For Agricultural Machinery and Equipment Purchases or Leases Form

Understanding the Nebraska Tax for Agricultural Machinery and Equipment Purchases

The Nebraska tax for agricultural machinery and equipment purchases is designed to support the agricultural sector by providing tax exemptions on specific purchases. This exemption applies to machinery and equipment used directly in agricultural production, which includes items like tractors, combines, and irrigation systems. Understanding this tax exemption is crucial for farmers and agricultural businesses to optimize their expenses and ensure compliance with state regulations.

How to Utilize the Nebraska Agricultural Machinery and Equipment Exemption

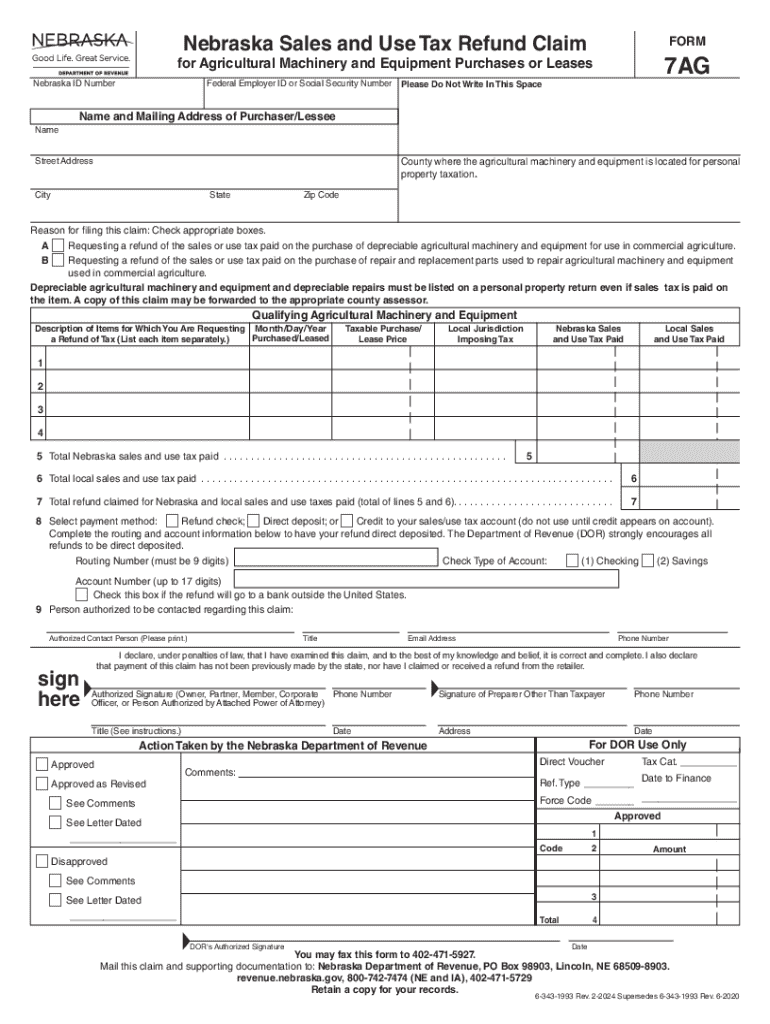

To take advantage of the Nebraska agricultural machinery and equipment exemption, businesses must complete the Nebraska 7AG form. This form certifies that the purchased machinery or equipment is intended for agricultural use. It is essential to retain this documentation for tax purposes and to present it during audits or inquiries from tax authorities. Properly filling out the form can prevent unnecessary tax liabilities.

Steps to Complete the Nebraska 7AG Form

Completing the Nebraska 7AG form involves several key steps:

- Gather necessary information about the equipment being purchased, including make, model, and intended use.

- Fill out the form with accurate details, ensuring all fields are completed to avoid delays.

- Submit the completed form to the seller at the time of purchase to qualify for the exemption.

- Keep a copy of the form for your records, as it may be required for future tax filings or audits.

Eligibility Criteria for the Nebraska Agricultural Exemption

To qualify for the Nebraska agricultural machinery and equipment exemption, the following criteria must be met:

- The machinery or equipment must be used primarily in agricultural production.

