Schedule M1mtc Fill Out & Sign Online Form

What is the Schedule M1mtc Fill Out & Sign Online

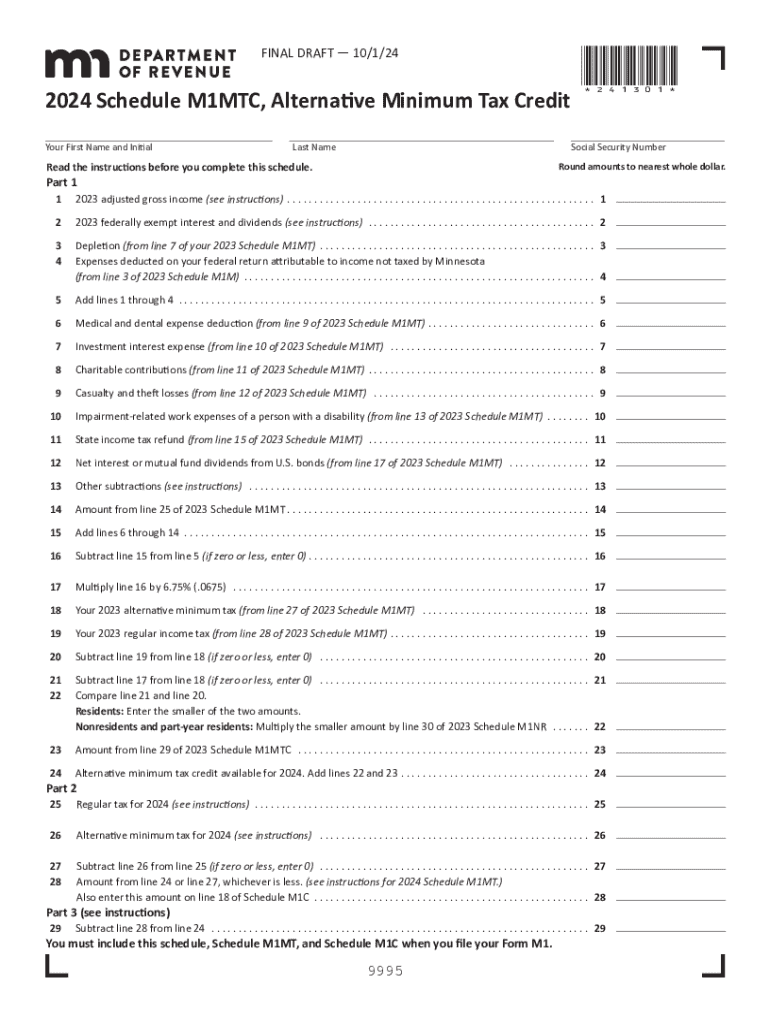

The Schedule M1mtc is a tax form used in the United States for reporting certain tax credits and adjustments. This form is particularly relevant for individuals and businesses looking to claim specific tax benefits. Filling out the Schedule M1mtc online allows users to complete the form efficiently, ensuring accuracy and compliance with IRS regulations. By utilizing digital tools, taxpayers can streamline their filing process, reduce errors, and maintain a clear record of their submissions.

Steps to complete the Schedule M1mtc Fill Out & Sign Online

Completing the Schedule M1mtc online involves several straightforward steps:

- Access the online form through a reliable platform.

- Input personal information, including your name, address, and Social Security number.

- Fill in the relevant sections regarding income, deductions, and credits.

- Review all entries for accuracy to avoid potential issues with the IRS.

- Sign the form electronically to validate your submission.

- Submit the completed form through the online platform or download it for mailing.

Legal use of the Schedule M1mtc Fill Out & Sign Online

The Schedule M1mtc can be filled out and signed online legally, provided that the digital signature complies with IRS standards. Electronic signatures are recognized as valid under U.S. law when they meet specific criteria. By using a trusted e-signature platform, taxpayers can ensure that their submissions are legally binding and secure. It is essential to retain a copy of the signed document for personal records and future reference.

Filing Deadlines / Important Dates

Filing deadlines for the Schedule M1mtc typically align with the annual tax return due dates. For most taxpayers, this means submitting the form by April 15 of the following year. However, extensions may be available under certain circumstances. It is crucial to stay informed about any changes to deadlines, as late submissions can result in penalties or loss of credits. Keeping track of these dates helps ensure timely and accurate filings.

