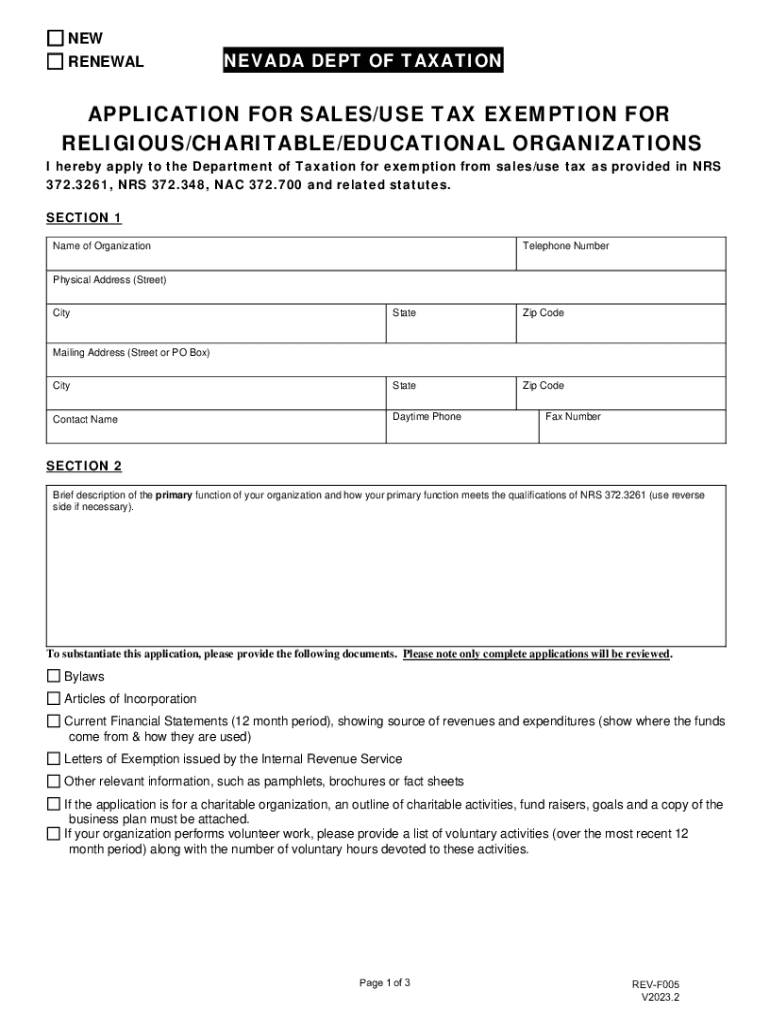

Sales Tax & Use Tax State of Nevada Form

Understanding Sales Tax and Use Tax in Nevada

The sales tax in Nevada is a tax imposed on the sale of goods and services, while the use tax applies to items purchased outside of Nevada but used within the state. Both taxes are critical for state revenue and are governed by specific regulations. The state sales tax rate is generally six and eight-tenths percent, but local jurisdictions may impose additional taxes, resulting in varying rates across the state. Understanding these taxes is essential for businesses and individuals to ensure compliance and avoid penalties.

Eligibility Criteria for Nevada Tax Exemption

To qualify for a Nevada tax exemption, applicants must meet specific criteria. Generally, organizations that are non-profit or engaged in certain types of activities, such as educational or charitable purposes, may be eligible. Additionally, businesses that purchase goods for resale may also qualify. It is important for applicants to review the eligibility requirements outlined by the Nevada Department of Taxation to ensure they meet all necessary conditions before applying.

Steps to Complete the Nevada Tax Exemption Application

Completing the Nevada tax exemption application involves several key steps:

- Gather required documentation, including proof of eligibility, such as a 501(c)(3) status for non-profits.

- Fill out the Nevada tax exemption form accurately, ensuring all information is complete.

- Submit the application either online or via mail, depending on your preference and the instructions provided.

- Await confirmation from the Nevada Department of Taxation regarding the status of your application.

Following these steps carefully can help streamline the application process and reduce the likelihood of delays.

Required Documents for the Nevada Tax Exemption

When applying for a Nevada tax exemption, certain documents are typically required. These may include:

- A completed Nevada tax exemption form.

- Proof of non-profit status, such as IRS determination letters.

- Financial statements or organizational bylaws that support your application.

- Any additional documentation as specified by the Nevada Department of Taxation.

Providing complete and accurate documentation is crucial for a successful application.

Form Submission Methods for Nevada Tax Exemption

Applicants can submit their Nevada tax exemption forms through various methods. The options typically include:

- Online submission via the Nevada Department of Taxation's website.

- Mailing the completed form to the designated address provided in the application instructions.

- In-person submission at local tax offices, if applicable.

Choosing the right submission method can depend on individual preferences and the urgency of the application.

Key Elements of the Nevada Tax Exemption Form

The Nevada tax exemption form contains several key elements that applicants must complete. These include:

- Identification of the applicant, including name, address, and contact information.

- Details about the organization or business, including type and purpose.

- Specifics regarding the exemption being requested and the applicable tax type.

