4 Sp Form

What is the 2019 Form 4 SP?

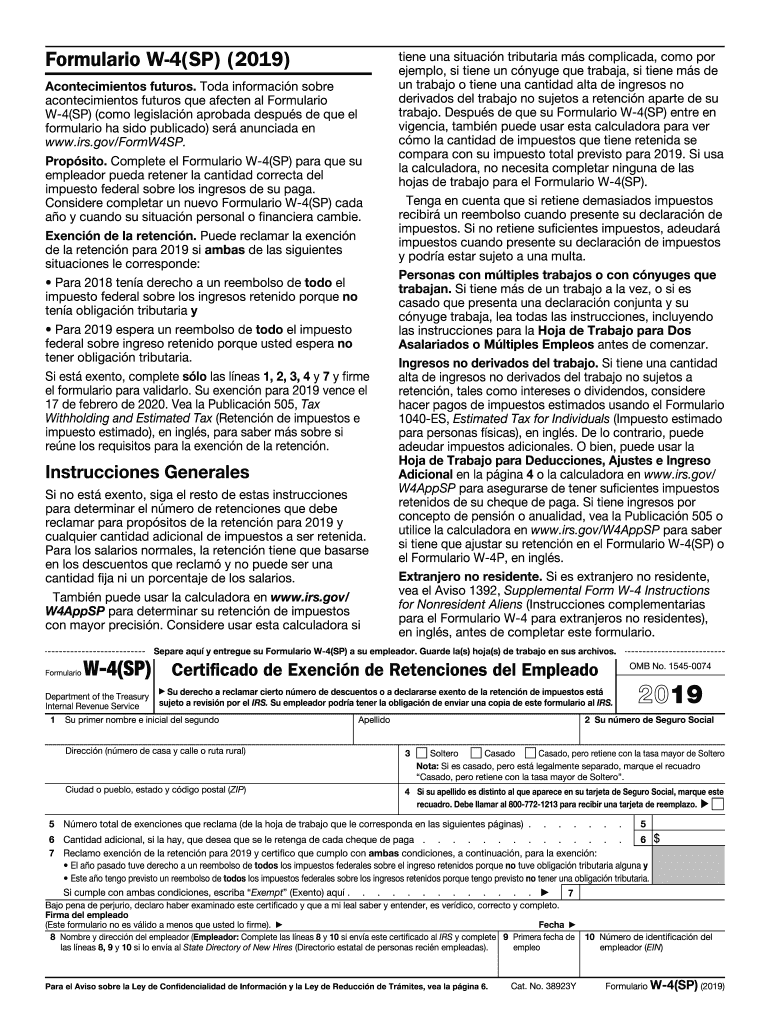

The 2019 Form 4 SP, also known as the "2019 Exención Form," is a tax document used by individuals in the United States to claim exemption from withholding on their income. This form is particularly relevant for those who expect to owe no federal income tax for the year or had no tax liability in the previous year. Understanding the purpose and proper use of the 2019 Form 4 SP is essential for ensuring compliance with IRS regulations.

Steps to Complete the 2019 Form 4 SP

Completing the 2019 Form 4 SP requires careful attention to detail. Here are the steps to follow:

- Begin by entering your personal information, including your name, address, and Social Security number.

- Indicate your filing status and the number of allowances you are claiming.

- Clearly state your eligibility for exemption by checking the appropriate box.

- Sign and date the form to validate your submission.

It is important to ensure that all information is accurate to avoid any issues with the IRS.

IRS Guidelines for the 2019 Form 4 SP

The IRS provides specific guidelines for using the 2019 Form 4 SP. To qualify for exemption, taxpayers must meet certain criteria, such as having no tax liability in the previous year and expecting none for the current year. Additionally, the IRS requires that the form be submitted to your employer to adjust your withholding appropriately. Familiarizing yourself with these guidelines can help prevent errors and ensure compliance.

Legal Use of the 2019 Form 4 SP

The 2019 Form 4 SP is legally recognized as a valid document for claiming exemption from withholding. To ensure that your use of this form is compliant with tax laws, it is crucial to understand the legal implications of submitting it. This includes being truthful about your tax situation and maintaining records that support your claim. Misuse of the form can lead to penalties or audits by the IRS.

Filing Deadlines for the 2019 Form 4 SP

Filing deadlines for the 2019 Form 4 SP are critical to ensure that your exemption is recognized in a timely manner. Typically, the form should be submitted to your employer by the end of the calendar year to affect your withholding for that year. It is advisable to check with the IRS or your tax professional for specific deadlines related to your situation, as they may vary based on individual circumstances.

Examples of Using the 2019 Form 4 SP

Understanding practical scenarios can clarify how the 2019 Form 4 SP is utilized. For instance, a recent college graduate who has started their first job and expects to earn below the taxable threshold may use this form to avoid having federal taxes withheld. Similarly, individuals who had no tax liability in the previous year, such as retirees with minimal income, can also benefit from submitting the 2019 Form 4 SP to ensure they do not have unnecessary taxes withheld from their paychecks.

