Form W 9 Signed PDF

Understanding the 411 Vermont Sample Form

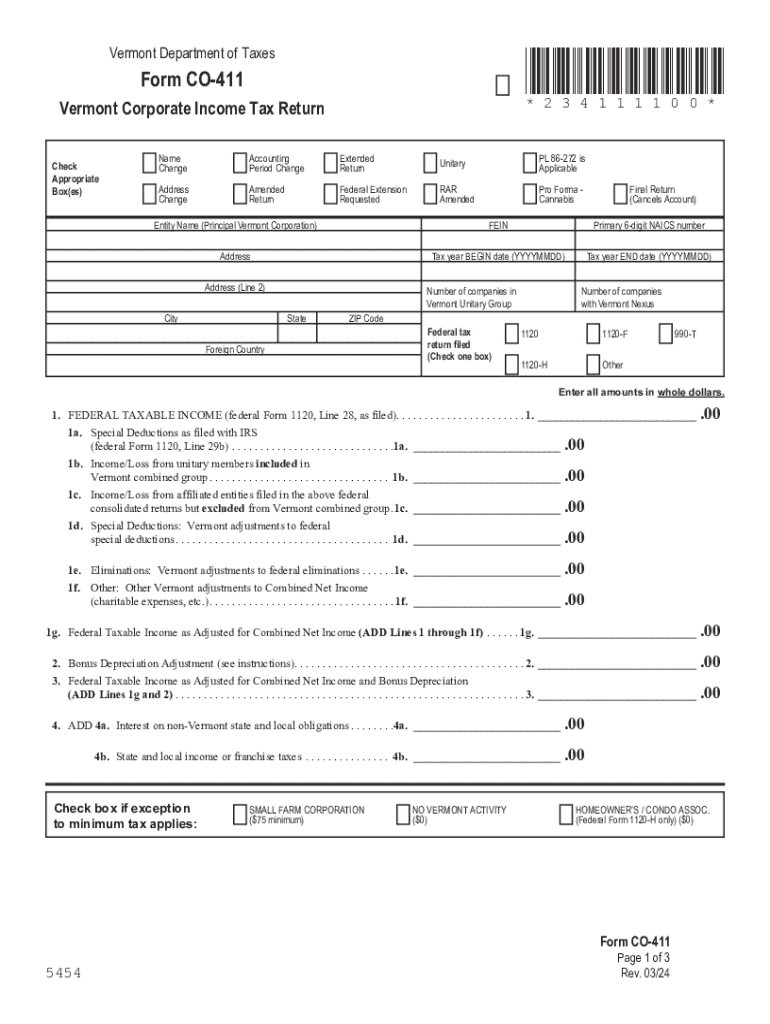

The 411 Vermont sample form is a document used primarily for tax purposes in the state of Vermont. It serves as a declaration of income and is essential for both individuals and businesses to report their earnings accurately. Understanding the structure and purpose of this form is crucial for compliance with state tax regulations.

Steps to Complete the 411 Vermont Sample Form

Completing the 411 Vermont sample form involves several key steps:

- Gather necessary documentation, including income statements and identification.

- Fill out personal information, such as name, address, and Social Security number.

- Report income details accurately, ensuring all figures are correct and up to date.

- Review the form for completeness and accuracy before submission.

Legal Use of the 411 Vermont Sample Form

The legal use of the 411 Vermont sample form is primarily for reporting income to the Vermont Department of Taxes. It is important to ensure that all information provided is truthful and accurate to avoid legal penalties. Misrepresentation or errors can lead to fines or additional scrutiny from tax authorities.

Filing Deadlines and Important Dates

Filing deadlines for the 411 Vermont sample form typically align with state tax deadlines. It is essential to be aware of these dates to ensure timely submission. Missing a deadline can result in penalties or interest on unpaid taxes. Always check the Vermont Department of Taxes website for the most current deadlines.

Required Documents for the 411 Vermont Sample Form

When preparing to complete the 411 Vermont sample form, certain documents are required:

- Income statements, such as W-2s or 1099s.

- Proof of residency in Vermont.

- Identification documents, such as a driver's license or Social Security card.

