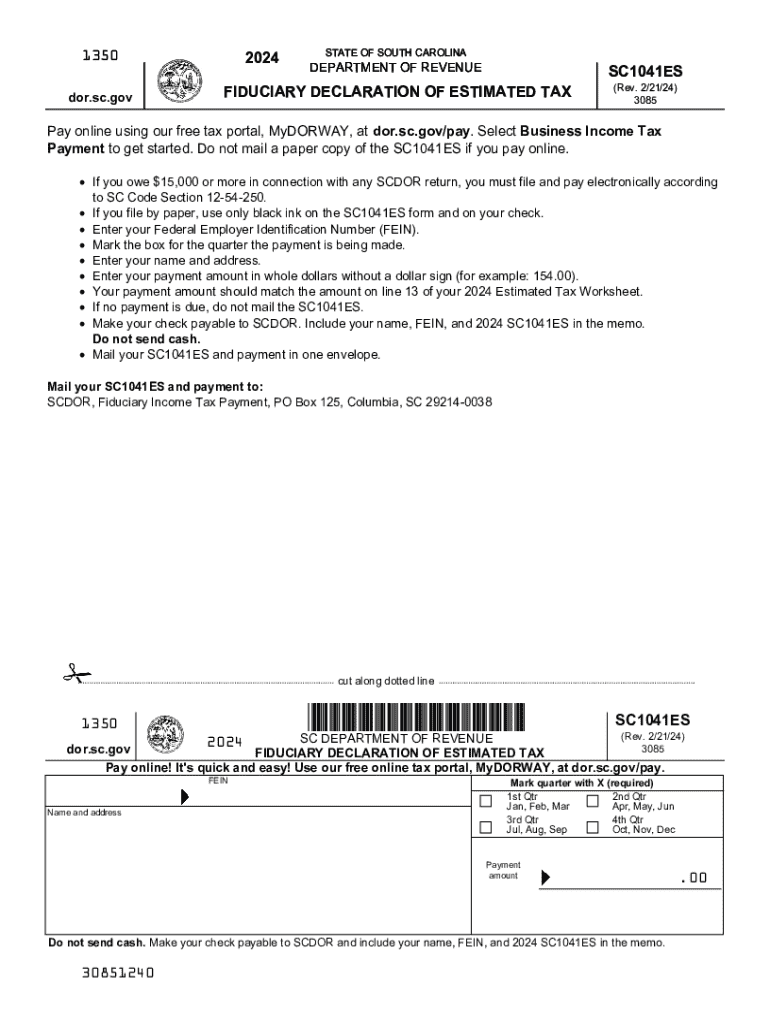

The SC1041ES tax form is used for estimated tax payments in South Carolina. This form is essential for individuals and entities that expect to owe tax of $100 or more when filing their annual tax return. The purpose of the SC1041ES is to help taxpayers manage their tax obligations throughout the year, rather than facing a large bill at tax time.

Steps to Complete the SC1041ES Tax Form

Completing the SC1041ES tax form involves several key steps:

- Gather necessary financial information, including income sources and deductions.

- Calculate your estimated tax liability for the year based on your expected income.

- Fill out the SC1041ES form with your estimated tax amounts.

- Submit the form by the designated deadlines to avoid penalties.

Filing Deadlines for the SC1041ES Tax Form

Timely filing of the SC1041ES is crucial to avoid penalties. The estimated tax payments are typically due on the 15th of April, June, September, and January of the following year. Keeping track of these deadlines ensures compliance with South Carolina tax regulations.

Required Documents for the SC1041ES Tax Form

To accurately complete the SC1041ES tax form, you will need:

- Your previous year’s tax return for reference.

- Documentation of income sources, such as W-2s or 1099s.

- Records of any deductions or credits you plan to claim.

Penalties for Non-Compliance with the SC1041ES Tax Form

Failure to file the SC1041ES tax form or to make the required payments can result in penalties. The South Carolina Department of Revenue may impose fines based on the amount owed and the length of time the payment is overdue. Understanding these penalties can help taxpayers avoid unexpected costs.

Eligibility Criteria for the SC1041ES Tax Form

Eligibility to file the SC1041ES tax form generally includes individuals, partnerships, and corporations that expect to owe tax when filing their annual return. It is advisable to review specific eligibility criteria based on your tax situation to ensure compliance.

Examples of Using the SC1041ES Tax Form

The SC1041ES tax form is commonly used by various taxpayers, including:

- Self-employed individuals who need to pay estimated taxes on their income.

- Investors with significant capital gains.

- Business owners who anticipate owing taxes at the end of the fiscal year.

