Form 1040 ES NR

What is the Form 1040 ES NR

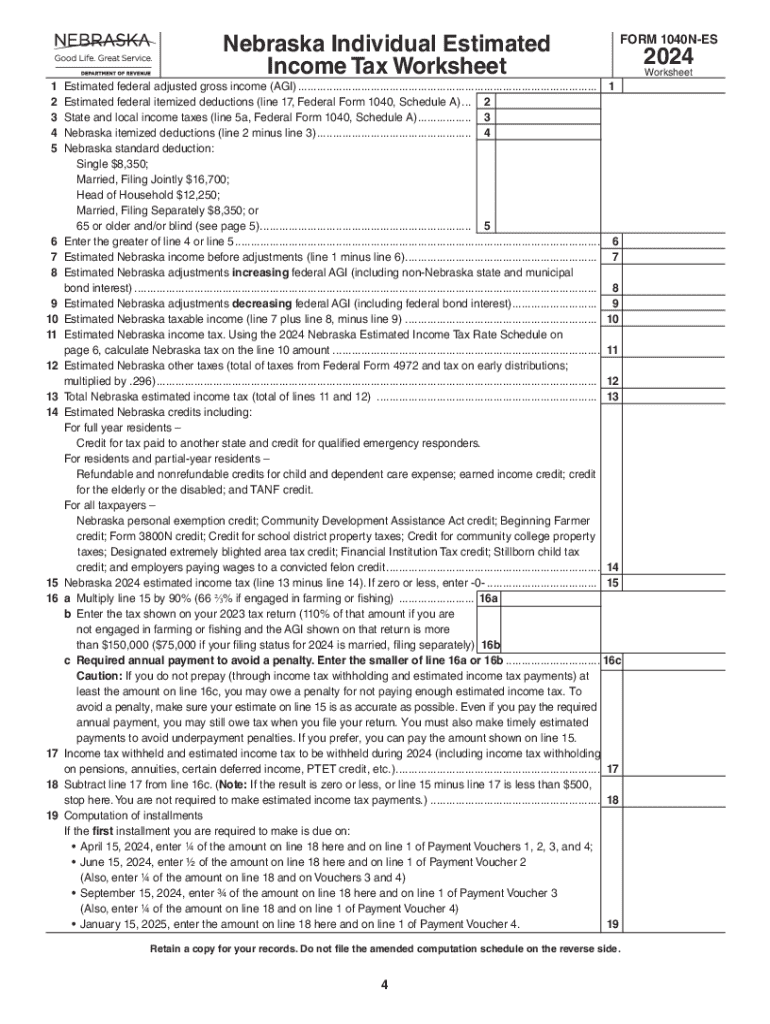

The Form 1040 ES NR is a crucial document for non-resident aliens who need to pay estimated taxes to the state of Nebraska. This form is specifically designed for individuals who earn income in Nebraska but do not reside there. It allows taxpayers to report their estimated income tax liability and make payments throughout the year, ensuring compliance with state tax laws.

How to use the Form 1040 ES NR

Using the Form 1040 ES NR involves several steps. First, you must calculate your expected Nebraska income for the year. This includes wages, dividends, interest, and any other sources of income. Next, you will determine your estimated tax liability based on the applicable tax rates. After calculating your tax, you can fill out the form, detailing your estimated payments and any credits you may be eligible for. Finally, submit the form by the designated deadlines to avoid penalties.

Steps to complete the Form 1040 ES NR

Completing the Form 1040 ES NR requires careful attention to detail. Start by gathering all necessary financial documents, including W-2s, 1099s, and any other income statements. Then, follow these steps:

- Calculate your total expected income for the year.

- Determine your estimated tax liability using Nebraska's tax rates.

- Fill out the form, ensuring all information is accurate.

- Include any estimated payments you have already made.

- Review the form for completeness and accuracy before submission.

Filing Deadlines / Important Dates

It is essential to adhere to the filing deadlines associated with the Form 1040 ES NR. Typically, estimated tax payments are due quarterly, with specific deadlines throughout the year. For 2024, the deadlines are usually set for April 15, June 15, September 15, and January 15 of the following year. Missing these deadlines can result in penalties and interest on unpaid taxes.

Required Documents

To accurately complete the Form 1040 ES NR, you will need several documents. These include:

- Income statements such as W-2s and 1099s.

- Records of any other income sources.

- Documentation of any tax credits or deductions you plan to claim.

- Previous year’s tax return for reference.

