Form 6251

What is the Form 6251

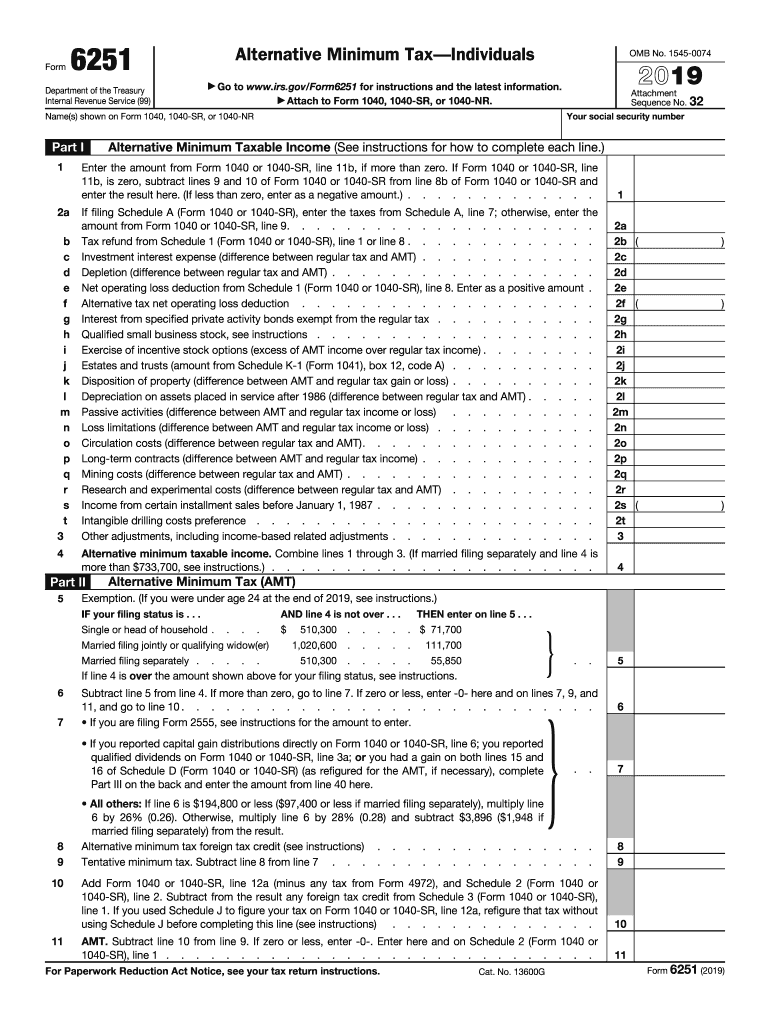

The Form 6251, also known as the Alternative Minimum Tax (AMT) Individual Tax Return, is a tax form used by individuals to determine their liability for the Alternative Minimum Tax. This form is essential for taxpayers who may be subject to AMT due to specific tax preferences or deductions that exceed certain thresholds. Understanding the purpose of Form 6251 is crucial for accurate tax reporting and compliance.

How to obtain the Form 6251

To obtain the Form 6251, taxpayers can visit the official IRS website, where the form is available for download in PDF format. Additionally, taxpayers may request a physical copy by contacting the IRS directly or by visiting local IRS offices. It is advisable to ensure that the version of the form is the most current, as tax laws and forms can change annually.

Steps to complete the Form 6251

Completing the Form 6251 requires careful attention to detail. Here are the general steps involved:

- Gather necessary financial documents, including income statements and deduction records.

- Begin by filling out personal information, such as your name and Social Security number.

- Calculate your alternative minimum taxable income (AMTI) by adding back certain deductions and tax benefits.

- Determine your AMT exemption amount based on your filing status.

- Complete the calculations for AMT owed based on the provided tax tables.

- Review the form for accuracy before submission.

Legal use of the Form 6251

The legal use of Form 6251 is governed by IRS regulations. Taxpayers are required to file this form if their income exceeds specific thresholds that trigger the Alternative Minimum Tax. Proper completion of the form ensures compliance with federal tax laws and helps avoid potential penalties. It is important to retain copies of the completed form and any supporting documentation for record-keeping purposes.

Key elements of the Form 6251

Key elements of the Form 6251 include:

- Personal identification information, including name and Social Security number.

- Calculation of alternative minimum taxable income (AMTI).

- AMT exemption amounts based on filing status.

- Details on specific deductions and credits that may affect AMT calculations.

- Final AMT liability calculation.

Filing Deadlines / Important Dates

The filing deadline for Form 6251 typically aligns with the standard tax filing deadline, which is usually April 15 for individual taxpayers. However, if this date falls on a weekend or holiday, the deadline may be extended. Taxpayers should also be aware of any extensions they may file for their income tax returns, which can affect the submission of Form 6251.

