Form FT 943 Quarterly Inventory Report by Retail Service Stations and Fixed Base Operators Revised 524

What is the Form FT 943 Quarterly Inventory Report

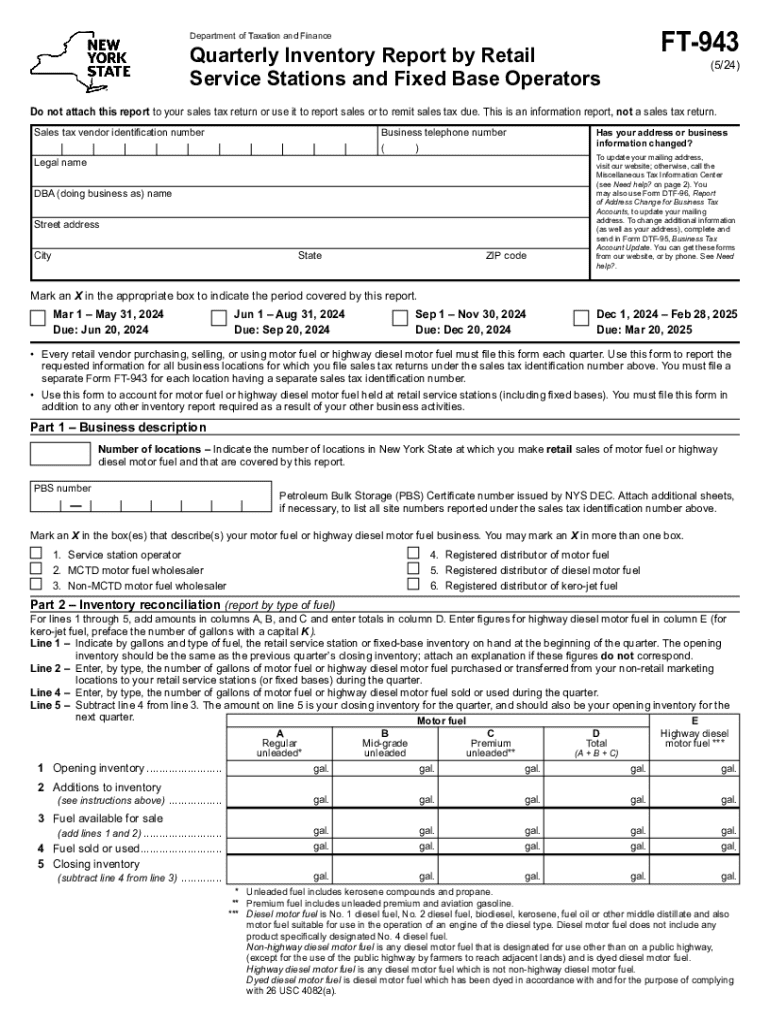

The FT 943 form, officially titled the Quarterly Inventory Report by Retail Service Stations and Fixed Base Operators, is a document required by the New York State Department of Taxation and Finance. This form is specifically designed for businesses involved in retail sales of petroleum products and fixed base operations, such as airports. It serves to report the inventory levels of petroleum products at the end of each quarter, ensuring compliance with state regulations and accurate tax reporting.

Steps to Complete the Form FT 943

Completing the FT 943 form involves several key steps to ensure accuracy and compliance. First, gather all necessary inventory data for the reporting period, including the beginning and ending inventory levels of petroleum products. Next, accurately fill out each section of the form, providing detailed information about the types and quantities of products sold. After completing the form, review all entries for accuracy before submitting it. It is crucial to ensure that all calculations are correct to avoid potential penalties.

Legal Use of the Form FT 943

The FT 943 form is legally mandated for businesses that sell petroleum products in New York State. Proper use of this form helps businesses comply with state tax laws and regulations. Failure to submit the FT 943 can result in penalties, including fines and increased scrutiny from tax authorities. Therefore, it is essential for businesses to understand their legal obligations regarding this form to avoid any compliance issues.

Filing Deadlines for the FT 943

Filing deadlines for the FT 943 are typically set at the end of each quarter. Businesses must submit the form by the last day of the month following the end of the quarter. For example, the deadline for the first quarter (January to March) is April 30. Adhering to these deadlines is crucial for maintaining compliance and avoiding penalties associated with late submissions.