- The purchaser must be engaged in farming or ranching activities.

- Items must be purchased or leased, not rented, to qualify for the exemption.

Required Documents for the Nebraska Agricultural Exemption

When applying for the Nebraska agricultural machinery and equipment exemption, it is important to have the following documents ready:

- The completed Nebraska 7AG form.

- Proof of purchase, such as receipts or invoices.

- Documentation that verifies the agricultural use of the equipment, if requested by tax authorities.

Legal Use of the Nebraska Agricultural Machinery and Equipment Exemption

The legal framework for the Nebraska agricultural machinery and equipment exemption is established by state tax laws. It is important for agricultural businesses to understand the legal implications of using this exemption. Misuse of the exemption, such as using exempted equipment for non-agricultural purposes, can lead to penalties and back taxes. Therefore, maintaining accurate records and ensuring compliance with state regulations is essential for all agricultural entities.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the for agricultural machinery and equipment purchases or leases

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is airSlate SignNow and how does it relate to Nebraska tax agricultural?

airSlate SignNow is a digital solution that allows businesses to send and eSign documents efficiently. For those involved in Nebraska tax agricultural, it streamlines the process of signing tax-related documents, ensuring compliance and saving time.

-

How can airSlate SignNow help with Nebraska tax agricultural documentation?

With airSlate SignNow, users can easily create, send, and manage agricultural tax documents electronically. This not only simplifies the paperwork involved in Nebraska tax agricultural but also enhances accuracy and reduces the risk of errors.

-

What are the pricing options for airSlate SignNow for Nebraska tax agricultural users?

airSlate SignNow offers various pricing plans tailored to meet the needs of businesses, including those in Nebraska tax agricultural. These plans are designed to be cost-effective, ensuring that users can access essential features without overspending.

-

What features does airSlate SignNow offer for Nebraska tax agricultural businesses?

airSlate SignNow includes features such as customizable templates, secure eSigning, and document tracking, which are particularly beneficial for Nebraska tax agricultural businesses. These tools help streamline the documentation process and enhance operational efficiency.

-

Is airSlate SignNow compliant with Nebraska tax agricultural regulations?

Yes, airSlate SignNow is designed to comply with various legal standards, including those relevant to Nebraska tax agricultural. This ensures that all signed documents are legally binding and meet state requirements.

-

Can airSlate SignNow integrate with other software used in Nebraska tax agricultural?

Absolutely! airSlate SignNow offers integrations with various software applications commonly used in Nebraska tax agricultural. This allows for seamless data transfer and enhances overall productivity by connecting different tools.

-

What are the benefits of using airSlate SignNow for Nebraska tax agricultural?

Using airSlate SignNow for Nebraska tax agricultural provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. These advantages help businesses focus on their core operations while ensuring compliance with tax regulations.

Get more for For Agricultural Machinery And Equipment Purchases Or Leases

- Virginia memorandum lien form

- Bad check notice form

- Correction statement and agreement virginia form

- Closing statement virginia form

- Flood zone statement and authorization virginia form

- Name affidavit of buyer virginia form

- Name affidavit of seller virginia form

- Non foreign affidavit under irc 1445 virginia form

Find out other For Agricultural Machinery And Equipment Purchases Or Leases

- Sign Montana Personal loan contract template Free

- Sign New Mexico Personal loan contract template Myself

- Sign Vermont Real estate contracts Safe

- Can I Sign West Virginia Personal loan contract template

- How Do I Sign Hawaii Real estate sales contract template

- Sign Kentucky New hire forms Myself

- Sign Alabama New hire packet Online

- How Can I Sign California Verification of employment form

- Sign Indiana Home rental application Online

- Sign Idaho Rental application Free

- Sign South Carolina Rental lease application Online

- Sign Arizona Standard rental application Now

- Sign Indiana Real estate document Free

- How To Sign Wisconsin Real estate document

- Sign Montana Real estate investment proposal template Later

- How Do I Sign Washington Real estate investment proposal template

- Can I Sign Washington Real estate investment proposal template

- Sign Wisconsin Real estate investment proposal template Simple

- Can I Sign Kentucky Performance Contract

- How Do I Sign Florida Investment Contract