- Signature of the authorized representative certifying the accuracy of the information provided.

Ensuring all key elements are accurately filled out is essential for the processing of the application.

Quick guide on how to complete sales tax amp use tax state of nevada

Finish Sales Tax & Use Tax State Of Nevada effortlessly on any gadget

Digital document management has become favored by companies and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed documents, as you can access the correct format and securely archive it online. airSlate SignNow equips you with all the resources necessary to generate, modify, and eSign your documents quickly and without delays. Manage Sales Tax & Use Tax State Of Nevada across any device with airSlate SignNow Android or iOS applications and streamline any document-related process today.

The simplest way to modify and eSign Sales Tax & Use Tax State Of Nevada with ease

- Locate Sales Tax & Use Tax State Of Nevada and click on Get Form to begin.

- Employ the tools we provide to complete your document.

- Select pertinent sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign feature, which takes moments and holds the same legal validity as a customary wet ink signature.

- Review the details and then click the Done button to save your modifications.

- Decide how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management requirements in just a few clicks from your preferred device. Edit and eSign Sales Tax & Use Tax State Of Nevada and guarantee excellent communication at every point of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the sales tax amp use tax state of nevada

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the nv tax exemption and how does it apply to my business?

The nv tax exemption refers to specific tax benefits available to eligible businesses in Nevada. By understanding the nv tax exemption, you can potentially reduce your tax liabilities, allowing you to allocate more resources to your business operations. It's essential to consult with a tax professional to determine your eligibility.

-

How can airSlate SignNow help with the nv tax exemption process?

airSlate SignNow streamlines the documentation process required for applying for the nv tax exemption. With our eSigning capabilities, you can quickly send, sign, and manage documents related to your tax exemption application. This efficiency can save you time and ensure that your paperwork is handled correctly.

-

Are there any costs associated with using airSlate SignNow for nv tax exemption documentation?

While airSlate SignNow offers various pricing plans, the cost is generally outweighed by the benefits of efficient document management for the nv tax exemption process. Our plans are designed to be cost-effective, ensuring that you can manage your documentation without breaking the bank. You can choose a plan that fits your business needs and budget.

-

What features does airSlate SignNow offer that support the nv tax exemption application?

airSlate SignNow provides features such as customizable templates, secure eSigning, and document tracking, all of which are beneficial for the nv tax exemption application. These features ensure that your documents are completed accurately and submitted on time. Additionally, our user-friendly interface makes it easy for anyone to navigate the process.

-

Can I integrate airSlate SignNow with other tools for managing nv tax exemption documents?

Yes, airSlate SignNow offers integrations with various tools and platforms that can enhance your workflow for managing nv tax exemption documents. Whether you use CRM systems, cloud storage, or accounting software, our integrations help streamline your processes. This connectivity ensures that all your documents are in one place, making it easier to manage your tax exemption needs.

-

What are the benefits of using airSlate SignNow for nv tax exemption documentation?

Using airSlate SignNow for nv tax exemption documentation provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform allows you to manage all your documents digitally, minimizing the risk of errors and delays. This can lead to a smoother application process for your nv tax exemption.

-

Is airSlate SignNow compliant with regulations related to nv tax exemption?

Yes, airSlate SignNow is designed to comply with relevant regulations, ensuring that your documentation for the nv tax exemption is handled securely and legally. We prioritize data security and compliance, giving you peace of mind as you manage sensitive information. Our platform is regularly updated to meet changing legal requirements.

Get more for Sales Tax & Use Tax State Of Nevada

- Liability injuries form

- Sale condominium unit form

- Instruction to jury regarding effect of conversion of part of chattel form

- Covenant agreement form

- Instruction to jury that refusal to deliver goods after demand and tender of freight and storage charges can constitute form

- Instruction to jury as to when demand is not necessary in constituting conversion form

- Lease renew form

- Letter for transportation form

Find out other Sales Tax & Use Tax State Of Nevada

- eSignature Kentucky Lodger Agreement Template Online

- eSignature North Carolina Lodger Agreement Template Myself

- eSignature Alabama Storage Rental Agreement Free

- eSignature Oregon Housekeeping Contract Computer

- eSignature Montana Home Loan Application Online

- eSignature New Hampshire Home Loan Application Online

- eSignature Minnesota Mortgage Quote Request Simple

- eSignature New Jersey Mortgage Quote Request Online

- Can I eSignature Kentucky Temporary Employment Contract Template

- eSignature Minnesota Email Cover Letter Template Fast

- How To eSignature New York Job Applicant Rejection Letter

- How Do I eSignature Kentucky Executive Summary Template

- eSignature Hawaii CV Form Template Mobile

- eSignature Nevada CV Form Template Online

- eSignature Delaware Software Development Proposal Template Now

- eSignature Kentucky Product Development Agreement Simple

- eSignature Georgia Mobile App Design Proposal Template Myself

- eSignature Indiana Mobile App Design Proposal Template Now

- eSignature Utah Mobile App Design Proposal Template Now

- eSignature Kentucky Intellectual Property Sale Agreement Online