Key Elements of the Form FT 943

The FT 943 form includes several key elements that must be accurately reported. These elements typically consist of the business's name, address, and identification number, as well as detailed inventory information. Businesses must report the beginning and ending inventory, sales during the quarter, and any adjustments made. Each section is designed to provide a comprehensive overview of the business's inventory status, which is essential for tax calculations.

Obtaining the Form FT 943

Businesses can obtain the FT 943 form from the New York State Department of Taxation and Finance website or by contacting their local tax office. The form is available in both digital and printable formats, allowing businesses to choose the method that best suits their needs. It is advisable to ensure that the most current version of the form is used to comply with any updates in regulations or requirements.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form ft 943 quarterly inventory report by retail service stations and fixed base operators revised 524

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is ft 943 and how does it relate to airSlate SignNow?

The ft 943 is a specific form used for various business transactions. airSlate SignNow allows users to easily eSign and send ft 943 documents, streamlining the process and ensuring compliance. With our platform, you can manage your ft 943 forms efficiently and securely.

-

How much does it cost to use airSlate SignNow for ft 943 documents?

airSlate SignNow offers competitive pricing plans that cater to different business needs. You can choose a plan that fits your budget while ensuring you can eSign and manage ft 943 documents effectively. Our pricing is transparent, with no hidden fees, making it a cost-effective solution.

-

What features does airSlate SignNow offer for managing ft 943 forms?

airSlate SignNow provides a range of features for managing ft 943 forms, including customizable templates, secure eSigning, and real-time tracking. These features enhance the efficiency of handling ft 943 documents, allowing for quick approvals and reduced turnaround times. Our user-friendly interface makes it easy to navigate these features.

-

Can I integrate airSlate SignNow with other tools for ft 943 processing?

Yes, airSlate SignNow offers seamless integrations with various business tools and applications. This allows you to automate workflows involving ft 943 documents and enhance productivity. Whether you use CRM systems or cloud storage solutions, our integrations ensure a smooth experience.

-

What are the benefits of using airSlate SignNow for ft 943 eSigning?

Using airSlate SignNow for ft 943 eSigning provides numerous benefits, including increased efficiency, reduced paper usage, and enhanced security. Our platform ensures that your ft 943 documents are signed quickly and securely, helping you save time and resources. Additionally, you can access your documents anytime, anywhere.

-

Is airSlate SignNow compliant with regulations for ft 943 documents?

Absolutely! airSlate SignNow is designed to comply with industry regulations, ensuring that your ft 943 documents are handled securely and legally. Our platform adheres to eSignature laws, providing you with peace of mind when managing sensitive information. Compliance is a top priority for us.

-

How can I get started with airSlate SignNow for ft 943 documents?

Getting started with airSlate SignNow for ft 943 documents is simple. You can sign up for a free trial to explore our features and see how they can benefit your business. Once you're ready, choose a plan that suits your needs and start managing your ft 943 forms with ease.

Get more for Form FT 943 Quarterly Inventory Report By Retail Service Stations And Fixed Base Operators Revised 524

Find out other Form FT 943 Quarterly Inventory Report By Retail Service Stations And Fixed Base Operators Revised 524

- Sign Louisiana Stock Certificate Free

- Sign Maine Stock Certificate Simple

- Sign Oregon Stock Certificate Myself

- Sign Pennsylvania Stock Certificate Simple

- How Do I Sign South Carolina Stock Certificate

- Sign New Hampshire Terms of Use Agreement Easy

- Sign Wisconsin Terms of Use Agreement Secure

- Sign Alabama Affidavit of Identity Myself

- Sign Colorado Trademark Assignment Agreement Online

- Can I Sign Connecticut Affidavit of Identity

- Can I Sign Delaware Trademark Assignment Agreement

- How To Sign Missouri Affidavit of Identity

- Can I Sign Nebraska Affidavit of Identity

- Sign New York Affidavit of Identity Now

- How Can I Sign North Dakota Affidavit of Identity

- Sign Oklahoma Affidavit of Identity Myself

- Sign Texas Affidavit of Identity Online

- Sign Colorado Affidavit of Service Secure

- Sign Connecticut Affidavit of Service Free

- Sign Michigan Affidavit of Service Online