Arizona A4 Form

What is the Arizona A4

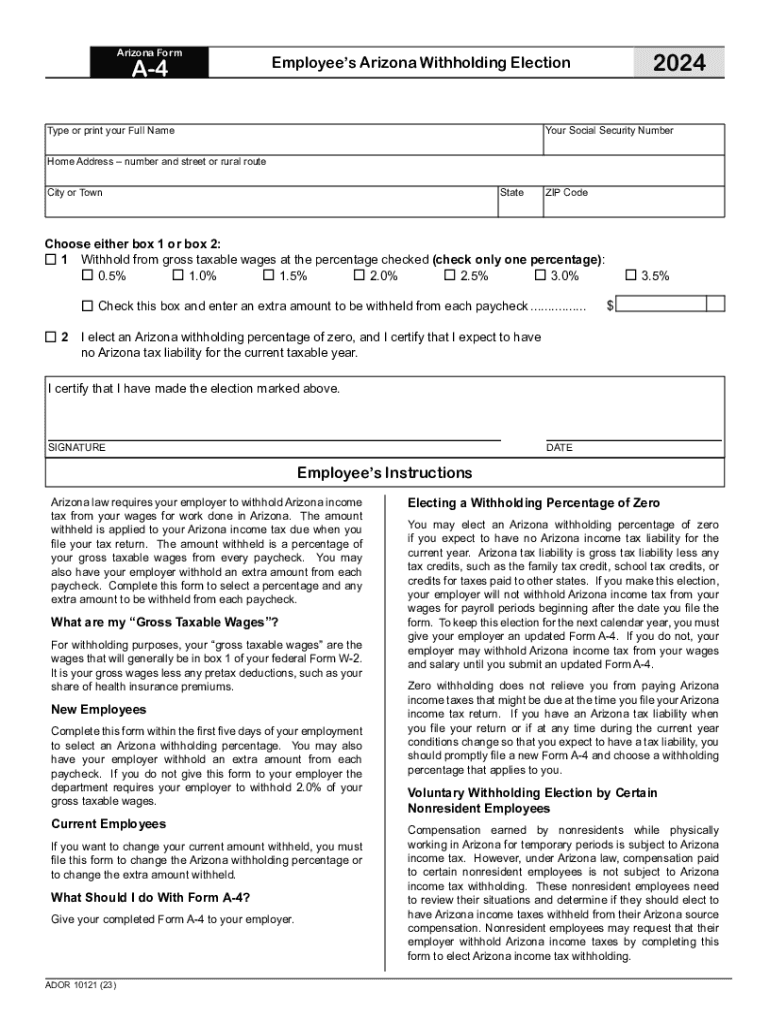

The Arizona A4 form, also known as the Arizona State Withholding Form, is a crucial document used by employers and employees in Arizona to determine the appropriate amount of state income tax to withhold from an employee's paycheck. This form is essential for ensuring compliance with Arizona tax laws and helps employees manage their tax obligations accurately. The A4 form captures personal information, including filing status and exemptions, which influence the withholding calculations.

How to use the Arizona A4

To use the Arizona A4 form effectively, employees should first complete the form by providing their personal details, including name, address, and Social Security number. Next, they must select their filing status and indicate any allowances or additional amounts they wish to withhold. Once completed, the form should be submitted to the employer, who will use the information to calculate the appropriate withholding amount from the employee's wages. It is advisable for employees to review their withholding annually or whenever there is a significant change in their financial situation.

Steps to complete the Arizona A4

Completing the Arizona A4 form involves several straightforward steps:

- Download the Arizona A4 form from a reliable source.

- Fill in your personal information, including your name, address, and Social Security number.

- Select your filing status: single, married, or head of household.

- Indicate the number of allowances you are claiming.

- Specify any additional withholding amounts if desired.

- Sign and date the form to validate your submission.

- Submit the completed form to your employer for processing.

Legal use of the Arizona A4

The Arizona A4 form is legally required for employers to ensure they withhold the correct amount of state income tax from employees' wages. Employers must keep this form on file for their records and must comply with Arizona tax regulations. Employees have the right to complete and submit this form to adjust their withholding as their personal or financial situations change. Failure to comply with withholding requirements can lead to penalties for both employers and employees.