Quick guide on how to complete 2019 form w 4sp employees withholding allowance certificate spanish version

Execute 4 Sp effortlessly on any device

Online document management has gained popularity among businesses and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed paperwork, allowing you to find the correct form and securely keep it online. airSlate SignNow provides you with all the tools necessary to create, edit, and eSign your documents swiftly without delays. Handle 4 Sp on any device using airSlate SignNow's Android or iOS applications and streamline any document-based process today.

The most efficient way to edit and eSign 4 Sp with ease

- Obtain 4 Sp and click on Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize pertinent sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign feature, which takes seconds and carries the same legal significance as a conventional wet ink signature.

- Review all the details and click the Done button to preserve your changes.

- Select your preferred method of delivering your form, whether by email, SMS, invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you choose. Modify and eSign 4 Sp and ensure excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 2019 form w 4sp employees withholding allowance certificate spanish version

How to make an electronic signature for your 2019 Form W 4sp Employees Withholding Allowance Certificate Spanish Version in the online mode

How to create an eSignature for your 2019 Form W 4sp Employees Withholding Allowance Certificate Spanish Version in Chrome

How to make an electronic signature for signing the 2019 Form W 4sp Employees Withholding Allowance Certificate Spanish Version in Gmail

How to generate an electronic signature for the 2019 Form W 4sp Employees Withholding Allowance Certificate Spanish Version right from your mobile device

How to generate an electronic signature for the 2019 Form W 4sp Employees Withholding Allowance Certificate Spanish Version on iOS

How to make an eSignature for the 2019 Form W 4sp Employees Withholding Allowance Certificate Spanish Version on Android

People also ask

-

What is the 2019 W-4 Spanish form and why is it important?

The 2019 W-4 Spanish form is the IRS's tax withholding form translated into Spanish for Spanish-speaking employees. It allows individuals to accurately provide their withholding preferences to ensure the right amount of federal income tax is withheld from their paychecks. Understanding this form is essential for proper tax compliance and financial planning.

-

How can airSlate SignNow help me with the 2019 W-4 Spanish form?

airSlate SignNow allows you to electronically sign and send the 2019 W-4 Spanish form seamlessly. With our intuitive platform, you can ensure that your documents are completed quickly and securely, eliminating the hassle of paper forms and manual signatures. Our solution is designed to streamline your onboarding process while ensuring compliance.

-

Is there a cost associated with using airSlate SignNow for the 2019 W-4 Spanish form?

Yes, airSlate SignNow offers flexible pricing plans tailored to different business needs. Our cost-effective solution allows you to manage documents like the 2019 W-4 Spanish form efficiently without incurring excessive expenses. We also provide a free trial so you can explore our features before committing.

-

What features does airSlate SignNow offer for managing the 2019 W-4 Spanish form?

With airSlate SignNow, you can access features such as customizable templates, electronic signatures, and document tracking specifically for the 2019 W-4 Spanish form. Our platform ensures that each step of the document management process is smooth and user-friendly, ultimately aiding in better organizational efficiency.

-

Can I integrate airSlate SignNow with other software I use for HR?

Absolutely! airSlate SignNow integrates seamlessly with various HR software and applications. By connecting your existing systems with airSlate SignNow, you can easily manage documents like the 2019 W-4 Spanish form without switching platforms, improving your workflow and saving valuable time.

-

What benefits does airSlate SignNow provide for businesses using the 2019 W-4 Spanish form?

Using airSlate SignNow not only simplifies the completion of the 2019 W-4 Spanish form but also enhances security, accelerates the signing process, and minimizes paperwork. This results in streamlined HR operations, leading to reduced administrative overhead and an improved employee experience.

-

How secure is the information when using airSlate SignNow for the 2019 W-4 Spanish form?

airSlate SignNow prioritizes data security with advanced encryption and compliance with regulations, ensuring that your documents, including the 2019 W-4 Spanish form, are protected. We use secure servers to store your information and regularly update our security protocols to safeguard your sensitive data.

Get more for 4 Sp

Find out other 4 Sp

- How Do I Electronic signature Nebraska Legal Form

- Help Me With Electronic signature Nevada Legal Word

- How Do I Electronic signature Nevada Life Sciences PDF

- How Can I Electronic signature New York Life Sciences Word

- How Can I Electronic signature North Dakota Legal Word

- How To Electronic signature Ohio Legal PDF

- How To Electronic signature Ohio Legal Document

- How To Electronic signature Oklahoma Legal Document

- How To Electronic signature Oregon Legal Document

- Can I Electronic signature South Carolina Life Sciences PDF

- How Can I Electronic signature Rhode Island Legal Document

- Can I Electronic signature South Carolina Legal Presentation

- How Can I Electronic signature Wyoming Life Sciences Word

- How To Electronic signature Utah Legal PDF

- How Do I Electronic signature Arkansas Real Estate Word

- How Do I Electronic signature Colorado Real Estate Document

- Help Me With Electronic signature Wisconsin Legal Presentation

- Can I Electronic signature Hawaii Real Estate PPT

- How Can I Electronic signature Illinois Real Estate Document

- How Do I Electronic signature Indiana Real Estate Presentation