Arizona Withholding Tax Form

What is the Arizona Withholding Tax

The Arizona Withholding Tax is a tax that employers are required to withhold from employees' wages and remit to the state. This tax applies to various types of income, including salaries, wages, and bonuses. The purpose of the withholding tax is to ensure that individuals contribute to state revenue throughout the year, rather than paying a lump sum at tax time. Understanding this tax is essential for both employers and employees to ensure compliance with state regulations.

Steps to complete the Arizona Withholding Tax

Completing the Arizona Withholding Tax involves several steps to ensure accurate reporting and payment. Here are the key steps:

- Determine the employee's withholding allowances using the Arizona Form A-4.

- Calculate the amount to withhold based on the employee's wages and the applicable tax rates.

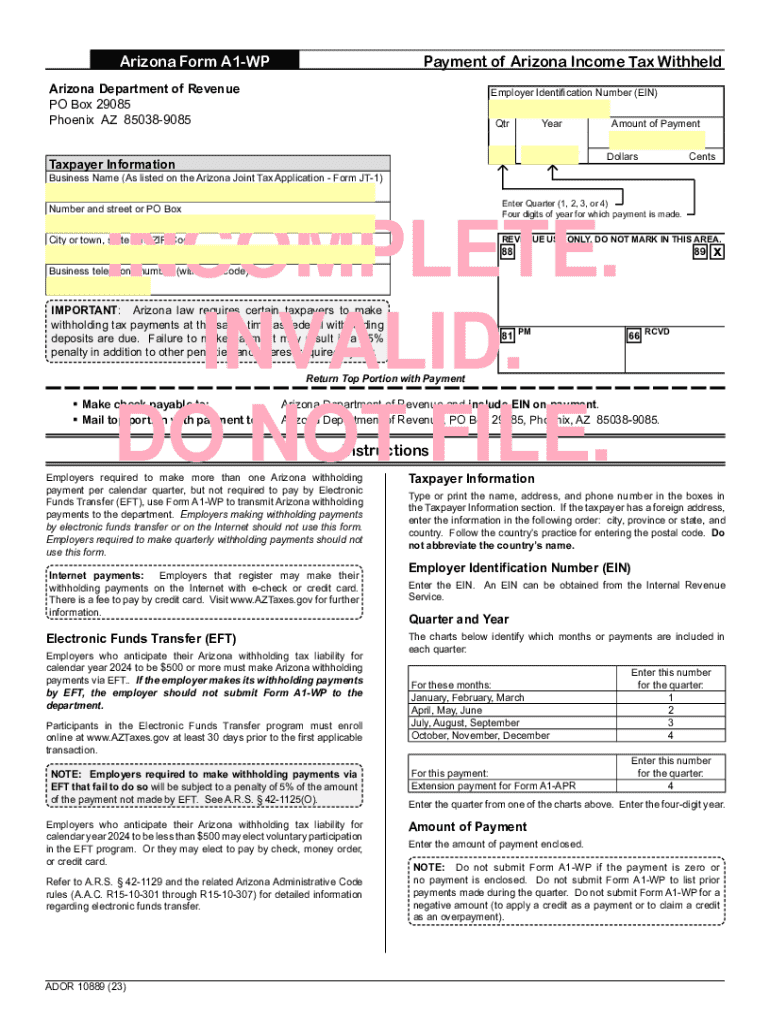

- Complete the Arizona A1 form, ensuring all required information is accurately filled out.

- Submit the completed form to the Arizona Department of Revenue, along with any withheld amounts.

- Keep records of all transactions for future reference and compliance checks.

Filing Deadlines / Important Dates

It is crucial to be aware of the filing deadlines associated with the Arizona Withholding Tax. Employers must remit withheld taxes on a regular schedule, typically monthly or quarterly, depending on the total amount withheld. The Arizona Department of Revenue provides specific due dates for these payments, and failure to meet these deadlines can result in penalties. Additionally, annual reconciliation must be completed by January 31 of the following year.

Required Documents

To accurately complete the Arizona Withholding Tax, certain documents are necessary. These include:

- Arizona Form A-4 to determine withholding allowances.

- The Arizona A1 form for reporting withholding tax.

- Wage and salary records for each employee.

- Any additional documentation required by the Arizona Department of Revenue.