Key elements of the Arizona A4

Several key elements are essential when filling out the Arizona A4 form:

- Personal Information: This includes your name, address, and Social Security number.

- Filing Status: Choose between single, married, or head of household.

- Allowances: Indicate the number of allowances you are claiming, which affects your withholding amount.

- Additional Withholding: Optionally specify any extra amount you wish to withhold from your paychecks.

- Signature: Your signature confirms the accuracy of the information provided.

Form Submission Methods

The Arizona A4 form can be submitted through various methods, depending on the employer's preferences:

- In-Person: Employees can hand the completed form directly to their employer's HR or payroll department.

- Mail: Some employers may allow employees to mail the completed form to their office.

- Digital Submission: If the employer supports electronic forms, employees may be able to submit the A4 online through a secure portal.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the arizona a4

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is airSlate SignNow and how does it work in Arizona from?

airSlate SignNow is a powerful eSignature solution that allows businesses in Arizona from to send and sign documents electronically. It streamlines the signing process, making it faster and more efficient. Users can create, send, and manage documents from anywhere, ensuring that businesses in Arizona from can operate smoothly.

-

What are the pricing options for airSlate SignNow in Arizona from?

airSlate SignNow offers flexible pricing plans tailored for businesses in Arizona from. Whether you are a small startup or a large enterprise, there is a plan that fits your needs. Each plan provides access to essential features, ensuring that businesses in Arizona from can choose a cost-effective solution.

-

What features does airSlate SignNow offer for users in Arizona from?

airSlate SignNow includes a variety of features designed to enhance document management for users in Arizona from. Key features include customizable templates, real-time tracking, and secure cloud storage. These tools help businesses in Arizona from streamline their workflows and improve efficiency.

-

How can airSlate SignNow benefit businesses in Arizona from?

Businesses in Arizona from can benefit from airSlate SignNow by reducing the time and costs associated with traditional document signing. The platform enhances productivity by allowing users to sign documents anytime, anywhere. This flexibility is crucial for businesses in Arizona from looking to stay competitive.

-

Is airSlate SignNow compliant with legal standards in Arizona from?

Yes, airSlate SignNow is compliant with all relevant legal standards for eSignatures in Arizona from. This ensures that documents signed through the platform are legally binding and secure. Businesses in Arizona from can trust that their electronic transactions meet all necessary regulations.

-

What integrations does airSlate SignNow offer for users in Arizona from?

airSlate SignNow integrates seamlessly with various applications that businesses in Arizona from may already be using. Popular integrations include CRM systems, cloud storage services, and productivity tools. These integrations help streamline workflows and enhance overall efficiency for users in Arizona from.

-

Can I try airSlate SignNow for free in Arizona from?

Yes, airSlate SignNow offers a free trial for users in Arizona from, allowing them to explore the platform's features without any commitment. This trial period is an excellent opportunity for businesses in Arizona from to assess how the solution can meet their document signing needs. Sign up today to experience the benefits firsthand.

Get more for Arizona A4

Find out other Arizona A4

- eSignature South Carolina Charity Confidentiality Agreement Easy

- Can I eSignature Tennessee Car Dealer Limited Power Of Attorney

- eSignature Utah Car Dealer Cease And Desist Letter Secure

- eSignature Virginia Car Dealer Cease And Desist Letter Online

- eSignature Virginia Car Dealer Lease Termination Letter Easy

- eSignature Alabama Construction NDA Easy

- How To eSignature Wisconsin Car Dealer Quitclaim Deed

- eSignature California Construction Contract Secure

- eSignature Tennessee Business Operations Moving Checklist Easy

- eSignature Georgia Construction Residential Lease Agreement Easy

- eSignature Kentucky Construction Letter Of Intent Free

- eSignature Kentucky Construction Cease And Desist Letter Easy

- eSignature Business Operations Document Washington Now

- How To eSignature Maine Construction Confidentiality Agreement

- eSignature Maine Construction Quitclaim Deed Secure

- eSignature Louisiana Construction Affidavit Of Heirship Simple

- eSignature Minnesota Construction Last Will And Testament Online

- eSignature Minnesota Construction Last Will And Testament Easy

- How Do I eSignature Montana Construction Claim

- eSignature Construction PPT New Jersey Later