Legal use of the Form 1040 ES NR

The Form 1040 ES NR must be used in accordance with Nebraska state tax laws. It is legally binding and serves as a formal declaration of your estimated tax payments. Using this form correctly ensures that you fulfill your tax obligations and helps prevent any legal issues related to tax compliance.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 1040 es nr

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 2024 Nebraska tax form and why is it important?

The 2024 Nebraska tax form is a document required for filing state income taxes in Nebraska. It is essential for individuals and businesses to accurately report their income and calculate their tax liabilities. Completing this form correctly ensures compliance with state tax laws and helps avoid penalties.

-

How can airSlate SignNow help with the 2024 Nebraska tax form?

airSlate SignNow simplifies the process of completing and eSigning the 2024 Nebraska tax form. Our platform allows users to fill out forms electronically, ensuring accuracy and efficiency. Additionally, you can securely send and receive documents, making tax season less stressful.

-

Is there a cost associated with using airSlate SignNow for the 2024 Nebraska tax form?

Yes, airSlate SignNow offers various pricing plans to accommodate different needs. Our cost-effective solutions provide access to features that streamline the completion of the 2024 Nebraska tax form. You can choose a plan that best fits your budget and requirements.

-

What features does airSlate SignNow offer for managing the 2024 Nebraska tax form?

airSlate SignNow provides features such as document templates, eSignature capabilities, and secure cloud storage. These tools make it easy to manage the 2024 Nebraska tax form efficiently. Users can collaborate in real-time, ensuring that all necessary information is included.

-

Can I integrate airSlate SignNow with other software for the 2024 Nebraska tax form?

Absolutely! airSlate SignNow integrates seamlessly with various accounting and tax software. This integration allows for easy import and export of data related to the 2024 Nebraska tax form, enhancing your workflow and reducing manual entry errors.

-

What are the benefits of using airSlate SignNow for the 2024 Nebraska tax form?

Using airSlate SignNow for the 2024 Nebraska tax form offers numerous benefits, including time savings and increased accuracy. Our platform reduces the hassle of paperwork and provides a secure way to manage sensitive information. Additionally, eSigning speeds up the approval process, allowing for quicker submissions.

-

Is airSlate SignNow user-friendly for completing the 2024 Nebraska tax form?

Yes, airSlate SignNow is designed with user-friendliness in mind. The intuitive interface makes it easy for anyone to navigate and complete the 2024 Nebraska tax form without prior experience. Our customer support team is also available to assist with any questions.

Get more for Form 1040 ES NR

- Letter from landlord to tenant for failure to keep all plumbing fixtures in the dwelling unit as clean as their condition 497427458 form

- Letter from landlord to tenant for failure to use electrical plumbing sanitary heating ventilating air conditioning and other 497427459 form

- Letter from landlord to tenant as notice to tenant of tenants disturbance of neighbors peaceful enjoyment to remedy or lease 497427460 form

- Letter from landlord to tenant as notice to tenant to inform landlord of tenants knowledge of condition causing damage to 497427461

- Letter from landlord to tenant about tenant engaging in illegal activity in premises as documented by law enforcement and if 497427462 form

- Letter from tenant to landlord containing notice to landlord to withdraw improper rent increase due to violation of rent 497427463 form

- Letter from tenant to landlord about insufficient notice of rent increase utah form

- Letter from landlord to tenant about intent to increase rent and effective date of rental increase utah form

Find out other Form 1040 ES NR

- Electronic signature Wyoming Car Dealer Lease Agreement Template Computer

- How Do I Electronic signature Mississippi Business Operations Rental Application

- Electronic signature Missouri Business Operations Business Plan Template Easy

- Electronic signature Missouri Business Operations Stock Certificate Now

- Electronic signature Alabama Charity Promissory Note Template Computer

- Electronic signature Colorado Charity Promissory Note Template Simple

- Electronic signature Alabama Construction Quitclaim Deed Free

- Electronic signature Alaska Construction Lease Agreement Template Simple

- Electronic signature Construction Form Arizona Safe

- Electronic signature Kentucky Charity Living Will Safe

- Electronic signature Construction Form California Fast

- Help Me With Electronic signature Colorado Construction Rental Application

- Electronic signature Connecticut Construction Business Plan Template Fast

- Electronic signature Delaware Construction Business Letter Template Safe

- Electronic signature Oklahoma Business Operations Stock Certificate Mobile

- Electronic signature Pennsylvania Business Operations Promissory Note Template Later

- Help Me With Electronic signature North Dakota Charity Resignation Letter

- Electronic signature Indiana Construction Business Plan Template Simple

- Electronic signature Wisconsin Charity Lease Agreement Mobile

- Can I Electronic signature Wisconsin Charity Lease Agreement