Quick guide on how to complete f6251 form 6251 department of the treasury internal revenue

Complete Form 6251 effortlessly on any apparatus

Digital document management has grown in popularity among enterprises and individuals. It serves as an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to obtain the necessary form and securely archive it online. airSlate SignNow provides all the tools you require to generate, modify, and eSign your documents quickly without delays. Manage Form 6251 on any device using airSlate SignNow's Android or iOS applications and streamline any document-related procedure today.

The easiest method to alter and eSign Form 6251 without stress

- Find Form 6251 and click on Get Form to begin.

- Use the tools we offer to complete your form.

- Emphasize pertinent sections of the documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature with the Sign tool, which takes mere seconds and has the same legal validity as a conventional wet ink signature.

- Review all details and click on the Done button to save your changes.

- Choose how you wish to send your form, whether via email, SMS, or invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searches, or mistakes that require reprinting new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Alter and eSign Form 6251 and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the f6251 form 6251 department of the treasury internal revenue

How to create an eSignature for your F6251 Form 6251 Department Of The Treasury Internal Revenue online

How to create an electronic signature for the F6251 Form 6251 Department Of The Treasury Internal Revenue in Chrome

How to create an eSignature for signing the F6251 Form 6251 Department Of The Treasury Internal Revenue in Gmail

How to create an electronic signature for the F6251 Form 6251 Department Of The Treasury Internal Revenue from your mobile device

How to generate an electronic signature for the F6251 Form 6251 Department Of The Treasury Internal Revenue on iOS devices

How to make an electronic signature for the F6251 Form 6251 Department Of The Treasury Internal Revenue on Android OS

People also ask

-

What is f6251 and how does it relate to airSlate SignNow?

The term f6251 refers to a specific feature within airSlate SignNow that enhances document management. This feature allows businesses to easily send, sign, and manage documents in a secure environment. Understanding f6251 can help users maximize their efficiency in document workflows.

-

How much does airSlate SignNow cost?

Pricing for airSlate SignNow varies based on the plan selected. The cost-effective solutions ensure that users can access features related to f6251 while staying within budget. Explore our pricing page to find a plan that includes the benefits of f6251.

-

What features does the f6251 provide in airSlate SignNow?

The f6251 feature of airSlate SignNow includes powerful eSigning capabilities, document templates, and real-time tracking. These features are designed to simplify the signing process and improve collaboration. Users can leverage f6251 to streamline their document workflows effectively.

-

How can f6251 assist with document security?

With f6251, airSlate SignNow prioritizes document security through robust encryption and compliance with industry standards. This ensures that all signed documents are secure and protected from unauthorized access. By utilizing f6251, users can trust that their sensitive information is safe.

-

What integrations does airSlate SignNow offer related to f6251?

airSlate SignNow offers seamless integrations with various platforms such as Google Drive, Salesforce, and Microsoft Teams, enhancing the functionality of f6251. These integrations allow users to manage their documents efficiently within their existing workflows. Discover the full list of integrations that complement f6251.

-

Can I use f6251 for team collaboration?

Absolutely! The f6251 feature in airSlate SignNow allows for team collaboration by enabling multiple users to collaborate on documents in real-time. Teams can quickly share, edit, and sign documents, making collaboration more efficient and productive. Utilize f6251 to enhance your team's workflow.

-

Is there a free trial available for airSlate SignNow?

Yes, airSlate SignNow offers a free trial that allows potential customers to explore the features of f6251 without any commitment. This trial period gives users a hands-on experience with our platform, including eSigning capabilities and document management. Sign up today to test out the benefits of f6251.

Get more for Form 6251

Find out other Form 6251

- Sign Maryland Non-Profit Business Plan Template Fast

- How To Sign Nevada Life Sciences LLC Operating Agreement

- Sign Montana Non-Profit Warranty Deed Mobile

- Sign Nebraska Non-Profit Residential Lease Agreement Easy

- Sign Nevada Non-Profit LLC Operating Agreement Free

- Sign Non-Profit Document New Mexico Mobile

- Sign Alaska Orthodontists Business Plan Template Free

- Sign North Carolina Life Sciences Purchase Order Template Computer

- Sign Ohio Non-Profit LLC Operating Agreement Secure

- Can I Sign Ohio Non-Profit LLC Operating Agreement

- Sign South Dakota Non-Profit Business Plan Template Myself

- Sign Rhode Island Non-Profit Residential Lease Agreement Computer

- Sign South Carolina Non-Profit Promissory Note Template Mobile

- Sign South Carolina Non-Profit Lease Agreement Template Online

- Sign Oregon Life Sciences LLC Operating Agreement Online

- Sign Texas Non-Profit LLC Operating Agreement Online

- Can I Sign Colorado Orthodontists Month To Month Lease

- How Do I Sign Utah Non-Profit Warranty Deed

- Help Me With Sign Colorado Orthodontists Purchase Order Template

- Sign Virginia Non-Profit Living Will Fast