M1PR, Property Tax Refund Return Form

What is the M1PR, Property Tax Refund Return

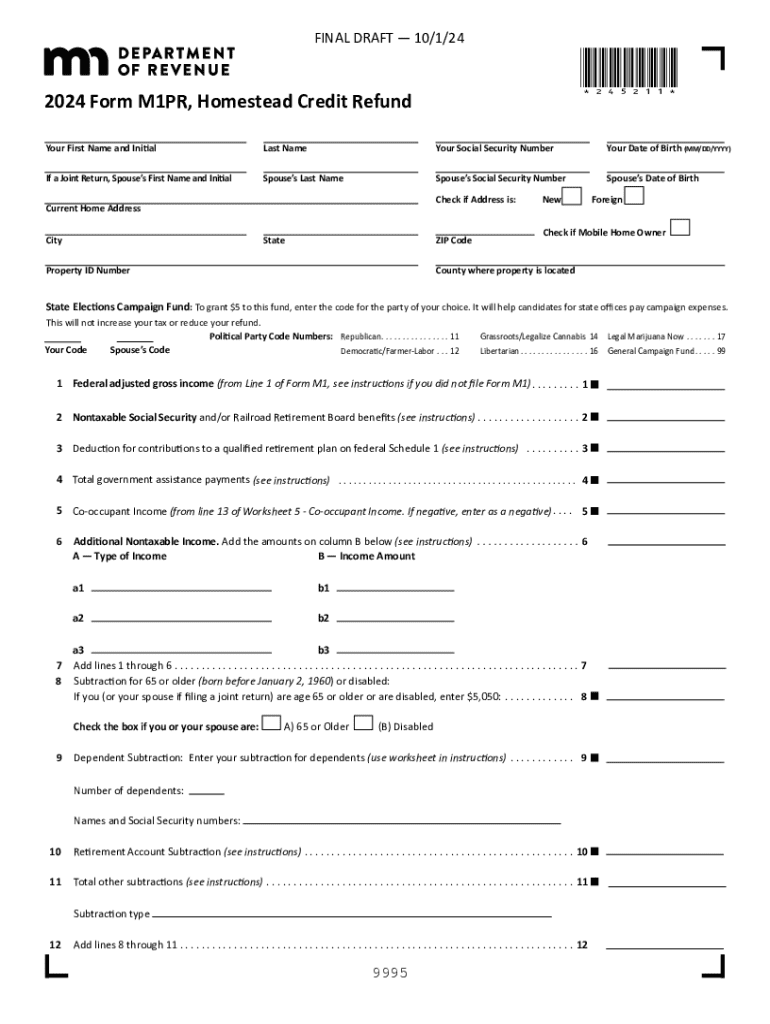

The M1PR, or Minnesota Property Tax Refund Return, is a form used by renters and homeowners in Minnesota to apply for property tax refunds. This form is specifically designed for individuals who pay rent and meet certain eligibility criteria. The refund is aimed at providing financial relief to low- and moderate-income residents by reimbursing a portion of the property taxes paid indirectly through rent. Understanding the M1PR is essential for renters seeking to maximize their tax benefits.

Eligibility Criteria

To qualify for the renter rebate in Minnesota, applicants must meet specific eligibility requirements. These include:

- Being a resident of Minnesota for at least half of the year.

- Renting an apartment or home during the tax year.

- Meeting income limits set by the Minnesota Department of Revenue.

- Not owning property or having a property tax refund claim filed in the same year.

It is important to review these criteria carefully to ensure eligibility before completing the M1PR form.

Steps to Complete the M1PR, Property Tax Refund Return

Filling out the M1PR form involves several steps to ensure accurate completion. Here is a straightforward guide:

- Gather necessary documents, including your rental agreement and income statements.

- Obtain the M1PR form from the Minnesota Department of Revenue website or local offices.

- Fill out the form with your personal information, including your name, address, and Social Security number.

- Provide details about your rental payments and any other income.

- Review the form for accuracy, ensuring all information is complete.

- Submit the form either online, by mail, or in person, depending on your preference.

Following these steps can help streamline the application process and increase the likelihood of receiving a refund.

Required Documents

When completing the M1PR form, specific documents are necessary to support your application. These include:

- A copy of your lease or rental agreement.

- Proof of income, such as W-2 forms or pay stubs.

- Any additional documentation that verifies your residency and rental payments.

Having these documents ready can facilitate a smoother application process and ensure that all required information is submitted.

Form Submission Methods

The M1PR form can be submitted through various methods, allowing flexibility for applicants. The available options include:

- Online submission via the Minnesota Department of Revenue's website.

- Mailing the completed form to the designated address provided on the form.

- In-person submission at local Department of Revenue offices.

Choosing the most convenient method for submission can help ensure that your application is processed efficiently.

Filing Deadlines / Important Dates

Understanding the filing deadlines for the M1PR form is crucial to avoid missing out on potential refunds. The general deadline for submitting the form is typically August 15 of the year following the tax year. For example, for the 2023 tax year, the form should be submitted by August 15, 2024. Staying informed about these dates can help ensure timely filing and receipt of any eligible refunds.