Required Documents

To complete the Schedule M1mtc, several documents may be required, including:

- Previous year’s tax return for reference.

- Documentation of income sources, such as W-2s or 1099s.

- Records of any deductions or credits being claimed.

- Identification information, including Social Security numbers for all dependents.

Having these documents on hand can facilitate a smoother completion process and help ensure that all necessary information is accurately reported.

Examples of using the Schedule M1mtc Fill Out & Sign Online

There are various scenarios where the Schedule M1mtc is applicable. For instance, a self-employed individual may use the form to claim deductions related to business expenses. Similarly, a family may fill out the form to apply for tax credits associated with child care or education. Each example highlights the importance of accurately reporting financial information to maximize potential tax benefits. Understanding these use cases can help taxpayers recognize their eligibility for various credits.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the schedule m1mtc fill out ampamp sign online

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the process to Schedule M1mtc Fill Out & Sign Online?

To Schedule M1mtc Fill Out & Sign Online, simply log into your airSlate SignNow account, select the document, and follow the prompts to fill out the necessary fields. Once completed, you can easily sign the document electronically. This streamlined process ensures that you can manage your documents efficiently and securely.

-

Is there a cost associated with using airSlate SignNow to Schedule M1mtc Fill Out & Sign Online?

Yes, airSlate SignNow offers various pricing plans to accommodate different business needs. You can choose a plan that best fits your requirements for scheduling M1mtc forms and signing them online. The cost is competitive, making it a cost-effective solution for businesses of all sizes.

-

What features does airSlate SignNow offer for scheduling M1mtc forms?

airSlate SignNow provides a range of features for scheduling M1mtc Fill Out & Sign Online, including customizable templates, real-time collaboration, and secure cloud storage. These features enhance the user experience and ensure that your documents are handled efficiently and securely.

-

Can I integrate airSlate SignNow with other applications for scheduling M1mtc forms?

Absolutely! airSlate SignNow offers integrations with various applications, allowing you to streamline your workflow when scheduling M1mtc Fill Out & Sign Online. This means you can connect with tools you already use, enhancing productivity and efficiency.

-

What are the benefits of using airSlate SignNow for scheduling M1mtc forms?

Using airSlate SignNow to Schedule M1mtc Fill Out & Sign Online provides numerous benefits, including time savings, reduced paperwork, and enhanced security. The platform simplifies the signing process, making it easier for you to manage your documents and focus on your core business activities.

-

Is airSlate SignNow secure for scheduling M1mtc forms?

Yes, airSlate SignNow prioritizes security, ensuring that your documents are protected when you Schedule M1mtc Fill Out & Sign Online. The platform employs advanced encryption and compliance measures to safeguard your sensitive information throughout the signing process.

-

How can I get support while using airSlate SignNow for scheduling M1mtc forms?

airSlate SignNow offers comprehensive customer support to assist you while scheduling M1mtc Fill Out & Sign Online. You can access help through various channels, including live chat, email, and an extensive knowledge base, ensuring you have the resources you need.

Get more for Schedule M1mtc Fill Out & Sign Online

Find out other Schedule M1mtc Fill Out & Sign Online

- Can I eSign South Dakota Real Estate Quitclaim Deed

- How To eSign Tennessee Real Estate Business Associate Agreement

- eSign Michigan Sports Cease And Desist Letter Free

- How To eSign Wisconsin Real Estate Contract

- How To eSign West Virginia Real Estate Quitclaim Deed

- eSign Hawaii Police Permission Slip Online

- eSign New Hampshire Sports IOU Safe

- eSign Delaware Courts Operating Agreement Easy

- eSign Georgia Courts Bill Of Lading Online

- eSign Hawaii Courts Contract Mobile

- eSign Hawaii Courts RFP Online

- How To eSign Hawaii Courts RFP

- eSign Hawaii Courts Letter Of Intent Later

- eSign Hawaii Courts IOU Myself

- eSign Hawaii Courts IOU Safe

- Help Me With eSign Hawaii Courts Cease And Desist Letter

- How To eSign Massachusetts Police Letter Of Intent

- eSign Police Document Michigan Secure

- eSign Iowa Courts Emergency Contact Form Online

- eSign Kentucky Courts Quitclaim Deed Easy