AP 201 Sales Tax Application Form AP 201 Sales Tax Application Form

What is the AP 201 Sales Tax Application?

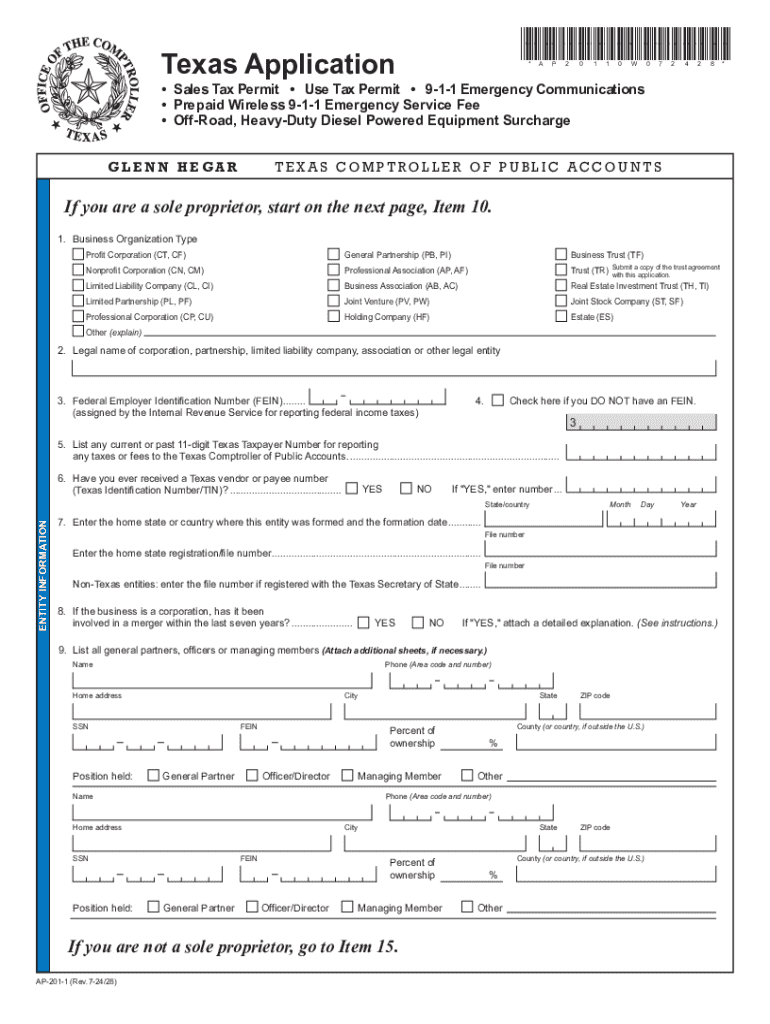

The AP 201 Sales Tax Application is a crucial form used by businesses in Texas to apply for a sales and use tax permit. This permit is necessary for any entity that intends to sell tangible personal property or taxable services in the state. The application gathers essential information about the business, including its name, address, and type of ownership, ensuring compliance with Texas tax regulations.

Steps to Complete the AP 201 Sales Tax Application

Completing the AP 201 Sales Tax Application involves several key steps:

- Gather Required Information: Collect details about your business, including ownership structure, physical location, and estimated sales.

- Fill Out the Form: Accurately complete all sections of the AP 201 form, ensuring that all information is up-to-date and correct.

- Review for Accuracy: Double-check the form for any errors or omissions that could delay processing.

- Submit the Application: Choose your preferred submission method, whether online, by mail, or in person.

How to Obtain the AP 201 Sales Tax Application

The AP 201 Sales Tax Application can be obtained through the Texas Comptroller's website. It is available for download in PDF format, allowing businesses to print and fill it out manually. Additionally, businesses can complete the application online through the Texas Comptroller's eSystems portal, which provides a user-friendly interface for submitting the form electronically.

Required Documents for the AP 201 Sales Tax Application

When applying for a sales tax permit using the AP 201 form, certain documents may be required to support your application. Commonly required documents include:

- Proof of business registration, such as a certificate of formation or partnership agreement.

- Identification documents for the business owner or responsible party.

- Any applicable licenses or permits related to your business activities.

Form Submission Methods

The AP 201 Sales Tax Application can be submitted through various methods, providing flexibility for businesses. These methods include:

- Online Submission: Use the Texas Comptroller's eSystems portal to complete and submit the application electronically.

- Mail: Send the completed form to the appropriate address provided on the form.

- In-Person: Visit a local Comptroller office to submit the application directly.

Eligibility Criteria for the AP 201 Sales Tax Application

To be eligible for the AP 201 Sales Tax Application, businesses must meet specific criteria, including:

- Operating a business that sells tangible personal property or taxable services in Texas.

- Providing accurate information about the business structure and ownership.

- Complying with all applicable state and local regulations.