Who Issues the Form

The Arizona A1 form is issued by the Arizona Department of Revenue. This state agency is responsible for administering tax laws and ensuring compliance among employers and employees. It provides the necessary forms and guidance for completing the Arizona Withholding Tax accurately.

Penalties for Non-Compliance

Employers who fail to comply with the Arizona Withholding Tax regulations may face penalties. These can include fines for late payments, interest on unpaid taxes, and potential legal action for continued non-compliance. It is essential for employers to understand their responsibilities and ensure timely and accurate submissions to avoid these consequences.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the arizona withholding tax 769995072

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Arizona A1 form and why is it important?

The Arizona A1 form is a crucial document used for various business and legal purposes in Arizona. It serves as a declaration of business activities and is essential for compliance with state regulations. Understanding the Arizona A1 form can help businesses avoid legal issues and streamline their operations.

-

How can airSlate SignNow help with the Arizona A1 form?

airSlate SignNow provides an efficient platform for businesses to create, send, and eSign the Arizona A1 form. With its user-friendly interface, you can easily customize the form and ensure that all necessary information is included. This simplifies the process and saves time for businesses needing to submit the Arizona A1 form.

-

What are the pricing options for using airSlate SignNow for the Arizona A1 form?

airSlate SignNow offers flexible pricing plans that cater to different business needs, making it cost-effective for handling the Arizona A1 form. You can choose from monthly or annual subscriptions, with options that scale based on the number of users and features required. This ensures that you only pay for what you need while efficiently managing the Arizona A1 form.

-

What features does airSlate SignNow offer for the Arizona A1 form?

airSlate SignNow includes features such as customizable templates, secure eSigning, and document tracking specifically for the Arizona A1 form. These features enhance the efficiency of document management and ensure that all signatures are legally binding. Additionally, the platform allows for easy collaboration among team members when preparing the Arizona A1 form.

-

Are there any integrations available for the Arizona A1 form with airSlate SignNow?

Yes, airSlate SignNow integrates seamlessly with various applications, making it easier to manage the Arizona A1 form alongside your existing tools. You can connect with popular platforms like Google Drive, Salesforce, and more. This integration capability enhances workflow efficiency and ensures that your Arizona A1 form is easily accessible.

-

What are the benefits of using airSlate SignNow for the Arizona A1 form?

Using airSlate SignNow for the Arizona A1 form offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. The platform allows for quick eSigning, which speeds up the approval process. Additionally, the secure storage of documents ensures that your Arizona A1 form is protected and easily retrievable.

-

Is airSlate SignNow compliant with Arizona state regulations for the A1 form?

Yes, airSlate SignNow is designed to comply with Arizona state regulations regarding the Arizona A1 form. The platform adheres to legal standards for electronic signatures, ensuring that your documents are valid and enforceable. This compliance gives businesses peace of mind when submitting the Arizona A1 form.

Get more for Arizona Withholding Tax

Find out other Arizona Withholding Tax

- eSignature Oregon Life Sciences Job Offer Myself

- eSignature Oregon Life Sciences Job Offer Fast

- eSignature Oregon Life Sciences Warranty Deed Myself

- eSignature Maryland Non-Profit Cease And Desist Letter Fast

- eSignature Pennsylvania Life Sciences Rental Lease Agreement Easy

- eSignature Washington Life Sciences Permission Slip Now

- eSignature West Virginia Life Sciences Quitclaim Deed Free

- Can I eSignature West Virginia Life Sciences Residential Lease Agreement

- eSignature New York Non-Profit LLC Operating Agreement Mobile

- How Can I eSignature Colorado Orthodontists LLC Operating Agreement

- eSignature North Carolina Non-Profit RFP Secure

- eSignature North Carolina Non-Profit Credit Memo Secure

- eSignature North Dakota Non-Profit Quitclaim Deed Later

- eSignature Florida Orthodontists Business Plan Template Easy

- eSignature Georgia Orthodontists RFP Secure

- eSignature Ohio Non-Profit LLC Operating Agreement Later

- eSignature Ohio Non-Profit LLC Operating Agreement Easy

- How Can I eSignature Ohio Lawers Lease Termination Letter

- Can I eSignature Ohio Lawers Lease Termination Letter

- Can I eSignature Oregon Non-Profit Last Will And Testament