Quick guide on how to complete 1350 dor sc gov2024state of south carolinadepartme

Accomplish 1350 Dor sc gov2024STATE OF SOUTH CAROLINADEPARTME effortlessly on any device

Digital document management has gained popularity among organizations and individuals. It serves as an ideal eco-friendly substitute for traditional printed and signed documents, as you can easily locate the necessary form and securely store it online. airSlate SignNow equips you with all the tools you require to create, modify, and electronically sign your documents promptly without delays. Manage 1350 Dor sc gov2024STATE OF SOUTH CAROLINADEPARTME on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The easiest method to alter and electronically sign 1350 Dor sc gov2024STATE OF SOUTH CAROLINADEPARTME without effort

- Locate 1350 Dor sc gov2024STATE OF SOUTH CAROLINADEPARTME and click on Get Form to begin the process.

- Utilize the tools we offer to fill out your form.

- Emphasize relevant portions of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Verify all the details and click on the Done button to save your changes.

- Choose how you wish to share your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate the hassle of lost or misfiled documents, tedious form searches, or mistakes that require the printing of new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Alter and electronically sign 1350 Dor sc gov2024STATE OF SOUTH CAROLINADEPARTME and guarantee exceptional communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 1350 dor sc gov2024state of south carolinadepartme

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the sc sc1041es tax form?

The sc sc1041es tax form is used for reporting income and expenses for certain types of entities. It is essential for businesses to accurately complete this form to ensure compliance with tax regulations. Understanding how to fill out the sc sc1041es tax form can help avoid penalties and streamline the filing process.

-

How can airSlate SignNow help with the sc sc1041es tax process?

airSlate SignNow simplifies the sc sc1041es tax process by allowing users to easily send and eSign necessary documents. With its user-friendly interface, businesses can quickly prepare and manage their tax forms, ensuring that all required signatures are obtained efficiently. This reduces the time spent on paperwork and enhances overall productivity.

-

What are the pricing options for airSlate SignNow related to sc sc1041es tax services?

airSlate SignNow offers various pricing plans to accommodate different business needs, including those related to the sc sc1041es tax. Each plan provides access to essential features for document management and eSigning. Businesses can choose a plan that best fits their budget and requirements for handling tax-related documents.

-

Are there any features specifically designed for managing sc sc1041es tax documents?

Yes, airSlate SignNow includes features tailored for managing sc sc1041es tax documents, such as customizable templates and automated workflows. These tools help streamline the preparation and signing process, making it easier to handle tax forms efficiently. Users can also track document status in real-time, ensuring timely submissions.

-

Can I integrate airSlate SignNow with other accounting software for sc sc1041es tax preparation?

Absolutely! airSlate SignNow offers integrations with various accounting software, making it easier to manage your sc sc1041es tax preparation. By connecting your existing tools, you can streamline data transfer and ensure that all necessary information is readily available for tax filing. This integration enhances efficiency and reduces the risk of errors.

-

What benefits does airSlate SignNow provide for businesses dealing with sc sc1041es tax?

Using airSlate SignNow for sc sc1041es tax offers numerous benefits, including improved efficiency and reduced paperwork. The platform allows for quick document turnaround times, ensuring that tax forms are completed and submitted on schedule. Additionally, the secure eSigning feature enhances compliance and protects sensitive information.

-

Is airSlate SignNow user-friendly for those unfamiliar with sc sc1041es tax forms?

Yes, airSlate SignNow is designed to be user-friendly, even for those unfamiliar with sc sc1041es tax forms. The intuitive interface guides users through the document preparation and signing process, making it accessible for everyone. With helpful resources and support, users can confidently manage their tax documents.

Get more for 1350 Dor sc gov2024STATE OF SOUTH CAROLINADEPARTME

Find out other 1350 Dor sc gov2024STATE OF SOUTH CAROLINADEPARTME

- How To eSignature Massachusetts Government Form

- How Can I eSignature Oregon Government PDF

- How Can I eSignature Oklahoma Government Document

- How To eSignature Texas Government Document

- Can I eSignature Vermont Government Form

- How Do I eSignature West Virginia Government PPT

- How Do I eSignature Maryland Healthcare / Medical PDF

- Help Me With eSignature New Mexico Healthcare / Medical Form

- How Do I eSignature New York Healthcare / Medical Presentation

- How To eSignature Oklahoma Finance & Tax Accounting PPT

- Help Me With eSignature Connecticut High Tech Presentation

- How To eSignature Georgia High Tech Document

- How Can I eSignature Rhode Island Finance & Tax Accounting Word

- How Can I eSignature Colorado Insurance Presentation

- Help Me With eSignature Georgia Insurance Form

- How Do I eSignature Kansas Insurance Word

- How Do I eSignature Washington Insurance Form

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word