Handy tips for filling out AP 201 Sales Tax Application Form AP 201 Sales Tax Application Form online

Quick steps to complete and e-sign AP 201 Sales Tax Application Form AP 201 Sales Tax Application Form online:

- Use Get Form or simply click on the template preview to open it in the editor.

- Start completing the fillable fields and carefully type in required information.

- Use the Cross or Check marks in the top toolbar to select your answers in the list boxes.

- Utilize the Circle icon for other Yes/No questions.

- Look through the document several times and make sure that all fields are completed with the correct information.

- Insert the current Date with the corresponding icon.

- Add a legally-binding e-signature. Go to Sign -> Add New Signature and select the option you prefer: type, draw, or upload an image of your handwritten signature and place it where you need it.

- Finish filling out the form with the Done button.

- Download your copy, save it to the cloud, print it, or share it right from the editor.

- Check the Help section and contact our Support team if you run into any troubles when using the editor.

We know how stressing filling out documents could be. Get access to a GDPR and HIPAA compliant platform for maximum straightforwardness. Use signNow to e-sign and share AP 201 Sales Tax Application Form AP 201 Sales Tax Application Form for e-signing.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ap 201 sales tax application form ap 201 sales tax application form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Texas Comptroller sales tax application?

The Texas Comptroller sales tax application is a tool designed to help businesses manage their sales tax obligations in Texas. It simplifies the process of calculating, collecting, and remitting sales tax, ensuring compliance with state regulations. By using this application, businesses can streamline their tax processes and reduce the risk of errors.

-

How does airSlate SignNow integrate with the Texas Comptroller sales tax application?

airSlate SignNow seamlessly integrates with the Texas Comptroller sales tax application, allowing users to eSign and send documents related to sales tax filings. This integration enhances efficiency by automating document workflows and ensuring that all necessary paperwork is completed accurately. Businesses can save time and improve compliance with this powerful combination.

-

What are the pricing options for the Texas Comptroller sales tax application?

Pricing for the Texas Comptroller sales tax application varies based on the features and level of service required. airSlate SignNow offers competitive pricing plans that cater to businesses of all sizes. By choosing the right plan, companies can access essential tools for managing their sales tax obligations effectively.

-

What features does the Texas Comptroller sales tax application offer?

The Texas Comptroller sales tax application includes features such as automated tax calculations, customizable reporting, and eSignature capabilities. These features help businesses manage their sales tax processes more efficiently and ensure compliance with Texas tax laws. Additionally, the application provides real-time updates to keep users informed of any changes in tax regulations.

-

What are the benefits of using the Texas Comptroller sales tax application?

Using the Texas Comptroller sales tax application offers numerous benefits, including improved accuracy in tax calculations and reduced administrative burden. Businesses can save time and resources by automating their sales tax processes. Furthermore, the application helps ensure compliance with state regulations, minimizing the risk of penalties.

-

Can small businesses benefit from the Texas Comptroller sales tax application?

Absolutely! Small businesses can greatly benefit from the Texas Comptroller sales tax application by simplifying their sales tax management. The application provides tools that are easy to use and cost-effective, making it accessible for businesses with limited resources. By leveraging this application, small businesses can focus more on growth and less on tax compliance.

-

Is training available for using the Texas Comptroller sales tax application?

Yes, airSlate SignNow provides training resources for users of the Texas Comptroller sales tax application. These resources include tutorials, webinars, and customer support to help users understand how to maximize the application's features. With proper training, businesses can effectively manage their sales tax obligations and improve their overall efficiency.

Get more for AP 201 Sales Tax Application Form AP 201 Sales Tax Application Form

Find out other AP 201 Sales Tax Application Form AP 201 Sales Tax Application Form

- eSignature Arkansas Legal Affidavit Of Heirship Fast

- Help Me With eSignature Colorado Legal Cease And Desist Letter

- How To eSignature Connecticut Legal LLC Operating Agreement

- eSignature Connecticut Legal Residential Lease Agreement Mobile

- eSignature West Virginia High Tech Lease Agreement Template Myself

- How To eSignature Delaware Legal Residential Lease Agreement

- eSignature Florida Legal Letter Of Intent Easy

- Can I eSignature Wyoming High Tech Residential Lease Agreement

- eSignature Connecticut Lawers Promissory Note Template Safe

- eSignature Hawaii Legal Separation Agreement Now

- How To eSignature Indiana Legal Lease Agreement

- eSignature Kansas Legal Separation Agreement Online

- eSignature Georgia Lawers Cease And Desist Letter Now

- eSignature Maryland Legal Quitclaim Deed Free

- eSignature Maryland Legal Lease Agreement Template Simple

- eSignature North Carolina Legal Cease And Desist Letter Safe

- How Can I eSignature Ohio Legal Stock Certificate

- How To eSignature Pennsylvania Legal Cease And Desist Letter

- eSignature Oregon Legal Lease Agreement Template Later

- Can I eSignature Oregon Legal Limited Power Of Attorney