Handy tips for filling out M1PR, Property Tax Refund Return online

Quick steps to complete and e-sign M1PR, Property Tax Refund Return online:

- Use Get Form or simply click on the template preview to open it in the editor.

- Start completing the fillable fields and carefully type in required information.

- Use the Cross or Check marks in the top toolbar to select your answers in the list boxes.

- Utilize the Circle icon for other Yes/No questions.

- Look through the document several times and make sure that all fields are completed with the correct information.

- Insert the current Date with the corresponding icon.

- Add a legally-binding e-signature. Go to Sign -> Add New Signature and select the option you prefer: type, draw, or upload an image of your handwritten signature and place it where you need it.

- Finish filling out the form with the Done button.

- Download your copy, save it to the cloud, print it, or share it right from the editor.

- Check the Help section and contact our Support team if you run into any troubles when using the editor.

We know how stressing filling out documents could be. Get access to a HIPAA and GDPR compliant solution for maximum simplicity. Use signNow to e-sign and send M1PR, Property Tax Refund Return for e-signing.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the m1pr property tax refund return

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a renter rebate mn?

A renter rebate mn is a financial incentive provided to eligible renters in Minnesota, allowing them to receive a portion of their rent back as a rebate. This program aims to assist low to moderate-income renters by alleviating some of their housing costs. Understanding how to apply for this rebate can signNowly benefit your financial situation.

-

How can I apply for the renter rebate mn?

To apply for the renter rebate mn, you need to complete the application form available on the Minnesota Department of Revenue website. Ensure you have all necessary documentation, including proof of income and rental payments. Submitting your application before the deadline is crucial to receive your rebate.

-

What are the eligibility requirements for the renter rebate mn?

Eligibility for the renter rebate mn typically includes being a Minnesota resident, meeting income limits, and having paid rent for the year. Additionally, you must not have received a property tax refund for the same rental property. Checking the specific criteria on the official website can help clarify your eligibility.

-

How much can I receive from the renter rebate mn?

The amount you can receive from the renter rebate mn varies based on your income, rent paid, and the number of dependents. Generally, the rebate can range from a few hundred to several thousand dollars. It's essential to calculate your potential rebate using the guidelines provided by the Minnesota Department of Revenue.

-

What documents do I need for the renter rebate mn application?

When applying for the renter rebate mn, you will need documents such as your rental agreement, proof of income, and any other relevant financial statements. These documents help verify your eligibility and ensure a smooth application process. Keeping these documents organized will expedite your application.

-

Can I track the status of my renter rebate mn application?

Yes, you can track the status of your renter rebate mn application through the Minnesota Department of Revenue's online portal. After submitting your application, you will receive a confirmation number that allows you to check your status. This feature helps you stay informed about your rebate progress.

-

Are there any deadlines for the renter rebate mn application?

Yes, there are specific deadlines for submitting your renter rebate mn application, typically set for August 15 of the year following the tax year. It's important to mark your calendar and ensure your application is submitted on time to avoid missing out on this financial benefit. Late applications may not be accepted.

Get more for M1PR, Property Tax Refund Return

- Letter from tenant to landlord containing notice of wrongful deductions from security deposit and demand for return new jersey form

- Letter from tenant to landlord containing request for permission to sublease new jersey form

- Nj letter rent 497319248 form

- Nj landlord rent 497319249 form

- Nj tenant landlord form

- Letter lease nonrenewal 497319251 form

- Letter from tenant to landlord for 30 day notice to landlord that tenant will vacate premises on or prior to expiration of 497319252 form

- Letter from tenant to landlord about insufficient notice to terminate rental agreement new jersey form

Find out other M1PR, Property Tax Refund Return

- Electronic signature Kentucky Non-Profit Stock Certificate Online

- Electronic signature Legal PDF Louisiana Online

- Electronic signature Maine Legal Agreement Online

- Electronic signature Maine Legal Quitclaim Deed Online

- Electronic signature Missouri Non-Profit Affidavit Of Heirship Online

- Electronic signature New Jersey Non-Profit Business Plan Template Online

- Electronic signature Massachusetts Legal Resignation Letter Now

- Electronic signature Massachusetts Legal Quitclaim Deed Easy

- Electronic signature Minnesota Legal LLC Operating Agreement Free

- Electronic signature Minnesota Legal LLC Operating Agreement Secure

- Electronic signature Louisiana Life Sciences LLC Operating Agreement Now

- Electronic signature Oregon Non-Profit POA Free

- Electronic signature South Dakota Non-Profit Business Plan Template Now

- Electronic signature South Dakota Non-Profit Lease Agreement Template Online

- Electronic signature Legal Document Missouri Online

- Electronic signature Missouri Legal Claim Online

- Can I Electronic signature Texas Non-Profit Permission Slip

- Electronic signature Missouri Legal Rental Lease Agreement Simple

- Electronic signature Utah Non-Profit Cease And Desist Letter Fast

- Electronic signature Missouri Legal Lease Agreement Template Free