Form Submission Methods

The 411 Vermont sample form can be submitted through various methods. Taxpayers can file online through the Vermont Department of Taxes website, or they can choose to mail a physical copy of the form. In-person submissions are also an option at designated tax offices. Each method has its own processing times and requirements.

Examples of Using the 411 Vermont Sample Form

Common scenarios for using the 411 Vermont sample form include:

- Self-employed individuals reporting their income for the year.

- Businesses filing their annual tax returns.

- Individuals claiming deductions or credits based on their income level.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form w 9 signed pdf

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 411 Vermont sample and how can it benefit my business?

The 411 Vermont sample is a customizable document template designed to streamline your eSigning process. By using this sample, businesses can save time and reduce errors in document management. It empowers users to create, send, and sign documents efficiently, enhancing overall productivity.

-

How much does it cost to use the 411 Vermont sample with airSlate SignNow?

Pricing for using the 411 Vermont sample with airSlate SignNow varies based on your subscription plan. We offer flexible pricing options to accommodate businesses of all sizes. You can choose a plan that best fits your needs and budget while enjoying the benefits of our eSigning solutions.

-

What features are included with the 411 Vermont sample?

The 411 Vermont sample includes features such as customizable fields, automated workflows, and secure eSigning capabilities. These features ensure that your documents are not only professional but also compliant with legal standards. Additionally, you can track the status of your documents in real-time.

-

Can I integrate the 411 Vermont sample with other software?

Yes, the 411 Vermont sample can be easily integrated with various software applications, including CRM and project management tools. This integration allows for seamless document management and enhances your workflow efficiency. airSlate SignNow supports numerous integrations to cater to your business needs.

-

Is the 411 Vermont sample secure for sensitive documents?

Absolutely! The 411 Vermont sample is designed with security in mind, utilizing advanced encryption and authentication methods. This ensures that your sensitive documents are protected throughout the signing process. You can trust airSlate SignNow to keep your information safe and secure.

-

How can the 411 Vermont sample improve my document workflow?

Using the 411 Vermont sample can signNowly enhance your document workflow by automating repetitive tasks and reducing manual errors. This leads to faster turnaround times for document approvals and signatures. Ultimately, it allows your team to focus on more strategic tasks rather than getting bogged down by paperwork.

-

What types of documents can I create using the 411 Vermont sample?

The 411 Vermont sample can be used to create a variety of documents, including contracts, agreements, and forms. Its versatility makes it suitable for different industries and business needs. You can easily customize the sample to fit the specific requirements of your documents.

Get more for Form W 9 Signed PDF

- Plumbing contract for contractor utah form

- Brick mason contract for contractor utah form

- Roofing contract for contractor utah form

- Electrical contract for contractor utah form

- Sheetrock drywall contract for contractor utah form

- Flooring contract for contractor utah form

- Agreement or contract for deed for sale and purchase of real estate aka land or executory contract utah form

- Notice of intent to enforce forfeiture provisions of contact for deed utah form

Find out other Form W 9 Signed PDF

- Sign Georgia Car Dealer Cease And Desist Letter Fast

- Sign Georgia Car Dealer Purchase Order Template Mobile

- Sign Delaware Car Dealer Limited Power Of Attorney Fast

- How To Sign Georgia Car Dealer Lease Agreement Form

- How To Sign Iowa Car Dealer Resignation Letter

- Sign Iowa Car Dealer Contract Safe

- Sign Iowa Car Dealer Limited Power Of Attorney Computer

- Help Me With Sign Iowa Car Dealer Limited Power Of Attorney

- Sign Kansas Car Dealer Contract Fast

- Sign Kansas Car Dealer Agreement Secure

- Sign Louisiana Car Dealer Resignation Letter Mobile

- Help Me With Sign Kansas Car Dealer POA

- How Do I Sign Massachusetts Car Dealer Warranty Deed

- How To Sign Nebraska Car Dealer Resignation Letter

- How Can I Sign New Jersey Car Dealer Arbitration Agreement

- How Can I Sign Ohio Car Dealer Cease And Desist Letter

- How To Sign Ohio Car Dealer Arbitration Agreement

- How To Sign Oregon Car Dealer Limited Power Of Attorney

- How To Sign Pennsylvania Car Dealer Quitclaim Deed

- How Can I Sign Pennsylvania Car Dealer Quitclaim Deed